Fumigant Products Market Size, Share & COVID-19 Impact Analysis, By Type (Phosphine, Sulfuryl Fluoride, Methyl Bromide, and Others), By Form (Solid, Liquid, and Gas), By Application (Commercial & Industrial, Agriculture, and Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

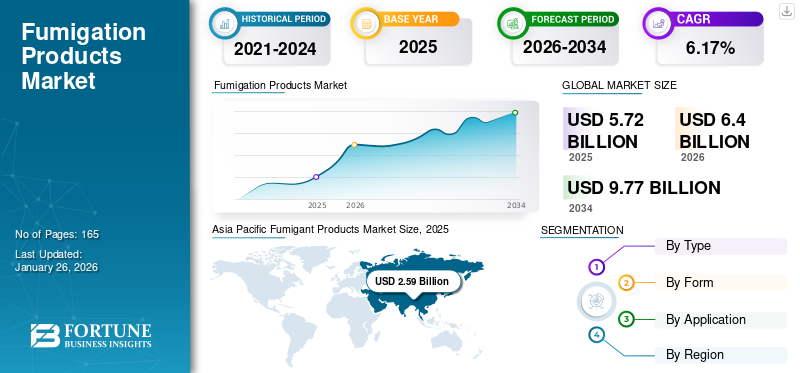

The global fumigant products market size was valued at USD 5.72 billion in 2025 and is projected to grow from USD 6.40 billion in 2026 to USD 9.77 billion by 2034, exhibiting a CAGR of 6.17% during the forecast period. Asia Pacific dominated the fumigant products market with a market share of 45.36% in 2025.

Fumigants are toxic or volatile, poisonous substances that produce lethal gases when inhaled. Fumigants kill nematodes, insects, and pests that cause damage to seeds, stored foods, clothing, human dwellings, and nursery stock. For the pest control process of rodents, fumigant products are primarily used as burrow fumigants in agricultural fields or vehicles transporting food commodities or as building fumigants in residential areas. Fumigation is also applied on nursery stocks, and major fumigants used to treat nursery stock or stored products include naphthalene, methyl bromide, hydrogen cyanide, and nicotine. The efficacy of these fumigants is highly influenced by the method of application. Fumigants can be applied individually or with other chemicals to enhance their effectiveness.

The emergence of biofumigants creates opportunities for the fumigant products market growth. The significant players in the fumigation market are emphasizing the launch of new biofumigation products to fulfill the surging demand for biofumigants. For instance, in May 2017, Isagro USA introduced a soil biofumigant, DOMINUS, to achieve effective control against pests, insects, weeds, and soil-borne pathogens. Various chemical fumigant products have limitations such as higher cost, lower efficacy on specific pests, and restrictions on use. This leads customers to shift their preferences toward new evolving fumigation techniques that extensively use fumigants. Introducing new fumigation techniques provides a potential opportunity for the growth of the fumigant chemical products market.

COVID-19 IMPACT

COVID-19 Moderately Impacted the Fumigant Products Market Generating Potential Opportunities for the Market Growth

Amidst the outbreak of COVID-19, crop protection companies have faced significant challenges in fulfilling the increased demand for food commodities and storing grains and food products free from insects and pests. However, the shutdown of the number of manufacturing facilities gave rise to the outbreak of pests, insects, and rodents, which created a considerable demand for fumigants. According to the National Center for Biotechnology Information (NCBI), the fumigants market witnessed a surge in demand for Plant Protection Products (PPPs), such as fumigants, insecticides, pesticides, herbicides, and many more, as groups and individuals ordered more than the required stock of fumigants. The over-purchase also affected the availability of plant protection products in the market.

The disruption caused due to the pandemic in the distribution of crop protection products, such as fumigants, insecticides, pesticides, and others, either from international or local suppliers to the farm levels resulted in reduced outputs during COVID-19. For instance, the transportation costs of fumigant products and pesticides to East Africa had increased, and the shipping of these products was delayed due to lesser flights to the region. This limited the Eastern African countries' potential to control locusts, resulting in substantial pest outbreaks. The shortage of equipment, such as fumigation foggers, also affected the fumigants market during COVID-19.

