Helicopter Fasteners Market Size, Share & Industry Analysis, By Material (Aluminum, Steel, Titanium, Superalloy, and Others), By Product (Screw, Bolt, Rivets, and Others), By Type (Military Helicopter and Civil Helicopter) By Application (Airframe, Rotor System, Engine & Transmission, Avionics and Electrical System, and Others), and Regional Forecast, 2025-2031

KEY MARKET INSIGHTS

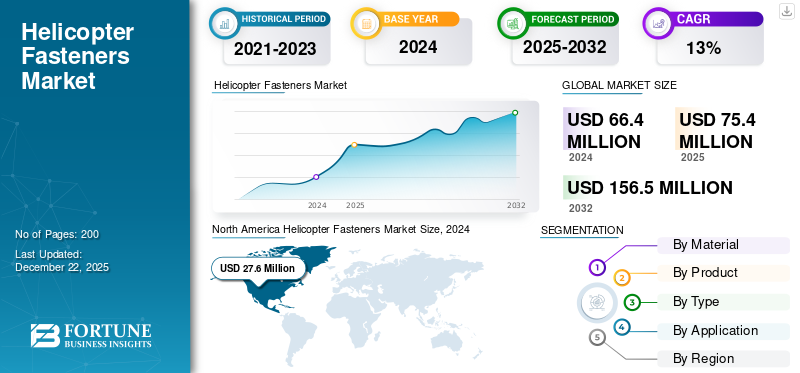

The global helicopter fasteners market size was valued at USD 66.4 million in 2024. The market is projected to grow from USD 75.4 million in 2025 to USD 156.5 million by 2031, exhibiting a CAGR of 13.0% during the forecast period. North America dominated the helicopter fasteners market with a market share of 41.57% in 2024.

The helicopter fasteners market is a vital segment within the broader aerospace fasteners industry, supporting the structural integrity and safety of both civil and military rotorcraft. Fasteners are essential for joining various helicopter components, including airframes, engines, rotor systems, and interior fittings. Their applications span primary structural assemblies, avionics, landing gear, and critical subsystems, where reliability under extreme vibration, temperature, and pressure is paramount. The demand for lightweight, high-strength, and corrosion-resistant fasteners is increasing as manufacturers adopt advanced materials and pursue greater fuel efficiency.

Download Free sample to learn more about this report.

Key players in the market include major global suppliers such as 3V Fasteners (Stanley Black & Decker Inc.), LISI AEROSPACE (SAS), Arconic Corporation, Precision Castparts Corp. (Berkshire Hathaway Inc.), and Boeing Distribution Services Inc. (The Boeing Company). These companies compete on innovation, quality, and the ability to supply fasteners that meet stringent aerospace standards.

The COVID-19 pandemic had a notable impact on the market, as it did across the aerospace sector. Global supply chains were disrupted, aircraft production slowed, and demand for new helicopters and related components declined during the height of the pandemic. However, the market is rebounding as air travel and defense spending recover and as maintenance, repair, and overhaul (MRO) activities increase to support aging fleets.

GLOBAL HELICOPTER FASTENERS MARKET KEY TAKEAWAYS

Market Size & Forecast:

- 2024 Market Size: USD 66.4 million

- 2025 Market Size: USD 75.4 million

- 2031 Forecast Market Size: USD 156.5 million

- CAGR: 13.0% from 2025–2031

Market Share:

- North America led the helicopter fasteners market in 2024, accounting for 41.57% of global revenue. The dominance is supported by strong defense spending, extensive MRO operations, and the presence of major OEMs such as Boeing, Bell, and Lockheed Martin.

- Titanium fasteners captured the highest market share by material, driven by their superior strength-to-weight ratio, compatibility with composites, and corrosion resistance—critical for next-gen and hybrid-electric helicopters.

Key Country Highlights:

- United States: A mature defense market and aging military helicopter fleets are spurring MRO demand. Continued focus on lightweight, high-performance fasteners aligns with growing electric propulsion and UAM segments.

