Gaming Accessories Market Size, Share & Industry Analysis, By Product Type (Gamepads/Controllers, Gaming Keyboards and Mice, Gaming Headsets, Gaming Chairs, VR Devices, and Others), By Device Type (PC (Desktop and Laptop), Gaming Consoles, and Smartphones), By Connectivity Type (Wired and Wireless), By Distribution Channel (Specialty Stores, Online, Departmental Stores, and Others), By End-User (Casual Gamers, Professional Gamers, Content Creators and Streamers, and eSports Organizations), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

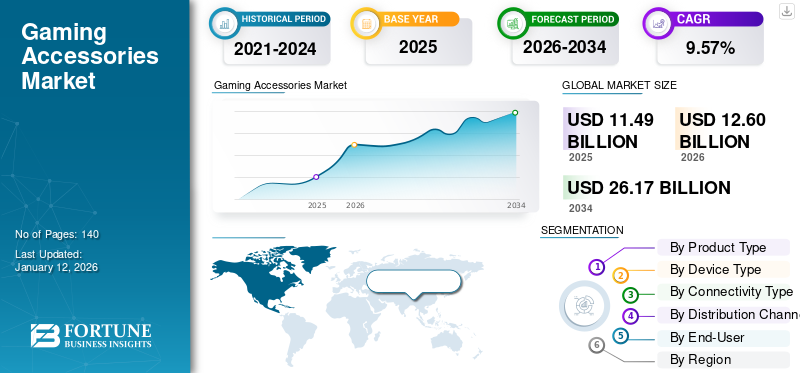

The global gaming accessories market size was valued at USD 11.49 billion in 2025 and is projected to grow from USD 12.6 billion in 2026 to USD 26.17 billion by 2034, exhibiting a CAGR of 9.57% during the forecast period. North America dominated the gaming accessories market with a market share of 39.66% in 2025.

Gaming accessories are equipment and peripherals designed to improve the gaming experience. The major players included in this market are Dell Technologies, Logitech International SA, Razer Inc., Mad Catz Global Limited, Turtle Beach Corporation, Corsair Gaming Inc., Cooler Master Co., Ltd, Sennheiser electronic GmbH & Co. KG, HyperX, and Anker.

The growth of this market is driven by many factors, including growing eSports industry and professional gaming, technological innovation, and immersive features of AR and VR. An industrial analyst stated that over 500 million viewers globally follow gaming content. The increase in disposable income and easy access has created a growing demand for these accessories, thus fueling the market growth. Furthermore, brands have adopted designs that focus on the health of users to avoid long-term damage, which attracts casual as well as professional gamers. All these factors are increasing the market share.

While restricted to their homes during the COVID-19 pandemic, gaming quickly became the primary source of fun and a means of empowerment due to connectivity. There was a shift in the gaming culture from being it being a minority interest to an accessible platform for engagement among diverse populations, making gaming equipment like headsets, keyboards, mice, controllers, and virtual reality equipment in high demand. However, lockdowns caused serious disruptions in the production, which had a serious impact on the supply chains.

IMPACT OF GENERATIVE AI

AI Integrated Chairs Using Gen AI Is Improving Gaming Experience

Generative AI is transforming the development of gaming accessories by changing how users engage. From chairs equipped with AI to smart keyboards, the range of possibilities keeps growing. AI technology improves gaming accessibility and enhances the complete experience through sophisticated learning algorithms that anticipate user preferences.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs are greatly increasing expenses for gaming accessories, particularly those produced in China. Relocating production to Vietnam or Cambodia provides only marginal assistance, as those nations are now imposing significant tariffs as well. Organizations can expect elevated prices, , supply challenges, and changes in production strategies throughout the gaming hardware industry.

MARKET DYNAMICS

Market Drivers

Growing eSports Industry and Professional Gaming to Aid Market Growth

The swift growth of eSports has significantly influenced the gaming accessories industry, as competitive gaming requires specialized, high-performance equipment for peak performance. The rise in investment in gaming peripherals fosters the demand for extreme precision optical sensors in gaming mice, minimal actuation distance in gaming keyboard switches, and retractable rear paddles in professional controllers.

Gamer Spending vs. Broader Benchmarks

|

Benchmark |

Annual Spend (USD) |

Insights |

|

Competitive gamer (DLC + accessories) |

~ 425 |

Your baseline figure |

|

Average U.S. household (gaming-related) |

~ 435 |

Nearly identical, including consoles, games, and accessories |

Market Restraints

High-end Prices of the Accessories to Hinder Market Expansion

A major obstacle impeding the gaming accessories market growth is the high prices of premium products. Though the functionalities that high-end accessories, such as a gaming mouse, VR headsets, and mechanical keyboards, are enormous, budget buyers still refrain from buying them due to their high prices.

