Game Engine Market Size, Share & Industry Analysis, By Type (2D Game Engines, 3D Game Engines, and Others), By Genre (Multiplayer Online Battle Arena, Action and Adventure, Shooting Games, Real-time Strategy, Role-playing Games, Simulation & Sports, and Others), By Platform (Mobile, Console, Computer, and Others), and Regional Forecast, 2026 – 2034

GAME ENGINE MARKET SIZE AND FUTURE OUTLOOK

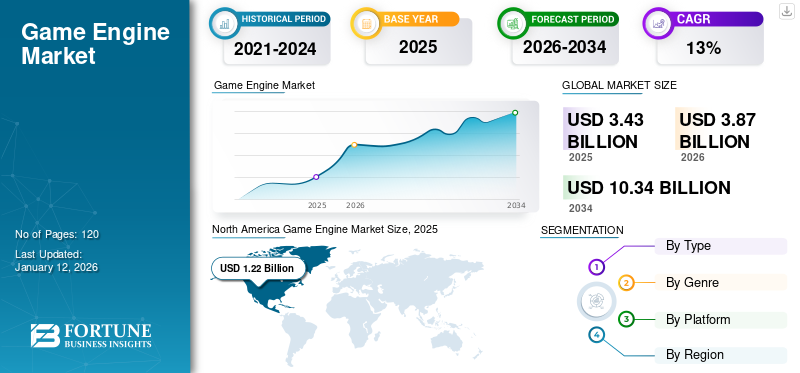

The global game engine market size was valued at USD 3.43 billion in 2025 and is projected to grow from USD 3.87 billion in 2026 to USD 10.34 billion by 2034, exhibiting a CAGR of 13.1% during the forecast period. North America dominated the market with a share of 35.60% in 2025.

A game engine is a software framework designed to facilitate the creation and development of video games. It provides developers with a set of tools and functionalities to streamline the game development process, enabling them to focus on game design, storytelling, and gameplay mechanics without building every component from scratch. The future of the game engine market is poised for significant growth, driven by advancements in technology and evolving consumer demands. The market is growing into a multifaceted ecosystem, bridging the gap between entertainment, enterprise, and immersive experiences. With continuous innovation and widespread adoption, its future remains highly promising. Moreover, the market is dominated by established key players and emerging players, such as Unity Technologies, Epic Games, Crytek, Godot Engine, Electronic Arts, and Rockstar Advanced Game Engine. These players cater to various needs, including high-performance video games, indie development, and immersive augmented reality (AR) / virtual reality (VR) applications. For instance,

- According to 6Sense survey in 2023, 27.2% of games are powered by Unity Technologies, while Epic Games has a 16.2% market share. These two are major players operating in the market.

The COVID-19 pandemic had a positive impact on the market, with lockdowns and remote work culture driving increased screen time making gaming as a primary source of entertainment. This surge boosted demand for game engines such as Unity and Unreal Engines to develop immersive online experiences. Additionally, demand for the adoption of AR/VR technologies increased for remote collaboration, virtual events, and training, promoting game engines to expand into these emerging areas.

IMPACT OF GENERATIVE AI

Enhanced Game Development Efficiency of GenAI Aids Market Growth

Generative AI enables the automatic generation of game assets such as environments, textures, characters, and even sound effects, reducing the time and effort required by game developers. For instance, AI tools can generate vast open-world landscapes with unique terrain, vegetation, and buildings, making it easier to create expansive game worlds. Furthermore, generative AI can create adaptive music that changes based on in-game events or player’s actions, enhancing the emotional depth of gameplay. It can also autonomously generate sound effects that match different in-game environments or interactions, delevering a richer and more immersive audio experience. In addition, gen AI helps automate the game testing process by generating various in-game scenarios, detecting bugs, and identifying glitches faster and more efficiently than traditional methods. For instance,

- In August 2024, NVIDIA launched NVIDIA ACE, a tool developed to improve digital human interactions with the help of generative AI technology. Mecha BREAK is the first game to use generative AI technology.