- France: With Airbus Helicopters as a key player, France maintains robust demand for aerospace-grade fasteners, benefiting from Europe’s advanced aviation regulatory environment and R&D investment.

- India: The Make in India initiative, combined with HAL’s indigenous helicopter programs, supports local fastener supply chains and strategic partnerships with global aerospace firms.

- China: Rapid expansion of civil and military rotorcraft fleets, coupled with government investments in localized aerospace production, continues to drive fastener demand across all application segments.

HELICOPTER FASTENERS MARKET TRENDS

Smart Fasteners and Digital Integration are Emerging Trends in Market

Smart fasteners and digital integration are rapidly transforming the market by introducing new levels of intelligence, safety, and efficiency to aerospace assembly and maintenance. Smart fasteners are equipped with embedded sensors that monitor critical parameters such as stress, temperature, and vibration in real-time, enabling continuous assessment of structural integrity. This capability allows maintenance teams to detect potential issues before they become critical, significantly enhancing operational safety and reducing the risk of in-flight failures.

The adoption of digital integration, particularly through the Industrial Internet of Things (IIoT), connects these smart fasteners to broader digital networks. This connectivity enables real-time data collection and analysis, supporting predictive maintenance strategies that minimize unscheduled downtime and lower maintenance costs. By tracking the lifecycle of each fastener, operators can ensure timely replacements and maintain the overall health of the helicopter, optimizing performance and safety.

MARKET DYNAMICS

MARKET DRIVERS

Urban Transportation Efficiency is Fueling Demand for Helicopters and Related Fastened Solutions, Contributing to Market Growth

The push for efficient transportation in urban environments is fundamentally reshaping the helicopter market, with a direct impact on the demand for helicopter fasteners and related solutions. As cities become increasingly congested and traditional ground transportation struggles to keep pace with population growth, Urban Air Mobility (UAM) is emerging as a transformative solution. UAM leverages helicopters and new aerial vehicles to provide rapid, on-demand transport for passengers and cargo, bypassing ground traffic and reducing travel times. This trend is driving the adoption of helicopters for urban transit as well as accelerating the need for advanced, reliable, and lightweight fastener systems that are critical to the safety and performance of these aircraft.

As the helicopter market expands to include electric and hybrid-electric vertical take-off and landing (eVTOL) aircraft, the demand for specialized fasteners that support these new designs is expected to rise further, opening up significant growth opportunities for manufacturers and suppliers in the fastener segment.

MARKET RESTRAINTS

Helicopters Entail Significant Maintenance, Operational, and Fuel Costs, which can Limit Adoption and Hamper Market Growth

Helicopters are renowned for their versatility and unique operational capabilities. Still, these advantages come with significant maintenance, operational, and fuel costs that can impede broader adoption and, in turn, hamper the helicopter fasteners market growth. According to a report by the Ministry of Civil Aviation, maintenance alone constitutes a substantial portion of a helicopter’s overall operating expenses, often accounting for around 24% of total costs.

This is particularly severe for aging fleets, which require more frequent and intensive Maintenance, Repair, and Overhaul (MRO) services to comply with stringent airworthiness regulations and evolving safety standards. As helicopters age, components- including fasteners-must be inspected, repaired, or replaced more regularly, driving up both direct costs and aircraft downtime.

MARKET OPPORTUNITIES

Development of Hybrid and Electric Helicopters, Autonomous Systems, and Sustainable Fuel Solutions is the Latest Market Opportunity

The integration of hybrid-electric propulsion, autonomous systems, and sustainable technologies in helicopters is driving transformative opportunities for fastener innovation. These advancements demand specialized fasteners that meet evolving performance, weight, and environmental requirements, reshaping the aerospace components market.

Hybrid-electric helicopters require lightweight, high-strength fasteners for electric motors, battery systems, and power electronics. The shift toward hybrid propulsion (projected to reduce fuel consumption by 5%) necessitates fasteners with superior thermal resistance and vibration damping to handle heat from electric systems and combustion engines. Materials such as titanium and advanced composite materials are critical for reducing weight while maintaining structural integrity.