Market Opportunities

Rise in Usage of Mobile Gaming to Create Lucrative Market Opportunities

As mobile devices gain more power and the ability to support high-quality games, players are looking for accessories that enhance their on-the-go gaming experiences. The growing trend and adoption of playing games on smartphones and tablets inspire developers to create peripherals oriented toward mobile gamers, including portable controllers, gaming grips, and many other enhancements. This does not just broaden the potential of the market but also opportunities for innovation and the introduction of new products directed at mobile gaming enthusiasts.

Gaming Accessories Market Trends

Integration of Wireless Technology and Focus on Sustainability to Emerge as a Key Market Trend

Download Free sample to learn more about this report.

The incorporation of wireless technology and enhanced battery life in gaming devices provides gamers with smooth and continuous gameplay. The demand for RGB lighting in accessories grows strong, as companies reveal apps that let users match light shows across different gear, building a joined gaming environment. Also, the growing focus on sustainability is driving makers to use eco-safe materials, meeting the needs of buyers who look for sustainable options.

SEGMENTATION ANALYSIS

By Product Type

Rising Ease of Interaction for Gamers Boosted the Demand for Gamepads/Controllers

Based on product type, the market is segmented into gamepads/controllers, gaming keyboards and mice, gaming headsets, gaming chairs, VR devices, and others.

By share, gamepads/controllers dominated the market with a share of 32.88% in 2026. Gamepads/controllers have a greater reach on different platforms. Be it consoles, PCs, or even on mobile, it offers a familiar and standardized way of interacting with the game. This is because of their universality, which leads to widespread adoption ensuring, catering to all the segments, from casual gamers to enthusiasts and professional players.

The gaming chairs segment is set to achieve the highest compound annual growth rate (CAGR) in the forecast period. Gaming chairs are becoming increasingly sophisticated in their ergonomic design and features, which continue to focus on lumbar support, adjustable arm rests, and breathable materials. The rise in popularity of home gaming and streaming setups is also helping to spur growth of the segment.

By Device Type

PC Devices Dominated the Market owing to Enhanced Gaming Quality and Other Features

Based on device type, the market is categorized into PC (desktop and laptop), gaming consoles, and smartphones.

The PC segment led the market with contributation of 45.07% globally in 2026, fueled by an increasing need for high-quality gaming equipment among laptop and desktop users. This segment's rise is mainly due to better play quality, ready supply of enhanced hardware and software, and improved internet bandwidth, which collectively enhance the gaming experience.

The gaming consoles segment is expected to witness the highest CAGR during the forecast period. This is due to the growth in wireless, 3D gaming, and cloud/subscription models and expansion of multifunctional (gaming and streaming) devices.

By Connectivity Type

Wired Connectivity Type Dominated Due to Rising Need for Stable and Lag-Free Connections

Based on connectivity type, the market is categorized into wired and wireless.

In 2026, the wired segment led the market with a share of 59.30% in 2026, owing to increasing eSports popularity and need for stable connections free from lags during play. Accessories such as controllers, headsets, and keyboards that are wired are preferred by competitive gamers because of their reliability, since they offer minimal latency and consistent performance.

The wireless segment is expected to witness the highest CAGR during the forecast period. The increasing inclination towards wireless options is fueling the demand for products like wireless gaming headsets equipped with surround sound and noise cancellation features, wireless keyboards and mice adorned with RGB lighting and customizable keys, and wireless controllers that offer haptic feedback and adaptive triggers.

By Distribution Channel

Specialty Stores Dominated the Market as They Provide an Exclusive Shopping Experience

Based on distribution channel, the market is categorized into specialty stores, online, departmental stores, and others.

The specialty stores segment had the largest share accounting for 41.04% market share in 2026. The significance of this segment comes primarily from the level of specifically directed gaming accessories within specialty stores. These retailers only have items related to gaming and provided buyers with all of the items that relate to gaming accessories. They are able to offer consumers in-depth, immersive shopping visits based simply on the level of quantity of accessories available for gaming.

The online segment is expected to register the highest CAGR in the forecast period as it provides convenience, more choices, is globally accessible, is demand-driven by influencers, and is usually at a discount. Greater significance for the industry involves the rise of eSports, shoppers are more comfortable with online shopping, technology advancing, and growing number of gamers.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Casual Gamers Drive Accessory Sales through Trend-Driven Purchases across Categories

Based on the end-user, the market is categorized into casual gamers, professional gamers, content creators and streamers, and eSports organizations.

