Graphene Oxide Market Size, Share & Industry Analysis, By Type (Solution-Based Graphene Oxide and Powder-Based Graphene Oxide), By Application (Paints & Coatings, Batteries, Electronic Components, Medical & Biological, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

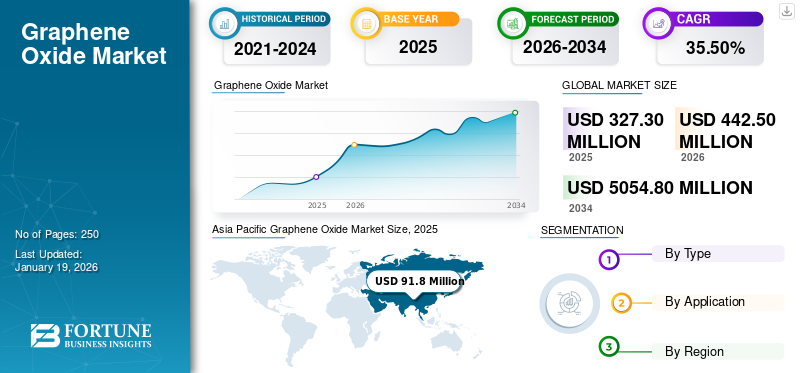

The global graphene oxide market size was valued at USD 327.3 million in 2025. The market is projected to grow from USD 442.5 million in 2026 to USD 5054.8 million by 2034, exhibiting a CAGR of 35.50% during the forecast period. Asia Pacific dominated the graphene oxide market with a market share of 28.00% in 2025.

Graphene Oxide (GO) is a single-layered material derived from graphite, known for its exceptional mechanical strength, large surface area, electrical conductivity, and thermal stability. Due to its multifunctional properties, it is widely used across various industries, including electronics, healthcare, energy storage, and water purification. The market is experiencing high growth driven by increasing R&D investments, rising demand for advanced medical and flexible electronics materials, and expanding applications in batteries and super capacitors. Additionally, its role in offering sustainable, high-performance solutions drives its adoption in developed and emerging markets. The major manufacturers operating in the market include AdNano Technologies Pvt. Ltd., Cheap Tubes, Global Graphene Group, ACS Material, Graphenea Inc., and Layer One-Advanced Materials.

- According to the Observatory of Economic Complexity (OEC), the global trade of graphite was valued at USD 720 million in 2023, ranking it 986th out of 1217 products. Graphite is a key raw material for graphene oxide, highlighting the growing global GO demand from advanced electronics, energy storage, and biomedicine applications.

GLOBAL GRAPHENE OXIDE MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 327.3 million

- 2026 Market Size: USD 442.5 million

- 2034 Forecast Market Size: USD 5054.8 million

- CAGR: 35.50% from 2026–2034

Market Share:

- Asia Pacific led in 2024 with a 28.00% share, rising from USD 91.8 million in 2025 to USD 126.6 million in 2026.

- By type: Solution-based graphene oxide dominates due to its wide use in research, biomedical, and flexible electronics.

- By application: Paints & coatings held the largest share owing to its superior barrier properties and corrosion resistance.

Key Country Highlights:

- China: Major exporter of graphite supporting GO production and advanced materials growth.

- India: Rising focus on energy storage and electric vehicle battery technologies.

- U.S.: Strong nanotechnology R&D and high demand in electronics and energy sectors.

- Germany: Expanding graphene-based battery and EV component innovations.

- Japan & South Korea: Leading in flexible electronics and semiconductor advancements.

GRAPHENE OXIDE MARKET TRENDS

Rising Emphasis on Sustainable Production and Recycling is Key Market Trend

As environmental regulations tighten and demand for greener technologies increases, the market is experiencing a notable shift toward sustainable manufacturing and circular economy practices. Companies are investing in research to develop efficient methods for recovering graphene oxide from industrial waste and used electronic components. These initiatives help reduce production costs and environmental footprints and ensure a steady product supply without overexploiting natural resources. This trend is particularly visible in regions prioritizing low-emission industries and eco-conscious innovation, positioning recycled graphene oxide as a strategic material for the future of electronics, energy storage, and advanced composites. Asia Pacific witnessed a Graphene Oxide Market growth from USD 48.9 million in 2023 to USD 66.9 million in 2024.

MARKET DYNAMICS

MARKET DRIVERS

Growing Technological Advancements and Demand in High-Performance Applications to Boost Market Growth

The increasing need for advanced materials in electronics, energy storage, and biomedicine is propelling the GO demand. Its exceptional electrical, thermal, and mechanical features make it highly suitable for cutting-edge applications, including flexible electronics, biosensors, and next-generation batteries. As industries strive for innovation and efficiency, graphene-based products are gaining traction as a key enabler of high-performance solutions. Additionally, ongoing advancements in nanotechnology and scalable production techniques make the GO more commercially accessible. These factors collectively support the expanding GO utilization across various high-growth industries.

- According to India’s National Electricity Plan, the country aims to deploy up to 84 GW (gigawatt) of battery storage by 2031-32, creating strong momentum for advanced energy materials. This growing focus on large-scale storage solutions is expected to fuel the product demand.

