GLP-2 Analogs Market Size, Share & Industry Analysis, By Drug (Teduglutide and Others), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies and Online & Retail Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

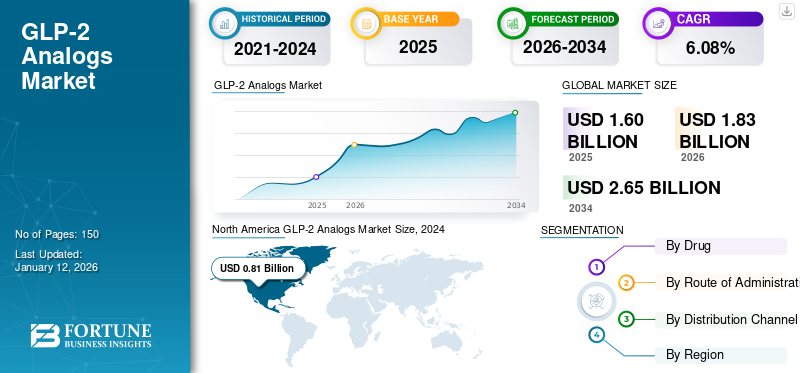

The global GLP-2 analogs market size was valued at USD 1.20 billion in 2025. The market is projected to grow from USD 1.83 billion in 2026 to USD 2.65 billion by 2034, exhibiting a CAGR of 6.08% during the forecast period. North America dominated the GLP-2 analogs market with a market share of 77.11% in 2025.

GLP-2 analogs (glucagon such as peptide-2 glp-2) are a drug class mainly used for the treatment and prevention of patients suffering from Short Bowel Syndrome (SBS) who need intravenous nutrition and fluids. The GLP-2 analog mimics the effect of naturally occurring GLP-2 hormone and promotes the function and growth of the intestine.

The market is witnessing significant growth due to the rising prevalence of gastrointestinal disorders such as short-bowel syndrome (SBS). Additionally, improvements in therapeutic delivery systems and rising clinical interest in intestinal failure therapies also drive market growth.

- For instance, according to the data published in Regenerative Therapy in December 2023, the prevalence of short bowel syndrome (SBS) in the U.S. in 2023 was approximately 30 cases per million people.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Cases of Short Bowel Syndrome Boost Market Growth

The global GLP-2 analogs market growth is primarily driven by a rise in the prevalence of short bowel syndrome across the globe. The prevalence of this syndrome rises due to several factors, such as gastrointestinal surgeries, congenital defects, or disease-associated loss of absorption. Additionally, a rise in awareness and increase in survival rates of individuals with intestinal failure also upsurges the patient population and supports market growth. These factors collectively create a large patient pool, leading to the rise in demand for effective treatment options, such as GLP-2 analogs. These are widely used to treat short bowel syndrome, which boosts market growth during the forecast period.

- For instance, according to the data published by Nutrition in Clinical Practice in May 2025, the prevalence of diagnosed short bowel syndrome in the general population in 2024 was 2.74 per 1,00,000 adults and 1.67 per 1,00,000 children.

MARKET RESTRAINTS

High Treatment Costs Can Hamper Market Growth

The high treatment cost may hamper the growth of the market. The GLP-2 analog treatment is expensive due to its development cost and R&D expenses. The GLP-2 analog dose is required to be taken on a daily basis, leading to a high financial burden on the patients to treat short bowel syndrome. The high prices associated with the GLP-2 analogs treatment are anticipated to restrict its adoption rate among the population, resulting in slower market growth.

- For instance, according to the data published in The American Journal of Clinical Nutrition, the estimated cost to treat short bowel syndrome with Teduglutide (GLP-2 analog) is more than USD 400,000 per patient per year.

MARKET OPPORTUNITIES

Longer-acting Analogs in Pipeline is Expected to Impact Market Growth Positively

In recent years, companies have shifted their focus to the development of long-acting GLP-2 analogs, which has created opportunities for market growth. This is due to advantages such as long-acting analogs that improve intestinal absorption in patients with short bowel syndrome (SBS). The new treatment approaches are also anticipated to boost market growth in the near future. Pharmaceutical companies are innovating longer-acting analogs, such as Apraglutide and Glepaglutide, which are designed for weekly dosing and improve patient compliance against daily dosing regimens.

- For instance, Zealand Pharma is developing Glepaglutide, which is a ready-to-use, long-acting GLP-2 analog for the treatment of short bowel syndrome (SBS), and it is stable in an aqueous solution.

MARKET CHALLENGES

Regulatory Hurdles May Limit Market Growth

Stringent regulations regarding the safety and efficacy of novel analogs must undergo rigorous clinical testing, which upsurges their time-to-market and research and development costs, limiting market growth. The strict regulations have been imposed due to concerns regarding side effects such as gastrointestinal discomfort, pancreatitis, and thyroid cancer influence regulatory scrutiny and patient confidence. These challenges may lead to a lower adoption rate of market products and lower market growth.