The casual gamers segment were the leading segment in 2024. Casual gamers are the largest consumer group, leading them to buy more gaming accessories as they tend to shop across various categories for entertainment, comfort, and style. They are more influenced by trends, regular updates, and gifts compared to professional gamers, who prioritize high performing equipment. As a result, casual gamers are the key contributors in overall accessory sales, even though their individual expenditures are lower.

The content creators and streamers are most likely to see the highest CAGR during the forecast period. Creators/streamers are the current trendsetters of game accessories, as they are always searching for ways to upgrade their streaming setup and gaming experience. The important trends are high-quality microphones for streaming, a webcam for streaming, lighting for streaming and gaming, ergonomic gaming chairs, adjustable RGB lighting, and specialized controllers.

GAMING ACCESSORIES MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

North America

[CzUmfRYrwI]

In 2025, the North America region acquired the largest gaming accessories market share in terms of gaming players. Northamerica dominated the global market in 2025, with a market size of USD 4.56 billion. The region has a large and diverse group of players, from casual users to professional eSports competitors. Gaming is a popular form of entertainment and has generated an enormous market of gaming accessories, including controllers, keyboards, headsets, and virtual reality equipment. The U.S. market is projected to reach USD 3.65 billion by 2026.

The continued progress of gaming technology in the U.S., in terms of the revolutionary graphics, spatial and immersive sound, and sophisticated peripherals, stimulates a strong demand for accessories that capitalize on technological enhancements.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to continue to have the highest CAGR over the forecast period. The growing adoption of smartphones and surging interest in mobile gaming have opened up fresh prospects for Asian gaming accessories manufacturers. The market in the region features a varied consumer demographic, including everything from casual mobile gamers to competitive e-sports professionals. An expanding middle-class demographic and increasing disposable incomes have made accessories available to a wider range of consumers in the region. The Japan market is projected to reach USD 0.93 billion by 2026, the China market is projected to reach USD 1.52 billion by 2026, and the India market is projected to reach USD 0.57 billion by 2026.

Europe

Europe is projected to be the second fastest-growing region during the forthcoming years. The gaming culture in countries like Germany, U.K., and France has made the market in this region strong. The European market benefits from a discerning consumer base that appreciates gaming peripherals and is inclined to spend on high-end gaming accessories.

South America

The region has a growing younger demographic, and these individuals are reaching an age with deeper engagement in online gaming platforms. Community gaming events and local gatherings are important in fostering engagement with the gaming culture and demand for associated gaming accessories. The UK market is projected to reach USD 0.44 billion by 2026, while the Germany market is projected to reach USD 0.41 billion by 2026.

Middle East & Africa

The region faces slight growth fueled by expanding internet access and a rising population of young people. The industry is experiencing considerable change with the emergence of gaming cafes and entertainment hubs in key urban areas.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Notable Players to Implement Strategic Strategies to Expand Business Reach

Key players present in this market are offering gaming accessories to provide users with features such as faster response times, better control, and more immersive audio. They concentrate on holding contracts with small and local businesses to grow their business. Moreover, mergers & acquisitions, partnerships, and investments will create a surge in demand for this technology.

List of Key Gaming Accessories Companies Studied

- Dell Technologies (U.S.)

- Logitech International SA (Switzerland)

- Razer Inc. (Singapore)

- Mad Catz Global Limited (China)

- Turtle Beach Corporation (U.S.)

- Corsair Gaming Inc. (U.S.)

- Cooler Master Co., Ltd (Taiwan)

- Sennheiser Electronic GmbH & Co. KG (Germany)

- HyperX (U.S.)

- Anker (U.S.)

- Reddragon (Eastern Times Technology Co. Ltd) (China)

- Nintendo Co. Ltd (Japan)

- Sony Corporation (Japan)

- SteelSeries (U.S.)

- Microsoft Corporation (U.S.)

- SCUF Gaming (U.S.)

- Xtrfy (Sweden)

- XPG (Xtreme Performance Gear) (Taiwan)

- A4Tech (Taiwan)

- Antec, Inc. (Taiwan)

…and more.

KEY INDUSTRY DEVELOPMENTS

- August 2025: HP Inc. announced a recent development in its HyperX and OMEN gaming systems with the integration of AI technology, designed for creators and gamers looking for efficiency and production value from each game session.

