Folic Acid Market Size, Share, and Industry Analysis, By Source (Natural and Synthetic), By Application (Food & Beverages, Pharmaceuticals, Nutraceuticals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

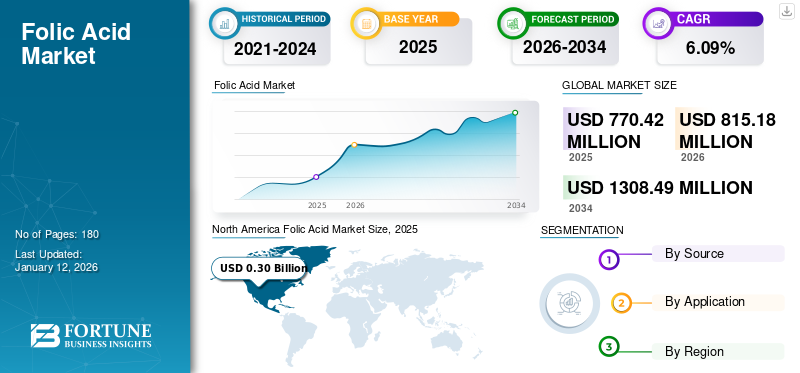

The global folic acid market size was valued at USD 0.77 billion in 2025. The market is projected to grow from USD 0.81 billion in 2026 to USD 1.30 billion by 2034, exhibiting a growth at a CAGR of 6.09% during the forecast period. North America dominated the folic acid market with a market share of 39.65% in 2025.

Folic acid, popularly known as Vitamin B9, is a naturally occurring B vitamin that is utilized in food fortification and also as a dietary supplement. As humans cannot produce and store folate, it is sourced through external supplementation, thus making it an essential nutrient. The main role of Vitamin B9 is to create healthy red blood cells and address folate deficiencies. A few of the natural sources of vitamin B9 include asparagus, Brussels sprouts, spinach, bananas, beef, and others. Moreover, folic acid is highly targeted toward pregnant and lactating mothers, as it assists in preventing neural tube defects during pregnancy. According to the National Institutes of Health, a Government agency, pregnant women should consume 400 mcg of Dietary Folate Equivalents (DFE).

The rising cases of iron deficiency globally and the growing number of players in the Vitamin B9 ingredients industry are remarkable factors that promote the industry's growth. A few of the well-renowned players in the market include DSM–Firmenich, Parchem, Jiangxi Tianxin Pharmaceutical Co., Ltd., and Nantong Changhai Food Additive.

Folic Acid Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 0.77 billion

- 2026 Market Size: USD 0.81 billion

- 2034 Forecast Market Size: USD 1.30 billion

- CAGR: 6.09% from 2026–2034

Market Share:

- North America dominated the folic acid market with a 39.65% share in 2025, driven by high incidences of anemia and increasing regulatory mandates for folic acid fortification. The synthetic source segment led the market due to its cost-effectiveness and ease of availability.

- The food & beverages application segment held the largest market share in 2024, supported by the growing awareness of nutritional fortification.

Key Country Highlights:

- United States: Led the North American market, supported by rising iron deficiency cases and a strong presence of fortified food initiatives.

- China & India: In Asia Pacific, rapid growth is propelled by government fortification mandates and increasing health awareness.

- Canada: Benefitted from established government-supported folic acid fortification programs.

- Germany: Saw steady growth owing to health-conscious consumers and aging demographics.

- Malaysia: Government enforced mandatory folic acid fortification for wheat flour in packs up to 25kg.

FOLIC ACID MARKET TRENDS

Surging Trend of Nutricosmetics Fosters Market's Potential

Nutricosmetics is emerging as the fast-growing category of nutraceuticals focused on improving beauty from within. As individuals look for holistic skincare and prioritize health, nutricosmetics ingredients are gaining popularity, with a mass of consumers inclining toward these supplements to mitigate the effects of lifestyle factors, as well as environmental stress. Moreover, this sector is experiencing drastic innovation through novel formulation methods, using vitamin B9 as an active ingredient, and advanced delivery systems. As a result, this trend of nutricosmetics is expected to enhance the usage of minerals and vitamins, including folic acid, as it is responsible for cellular growth and also acts as a barrier to sun damage. North America witnessed a growth from USD 272.19 Million in 2023 to USD 288.26 Million in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Incidences of Anemia bolster Consumption of Folic-Acid

