Golf Simulator Market Size, Share & Industry Analysis, By Offering (Simulator Hardware, Simulator Software, and Simulator Services), By Product Type (Portable and Built-in), By Simulator Type (Full Swing Simulators and Virtual Reality (VR) Golf), By Business Model (Built-in and Subscription-based), By End-user (Commercial, Residential/Amateur, and Educational Institutes), and Regional Forecast Report, 2026-2034

KEY MARKET INSIGHTS

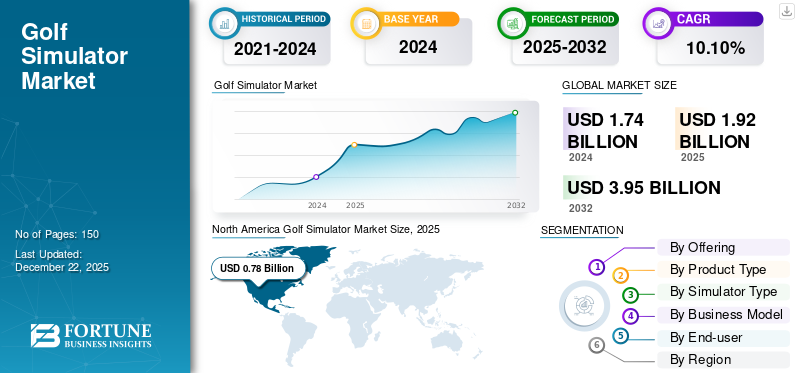

The global golf simulator market size was valued at USD 1.92 billion in 2025 and is projected to grow from USD 2.11 billion in 2026 to USD 4.7 billion by 2034, exhibiting a CAGR of 10.10% during the forecast period. North America dominated the golf simulator market with a share of 40.70% in 2025.

Market Trends and Strategic Insights

- North America golf simulator market held the largest share of 40.70% of the global market in 2025.

- By offering, Simulator hardware segment held the highest market share in 2025.

- By product type, Portable simulators segment held the highest market share in 2025.

- By business model, Built-in segment held the highest market share in 2025.

- By end user, Commercial segment held the highest market share in 2025.

Market Size and Growth Forecast

- 2025 Market Size: USD 1.92 Billion

- 2026 Market Size: USD 2.11 Billion

- 2034 Projected Market Size: USD 4.7 Billion

- CAGR (2026–2034): 10.10%

- North America: Largest market in 2026

- Asia Pacific: Fastest-growing region during the forecast period

A golf simulator is an advanced system that replicates real-world golf environments through a combination of hardware and software technologies, enabling users to play and practice golf indoors. These systems use high-speed cameras, radar, and sensors integrated with interactive software to mimic the experience of playing on actual golf courses. They cater to a wide range of users, from amateurs to professionals across residential, commercial, and institutional settings.

The market comprises major companies, including Panasonic Corporation, E6 Connect (TrueGolf), Foresight Sport, Full Swing Golf, Golfzon, SKYTRAK, TruGolf, OptiShot Golf, Vgolf, and TrackMan, among others.

IMPACT OF ARTIFICIAL INTELLIGENCE (AI)

Artificial Intelligence (AI) is transforming the market by enhancing the precision and personalization of gameplay. AI-powered swing analysis systems use machine learning algorithms to evaluate player performance in real time and provide personalized feedback. This allows users to improve their skills more efficiently, making simulated golf more engaging to amateurs and professionals. For instance,

- In May 2025, IdeasLab launched XView AI, a markerless app that provides real-time, offline analysis of the full golf swing by tracking body, shaft, and club movement. This app is available on the iPhone App Store.

AI integration is streamlining the software experience by automating course recommendations, adapting difficulty levels, and personalizing virtual environments based on users' skill levels. These intelligent features increase user engagement and extend session durations, boosting the overall usage of simulators. Therefore, simulator manufacturers are increasingly adopting AI-driven interfaces to differentiate their offerings in a competitive market. For instance,

- In April 2025, TruGolf and Digital Legends announced a partnership to launch an advanced golf simulator experience. It is built on TruGolf's Apex platform, featuring AI-driven recreations of legendary players such as Ben Hogan. The simulator will enable users to compete with historic golf figures, receive AI-powered coaching, and engage in golf tournaments on modern courses.

GOLF SIMULATOR MARKET TRENDS

Growing Adoption of Virtual Reality and Augmented Reality to Propel Market Growth

In the dynamic landscape of golf simulation, the convergence of innovative technologies is opening new borders for gaming enthusiasts. One such groundbreaking trend is the integration of Augmented Reality (AR) and Virtual Reality (VR) with golf simulators, offering an unequaled experience.