MARKET DYNAMICS

Market Drivers

Growing Adoption of Gaming Across All Age Groups Drives Market Progress

The market is growing rapidly, fueled by technological advancements, increasing demand for interactive content, and its expanding use across industries. The global video game industry is witnessing exponential growth, driven by increased adoption of gaming across all age groups. High demand for immersive and realistic gaming experiences has created the need for advanced game engines with powerful graphics and physics capabilities. In addition, the growing global gaming audience, fueled by esports, live streaming, and social gaming, is driving the development of games, thereby boosting the market growth. For instance,

- In December 2023, Godot Engine, the U.S.-based game engine provider engaged in a partnership with Google and The Forge. Through this collaboration, the company aimed to develop optimized mobile games.

Market Restraints

Performance and Hardware Limitations and Competition from Open-Source Alternatives May Hinder Market Growth

High-performance game engines require powerful hardware, which may limit their use on low-end devices, especially in emerging markets. Developers often face challenges in optimizing games across multiple platforms without compromising quality. Moreover, open-source engines such as Godot offer free and customizable solutions, creating competition for commercial engines such as Unity and Unreal. While beneficial for developers, it may reduce profitability for established game engine providers. For instance,

- As per the industry survey, 85% of game engines, other than major players, set their software price below USD 19.99, creating huge competition among local players and well-established players.

As games become more sophisticated, development timelines and costs increase, requiring substantial resources and expertise. These challenges can deter smaller studios or organizations from adopting advanced game engines, poptentially hindering market growth.

Market Opportunities

Rising Adoption of Product in Diverse Industry to Create Lucrative Opportunities for Market Players

Game engines are critical in creating augmented reality/virtual reality experiences for gaming, training, and entertainment. They are increasingly used in virtual production, pre-visualization, and special effects within the entertainment industry, and in the sectors such as healthcare (surgical training), real estate (virtual tours), and education (interactive learning). Furthermore, the development of the metaverse depends heavily on game engines to create interactive and immersive virtual environments. Companies such as Meta (Facebook), Microsoft, and Epic Games are driving innovation in this space, creating major growth opportunities for the market during the forecast period.

Game Engine Market Trends

Increasing Demand for Mobile Gaming among Customers Boosts Market Growth

The rising popularity of mobile gaming is significantly contributing to the growth of the market. The increasing availability and affordability of smartphones have expanded the mobile gaming user base globally. High-performance mobile devices now support sophisticated games, driving demand for advanced game engines. Mobile gaming continues to grow, with engines such as Unity and Cocos2d-x being widely adopted for creating mobile-friendly games catering to both casual and hardcore gamers. Freemium models and app stores such as Google Play and the Apple App Store make mobile gaming highly accessible, driving innovation and contributing to the continued expansion of market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Based on type, the market is divided into 2D game engines, 3D game engines, and others (2.5D game engines.

3D game engines captured 64.82% of the largest market share in 2026 and it is expected to continue its dominance. It is also expected to witness the highest CAGR during the forecast period. 3D game engines offer advanced rendering capabilities, enabling developers to create highly realistic and immersive environments, characters, and effects. They also support AR/VR integration, making them ideal for games, simulations, and applications requiring immersive experiences.

2D game engines are expected to grow at a prominent CAGR in coming years, as they are simpler and faster to use, making them ideal for beginners and indie developers. 2D games typically require less computing power, making them suitable for mobile platforms and devices with limited hardware capabilities. Additionally, 2D engine development costs are lower due to simpler assets, reduced development time, and affordable tools.

By Genre

Rising Need for Complex Mechanics and High-Quality Visuals Boosts the Popularity of Action and Adventure Games

Based on genre, the market is categorized into multiplayer online battle arena, action and adventure, shooting games, real-time strategy, role-playing games, simulation & sports, and others (puzzle games, horror games, etc.).

Action and adventure captured the largest market share in 2024. These games often include diverse mechanics such as combat, puzzles, and exploration, which game engines handle through modular tools and plugins. Stunning visuals are crucial for immersive gameplay, and game engines provide ray tracing, HDR support, and post-processing effects to achieve cinematic-quality graphics. Addditionally, action games require advanced Artificial Intelligence (AI) for enemies and non-player characters (NPCs) to enhance player engagement and challenge. Action and adventure is expected to capture 22.63% of the market share in 2026.

Multiplayer online battle arena (MOBA) is expected to grow at the highest CAGR of 17.00% in coming years, as they require handling thousands of simultaneous players. Game engines offer optimization tools to ensure smooth performance across devices with varying hardware capabilities. MOBA games often have intricate maps and dynamic environments, which are efficiently developed using the level design tools available in advanced game engines.