Segmentation Analysis

By Material

Titanium Dominated Market Owing to its High Strength-To-Weight Ratio and Excellent Corrosion Resistance

Based on material type, the market is classified into aluminum, steel, titanium, superalloy, and others.

The titanium segment dominated the global helicopter fasteners market share in 2024. The segment’s growth is driven by titanium’s high strength-to-weight ratio, excellent corrosion resistance, and ability to withstand high temperatures, making it ideal for critical helicopter applications where weight reduction and durability are essential. The increasing use of carbon composites in modern helicopter designs further boosts demand, as titanium fasteners are highly compatible with these materials, ensuring structural integrity and longevity.

The superalloy segment is anticipated to witness the second-largest growth during the forecast period. It is primarily used in high-stress areas such as engine components and rotor systems where performance under severe conditions is critical. Growth in this segment is supported by ongoing advancements in helicopter engine technology and the increasing need for fasteners that can maintain integrity under high thermal and mechanical loads.

By Product

Rivets Led Market Due to Their Widespread Use in Assembling Airframes and Structural Components

Based on product, the market is divided into screw, bolt, rivets, and others (nuts, washers, pins, etc.).

The rivets segment dominated the global market share in 2024. Rivets’ widespread use in assembling airframes and structural components is supported by their ability to provide strong, permanent joints. The growth of rivets is tied to the increasing production of new helicopters and the rising demand for lightweight, high-strength joining solutions that can withstand vibration and dynamic loads typical in rotorcraft operations.

The screw segment is anticipated to witness the second-largest growth during the forecast period. Screws remain a fundamental fastener type, used extensively for both structural and non-structural applications. Their versatility, ease of installation, and ability to be removed for maintenance make them indispensable in helicopter assembly and MRO activities. Growth in this segment is driven by the expansion of helicopter fleets and the need for regular maintenance and repair, which often requires screw replacement.

By Type

Rising Geopolitical Tensions and Modernization of Defense Fleets Boosted Military Helicopter Segment Growth

Based on type, the market is segmented into military helicopter and civil helicopter.

The military helicopter segment dominated the global market in 2024. Rising geopolitical tensions, modernization of defense fleets, and demand for advanced, durable fasteners in mission-critical applications are key drivers. Military helicopters require frequent upgrades and maintenance, further increasing demand for high-performance fasteners.

The civil helicopter segment is anticipated to grow to second rank during the study period. Growth in civil and commercial aviation, increased urban air mobility initiatives, and expanding roles in medical, transport, and tourism sectors drive the civil market. The need for lightweight, reliable fasteners to improve fuel efficiency and reduce operational costs is also a significant growth factor.

By Application

Rising Demand for Fasteners in Airframes Drives Segmental Growth

Based on application, the market is segmented into airframe, rotor system, engine & transmission, avionics and electrical system, and others.

The airframe segment dominated the global market as fasteners are essential for assembling fuselage, wings, and other primary structures. The trend toward lightweight airframes using advanced materials (composites, titanium) increases the need for specialized fasteners that can maintain safety and structural integrity.

The rotor system segment is expected to hold the fastest growth during the study period. Rotor systems require high-performance fasteners capable of withstanding extreme mechanical stress and vibration. Innovations in rotor blade design and the adoption of advanced fastener systems, such as the True-Lock system, are driving growth in this segment. The need for enhanced safety, reduced maintenance downtime, and improved performance in both military and civil helicopters further supports the demand for advanced rotor system fasteners.

Helicopter Fasteners Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Helicopter Fasteners Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America remains the largest and most mature market for helicopter fasteners. The region's leadership is driven by the presence of major aircraft and helicopter manufacturers such as Boeing, Lockheed Martin, Bell Helicopter, and Gulfstream. The U.S., in particular, boasts the world’s largest military and one of the highest demands for commercial aircraft fleets, fueling robust demand for high-performance fasteners. The market benefits from advanced manufacturing technologies, significant R&D investments, and a strong focus on lightweight, high-strength materials such as titanium. North America's aerospace sector is further supported by frequent maintenance, repair, and overhaul (MRO) activities, which require regular fastener replacement. The U.S.’s strong focus on advanced materials, frequent aircraft maintenance, and high defense spending ensures sustained demand for high-performance, reliable fasteners.

