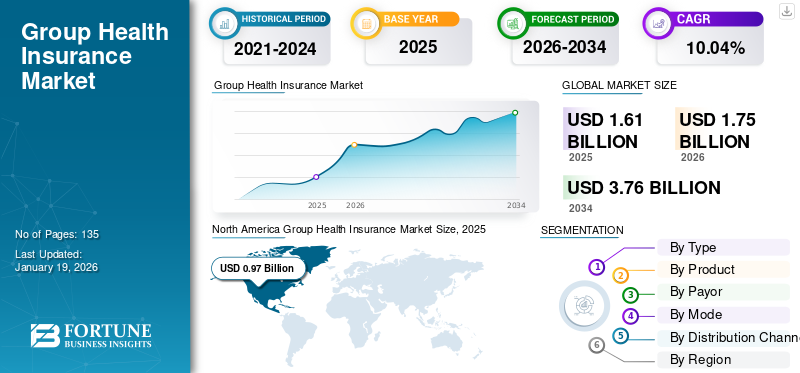

Group Health Insurance Market Size, Share & Industry Analysis, By Type (Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Others), By Product (Contributory Plans and Non-Contributory Plans), By Payor (Private and Public), By Mode (Offline and Online) By Distribution Channel (Direct Sales, Agents, Brokers, Banks, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global group health insurance market size was valued at USD 1.61 billion in 2025. The market is projected to grow from USD 1.75 billion in 2026 to USD 3.76 billion by 2034, exhibiting a CAGR of 10.04% during the forecast period. North America dominated the group health insurance market with a market share of 66.89% in 2025.

Group health insurance refers to a health insurance plan offered by an organization or employer to its employees, covering multiple employees under a single policy. The market is primarily driven by the growing prevalence of chronic disorders, including cancer, urological conditions, cardiovascular conditions, and others, causing a growth in the number of consultations and treatments among the patient population. This, along with increasing healthcare costs, growing focus among employers to provide insurance plans to employees, among others, are some additional factors supporting the increasing number of insurance claims nationwide.

- According to statistics published by the World Health Organization (WHO), there were an estimated 20.0 million new cancer cases globally in 2022.

Additionally, the rising number of prominent players, including UnitedHealth Group, Elevance Health, and others, is focusing on introducing novel insurance products to increase their market share.

MARKET DYNAMICS

MARKET DRIVERS

Growing Prevalence of Chronic Disorders to Boost Market Expansion

The increasing prevalence of chronic conditions, including cardiovascular diseases, cancer, and gynecological conditions, among others, with growing healthcare costs, is resulting in increasing demand for innovative insurance policies with limited premiums globally. The increasing need for insurance policies and awareness about the benefits of novel group insurance policies, such as lower premiums, inclusive coverage, among others, is driving the focus of key players toward launching these group insurance products in the market. Additionally, the rising focus on member retention among employers and its association with a healthy and cheerful workplace is another factor driving companies to launch various strategic initiatives and programs, such as health insurance coverage, among others.

- In January 2023, Tyson Foods, Inc., invested around USD 20.0 million to offer additional mental health support and other wellness and health plans at no additional cost to its employees.

Therefore, the factors mentioned above, with the rising focus of governmental organizations toward promoting group health insurance plans, are likely to aid the global group health insurance market growth.

MARKET RESTRAINTS

Limited Awareness in Developing Nations to Limit Market Growth

The increasing disease burden in emerging countries, such as Brazil, India, China, and others, is leading to an increasing need for strategic initiatives among companies to offer innovative insurance policies to their members. However, the adoption of these programs in low and middle-income countries is limited due to a lack of awareness regarding the importance and benefits of these programs for employees and employers.

Additionally, the high rate of premiums for these group insurance policies, along with limited financial literacy in developing nations, are additional factors attributable to lower penetration of these insurance products and solutions among the population across these countries.

- For instance, according to 2023 data published by the National Center for Biotechnology Information (NCBI), it was reported that only 25% of people are covered under health insurance in India.

MARKET OPPORTUNITIES

Rising Disposable Income and Growing Healthcare Expenditure in Emerging Countries Create a Lucrative Opportunity for Market Growth

The increasing population, coupled with growing disposable income due to surging economic status and condition of emerging countries, is a favorable factor creating opportunities for the penetration of health insurance products.

The increasing disposable income is further expected to increase the affluent population with higher annual income. This growing affluent population will result in higher financial literacy and awareness regarding these insurance products and policies among the general population.