One of the transformative parts of AR in golf simulators is its capability to visualize difficult data in real time. With AR and VR technology, users can view immediate feedback on clubhead speed and swing mechanics seamlessly within the user’s field of view. AR technology improves the visualization of performance data, providing a detailed analysis of every swing.

Companies in the market are integrating AR and VR technology in their product line to enhance gamers experience. For instance,

- In February 2025, Golfjoy Limited announced the integration of the launch monitor and simulator with Virtual Reality (VR) and Augmented Reality (AR) technology. By wearing a virtual reality headset, players can effectively transport themselves to some of the greatest courses in the world.

Thus, the growing adoption of AR and VR can offer numerous advancements that will cater to the golf simulator market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Number of Golf Courses to Drive the Growth of Golf Simulators

People are progressively seeking more practical training methods, including golf simulation. The major growth in the expansion of new golf courses is one of the main factors that motivate the popularity of golf simulation processes. Owing to the increase in the participation of individuals, the number of planning and construction projects will increase. This scenario is helping to improve the golf simulator market share. For instance,

As per the Global Golf Participation 2024 Survey,

- 0.0082 billion registered golfers are officially part of the sport.

- An additional 0.03 billion unregistered 9 & 18-hole golfers actively engage in casual play.

- A total of 0.062 billion adults worldwide are engaged with golf in some capacity.

- There has been a 10% rise in registered golfers since 2020, showing growth and increasing interest in the sport.

- There are currently 21,507 golf courses in R&A-affiliated nations worldwide.

Additionally, as the number of golf courses increase, more individuals are being exposed to the sport, which leads to greater participation in golf-related products. Golf simulators are becoming crucial tools for both recreation and training as golfers seek ways to enhance their game in urban areas or during the off-season when outdoor space is limited.

Such a growing number of golf courses and golf engagement by individuals drives the growth of the golf simulator market.

Market Restraints

High Initial Investment in Golf Restricts Market Growth

The high initial investment needed to set up a golf simulation system is still one of the main challenges that limit the application of common golf simulation processes, especially in some market segments. While golf simulation provides role-based experience to help golf players improve their skills, equipment, software, and installation costs may be prohibitively high for some potential users, limiting market growth in some regions and fields. Thus, the high initial cost of such systems limits adoption in high-tech golf clubs, commercial training centers, and luxury home installations, restricting the broader growth of the market.

Market Opportunities

Portable Golf Simulators Gaining Traction among Younger Audiences, Leading to Lucrative Market Opportunities

Portable simulators are generally more affordable and require less space compared to traditional setups. This makes them an attractive option for younger individuals, including students and young professionals, who may have limited space or budget for a full-scale golf setup. Portable simulators are becoming more appealing to younger generations who may not have the time or inclination to visit a traditional golf course. This demographic is particularly interested in technology-driven leisure and fitness activities.

Younger generations are increasingly adopting golf as a sport, and portable simulators are an appealing option for these tech-savvy, budget-conscious, and space-limited individuals. For instance,

- In Australia, venues such as X-Golf and Big Swing Golf have reported that a major portion of their clientele is aged between 25 and 40, highlighting the appeal of simulators to younger players.

- According to the National Golf Foundation, nearly 6 million individuals in the 18-34 age group are actively participating in golf.

Thus, the growing adoption of these portable simulators among younger demographics is creating significant opportunities in the golf industry.

SEGMENTATION ANALYSIS

By Offering

Increasing adoption Among Commercial Facilities and Professional Users to Drive Simulator Hardware Segment

Based on offering, the market is divided into simulator hardware, simulator software, and simulator services.

Simulator hardware led the global market share by 52.07% in 2026 due to its fundamental role in enabling realistic gameplay through high-end sensors, screens, and launch monitors. The increasing adoption of advanced hardware among commercial facilities and professional users further supports its market dominance. For instance,

- Major hardware providers such as TrackMan, Foresight Sports, and Golfzon dominate the global market, supplying high-precision launch monitors and sensors used in commercial and residential simulators.

Simulator services are expected to grow at the highest CAGR owing to the increasing demand for installation, maintenance, and software upgrades. The shift toward customizable solutions and ongoing support enhances the value for service providers.

By Product Type

Portable Simulators Dominate Owing to their Ease of Installation and Cost-Effectiveness

Based on product type, the market is separated into portable and built-in.

