Gas Engine Market Size, Share & Industry Analysis, By Product Type (Natural Gas, Special Gas, & Other), By Power Output (0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, and 10-20 MW), By Application (Power Generation, Mechanical Drive, Cogeneration, and Others) and Regional Forecast, 2026-2034

Gas Engine Market Size

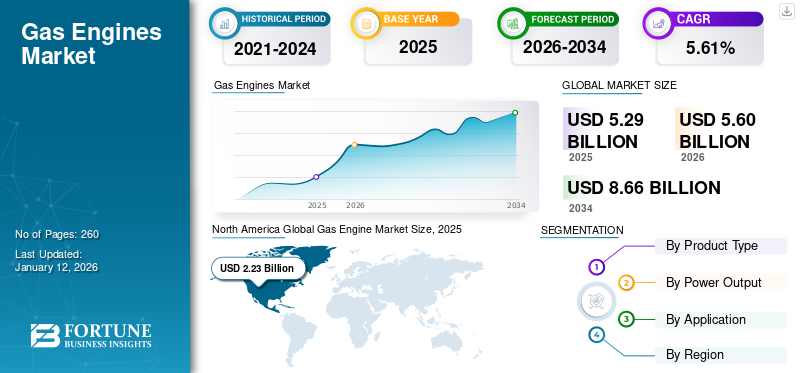

The global gas engine market size was valued at USD 5.01 billion in 2025 and is projected to grow from USD 5.29 billion in 2026 to USD 8.08 billion by 2034, exhibiting a CAGR of 5.61% during the forecast period. North America dominated the global market with a share of 42.10% in 2025. The Gas Engines market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.82 billion by 2032, driven by the rising demand for outdoor power equipment and small construction equipment.

Gas engines, also referred to as combustion engines or internal combustion engines, are a class of heat engines that use a sequence of carefully controlled explosions or combustion actions to transform the chemical energy of a gaseous fuel—typically a hydrocarbon-based fuel, such as diesel, gasoline, natural gas, or propane—into mechanical energy. They are widely employed in many different applications, such as industrial machinery, power generation, automobiles, and more.

The development of various technological breakthroughs in the past few years has led to the creation and evolution of exceptional gas engines, greatly enhancing the market for these engines. Furthermore, the market is also witnessing huge demand for clean and efficient power generation technology, which further adds to the overall growth of the market. Consequently, these factors will contribute to the market's growth in the near future. Also, the increasing emphasis on carbon emission reduction, as well as transitioning to cleaner and more sustainable energy sources, has resulted in various initiatives such as regulatory frameworks and tax incentives.

The COVID-19 pandemic disrupted global supply chains, causing delays in the production and delivery of gas engines and related components. The move to remote work decreased the energy consumption in workplaces and commercial buildings, which in turn reduced the need for backup power solutions, which are frequently gas-powered engines. In the face of economic uncertainty and lower demand, a number of planned projects, including cogeneration plants and power generation facilities, were postponed or canceled, which had an impact on the gas engine market growth.

Gas Engine Market Trends

Ongoing Advancements in Gas Engine Technology to Boost Market Expansion

Decentralized or distributed power generation is becoming prevalent. Gas engines are well suited to distributed energy systems, including CHP applications, where they can deliver both electricity and heat to local facilities, thereby improving resilience and energy efficiency. Ongoing advancements in gas engine technology, including improvements in efficiency, emissions control, and reliability, have made these engines more attractive and competitive in various sectors.

In February 2023, Cummins Inc. announced the launch of the new engine named ‘X10’ in North America in 2026, thus adding to the existing fuel-agnostic engine series. This engine is featured to comply with the U.S. EPA’s 2027 regulations and has the versatility to serve both medium and heavy-duty applications. Moreover, these X10 engines are manufactured to replace the existing L9 and X12 engines in application.

Download Free sample to learn more about this report.

Gas Engine Market Growth Factors

High Reliability and Efficiency of Gas Engines Compared to Other Fuel Engines to Fuel Market Growth

The gas engine operates continuously at maximum capacity, specifically in the industrial and commercial sectors, owing to its stable and consistent electrical supply. These engines also have a high utilization rate, a rapid startup, and a load efficiency that varies depending on the power demand. They reduce dependence on the power grid and decrease greenhouse gas emissions compared to traditional diesel motors, and this aspect makes these engines more dependable for power generation at both small and large scales. These engines have a higher open cycle efficiency and a lower fuel consumption. In small simple cycle plants with lower power outputs, these engines provide the highest electrical efficiency.

For instance, gas engines with a power output between 300 – 2,000 kW have a standard electrical efficiency of 40-45% and a total efficiency of 85-92% in low-temperature applications of CHP.