Fumigant Products Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.72 billion

- 2026 Market Size: USD 6.40 billion

- 2034 Forecast Market Size: USD 9.77 billion

- CAGR: 6.17% from 2026–2034

Market Share:

- Asia Pacific dominated the fumigant products market with a 45.29% share in 2024, driven by high agricultural output, densely populated regions prone to pest infestation, and increasing use in residential and industrial applications in countries like China, India, and Japan.

- By type, Phosphine is expected to retain the largest market share in 2025, due to its effectiveness against major storage pests, broad regulatory acceptance, residue-free profile, and widespread use in diverse storage formats from silos to ships.

Key Country Highlights:

- United States: Growth supported by increasing residential pest control demand, advanced tech-enabled services like Bayer’s Digital Pest Management, and commercial adoption of alternative fumigants like eFume.

- India: High agricultural production and growing urban population drive demand for fumigation in both farm storage and residential sectors.

- China: Strong grain production and storage infrastructure support consistent demand for fumigants amid concerns over pest outbreaks.

- Brazil: Increased grain storage capacity (+35% from 2011 to 2022) and adoption of phosphine as a methyl bromide alternative are fueling market growth.

- Germany/Europe: Rising need for food-grade pest control and growing residential fumigation demand support moderate growth in the region.

- Middle East & Africa: Increasing yield losses and food security concerns are pushing farmers to adopt fumigants for protection and preservation of produce.

Fumigant Products Market Trends

Technology-enabled Pest Control Service is an Evolving Trend

The use of technology for various industry verticals has been fueled in the last decade with the introduction of Internet of Things (IoT) platforms. IoT platforms are vital in changing how Pest Management Professionals (PMPs) do their business in the pest control industry. Rising service and product performance expectations are increasing customer demand for tech-enabled services. Considering the rising demand for tech-enabled services, manufacturers of fumigants and fumigation service providers are changing how they introduce products and services. The digital pest control system is a wireless network of high-tech trap sensors, which provide 24/7 real-time capture alerts, monitoring, and up-to-the-minute rodent activity verification. This technique provides pest infestation data to consumers, which, in turn, helps them to take preventive actions.

The technology-enabled pest control system aids in providing valuable data. The system also enables consumers to receive instant information regarding the emergence of new pests and insects in the facility with real-time automated alerts sent on the smartphones or tablets of consumers. It also enables quick root-cause analysis.

For instance, manufacturers and providers of several agricultural products have introduced the new Bayer Digital Pest Management services platform, which combines the traditional pest management expertise of the company and the power of the Microsoft Azure cloud platform. Bayer's Rodent Monitoring System (RMS) is a wireless network of high-tech sensors that are added to traps intelligently placed in the surroundings of food-processing plants and other sensitive environments. With the increasing penetration of technology-enabled services, growth can be witnessed in the market in the coming years.

Download Free sample to learn more about this report.

Fumigant Products Market Growth Factors

Increased Application of Fumigation Services in Residential Areas Boosts the Market Growth

The world's population is highly concentrated in metropolitan cities and urban areas. According to World Bank data, the population in urban areas in 2017 was 4.12 billion, which would increase to 4.37 billion in 2021. The pests are expected to spread more quickly in urban areas as apartments and buildings are densely located. In addition, the time to keep residential and working spaces pest-free has been reduced with the rising workload and busy lifestyle. This factor has increased the demand for pest control services, including fumigation to maintain residential areas and public health.

The increase in pest prevalence in urban areas led to an increased demand for residential fumigation in the past few years. According to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, 765,000 new houses were sold in February 2020, compared to 669,000 new single-family houses sold in February 2019. With increasing numbers of structural buildings, there arises a need to fumigate the houses after every few months/years. This factor will favor the growth of residential application of fumigant products in North America.

Surge in Pest Infestation due to Climate Change Fuels the Adoption of Fumigants

The global annually averaged surface temperature has increased by 1.8°F (1.0°C) during the last 115 years (1901-2016), according to the USDA ERS (U.S. Department of Agriculture, Economic Research Service). Variation in climate has complex effects on most ecosystems, including cultivated land. According to the FAO, climatic change is an essential factor that increases the risk of spreading insects and pests in forestry and agricultural ecosystems. An increase in precipitation levels and temperature favors the distribution and growth of most pest species. The impact of climate change can be seen in the increased number of crop pests ravaging economically important crops by being more destructive due to favorable climate. For example, rice weevils do not multiply when the moisture content is 9%, but when it exceeds 9%, the multiplication of progenies of rice weevils is observed. The rise in annual average temperature is expected over the next few decades, leading to an increased pest population. With increasing temperatures, fumigant chemical product demand is expected to rise over the forecast period.