Portable simulators dominate the global market as they offer ease of installation, mobility, and cost-efficiency, making them highly suitable also for setups such as homes and small businesses. Their growing use among amateur players and indoor entertainment contributes to their widespread adoption. Portable simulators are anticipated to capture 64.37% of the market share in 2026. For instance,

- Portable simulators such as SkyTrak, Phigolf, and Garmin Approach R10 are widely used across North America, Europe, and the Asia Pacific due to their affordability and ease of installation in homes and small businesses.

Built-in simulators are expected to grow at the highest CAGR of 12.31% during 2025-2032, due to increasing installations in commercial settings such as golf clubs, hotels, and sports complexes. The demand for immersive and permanent setups with advanced features drives this segment's growth trajectory.

By Simulator Type

Realistic Gameplay and Professional Demand to Drive Full Swing Simulators Growth

Based on simulator type, the market is distributed into full swing simulators and Virtual Reality (VR) golf.

Full swing simulators hold the highest share of the global market owing to their realistic gameplay experience, accuracy, and demand from commercial and professional users. Their ability to replicate complete golf swings and course conditions makes them the preferred choice. The full swing simulators are anticipated to capture 70.32% of the market share in 2026.

Virtual Reality (VR) golf is expected to grow at the highest CAGR of 12.18% during 2025-2032, due to the rising interest in immersive experiences and technological advancements in VR hardware. Increasing user-friendliness of affordable VR equipment is further expanding the user base across residential and amateur categories. For instance,

- VR golf is rapidly expanding in entertainment venues and gaming cafés, especially in the U.S., Europe, and Asia Pacific, leveraging platforms such as Oculus Rift and HTC Vive.

By Business Model

Rising Demand for Consistent and High-Quality Services Boost Built-in Segment’s Growth

Based on business model, the market is divided into built-in and subscription-based.

The built-in business model dominates the global market as many commercial establishments opt for permanent simulator setups to offer consistent, high-quality services. These installations provide long-term value and are integral to professional training and entertainment venues. The built-in segment is anticipated to capture 73.21% of the market share in 2026. For instance,

- Global leaders such as Golfzon and Full Swing Golf offer comprehensive, built-in solutions catering to large-scale installations.

The subscription-based model is expected to witness the highest CAGR of 12.47% due to its affordability and flexibility, especially among individual users and small businesses. Recurring revenue models offering regular software updates and online content are gaining popularity.

By End-user

To know how our report can help streamline your business, Speak to Analyst

High Demand for Premium Leisure Offerings Fuel Commercial Segment’s Growth

Based on end-user, the market is trifurcated into commercial, residential/amateur, and educational institutes.

The commercial sector leads the global market, driven by demand from golf clubs, academies, entertainment centers, and hotels offering golf as a premium leisure activity. The need for high-traffic, durable systems supports market dominance. The commercial sector is anticipated to capture 51.56%% of the market share in 2025.

The residential/amateur segment is expected to grow at the highest CAGR of 12.01% during 2025-2032, due to increasing consumer interest in golf as a home-based leisure activity. The growing availability of affordable simulators and rising disposable incomes further boost segment expansion.

GOLF SIMULATOR MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Golf Simulator Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market in 2026 by USD 0.85 billion, and USD 0.78 billion in 2025, mainly led by the U.S., where major players such as Foresight Sports, Uneekor, and SkyTrak have established strong retail and online distribution networks. Commercial adoption is expanding in urban areas through simulation-based golf bars and private club installations in metropolitan hubs such as New York, Chicago, and Los Angeles. High per capita income and strong interest in golf as a sport and a leisure activity further reinforce market leadership. The U.S. market in 2026 is expected to reach USD 0.5 billion. For instance,

- In May 2025, Golf VX, a provider of indoor golf simulators, announced the opening of its newest franchise location, Golf VX Boston. This marks the company’s second U.S. agreement after the launch of Golf VX Arlington Heights in 2024.

Asia Pacific

The Asia Pacific is anticipated to be the third-largest market with a value of USD 0.41 billion in 2026. This region’s golf simulator market is expected to grow at the highest CAGR, driven by rapid urbanization and the rise of compact leisure formats suitable for dense urban environments. For instance,

- According to industry specialists, the region significantly contributes to the global golfing population, supporting a total record of 66.6 million players worldwide.

China leads the region with Golfzon operating thousands of simulation-based screen golf centers nationwide, reflecting a strong cultural integration of the technology. Japan is following with increased deployment in commercial entertainment spaces and upscale residential developments. The market in China is estimated to be USD 0.10 billion in 2025. The Indian market is anticipated to be USD 0.08 billion and Japan’s market is projected to reach USD 0.1 billion in 2026.