By Platform

To know how our report can help streamline your business, Speak to Analyst

Surge in Demand for Cross-Platform Games Encouraged the Mobile Segment Growth

Based on platform, the market is classified into mobile, console, computer, and others (TV, arcades, etc.).

Mobile captured the highest market share in 2024, with game engines such as Unity and Unreal Engine enabling developers to build games that work seamlessly across iOS, Android, and other platforms. These engines simplify porting, reducing development time and costs. Game engines provide built-in tools for monetization (ads, in-app purchases) and analytics, essential for the free-to-play mobile gaming model. Mobile segment is projected to capture 42.85% of the market share in 2026.

Console is expected to grow at the highest CAGR of 15.80% during the forecast period. Console gaming emphasizes realism and visual fidelity. Game engines such as Unreal Engine are equipped with ray tracing, HDR, and other advanced rendering technologies, while engines such as Frostbite are commonly used for developing video games with large budgets and high production values.

GAME ENGINE MARKET REGIONAL OUTOOK

North America

North America Game Engine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest game engine market share in 2024, owing to the robust gaming industry, advanced technological infrastructure, and growing demand for interactive content. The region is home to leading game development studios, including EA, Activision Blizzard, Godot, and Epic Games, which rely heavily on advanced game engines such as Unreal Engine and Unity. For instance,

- In March 2024, W4 Games announced to collaborate with Meta to enhance the game developer experience with Godot Engine.

These factors play a vital role in fueling the market growth in the region. The North American market size stood at USD 1.35 billion in 2026, and in 2025, the market size was accounted for USD 1.22 billion.

The U.S. market size is expected to reach USD 0.95 billion in 2026. The increasing popularity of mobile gaming among U.S. consumers drives the adoption of mobile-optimized game engines such as Unity. Universities and online platforms in the U.S. offer courses on game development using engines such as Unity and Unreal, increasing adoption among students, thereby fueling market growth across the U.S.

Asia Pacific

Asia Pacific region is projected to be the second-largest market with a value of USD 0.97 billion in 2026. This region is expected to grow at the second-highest CAGR of 18.10% during the forecast period, with countries such as China, Japan, and South Korea, leading in mobile gaming adoption. Unity is widely used for developing mobile games for a diverse player base. The freemium model and growing smartphone penetration drive game engine adoption in emerging markets such as India and Southeast Asia. In addition, the booming esports industry in South Korea, China, and Japan accelerates the demand for high-quality games developed using advanced game engines.

- For instance, in October 2024, Alchemy Pay, a fiat-crypto payment gateway partnered with a China-based Cocos Studio to permit Fiat Payments for GameFi Projects.

The market in China is estimated to be USD 0.22 billion in 2026, whereas Japan is projected to reach USD 0.2 billion and India is likely to hit USD 0.16 billion in 2026.

South America

The adoption of the product is growing significantly in South America. Developers are using game engines to create games reflecting local culture, history, and themes, catering to regional and global players. High penetration of smartphones and affordable internet access drive mobile gaming in countries such as Brazil, Argentina, and Colombia, fueling market growth in the region during the forecast period.

- For instance, in April 2023, Epic Games acquired AQUIRIS, a Brazil-based game developer, to enhance its online gaming presence in Brazil.

Europe

Europe region is projected to be the third-largest market with a value of USD 0.87 billion in 2026. In Europe, the market is growing at a prominent pace, with renowned game development studios such as Ubisoft, CD Projekt Red, and Remedy Entertainment using advanced game engines such as Unreal Engine, Unity, and proprietary engines. The rise of indie game development in countries such as the U.K., Germany, and Sweden has led to increased adoption of cost-effective and flexible gaming software such as Godot and Game Maker.

- For instance, in May 2022, Azerion, the Netherlands-based digital entertainment and media platform company engaged in a partnership with Cocos. Through this collaboration, the company aimed to help developers to create quality games and apps.

The market in U.K. is estimated to be USD 0.17 billion in 2026, whereas Germany is projected to reach USD 0.16 billion. France is likely to hit USD 0.12 billion in 2026.