RESTRAINING FACTORS

Increasing Incidences Related to the Hazardous Effects of Fumigant Products on Human Health are Limiting the Market Growth

Fumigant emission is a considerable concern, as direct inhalation of these chemicals impacts people working and living close to the application sites. Inhalation of fumigant emissions adversely affects health, causing coughing, dizziness, respiratory tract irritation, muscular twitching, and shortness of breath. Fumigants' residues can be found in different forms in human or animal bodies. Thus, fumigants may be excreted, bio-accumulated in body fat, metabolized, or stored.

Residues of fumigant products can also be found in different beverages and foods, including water, fruit juices, animal feeds, instant-cooked meals, and refreshments. In most cases, the concentrations of these residues do not exceed the legislatively set safe levels.

The residues of unchanged fumigant can remain in the commodity due to continuous use of the same fumigant. Therefore, the reaction of the individual components of different commodities with fumigants can alter their physical or chemical properties. It results in a change in taste, nutritional value, odor, and flavor. This leads to hazardous effects on consumers' health by consuming fumigated products, thereby restraining market growth.

Fumigant Products Market Segmentation Analysis

By Type Analysis

Phosphine Segment to Hold Larger Share Backed by its Increasing Popularity Owing to Numerous Uses in Pest Control

The phosphine fumigants segment is projected to dominate the fumigant products market, accounting for 69.38% of the global market share in 2026. The popularity of phosphine fumigants in pest control of stored products over the past few decades is due to its ease of application in several different storage structures, relatively low cost, acceptance in all markets, and effectiveness against major pest species. Fumigants commercial formulations are available in the form of sachets, blankets, solid tablets, or cylindered gas. Their ease of application enables them to be used across various storage structures, whether a bag stack, bunker, railcars, a large-bulk shipload, silo, or padded storage. Another key attribute increasing the adoption of phosphine is its acceptance as a residue-free product by international markets. It can disperse faster through the commodities owing to its low density, similar to air. Phosphine also breaks down immediately after fumigation, making it atmospherically safer than methyl bromide. Owing to these benefits, the demand for phosphine is expected to aid the market growth.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Solid Segment to Hold Larger Share Owing to its Ease of Application and Large Adoption among Consumers

Based on the form, the global market is segmented into solid, liquid, and gas.

The solid form segment is expected to lead the market, contributing 67.03% globally in 2026. The solid form of fumigants contributed a significant share worldwide due to its high adoption among consumers and ease of application. Moreover, solid fumigants are considered safe as they have lower chances of gas exposure upon application.

The demand for gas fumigants is expected to grow at a CAGR of 5.82% during the forecast period. The gaseous form of fumigants is usually applied in enclosed chambers with a glass-proof covering to avoid gas leakage in the environment.

By Application Analysis

Commercial & Industrial Segment to Grow Significantly Fueled by Higher Adoption of Fumigant Products in Emerging Countries

The commercial & industrial segment accounting for 43.91% of the global market share in 2026. Commercial and industrial fumigation includes fumigation of ship-holds, railcars, sea containers, bins and silos, tarps and bunkers, trailers, elevators, chambers, vaults, trucks, warehouses, vans, transport vehicles, tarpaulin-covered commodities, and others. Thus, the increasing requirement for fumigation in commercial and industrial sectors is making key players enter into mergers and partnerships with other established players manufacturing fumigant products. For instance, in June 2022, the Western Fumigation Company partnered with Hot Logistics, USDA, and product manufacturer, Draslovka Services. Western Fumigation Company used Draslovka's fumigant product eFume, an alternative to its current fumigation treatments, through this partnership. Thus, the Western Fumigation Company also started fumigating the containers, silos, and other storage structures. With increasing demand for fumigants from developing countries, the market is expected to bolster in the coming years.