Europe

Europe is expected to hold the second-largest share of the market with USD 0.61 billion in 2026, exhibiting the second-fastest growing CAGR of 10.10%, supported by strong consumer interest in off-course golfing activities and structured training. The U.K. and Germany have witnessed high installation rates of simulators in golf academies and year-round training facilities. Regulatory support for indoor sports infrastructure and investments from regional sports federations further aid market expansion. Further, the presence of established golf tourism circuits also enables growth in hotel-based simulation installations. For instance,

- According to Skal Europe, the European golf tourism market generated approximately USD 8.11 billion in revenue in 2023. The market is projected to reach USD 16.23 billion by 2035, reflecting a strong annual growth rate of 7%.

The market in U.K. is estimated to be USD 0.17 billion in 2026. The France market is anticipated to be USD 0.09 billion in 2025. Germany’s market is projected to reach USD 0.14 billion in 2026.

Middle East & Africa (MEA) and South America

The Middle East & Africa is anticipated to be the fourth fastest growing market with size USD 0.13 billion in 2026 and expected to grow at a significant CAGR due to the increasing adoption of luxury indoor golfing experiences in premium hospitality venues. Countries, including the UAE and Saudi Arabia, are investing in elite leisure destinations where golf simulators are offered as part of exclusive amenities in resorts and private clubs. High-temperature climates also make indoor golf facilities a more practical and attractive option year-round. The GCC countries are expecting market to hit USD 0.03 billion in 2025. For instance,

- In April 2024, Club Lab Golf, a UAE-based company, entered the premium at-home golf simulator market in response to increasing consumer demand. The company is leveraging the convergence of affordability, advanced technology, and personalized service to deliver enhanced residential golf simulation solutions.

However, South America is projected to grow at an average rate due to limited regional awareness of simulation-based golf, especially outside of Brazil, Argentina, and Chile.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Major players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Key Golf Simulator Companies Profiled:

- Panasonic Corporation (Japan)

- E6 Connect (TrueGolf) (U.S.)

- Foresight Sports (U.S.)

- Full Swing Golf (U.S.)

- Golfzon (South Korea)

- SKYTRAK (U.S.)

- TruGolf (U.S.)

- OptiShot Golf (U.S.)

- Vgolf (France)

- TrackMan (Denmark)

- Phigolf (South Korea)

- Toptracer (Sweden)

- HD Golf (Canada)

- Uneekor (U.S.)

- X-Golf (U.S.)

- ProTee United (Netherlands)

- FlightScope (U.S.)

- AboutGolf (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2025: IdeasLab launched XView AI, a markerless app that provides real-time, offline analysis of the full golf swing by tracking body, shaft, and club movement. This app is available on the iPhone App Store.

- May 2025: Golf VX, a provider of indoor golf simulators, announced the opening of its newest franchise location, Golf VX Boston. This marks the company’s second U.S. agreement after the launch of Golf VX Arlington Heights in 2024.

- April 2025: TruGolf and Digital Legends announced a partnership to launch an advanced golf simulator experience. It is built on TruGolf's Apex platform, featuring AI-driven recreations of legendary players such as Ben Hogan. The simulator will enable users to compete with historic golf figures, receive AI-powered coaching, and engage in tournaments on modern courses.

- February 2025: Canopy, a remote monitoring and management software provider, partnered with Full Swing Golf. This collaboration allows Full Swing’s support and software teams to leverage Canopy’s platform to enhance the performance, reliability, and remote management of their global simulator fleet.

- November 2024: Smartgolf LLC launched Smartgolf AI Coach, an advanced device aimed at enhancing golf performance through precise skill improvement. The device uses AI to analyze swing metrics such as speed, distance, angle, and direction, providing instant, detailed feedback via a connected app.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product types, and leading product end-users. Besides, it offers insights into the market trend analysis and highlights vital industry developments. In addition to the factors above, it encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 10.10% from 2026 to 2034 |

|

|

Segmentation |

By Offering, Product Type, Simulator Type, Business Model, End-user, and Region |

|

|

Segmentation |

By Offering

By Product Type

By Simulator Type

By Business Model

By End-user

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to record a valuation of USD 4.7 billion by 2034.

In 2026, the market size stood at USD 2.11 billion.

The market is projected to grow at a CAGR of 10.10% during the forecast period of 2026-2034.

Based on end-user, the commercial sector is leading the market.

The rising number of golf courses drives the growth of the golf simulator.

Panasonic Corporation, E6 Connect (TrueGolf), Foresight Sports, and Full Swing Golf are the top players in the market.

North America dominated the golf simulator market with a share of 40.70% in 2025.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us