- According to 2023 statistics published by the State Council of China, the per capita disposable income of China was around USD 5,543.2 in 2023, witnessing a growth of around 6.3% as compared to the previous year.

Therefore, the increasing disposable income among the population and growing awareness regarding the health insurance policy benefits, coverage, and other terms are expected to present a lucrative opportunity for insurers over the forecast period.

MARKET CHALLENGES

Rising Concerns Regarding Data Privacy and Cyberattacks to Hamper Market Growth

The integration of artificial intelligence and machine learning in the insurance industry has various advantages, including enhanced customer service. However, the technology integration presents several drawbacks, such as data leaks and misuse of personal information, further resulting in challenges in maintaining privacy among the insured individuals.

The leaks of confidential patient data increase the risk of cyberfraud, further leading to financial and reputational damage for the insurer. Therefore, the rising use of big data technology creates obstacles in protecting sensitive patient information, which is expected to hamper the adoption of these insurance policies among the general population. Moreover, the lack of regulations, particularly for anti-insurance fraud, is a vital reason for the increasing data privacy cyberattacks.

- For instance, according to the 2018 data published by the American Association of Retired Persons (AARP), insurance fraud steals at least USD 308.6 billion from American consumers every year.

Other Prominent Challenges

- Increasing Regulatory Volatility to Hamper Product Adoption: Ongoing changes to ACA subsidies, Medicaid enrollment, and employer mandates increase uncertainty and are further likely to hamper the product demand globally.

- Data & Privacy Compliance to Limit Its Adoption Rate: The digital health operations face regulatory risks across borders under the General Data Protection Regulation (GDPR) and other country-specific frameworks, which are likely to limit the product adoption.

- Limited Investment Returns to Hinder Product Adoption: The strong competition and escalating compliance costs are resulting in margin compression among insurers, further limiting the market growth.

Group Health Insurance Market Trends

Technological Advancements in Digital Insurance Infrastructure are an Emerging Trend in Market

There has been a shifting preference toward digital tools in the insurance industry by prominent players in the market. The growing need for innovations in products and sales channels is resulting in the increasing focus of key players to adopt digital capabilities and implement various digital tools and solutions for enhanced efficiency, penetration, and market growth.

The integration of digital tools offers several advantages, such as personalization, faster claims processing, improved customer service, increased transparency, convenience, and others. Additionally, digital platforms help provide a user-friendly interface and improved claim processing, enabling easy access to information and healthcare services according to their convenience and needs of the insured population. The insurers are also focusing on strategic initiatives and plans to innovate and implement technological advancements in the industry's digital infrastructure.

- For instance, according to 2025 data published by Feathery, about 67% of insurance companies have expedited their digital transformation efforts to integrate streamlined processes powered by technology in the industry.

Other Prominent Trends

- Shifting Preference toward Self-Funding in these Policies Among the Employers: Increasing benefits, such as cost-effectiveness, better transparency, and control, have shifted employers' preference toward self-funded group health insurance.

- Increasing Coverage for Mental Disorders in Insurance Plans: There is an increasing focus on offering coverage for mental health conditions among employers, which is expected to increase the product adoption in the market.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Increasing Emphasis on Preventive Care Boosted Health Maintenance Organization (HMO) Segment Growth

Based on type, the market is divided into health maintenance organization (HMO), preferred provider organization (PPO), exclusive provider organization (EPO), and others.

The health maintenance organization (HMO) segment dominated the market in 2024. Its benefits include cost-effectiveness, emphasis on preventive care, lower insurance premium costs, among others. Moreover, key players are focusing on acquisitions and mergers among other players to increase their brand presence for these HMO plans, which is further likely to boost the segment growth in the market.

On the other hand, the exclusive provider organization (EPO) segment is expected to grow with a considerable CAGR during the forecast period. This growth is due to increasing demand for different health insurance plans, further resulting in an increasing focus of prominent players toward introducing novel policies in the market.

- For instance, in April 2025, Parkview Health launched a new direct-to-employer health plan, Signature Care EPO Plus, designed to offer the lowest possible healthcare costs for employers to strengthen its product portfolio.

By Product

Rising Claims for Non-Contributory Plans Propelled Segment Growth

Based on the product, the market is segmented into contributory plans and non-contributory plans.

The non-contributory plans segment dominated the market in 2024. The increasing benefits of non-contributory plans, such as health insurance coverage at no additional cost, and others, attract the employees and favor their retention in the firm, resulting in a rising adoption rate of these plans in the market.