- March 2025: PowerA revealed its collaboration with Bandai Namco Entertainment America Inc. to celebrate the 45th anniversary of PAC-MAN. The two companies would be releasing a collection of special-edition gaming accessories for the Nintendo Switch and Xbox platforms, inspired by the iconic PAC-MAN universe.

- January 2025: ASUS Republic of Gamers (ROG) unveiled the latest ROG Phone 9 series, featuring sleek and high-performance gaming smartphones designed to deliver an exceptional gaming experience within a premium design.

- June 2024: ASUS Republic of Gamers (ROG) unveiled the Archer ErgoAir Gaming Backpack BP3800. With a 40-liter capacity, the multifunctional Archer ErgoAir includes a removable top pouch that can serve as a small day pack, along with an extra accessories pouch, a waterproof cover, and two hidden pockets.

- April 2024: Intel unveiled the Intel Gaudi 3 Gaming Accessories at the Intel Vision event to address the challenges in generative AI. Gaudi 3 offers flexibility to customers by providing open community-driven software and using industry-standard Ethernet networking for more adaptable system scaling.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Organizations can invest in startups innovating in wireless, AI, and eco-friendly accessories and acquire niche brands (like SteelSeries) to expand their product portfolio. Additionally, companies are investing in seeking out more opportunities. For instance,

- The VanEck Video Gaming & eSports ETF, led by investments in Roblox, is gaining steam, especially as AI drives growth across gaming platforms.

- SuperGaming raised USD 15 million, increasing its valuation to USD 100 million, reflecting investor appetite for gaming-focused ventures even beyond core hardware.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and the leading end-user of the product. Besides, it offers insights into the gaming accessories market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.57% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type · Gamepads/Controllers · Gaming Keyboards and Mice · Gaming Headsets · Gaming Chairs · VR Devices · Others (Gaming Bags, Cooling Fans, etc.) By Device Type · PC (Desktop and Laptop) · Gaming Consoles · Smartphones By Connectivity Type · Wired · Wireless By Distribution Channel · Specialty Stores · Online · Departmental Stores · Others (Gaming Arcades, eSports Lab, etc.) By End-User · Casual Gamers · Professional Gamers · Content Creators and Streamers · eSports Organizations By Region · North America (By Product Type, Device Type, Connectivity Type, Distribution Channel, End-User, and Country) o U.S. (By End-User) o Canada (By End-User) o Mexico (By End-User) · South America (By Product Type, Device Type, Connectivity Type, Distribution Channel, End-User, and Country) o Brazil (By End-User) o Argentina (By End-User) o Rest of South America · Europe (By Product Type, Device Type, Connectivity Type, Distribution Channel, End-User, and Country) o U.K. (By End-User) o Germany (By End-User) o France (By End-User) o Italy (By End-User) o Spain (By End-User) o Russia (By End-User) o Benelux (By End-User) o Nordics (By End-User) o Rest of Europe · Middle East & Africa (By Product Type, Device Type, Connectivity Type, Distribution Channel, End-User, and Country) o Turkey (By End-User) o Israel (By End-User) o GCC (By End-User) o North Africa (By End-User) o South Africa (By End-User) o Rest of the Middle East & Africa · Asia Pacific (By Product Type, Device Type, Connectivity Type, Distribution Channel, End-User, and Country) o China (By End-User) o Japan (By End-User) o India (By End-User) o South Korea (By End-User) o ASEAN (By End-User) o Oceania (By End-User) o Rest of Asia Pacific |

|

Companies Profiled in the Report |

Dell Technologies (U.S.) Logitech International SA (Switzerland) Razer Inc. (Singapore) Mad Catz Global Limited (China) Turtle Beach Corporation (U.S.) Corsair Gaming Inc. (U.S.) Cooler Master Co., Ltd (Taiwan) Sennheiser Electronic GmbH & Co. KG (Germany) HyperX (U.S.) Anker (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 26.17 billion by 2034.

In 2025, the market was valued at USD 11.49 billion.

The market is projected to record a CAGR of 9.57% during the forecast period.

By product type, the gamepads/controllers segment led the market in 2025.

The growing eSports industry and professional gaming to aid market growth.

Dell Technologies, Logitech International SA, Razer Inc., Mad Catz Global Limited, Turtle Beach Corporation, Corsair Gaming Inc., Cooler Master Co., Ltd, Sennheiser Electronic GmbH & Co. KG, HyperX, and Anker are the top players.

North America held the highest market share in 2025.

By end-user, the content creators and streamers are expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us