- For instance, in December 2024, Zealand Pharma A/S received a complete response letter from the U.S. FDA for the much-anticipated GLP-2 analog (glepaglutide). The new drug application was not ready for approval, as stated by the complete response letter.

GLP-2 ANALOGS MARKET TRENDS

Shift from Total Parenteral Nutrition to GLP-2 Drugs to Treat SBS

Earlier, these analogs were used as total parenteral nutrition (TPN), but in recent years, GLP-2 analogs have been used to treat diseases such as short bowel syndrome. This is due to the complications and high costs associated with total parenteral nutrition (TPN), and the potential of GLP-2 drugs to improve intestinal absorption and reduce parenteral support. These analogs mimic the action of hormones that help to advance intestinal function, which leads to better nutrient absorption and potentially reduces the need for TPN. Additionally, the ongoing clinical trials on these analogs by key market players further promote market growth.

- For instance, in January 2021, Hanmi Pharmaceutical Co., Ltd. cleared the phase 2 clinical trial for GLP-2 analog (HM15912), which was used in the treatment of short bowel syndrome.

Other Market Trends

Expansion of Indications is a Key Trend Reshaping the Market

The GLP-2 analogs are currently approved only for the treatment of short bowel syndrome. The ongoing clinical research is exploring the applications of these analogs for Crohn’s disease, ulcerative colitis, and chemotherapy-induced enteropathy. Additionally, these analogs are also used in the treatment of patients with steroid-refractory gastrointestinal acute graft-versus-host disease.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug

High Safety and Efficacy Drive Teduglutide Segment’s Dominance

Based on a drug, the market is classified into teduglutide and others.

The teduglutide segment is expected to dominate the market during the forecast period due to its unique combination of efficacy, safety, and established clinical use for treating short bowel syndrome (SBS). It has a long-term half-life, which is more resistant to degradation than native GLP-2. This prolonged activity lowers the rate of frequent dosing (fewer injections required) and potentially better intestinal growth and function. Teduglutide is a synthetic peptide that improves intestinal absorption by promoting mucosal growth and decreasing gastric motility.

- For instance, according to the data published by Frontiers in Pharmacology in September 2024, teduglutide is the first GLP-2 analog used for the absorption of gut nutrients. It reduces the need for parenteral assistance in patients with short bowel syndrome (SBS).

On the other hand, the others segment, which includes glepaglutide, is expected to witness steady growth in the forecast period. Apraglutide is an investigational GLP-2 analog that is being evaluated as a once-in-a-week treatment for short bowel syndrome.

By Route of Administration

Availability of Parenteral Drug Options Boosts Dominance of Parenteral Segment

Based on route of administration, the market is classified into oral and parenteral.

The parenteral segment held the major GLP-2 analogs market share 2024. The dominance of this segment is due to the primary use of analogs to treat intestinal failure and disease conditions, such as short bowel syndrome (SBS). The SBS-IF patients required parenteral nutrition to fulfill their nutritional needs owing to impaired intestinal absorption.

- For instance, GATTEX, a glucagon-alike peptide-2 (GLP-2) analog is used for the treatment of short bowel syndrome (SBS) in adults and pediatric patients who depend on parenteral support.

The oral segment holds a significant portion of the market attributed to the high patient compliance and cost-effectiveness of the oral analogs as compared to parenteral analogs. Additionally, technological advancement, such as the development of nanoparticle delivery systems also aids in boosting the segment growth.

- For instance, in March 2024, Entera Bio Ltd. announced the positive pharmacokinetic results for oral GLP-2 peptide tablets used for the treatment of patients with short bowel syndrome.

By Distribution Channel

Increase in Patient Shift Toward Online and Retail Pharmacies Boosted Segment’s Growth

Based on distribution channel, the market is segmented into hospital pharmacies and online & retail pharmacies.

The online & retail pharmacies segment accounted for the larger share of the market in 2024, primarily due to the convenience and accessibility of online platforms. Many emerging and developed countries have established networks of retail pharmacies, leading to an increase in segment growth.

- For instance, according to the data published by the Pharmaceutical Care Management Association in August 2022, in the U.S., more than 23,254 independent retail pharmacies were working in 2022.

The hospital pharmacies segment held a significant share of the market due to the rise in the prevalence of diseases such as short bowel syndrome (SBS). The rise in patient flow and hospital facilities also supports the segment growth.

GLP-2 Analogs Market Regional Outlook

North America

North America GLP-2 Analogs Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.23 billion in 2025 and USD 1.43 billion in 2026. The high adoption rate for advanced drugs and new treatment options drives the growth of the market in this region.

U.S.

The U.S. dominated the North American region in 2024 due to the high usage of approved drugs that are used in the treatment of short bowel syndrome in adult and pediatric patients. Additionally, the patent for Teduglutide has expired in the U.S., leading to a rise in interest in biosimilar versions of GLP-2 analogs, which further propel the market growth in this region. Moreover, a rise in research and development activities and pipeline products further drives market growth in this region.