Stringent Environmental Regulations to Reduce Greenhouse Gas Emissions to Boost Market Expansion

Strict environmental regulations and the emerging need to reduce greenhouse gas emissions (GHG) are leading to a global shift toward cleaner and more sustainable energy sources. Gas engines, especially those that run on natural gas or biogas, emit fewer pollutants, such as carbon dioxide, nitrogen oxides, and particulate matter, than traditional fossil fuels. The environmental benefits of gas engines make them an attractive choice for industry, power generation, and transport sectors seeking to meet emissions targets and improve air quality.

Environmental regulation is regarded as an effective means for governments across countries to improve environmental quality and is favored and valued by regulators in environmental governance. In April 2023, the U.S. government's Environmental Protection Agency (EPA) published a proposal to impose stricter standards to minimize greenhouse gas emissions for heavy-duty vehicles beginning in the 2027 model year. The revised regulations would also apply to H.D. Professionals.

Similarly, in response to the growing problem of pollution caused by Manufacturing Carbon Emissions (MCE), the Chinese government has proposed specific emission reduction targets and taken positive regulation measures to control carbon emissions through enhanced ecological supervision. For example, “Made in China 2025” explicitly sets the target of reducing the carbon emissions per unit of added value by 40% from 2015 to 2025 value. Such regulations across various countries are driving market expansion due to their lower emission rates.

RESTRAINING FACTORS

Operation Challenges Due to Gas Engine Oil Formulation to Hamper Market Growth

Gas Engine Oils (GEO) are a careful balance of base oils, and GEO approval depends on-field performance. The increasing use of harsher gas fuels, combined with performance requirements from OEMs and consumers, poses significant challenges for GEO formulators. The biggest challenge in formulation is finding the right balance of sulfated ash in the finished oil. However, excessive ash can result in loss of power.

On the other hand, insufficient ash can cause the valve seal to be damaged, which in turn causes the engine to lose power. One or both of these conditions require additional costs or repairs/engine downtime. Also, the unique combustion chemistry of stationary gas engines, which exhibit high nitrification and oxidation, poses a significant challenge to GEO formulations. Thus, this factor hampers market growth.

Gas Engine Market Segmentation Analysis

By Product Type Analysis

Natural Gas Segment Dominated the Market Due to Its Easy Accessibility

Based on product type, the market is segmented into natural gas, special gas, and others.

The natural gas segment is projected to dominate the market with a share of 89.71% in 2026, owing to its easy accessibility. Natural gas is one of the cleanest fossil fuels and has low carbon emissions, as compared to other product types of fossil fuels, such as syngas, producer gas, and others. It also has lower transmission loss and high energy delivery.

Special gas engines are designed to meet the unique requirements of various specialized applications. As industries and technologies evolve, there is a growing demand for engines tailored to specific needs.

By Power Output Analysis

1-2 MW Segment Accounted for the Highest Market Share Due to Its Excess Use in the Power Generation and Cogeneration Markets

Based on power output, the market is segmented into 0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, and 10-20 MW.

The 0.5–1 MW capacity segment is expected to account for 24.63% of the total market share in 2026, and it is expected to grow, as these generators are primarily used in power generation and cogeneration. In cogeneration, engines produce power along with energy for space heating and water heating, which enables energy savings of up to 60%. Gas engines with a capacity of 1 to 2 MW are commonly used in cogeneration systems. These engines are designed to increase energy efficiency by using waste heat generated durinssg power generation for heating or cooling purposes. Cogeneration systems are popular in industries that require electricity and thermal energy.

Gas engines in the 0.5-1 MW range offer excellent energy efficiency. Energy-intensive industries are particularly interested in maximizing energy efficiency by using waste heat for high-quality heating, cooling, or industrial processes. Thus, this segment is also projected to witness growth over the forecast period.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Cogeneration Segment Leads Due to Cost-Effectiveness and Energy Sustainability

Based on the application, the market is segmented into power generation, mechanical drive, cogeneration, and others.

The cogeneration segment is anticipated to hold a significant market share of 36.16% in 2026 and is expected to dominate the market over the forecast period since cogeneration is clean and cost-effective and promotes energy sustainability by making efficient use of fuel or heat that would otherwise be wasted.

Technological advances, cost reductions, and competitive fuel prices have improved the economic viability of gas engines for power generation applications. Gas engines can power in remote and off-grid locations, such as rural electrification projects, mining operations, and island communities, where the main grid is inaccessible and offers consistent electricity.

REGIONAL INSIGHTS

The market has been divided into five key regions: North America, Latin America, Europe, the Middle East and Africa, and Asia Pacific.

North America Global Gas Engine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market has observed a shift toward the use of renewable gases, such as biogas, synthetic natural gas (SNG), and hydrogen. This transition is consistent with sustainable development goals and includes retrofitting or designing gas engines to run on these cleaner fuels. The trend of decentralized energy production is increasing. North America is the dominant region in the market since it is undergoing a transition to cleaner fuels in the gasoline engine market. These trends include an increased focus on natural gas, Renewable Natural Gas (RNG), and hydrogen as fuel sources due to environmental concerns and regulatory initiatives aimed at reducing emissions. The U.S. market is projected to reach USD 1.97 billion by 2026.