- For instance, in March 2024, the Government of India launched Universal Health Insurance, covering about 400 million citizens who are not covered under existing schemes, to provide insurance coverage for the people, specifically in rural areas in India.

On the other hand, the contributory segment is expected to grow considerably during the study period. This growth is due to the increasing awareness about the benefits of health insurance, resulting in the surging demand for further additions in the insurance plans among the insured individuals, thereby supporting the segmental growth in the market.

By Payor

Increasing Introduction of Policies Among Private Insurers Fostered Segment Growth

Based on payor, the market is segmented into private and public.

The private segment dominated the market in 2024 due to the increasing benefits of private health insurance, such as improved coverage, access to quality healthcare, higher sum insured, and others. The growing focus of insurers on the introduction of novel private policies is likely to contribute to the increasing adoption rate of these policies in the market.

- For instance, according to 2025 data published by Money Pty Ltd., it was reported that about 15.0 million people are covered with different private health insurance in Australia.

On the other hand, the public segment is expected to grow at a considerable growth rate during the study period. This growth is primarily owing to the increasing initiatives among governmental organizations to raise awareness about the benefits of public health insurance among the general population.

By Mode

Surging Focus on Strengthening Offline Channels Among Companies Fueled Segment Expansion

Based on mode, the market is segmented into offline and online.

The offline segment dominated the market in 2024. The increasing benefits of insurance purchase through offline mode, such as face-to-face interaction, customized plans, detailed explanations, and others, are resulting in a growing adoption rate for insurance policies through offline mode. This, along with an increasing focus of key players toward strategic initiatives to strengthen their offline channels, is further expected to support the segmental growth in the market.

On the other hand, the online segment is expected to grow with a considerable CAGR during the forecast period. This growth is due to the distinct benefits of the online method for insurance purchase, such as less time-consuming, limited paperwork required, among others, further shifting the preference toward the online mode among the general population, thereby contributing to the growth of the segment.

- For instance, according to 2024 data published by YouGov PLC, it was reported that about 64% people prefer health insurance plans through online mode in Australia.

By Distribution Channel

Growing Number of Agents to Boost Segment’s Growth

By the distribution channel, the market is divided into direct sales, agents, brokers, banks, and others.

The agents segment dominated the market in 2024. The increasing healthcare costs, coupled with a rising number of agents in the insurance industry, are resultant in a rising number of insurance claims for group health insurance policies through these agents, further anticipated to support the segment’s growth in the market.

- According to 2024 statistics published by AgentMethods, it was reported that there are 902,500 health and life insurance agents in the U.S.

Moreover, the banks segment is also expected to grow with a considerable CAGR during the study period. The growth is due to rising demand for cost-effective group insurance policies, resulting in increasing initiatives among the bancassurance models toward offering novel insurance products to customers, thereby contributing to the segment's growth globally.

Group Health Insurance Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Group Health Insurance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.97 billion in 2025 and USD 1.06 billion in 2026. The increasing healthcare expenditure, improved regulatory structure, availability of employee subsidies, suitable reimbursement policies, and increasing number of prominent players focusing on mergers and collaborations among the other players are a few factors contributing to the market's growth.

- According to the 2023 data published by the Centers for Medicare & Medicaid Services (CMS), it was reported that the per capita healthcare expenditure is USD 14,570 in the U.S.

U.S.

The growing prevalence of chronic conditions, including cardiology disorders, cancer, gynecological disorders, among others, and the adoption of digital tools to offer personalized insurance plans are some of the major factors contributing to the growing demand for these medical insurance products. This, coupled with the increasing number of prominent players focusing on introducing novel policies, is further expected to support the growth of the market in the country.

Europe

Europe is expected to grow at a considerable CAGR during the forecast period. The growth is due to the increasing geriatric population, a surge in focus toward digital transformation, and awareness of novel group insurance policies, which are supporting the rising number of group health insurance claims in the market. This, coupled with growing initiatives among governmental organizations to promote the adoption of group insurance policies, is further expected to support the market growth.

- For instance, according to 2025 statistics published by the American Association of Retired Persons, it was reported that about 25% of the population is aged 65 or older in Germany.

Asia Pacific

Asia Pacific is set to rise with the highest growth rate during the forecast period. The increasing prevalence of chronic conditions, aging population, increasing awareness about group health insurance products, and rising government focus on improving healthcare access are crucial factors anticipated to drive the market's growth. Additionally, increasing demand for customized insurance products, especially in China and India, is resulting in key players focusing on adopting digital tools to introduce innovative insurance policies, which is further likely to contribute to the market growth.