- For instance, in February 2024, Ironwood Pharmaceuticals announced the positive result of a global phase 3 trial for once-weekly Apraglutide, a GLP-2 analog used in the treatment of short bowel syndrome in adults.

Europe

Europe has a significant share of the market due to the rising prevalence of short bowel syndrome and high research and development spending. The key players of this region are primarily focusing on developing innovative drugs and new biologics which further propel the market growth. Additionally, government support and favorable regulatory policies also increase the region's growth.

- For instance, according to the data published in GE Portuguese Journal of Gastroenterology in September 2022, Europe has 1-9 cases of short bowel syndrome per 100,000 inhabitants, which arises from extensive bowel resection and congenital disabilities.

Asia Pacific

Asia Pacific is expected to grow substantially over the forecast period. The rise in research and development activities for the treatment of rare diseases and government support drives regional growth. Additionally, the presence of key market players and the rise in focus on clinical trials of GLP-2-based drugs support market growth.

- In March 2023, Asahi Kasei Pharma started a phase 1 study for the next-generation, long-acting GLP-2 analog peptide apraglutide in Japan.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to have considerable growth in the near future. The rise in awareness about rare diseases and the demand for advanced products support regional growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and High R&D Investment by Key Companies Resulted in their Dominating Position

The market is concentrated with companies such as Takeda Pharmaceutical Company Limited, Zealand Pharma, and Hanmi Pharm Co., Ltd., accounting for a significant market share.

The Takeda Pharmaceutical Company Limited holds significant share of the market. The dominance of Takeda Pharmaceuticals is due to its high research and development investment and global presence. The company has teduglutide, an approved drug from the U.S. Food and Drug Administration (FDA), and EMA, which is used for the treatment of short bowel syndrome. The company’s GLP-2 analog drug has received the orphan drug designation in Japan and other regions.

- In May 2019, Takeda Pharmaceuticals, U.S.A., Inc., received U.S. FDA approval for the use of GATTEX (teduglutide) as an injection to treat short bowel syndrome in pediatric patients of 1 year of age and older.

Zealand Pharma accounted for a notable share in 2024, ascribed to its commercial success with the first GLP-2 analog, teduglutide, for short bowel syndrome. Additionally, pipeline products and clinical success further propel the growth of the company.

Furthermore, OxThera, Ironwood, Hanmi Pharm Co., Ltd., Jaguar Health, Merck KGaA, EnteraBio Ltd., and Nestlé are among the other major players. They are focusing on significant investments in the research & development of innovative products to support the companies’ share in the market.

LIST OF KEY GLP-2 ANALOGS COMPANIES PROFILED

- Takeda Pharmaceutical Company Limited (Japan)

- OxThera (Sweden)

- Zealand Pharma (Denmark)

- Ironwood (U.S.)

- Hanmi Pharm Co., Ltd. (South Korea)

- Jaguar Health (U.S.)

- Merck KGaA (Germany)

- EnteraBio Ltd. (Israel)

- Nestlé (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Zealand Pharma A/S submitted a marketing authorization application (MAA) for glepaglutide, a long-acting GLP-2 analog, to the European Medicines Agency (EMA).

- March 2024: Ironwood Pharmaceuticals announced the positive result for the phase 2 exploratory stargaze trial of Apraglutide, a long-acting GLP-2 analog used to treat patients with steroid-refractory gastrointestinal acute graft-versus-host disease.

- September 2023: Entera Bio Ltd. and OPKO Biologics, Inc. entered into an agreement in which, for the development of oral tablet formulations, OPKO will supply its proprietary long-acting GLP-2 peptide and certain Oxyntomodulin (OXM) analogs.

- August 2021: Zealand Pharma A/S announced the first patient dose administration in the Phase 3b trial, EASE-SBS 4, evaluating glepaglutide, the company’s long-acting GLP-2 analog.

- April 2021: Hanmi Pharm.Co., Ltd. received orphan drug designation for its sonefpeglutide (GLP-2 Analog) from the U.S. FDA.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.08% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.20 billion in 2025 and is projected to reach USD 2.65 billion by 2034.

In 2025, the market value stood at USD 1.23 billion.

The market is expected to exhibit a CAGR of 6.08% during the forecast period of 2026-2034.

The teduglutide segment led the market by drug.

The key factors driving the market are the increasing burden of short bowel syndrome and the rise in demand for advanced treatment options.

Takeda Pharmaceutical Company Limited, ZEALAND PHARMA, and Hanmi Pharm Co., Ltd. are the top players in the market.

North America dominated the market in 2025 in terms of share.

Increased awareness about the benefits of GLP-2 analogs, the novel pipeline products, and a surge in the demand for these products in developing markets are some of the factors that are expected to favor product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us