MARKET RESTRAINTS

Fluctuating Raw Material Prices and Costly Manufacturing Processes to Hinder Market Growth

The market's growth is considerably impacted by the volatility in raw material prices, particularly graphite, which is a primary input in production. Frequent fluctuations in graphite prices lead to uncertainty in production costs and profit margins, making it difficult for manufacturers to plan efficiently. Additionally, synthesizing GO involves complex chemical processes that are not only cost-intensive but also require stringent safety and environmental controls. These factors collectively raise the overall production cost and hinder manufacturing scalability.

MARKET OPPORTUNITIES

Rising Demand for Advanced Protective Coatings to Drive Product Utilization

The paints and coatings industry increasingly seeks advanced materials that offer superior protection and longevity, especially in harsh environmental conditions. Graphene oxide, with its excellent mechanical strength, thermal stability, and impermeability to gases and liquids, is emerging as a valuable additive in formulating high-performance protective coatings. Its ability to enhance corrosion resistance, scratch durability, and UV protection makes it ideal for use in industries such as automotive, aerospace, marine, and construction. Additionally, its lightweight nature and strong adhesion properties allow for the development of thinner, more efficient coatings. As infrastructure and equipment demand longer lifespans and reduced maintenance, integrating this product into coating systems presents a significant opportunity for the graphene oxide market growth.

- According to World’s Top Exports, synthetic paints accounted for 96.7% of the global paints exports worth USD 25.4 billion in 2023, presenting a growth opportunity for GO as a key additive to improve the durability of coatings.

MARKET CHALLENGES

Regulatory Constraints and Alternative Materials Limit Market Growth

Graphene oxide faces growing challenges due to strict regulations regarding the environmental and health risks associated with nanomaterials, resulting in increased production costs and prolonged approval timelines. Additionally, the growth of alternative materials, such as carbon nanotubes and other advanced nanostructures, offers similar or superior properties. As a result, manufacturers are pressured to comply with these regulations, invest in advanced, safer processing technologies, and drive continuous innovation to sustain their competitive edge and market position.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Solution-Based Graphene Oxide to Dominate Due to Its Extensive Use in Research Laboratories

Based on type, the market is classified into solution-based graphene oxide and powder-based graphene oxide.

Solution-based graphene oxide holds the dominant graphene oxide market share, driven by its widespread use in research laboratories, biomedical applications, and flexible electronics. Its high dispersibility in solvents makes it ideal for coatings, printing, and thin-film applications. Additionally, it is comfortable with a wide range of substrates, and its ease of processing enables manufacturers to use it in sensors, batteries, and super capacitors. Increasing investments in research and development and growing interest in nanotechnology fuel the segment's growth.

The powder-based GO segment also accounts for a significant market share. It is primarily used in composite materials, energy storage devices, and coatings. Its high surface area and excellent mechanical properties make it suitable for reinforcing polymers, improving battery electrodes, and developing advanced materials. The demand is further driven by advancements in scalable production techniques and the need for high-performance, lightweight materials in aerospace, automotive, and construction sectors.

By Application

Paints & Coatings Segment to Lead Market with Demand for Advanced Functional Surfaces

Based on application, the market is segmented into paints & coatings, batteries, electronic components, medical & biological, and others.

The paints & coatings segment dominates the market, driven by increasing demand for advanced functional surfaces across the automotive, aerospace, and construction industries. Graphene oxide is increasingly used in this application due to its superior barrier properties, anti-corrosion capabilities, and mechanical strength, making it well-suited for high-performance coatings. Its ability to improve adhesion, thermal resistance, and chemical durability further supports its growing use in industrial and protective coatings. Additionally, the increasing focus on nanomaterial-based technologies to enhance energy efficiency and extend infrastructure lifespan further propels the segment's growth.

In the battery segment, the product is primarily used to enhance the performance of next-generation and lithium-ion batteries by improving conductivity, energy density, and cycle life. Its high surface area and excellent electrochemical stability make it ideal for efficient charge storage in advanced battery electrodes. The segment is experiencing rapid growth, driven by the global shift toward clean energy, increasing adoption of electric vehicles, expansion of renewable energy storage solutions, and rising demand for portable electronic devices.

In the electronic components segment, the product is primarily applied in flexible circuits, transparent conductive films, sensors, and semiconductor devices. Its unique features, such as high electron mobility, thermal conductivity, and flexibility, contribute to the advancement and downsizing of electronic devices. The growing adoption of wearable technology, smart devices, and the rollout of 5G networks is driving demand in this segment. At the same time, continuous research and development in nanoelectronics continues to expand its potential applications.

Graphene Oxide Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Graphene Oxide Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominated the market with a valuation of USD 91.8 billion in 2025 and USD 126.6 billion in 2026, driven by rapid technological advancements, expanding electronics and automotive sectors, and strong government support for innovation and sustainable materials. China, Japan, South Korea, and India are heavily investing in R&D and large-scale production of graphene-based materials to support industries such as energy storage, flexible electronics, and biomedical devices. Additionally, the growing presence of key manufacturers, increasing demand for lightweight and high-performance materials, and favorable policies promoting nanotechnology contribute to market growth. The region’s focus on clean energy and advanced technologies positions it as a GO development and commercialization hub.