Anemia is recognized as a major public health condition globally that affects postpartum and pregnant women, menstruating adolescent girls and women, and young children. Poor dietary intake, chronic ailments, and family history of anemia are the key factors increasing the risk of anemic conditions amongst the population. Owing to such factors, the cases of anemia are extensively growing, particularly in low-income countries. According to the World Health Organization, a government agency, in 2023, Southeast Asia and Africa regions faced a high prevalence of anemia, with approximately 83 million children and 244 million women in Southeast Asia and 106 and 103 million women and children in Africa. As a result, global manufacturers are concentrating on creating folic-acid-infused supplements/food items, which enhance the consumption rate of Vitamin B9.

Augmented Fortification Awareness by Government Encourages Market Growth

The Government-mandated food-fortification schemes, aimed at addressing Vitamin B9 deficiencies amongst individuals, are another remarkable driver, encouraging the market growth. The success of fortification programs in Canada, the U.S., and various European countries has influenced other regions to adopt similar measures. Moreover, in middle and low-income countries, where access to nutritional supplements or other preventative healthcare options may be limited, Vitamin B9 fortification programs initiated by the Government serve as an accessible and economical way to strengthen public health outcomes. As more countries realize the importance of Vitamin B9 fortification, the demand for related supplements or products is fueled, further augmenting the global folic acid market growth.

Market Restraints

Potential Side Effects of Vitamin B9 Leads to Less Intake and Hampers Market Growth

The surge in the prevalence of health ailments worldwide due to high vitamin B9 consumption acts as a pivotal restraint in the market. Stomach ulcers, seizures, skin rashes, and loss of appetite are a few of the major hurdles faced by consumers globally. Moreover, in severe cases, a high dosage of Vitamin B9 can lead to a high risk of cancer and cardiovascular ailments. As a result, these disadvantages impede individuals from purchasing and consuming Vitamin B9-enriched supplements.

Market Opportunities

Technological Advancements in Folic-Acid Production Unlocks Numerous Growth Opportunities

The use of advanced technologies in Vitamin B9 production is focused on enhancing the sustainability, scalability, and efficiency of the production process. One major technological development in this field is the rising utilization of biotechnological processes, such as microbial fermentation, to manufacture folic-acid. This method uses genetically engineered microorganisms to synthesize Vitamin B9 in an internal control environment, thus providing a potentially cost-effective and sustainable substitute to traditional synthesis. Moreover, this type of advanced method is gaining high popularity, as it reduces dependency on chemical agents and minimizes waste production, aligning with sustainable and eco-friendly manufacturing goals.

Advancements in Vitamin B9 fortification play a remarkable role in strengthening its use across food industries. The use of innovative techniques allows easy incorporation of folic-acid into several food items, such as beverages, cereals, and flour, without hampering the product's shelf life and nutrient bioavailability. As a result, such utilization of advancements unlocks growth opportunities for the market.

Market Challenges

High Prices of Vitamin B9 and Market Competition Disrupt Industry's Momentum

The high cost prices of Vitamin B9 is the prime challenge faced by folic-acid producers across the global market. Folic acid is highly expensive, which stresses manufacturers' ability to utilize it in the preparation of supplements/food products. Moreover, compared to the synthetic form, natural Vitamin B9 is expensive, as it is produced via complex processes. As a result, these factors interfere with the production of Vitamin B9-based products.

Strong market competition is another hurdle experienced by key manufacturers globally. The Vitamin B9 industry faces tough competition from its supplement competitors, which puts pressure on the B9 players.

Impact of COVID-19

The coronavirus pandemic had a varied impact on several industries and sectors, including the vitamins industry. In the first phase of lockdown 2020, the vitamin ingredients manufacturers faced enormous challenges in fulfilling consumer demands due to supply chain disruptions, shortage of raw materials, and hampered logistical activities.