Middle East & Africa

The Middle East & Africa region is projected to be the fourth-largest market with a value of USD 0.39 billion in 2026. The region is expected to showcase noteworthy growth during the forecast period. The growing esports industry in MEA encourages the development of competitive games using advanced game engines. Countries such as Saudi Arabia and Egypt are merging as key players in this space. Furthermore, governments in countries such as Saudi Arabia and the UAE are investing in gaming and digital content creation as part of their economic diversification efforts, boosting game engine market growth. The GCC market size is estimated to hit USD 0.10 billion in 2025.

- For instance, according to industry experts, 67% of Saudi Arabia’s population are game enthusiasts.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Footprints Globally

Key players are focusing on expanding their geographical presence by presenting industry-specific services. Major players are strategically pursuing acquisitions and collaborations with regional players to maintain their dominance across various regions. Top market participants are launching new solutions to increase their consumer base along with increased investments in R&D for product innovations to strengthen their market position. Companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Companies Studied:

- Unity Technologies (U.S.)

- Epic Games, Inc. (U.S.)

- RPG Maker (U.S.)

- AppOnboard, Inc. (U.S.)

- Cocos (China)

- Clickteam (France)

- Crytek GmbH (Germany)

- GameSalad (U.S.)

- Stencyl LLC (U.S.)

- YoYo Games Ltd. (GameMaker Studio 2) (U.K.)

- Stride (U.S.)

- Scirra Ltd. (Construct 3) (U.K.)

- Marmalade Technologies Ltd. (U.K.)

- Photon Storm Ltd. (U.K.)

- Electronic Arts Inc. (U.S.)

- MonoGame Foundation, Inc. (U.S.)

- Godot Engine (U.S.)

- Open 3D Engine (U.S.)

- GDevelop (U.K.)

- Solar2D (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS:

November 2024: Webster University partnered with Epic Games to enhance its Games & Game Design and Film, Television, and Video Production programs.

October 2024: Unity Technologies launched Unity 6, a novel game engine, during its annual Unite Developer Conference.

February 2024: Epic Games engaged in a partnership with Walt Disney Company, where Walt Disney would invest USD 1.5 billion to acquire an equity stake in Epic Games and create open games for customers

June 2023: Epic Games engaged in a partnership with LVMH, a manufacturer of luxury products to provide an enhanced virtual experience for its customers.

August 2022: Unity Technology engaged in a partnership with Microsoft Corporation to develop multiple cloud capabilities. These capabilities will help customers to deliver new functionality, improve workflows, and more global access options.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Unity Technologies, Epic Games, Crytek, Godot Engine, Electronic Arts, and Rockstar Advanced Game Engine are engaged in collaborating with hardware manufacturers (e.g., NVIDIA and AMD) to optimize engines for the latest GPUs and CPUs. Unreal Engine works closely with Nvidia for technologies such as ray tracing and Deep Learning Super Sampling (DLSS) integration. These factors are expected to create a lucrative opportunity for the market growth. Addionally, partnerships with console manufacturers such as Sony, Microsoft, and Nintendo ensure engines are optimized for their platforms, providing seamless development support.

- For instance, in 2022, around 636 gaming companies' acquisition deals took place, valuing approximately USD 125 billion.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

GAME ENGINE MARKET REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Genre

By Platform

By Region

|

|

Companies Profiled in the Report |

Unity Technologies (U.S.), Epic Games, Inc. (U.S.), RPG Maker (U.S.), AppOnboard, Inc. (U.S.), Cocos (China), Clickteam (France), Crytek GmbH (Germany), GameSalad (U.S.), YoYo Games Ltd. (U.K.), Stencyl LLC (U.S.), etc. |

Frequently Asked Questions

The game engines market is projected to reach USD 10.34 billion by 2034.

In 2025, the game engines market was valued at USD 3.43 billion.

The game engines market is projected to grow at a CAGR of 13.10% during the forecast period.

By type, 3D game engine led the market.

Growing adoption of gaming across all age groups is a key factor driving market progress.

Unity Technologies, Epic Games, Inc., RPG Maker, AppOnboard, Inc., Cocos, Clickteam, Crytek GmbH, GameSalad, YoYo Games Ltd., and Stencyl LLC are the top players in the market.

North America held the highest game engines market share in 2025.

By platform, the console is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us