Asia Pacific

In Asia Pacific, rapid economic expansion and urbanization in nations such as China and India are driving a surge in energy consumption. Gas engines are used to meet the growing demand for electricity and heat. Many countries in the region are turning to natural gas as a cleaner, more environmentally friendly fuel source to produce electricity. This transition has led to the adoption of gas engines that can run on natural gas or LNG (liquefied natural gas). The Japan market is projected to reach USD 0.36 billion by 2026, the China market is projected to reach USD 0.67 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

Europe

The UK market is projected to reach USD 0.22 billion by 2026, while the Germany market is projected to reach USD 0.27 billion by 2026.

Latin America holds potential growth opportunities owing to the new investment projects and innovations. At the same time, governments and numerous other companies are planning to implement investment projects for the construction, expansion, and modernization of power generation plants.

Key Industry Players

Key Participants Focus on Developing New Product Development and Expanding their Product Capabilities

The global gas engine market is fragmented into large and medium-sized regional players providing a wide range of products locally and nationally across the value chain. Many companies are actively operating in different countries to meet the specific needs of customers. In terms of the economic landscape, the market portrays the presence of recognized and emerging gas engine companies. Caterpillar Inc. is one of the leading manufacturers of gas engines, industrial gas turbines, and diesel-electric locomotives. It helps its customers build a better, more sustainable world and is committed to contributing to a reduced-carbon future.

Major players include Cummins Inc., Wärtsilä, INNIO, Caterpillar Inc., Rolls-Royce PLC, MAN Energy Solutions, and Mitsubishi Heavy Industries Ltd., among others. Major companies constitute around one-fourth of the market, and the remaining market is dominated by a large number of regional and local players for a variety of end-use applications.

LIST OF KEY COMPANIES PROFILED:

- Cummins Inc. (U.S.)

- Wärtsilä (Finland)

- INNIO (Austria)

- Caterpillar Inc. (U.S.)

- Rolls-Royce PLC (U.K.)

- MAN Energy Solutions (Germany)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Tokyo)

- Siemens Energy (Germany)

- NINGBO C.S.I. POWER AND MACHINERY GROUP CO., LTD. (China)

- IHI Power Systems Co., Ltd. (Japan)

- JFE Engineering Corporation (Japan)

- Hyundai Heavy Industry Co (South Korea)

- Liebherr (Switzerland)

- R Schmitt Enertec GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2022: Wärtsilä signed a 5-year Operation & Maintenance (O&M) agreement and EPC (engineering, procurement, and construction) contract with Tamilnadu Petroproducts Limited (TPL), which is a world-class heavy chemical and Linear Alkyl Benzene manufacturer and part of AM International, Singapore. Under the contract, Wärtsilä will supply its 34SG gas engines to a gas-fuelled 15.5 MW captive power plant in Chennai, India. The partnership is aligned with the sustainable manufacturing and eco-friendly modernization targets in India.

- November 2022: Rolls-Royce and EasyJet completed the ground test of the project to run a modern aero engine on hydrogen, which is considered a new milestone in the aviation industry. The test was performed on a converted Rolls-Royce AE 2100, which is a regional aircraft engine. It is a significant step showing hydrogen could be the future zero-carbon aviation fuel and is also a vital part of the decarbonization strategy of Rolls-Royce and EasyJet.

- November 2022: Global investment firm Mutares SE & Co. KGaA successfully acquired Siemens Energy Engines S.A.U. and related assets. Mutares completed the acquisition of diesel and gas fuel engine manufacturer Siemens Energy Engines, which will now operate under the name Guascor Energy.

- September 2021: Caterpillar Inc. announced its new offering of a Cat generator set named Cat G3516H, which is featured to operate on 100% hydrogen as well as renewable green hydrogen. This generator set has an output of 1250 kW and 50 - 60 Hz for primary and load management applications.

REPORT COVERAGE

The market research reports grant a complete industry assessment by proposing valuable insights, facts, industry-related information, competitive landscape, and past data. Various methodologies and approaches are accepted to make expressive assumptions and views to formulate the global pipeline and process services market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 5.61% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Power Output

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market size was USD 5.29 billion in 2025.

The global market is projected to grow at a CAGR of 5.61% over the forecast period.

The market size of North America stood at USD 2.23 billion in 2025.

By product type, the natural gas segment accounts for a considerable share of the market.

The global market size is expected to reach USD 8.66 billion by 2034.

The key market driver is the high reliability and efficiency compared to other fuel engines in the oil and gas industry.

The top players in the market are Cummins Inc., Wärtsilä, INNIO, and Caterpillar Inc., among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us