However, government regulations regarding the production of essential items fueled the production of vitamin ingredients such as Vitamin B9. As the majority of the population was switching toward natural and health-promoting products, the consumption of folic-acid rose during that period. As a result, this demand improved the purchase and consumption of Vitamin B9. Moreover, the factors mentioned above further influenced the active producers in the market to capitalize on this trend and introduce folic-acid-enriched products, which promote consumer health.

SEGMENTATION ANALYSIS

By Source

Synthetic Source Leads Market Due to Its Cost-Effectiveness

Based on source, the market is distributed into natural and synthetic.

Out of both categories, the synthetic segment led the market with a share of 88.90% in 2026 and is expected to maintain its dominance in the coming years. The easy extraction and affordability of synthetically sourced Vitamin B9, compared to natural sources, are the key factors contributing to the segment's growth. Moreover, the increasing number of players in synthetic Vitamin B9 production and the easy availability of synthetic Vitamin B9 further strengthen the segment's momentum.

The natural sources segment secured the second position in the global market share by 11% in 2024. The complex extraction method of Vitamin B9 and its high cost, in comparison to synthetic sources, deter consumers from buying such products.

By Application

To know how our report can help streamline your business, Speak to Analyst

Food & Beverages Segment Dominates Due to Its Nutritional Benefits

Based on application, the market is segmented into food & beverages, pharmaceuticals, nutraceuticals, and others.

Amongst all, the food & beverage segment is expected to contributing 45.23% globally in 2026 and exhibit a strong CAGR of 6.09% and holds the largest folic acid market share. The increasing consumption of both natural food products, enriched with Vitamin B9 (citrus fruits, legumes) and animal-sourced Vitamin B9 infused items (beef, eggs) opens avenues for significant growth of the segment. Moreover, the augmented awareness for fortification and stringent government regulations further necessitate food producers to fortify foods with Vitamin B9. As a result, such instances are anticipated to fuel the intake of Vitamin B9 among consumers.

- The nutraceuticals segment is expected to hold a 20.01% share in 2024.

The pharmaceuticals segment experienced the highest CAGR in the market and is projected to soar during the forecast period. Pharmaceutical formulations comprising Vitamin B9 are the active ingredient that is broadly used in the treatment of anemic patients. Also, the recommendations for folic acid supplementation during pregnancy to reduce the cases of congenital disabilities in infants further foster segment growth. The pharmaceuticals segment is anticipated to capture 30% of the market share in 2025.

Folic Acid Market Regional Outlook

North America Folic Acid Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

On the basis of regions, the market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

To know how our report can help streamline your business, Speak to Analyst

North America dominated the global market with a value of USD 0.32 billion by generating the maximum share in 2026. The region displays high incidences of anemia, which has augmented the need for fortified food items comprising folic acid. Moreover, the rising regulatory mandates for Vitamin B9 fortification and a growing emphasis on public health initiatives further escalated the sales of Vitamin B9-based products. Amongst all the North American countries, the U.S. leads in the regional market due to the increasing prevalence of iron deficiencies. As per the National Center for Health Statistics, a non-profit organization in the U.S., the cases of anemia were higher in females (13.00%) than males (5.50%) during August 2021 – August 2023. Moreover, the surge in R&D investments and growing awareness of prenatal supplements collectively fuels the country's growth potential. The U.S. market estimated to hit USD 0.20 billion in 2026.

- In North America, the nutraceuticals segment is estimated to hold a 19.32% market share in 2024.

Europe

Europe is projected to secure the second position in the market with a value of USD 0.21 billion in 2026 and witnessed a CAGR of 5.11% during the forecast period. In the region, the majority of individuals prefer health-promoting supplements/food items to enhance their immunity, as well as overall well-being. This rise in demand has allowed key manufacturers to introduce products that appeal to varied lifestyle preferences, including vegetarian and vegan populations. Moreover, the rising cases of chronic ailments and the aging population are driving the consumption of Vitamin B9-enriched products. The market in U.K. is projected to reach USD 45.53 million in 2026. The France market is estimated to hit USD 30.87 million in 2025 and Germany is likely to hit USD 56.05 million in 2026.