- According to OEC, China was the leading exporter of graphite, with exports valued at USD 402 million in 2023, highlighting its crucial role in supporting global production and the broader advanced materials industry.

North America

The market in North America is experiencing a high rise, due to increasing demand for innovative materials in sectors such as consumer electronics, energy storage, aerospace, and healthcare. This growth is supported by strong government funding for nanotechnology research, robust R&D infrastructure, and the existence of leading tech companies and academic institutions. Additionally, the increasing adoption of electric vehicles, renewable energy technologies, and high-performance medical devices is further boosting the product use in the region.

- According to OEC, the U.S. was the top importer of graphite, with an import value of USD 160 million in 2023, indicating a strong and growing GO demand in the U.S. market.

Europe

In Europe, the market is driven by strong regulatory support for sustainable technologies, advanced research initiatives, and rising demand across electronics, energy, and healthcare sectors. Germany, France, and the U.K. are heavily investing in graphene-based innovations for applications including lithium-ion batteries, sensors, and medical devices. The growing electric vehicle sector also contributes to demand, as GO plays a key role in enhancing battery performance and energy efficiency. With its advanced infrastructure and commitment to high-performance, eco-friendly materials, Europe remains vital to the global market.

- According to the World's Top Exports, Germany exported USD 40.1 billion worth of electric cars in 2023, accounting for 26.6% of global electric car exports. This reflects its shift toward electric mobility and boosts product demand in the region.

Latin America

In Latin America, the market is growing steadily, driven by rising R&D efforts, government support, and interest in sustainable technologies. Brazil and Mexico are exploring graphene applications in energy storage, consumer electronics, and construction. The region’s emerging EV sector and focus on renewable energy also boost demand for GO in advanced battery solutions.

- According to a report by the International Energy Agency (IEA), electric car sales in Latin America reached nearly 90,000 in 2023. Brazil experienced rapid growth supported by Chinese automakers and increasing local adoption of hybrid and ethanol-electric vehicles. This reflects a growing demand for GO-based advanced battery technologies.

Middle East & Africa

In the Middle East & Africa, the market is emerging, driven by increasing interest in nanotechnology for applications such as renewable energy, water purification, and smart infrastructure. The UAE and South Africa are investing in research and innovation to support sustainable development and diversify their economies.

- According to a report by the Government of South Africa, infrastructure investment reached approximately USD 24 billion in 2025, the highest since 2021. This surge creates significant opportunities for GO applications in construction materials, coatings, and composites, contributing to durable and energy-efficient infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Agreements and Partnerships are Strategies Adopted by Key Companies to Increase Market Share

The global market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and expanding capacity to increase their market presence. Global companies include AdNano Technologies Pvt. Ltd., Cheap Tubes, Global Graphene Group, ACS Material, Graphenea Inc., and Layer One-Advanced Materials. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are aggressively expanding in emerging economies, intensifying competition within the industry.

LIST OF KEY GRAPHENE OXIDE COMPANIES

- AdNano Technologies Pvt. Ltd. (India)

- Cheap Tubes (U.S.)

- Global Graphene Group (U.S.)

- Directa Plus S.p.A. (Italy)

- First Graphene (Australia)

- ACS Material (U.S.)

- NanoXplore Inc. (Canada)

- Thomas Swan & Co. Ltd. (U.K.)

- Graphenea, Inc. (U.S.)

- Layer One – Advanced Materials (Norway)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Global Graphene Group, a key manufacturer of graphene oxide, completed a USD 925 million merger of its subsidiary Honeycomb Battery Company with Nubia Brand International Corp. This highlights the growing commercial momentum of graphene applications, particularly in advanced battery and energy storage solutions.

- July 2022: Thomas Swan & Co. Ltd. partnered with Concrete Ltd. to introduce graphene into the concrete market, with tests showing that adding less than 1% by weight of Graphene Nano Platelets (GNPs) can boost compressive strength by over 20%, highlighting graphene’s potential to improve material performance and support sustainability in construction.

- June 2021: NanoXplore Inc. entered into a multi-year supply and distribution agreement with Gerdau Graphene, a subsidiary of Brazil’s largest steel producer, Gerdau S.A., to expand graphene applications across industrial markets in the Americas, particularly in concrete and construction.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 35.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 327.3 million in 2025 and is projected to reach USD 5054.8 million by 2034.

In 2025, the market value stood at USD 91.8 million.

The market is expected to exhibit a CAGR of 35.50% during the forecast period.

Solution-based graphene oxide led the market by type.

The increasing demand for high-performance applications and nanotechnology advancements is a key factor driving the market.

AdNano Technologies Pvt. Ltd., Cheap Tubes, Global Graphene Group, ACS Material, Graphenea Inc., and Layer One-Advanced Materials are the top players.

Asia Pacific dominated the market in 2025.

Developing cost-effective production methods, advancements in research and technology, and a growing demand for sustainable and efficient materials in sectors such as electronics, healthcare, and energy storage are key factors expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us