REGIONAL INSIGHTS

Asia Pacific Fumigant Products Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for USD 2.59 billion in 2025. Asia Pacific has the largest percentage of the global population residing in the region. Densely populated areas are more prone to pest infestation, increasing the demand for residential fumigation. According to the Organization for Economic Cooperation and Development and Food and Agricultural Organization (OECD), the Asia Pacific region is expected to account for about 53% of global agricultural production by 2030. Out of this, crop production accounts for around 60% of the total agricultural production of Asia Pacific. The China market reaching USD 0.93 billion by 2026 and the India market reaching USD 0.67 billion by 2026.

Further, North America accounts for a significant share of the global fumigant products market share, followed by Asia Pacific. North America, which consists of the U.S., Canada, and Mexico is expected to show rapid revenue growth over the forecast period owing to the growing demand for fumigants due to increased farm yields. The major factor boosting the growth of the fumigant chemicals market in North America is the increasing number of residential clusters, where pest control is highly required. The U.S. market reaching USD 1.04 billion by 2026.

Europe holds a considerable share of the global market. The increase in agricultural production (food grains) and growing demand for pest control favor the growth of fumigants in Europe. Residential and commercial & industrial fumigation is also on the rise in Europe, which generates demand for fumigants in the region. The UK market reaching USD 0.10 billion by 2026 and the Germany market reaching USD 0.16 billion by 2026.

Further, South America accounts for a significant share of the global market. The demand for phosphine fumigants is increasing as it is an effective alternative to methyl bromide. Due to the surplus production of food grains, storage facilities are increasing. According to the Department of Agriculture and Consumer Economics, from 2011 to 2022, Brazil's total grain storage capacity increased by 35%. Therefore, various companies and manufacturers are investing in expanding their warehouses owing to the surplus production of grains, which is anticipated to surge the demand for fumigant products for warehouse applications in the region.

The Middle East & Africa accounts for a substantial market share in the fumigants market, owing to increasing demand for food and rising incidences of yield losses. Thus, farmers in the Middle East & Africa are increasingly utilizing fumigants, boosting the fumigants market growth in the region.

KEY INDUSTRY PLAYERS

Companies Focus on Mergers & Acquisitions and Partnerships to Gain Competitive Edge

The market players focus on manufacturing products tailored to different regions and consumer bases. New products are being launched in the market to have an edge over the competitors and more consumer attention. New products and an extensive portfolio will enable key players to respond to new market trends, gain a competitive advantage, and enter new markets. Product differentiation will be a key factor driving product sales and influencing market dynamics throughout the forecast period. Many companies are forming mergers & acquisitions and partnership & collaboration strategies to enable market growth.

List of Top Fumigant Products Companies:

- AMVAC Chemical Corporation (U.S.)

- Arkema (France)

- Detia Degesch GmbH (Germany)

- Ecotec Fumigation (Argentina)

- Intech Organics Ltd (India)

- LANXESS AG (Germany)

- Solvay S.A. (Belgium)

- Draslovka Services Group (Australia)

- S.C. JOHNSON & SON, INC. (U.S.)

- Ensystex Australasia Pty Ltd (Australia)

KEY INDUSTRY DEVELOPMENTS:

- December 2021 – Draslovka Services Group acquired the mining solutions business of the Chemours Company. Through acquiring the mining business of the Chemours Company, Draslovka was able to establish its operations in three continents, Europe, Asia Pacific, and the Americas, enabling it to offer good quality products and services to its customers in the agriculture, mining, and diversified industrial sectors across the world.

- August 2021 – LAXNESS acquired Emerald Kalama Chemical, a specialty chemicals manufacturer. The acquisition benefitted LANXESS by enabling the company to enter new businesses and strengthen its position in untapped markets.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments and the competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.17% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Form

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 5.72 billion in 2025.

The market is likely to grow at a CAGR of 6.17% over the forecast period (2026-2034).

The phosphine segment is expected to lead the market due to its numerous uses in different industries for fumigation.

The increased pest infestation in commercial & industrial, agriculture, and residential sectors and the frequently changing climate are expected to drive the market growth.

Some of the top players in the market are Solvay, LANXESS, Arkema, American Vanguard Corporation, and Detia Degesch GmbH.

The U.S. dominated the market in terms of increased residential fumigation in 2024.

The presence of residues of fumigants in fumigated commodities that consumers further consume, thereby having adverse effects on human health, is expected to restrain its deployment globally.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us