Asia Pacific

Asia Pacific observed the highest CAGR and anticipated to emerge as the third-fastest growing regional market with USD 0.17 billion in 2026. This is attributed to the region's growth, which includes increasing disposable income, improved awareness regarding healthy lifestyles, and expansion of e-commerce channels. Moreover, the surge in the elderly population, especially in China and India, and the strong government's regulatory support for Vitamin B9 fortification facilitates the chances of growth. According to the Malaysia Ministry of Health, wheat flour, marketed in 25 kg or under bags, should be fortified with Vitamin B9. Prior to this, the government only applied this regulation for 1kg packages of flour. The market in China is likely to hit USD 69.37 million in 2026. The Japan market is estimated to reach USD 35.75 million and India is predicted to show USD 26.52 million in 2026.

South America

South American market is anticipated to be the fourth-largest region for USD 66.19 million in 2025, and is still at its developing stage and is predicted to soar at a higher pace in the near term. The robust animal feed industry and the growing use of vitamins in the personal care & cosmetics industry are the considerable factors responsible for the region's growth.

Middle East & Africa

The Middle East & Africa are also at their promising stage and are projected to grow enormously throughout the forecast period. The strong nutritional supplement industry, import of vitamins, and improved purchasing power drive the region's growth potential. The UAE market is anticipated to hit USD 7.57 million in 2025.

COMPETITIVE LANDSCAPE

Major Industry Player

Active Players in Market Are Concentrating on Product Launches to Improve Profitability

Dominant players operating in the global space include DSM–Firmenich, Parchem, Jiangxi Tianxin Pharmaceutical Co., Ltd., Nantong Changhai Food Additive, and others. These key players are concentrating on product launches by introducing new supplements/food products across the market. Owing to the rising anemic cases and growing need for prenatal vitamins, consumers are in search of iron-rich items, which further enhance the chances of profitability.

List of Key Folic Acid Companies Profiled

- DSM – Firmenich (Switzerland)

- Jiangxi Tianxin Pharmaceutical Co., Ltd. (China)

- Parchem (U.S.)

- Nantong Changhai Food Additive (China)

- Xinfa Pharmaceutical Co., Ltd. (China)

- Foodchem International Corporation (China)

- Hebei Jiheng Pharmaceutical Co., Ltd. (China)

- Fengchen Group Co., Ltd. (China)

- Vivion (U.S.)

- Superior Supplement Manufacturing (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: The Department of Health, a Northern Irish government department, introduced a new legislation that mandates folic acid fortification to non-whole meal flour across Northern Ireland. This fortification is helpful in minimizing the occurrence of spine and brain problems in newborn babies.

- June 2024: Balchem Corporation, a specialty ingredients producer in the U.S., announced the launch of Optifolin, a choline-enriched folate supplement, across the nation.

- April 2024: Corbion, a chemicals enterprise in the Netherlands, announced the news of collaborating with producers to launch corn tortillas fortified with Vitamin B9 to address the prevalence of neural tube defects in infants.

- June 2021: Southern Health Foods Pvt Ltd., an Indian enterprise, entered into the women's health drink field with Manna iStrong. The product launched is an iron-fortified multigrain instant drink mix composed of super grains and has 100% RDA of Vitamin B12, C, and B9.

- April 2019: Merck, a German-based pharmaceuticals enterprise, released its new product, "Arcofolin," an active form of B9, for pharmaceutical and nutritional applications.

Investment Analysis and Opportunities

The market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The report highlights the various opportunities that have the potential for investments, including new product portfolio launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGES

The market report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market sizing and growth rate for all possible market segments. Various key insights presented in the market research report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.09% from 2026 to 2034 |

|

Segmentation |

By Source

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 0.77 billion in 2025.

The market is expected to grow at a CAGR of 6.09% during the forecast period (2026-2034).

The synthetic segment led the market.

Increasing cases of anemia and augmented awareness by Government Support are the key drivers in the market.

DSM-Firmenich, Parchem, Jiangxi Tianxin Pharmaceutical Co., Ltd., and Nantong Changhai Food Additive are a few of the top players in the market.

The U.S. is anticipated to hold the largest share of the global market throughout the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us