- For instance, according to 2023 data published by TATA AIG General Insurance Company Limited, it was reported that 88% of insurance consumers prefer personalization in their insurance policies in India.

Latin America

Latin America is expected to grow with a considerable CAGR during the forecast period. Increasing development of healthcare infrastructure, healthcare costs, number of healthcare facilities, awareness about the advantages of early diagnosis of chronic conditions, government focus on increasing healthcare access, and others are a few vital factors contributing to the growth of the market in the region.

- For instance, according to 2023 data published by the International Trade Administration (ITA), there are about 7,191 hospitals in Brazil.

Middle East & Africa

The Middle East & Africa region is expected to witness considerable growth during the study period. The increasing number of healthcare facilities, growing introduction of novel insurance products among the key players, improving access to healthcare facilities, and others are some of the factors supporting the adoption rate for group health insurance policies in the market.

- For instance, according to 2025 statistics published by GetSavvi Health (Pty) Ltd., about 9.5 million people have access to private medical care in South Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Ongoing Launches of New Insurance Policies by Key Players Resulted in Their Dominating Positions

The global market is fragmented, with players such as UnitedHealth Group, Elevance Health, and AXA accounting for a significant market share.

UnitedHealth Group is one of the dominant companies operating in the industry. The dominance is primarily attributed to certain factors, such as a growing focus of the company on the introduction of novel insurance products and a strong emphasis on the expansion of its geographical network to increase its geographical presence in the market.

On the other hand, Elevance Health is also growing due to its increasing focus on acquisitions and mergers with other players to increase its brand presence, and is further expected to increase its group health insurance market share.

- In April 2024, Elevance Health, Inc., collaborated with Clayton, Dubilier & Rice ( CD&R) to accelerate innovation in primary care delivery, enhance the healthcare experience, and improve health outcomes among the general population.

LIST OF KEY GROUP HEALTH INSURANCE COMPANIES PROFILED

- UnitedHealth Group (U.S.)

- AXA (France)

- Elevance Health (U.S.)

- Bupa Global (U.K.)

- CVS Health (U.S.)

- Cigna Healthcare (U.S.)

- AIA Group Ltd. (Hong Kong)

- Allianz (Germany)

- China Pacific Insurance (Group) Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Almarai, partnered with the General Organization for Social Insurance (GOSI) to launch the Health Insurance Extension service, offering affordable post-retirement health coverage for its employees. This helped the company strengthen its presence globally.

- September 2024: Elevance Health expanded its Affordable Care Act Plans in 3 U.S. states, including Florida, Maryland, and Texas, to widen its geographical presence in the U.S.

- January 2024: Bupa Global became the majority shareholder in Niva Bupa, an Indian health insurance business, with an aim to expand its geographical presence in the market.

- November 2021: AXA launched a new insurance plan type, “Healthy You,” which included cancer coverage, a second medical opinion in case of critical illnesses, in-depth medical analysis, and others for its employees. This helped the company to strengthen its presence in the market.

- July 2020: Plum, an Indian startup, raised USD 0.8 million in seed funding to provide employee health insurance for over 1.1 million companies in India. This helped the company to increase its brand presence.

REPORT COVERAGE

The global report provides market size & forecast by all the market segments included in the report. It includes details on the dynamics of the group health insurance market trends expected to drive the market in the forecast period. It offers insights on insurance penetration in key countries, key industry developments, new product launches, and an overview of the regulatory scenario for major countries/regions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.04% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Product

|

|

|

By Payor

|

|

|

By Mode

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market value stood at USD 1.61 billion in 2025 and is projected to reach USD 3.76 billion by 2034.

In 2025, the market value in North America stood at USD 0.97 billion.

The market is expected to exhibit a CAGR of 10.04% during the forecast period of 2026-2034.

The health maintenance organization (HMO) segment led the market by type.

The key factors driving the market are the growing prevalence of chronic conditions, increasing healthcare costs, rising development in healthcare infrastructure, and the growing introduction of insurance products.

UnitedHealth Group, Elevance Health, and AXA are the top players in the market.

North America dominated the market in 2025.

Increased awareness of the benefits of group insurance policies, the launch of novel insurance products, and a surge in the demand for these products in emerging nations are vital factors expected to boost product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us