Europe

Europe is the second-largest market, supported by a well-established aerospace manufacturing base and stringent regulatory standards. Countries such as France, the U.K., Germany, Italy, and Russia drive the market regional demand, with leading companies such as Airbus, Leonardo, and Dassault Aviation at the forefront. The region’s demand for helicopter fasteners is bolstered by both commercial and military helicopter production, as well as ongoing investments in advanced fastening technologies to meet evolving safety and performance requirements. Europe’s adherence to strict aviation safety regulations and its focus on fuel-efficient, lightweight aircraft segment contribute to continued innovation and growth in the helicopter fasteners segment.

Asia Pacific

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period. This growth is propelled by rapid expansion in the aviation sector, increasing air travel, and significant investments in aerospace infrastructure. China, India, Japan, and South Korea are key contributors, with China leading the region due to its extensive manufacturing base and government initiatives such as the Belt and Road Initiative. The region is witnessing rising demand for commercial and military helicopters, expansion of local OEMs, and establishment of assembly plants for global manufacturers.

Rest of the World

The rest of the world, encompassing Latin America, the Middle East & Africa, is experiencing steady growth in demand for helicopter fasteners, driven by increasing air travel, defense modernization, and investments in regional airline operations. The Middle East & Africa, in particular, are expected to grow at a high CAGR due to rising air passenger traffic and the expansion of both commercial and military aviation fleets. While these regions currently represent a smaller share of the global market compared to North America, Europe, and Asia Pacific, their role is expanding as local aerospace industries develop and international collaborations increase.

COMPETITIVE LANDSCAPE

Key Industry Players

Technology Advancements and Integration of AI-Driven Automation and 3D Printing by Leading Firms Have Secured Their Market Dominance

Ongoing advancements in technology, particularly the integration of next-generation manufacturing solutions, such as AI-driven automation and 3D printing, with raw materials, are fundamentally reshaping the competitive landscape of the helicopter fasteners market. Leading firms are leveraging artificial intelligence to enhance production efficiency, precision, and quality control. AI-driven automation streamlines manufacturing lines, reduces costs, and shortens design cycles by enabling real-time monitoring, predictive maintenance, and adaptive corrections during production. Machine learning algorithms are also used to optimize fastener designs, simulate performance, and ensure compliance with stringent aerospace standards, resulting in lighter, stronger, and more reliable components.

LIST OF KEY HELICOPTER FASTENER COMPANIES PROFILED

- LISI Aerospace SAS (France)

- Precision Castparts Corp. (U.S.)

- Howmet Aerospace Inc. (U.S.)

- TriMas (U.S.)

- Arconic Corporation (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- SPS Technologies Ltd. (U.K.)

- TFI Aerospace Corporation (Canada)

- B&B Specialties, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Mahindra Aerostructures Pvt. Ltd. (MASPL), a member of the Mahindra Group, obtained a contract from Airbus Helicopters to construct and build the main fuselage for the H130 helicopter. This represents a change in Mahindra's business from providing lesser parts to creating more sophisticated aerostructures.

- April 2025: The support agreement for the UK Royal Navy's (RN's) 54-strong AW101 Merlin rotorcraft fleet, owned by Leonardo Helicopters, has been extended for a period of up to two years. The brief extension to the Integrated Merlin Operational Support (IMOS) contract is valued at over USD 213 million. It is meant to pave the way for a new support model later this decade.

- March 2025: The Ministry of Defense (MoD) and Hindustan Aeronautics Ltd (HAL) signed two contracts for the delivery of 156 Prachand light combat helicopters (LCHs), as well as training and related equipment.

- February 2025: TriMas announced that its brands, Monogram Aerospace Fasteners, Allfast Fastening Systems, and Mac Fasteners, have secured a multi-year global contract with Airbus. This agreement expands the existing contract scope across all fastener business units, further strengthening TriMas Aerospace’s role in the global Airbus supply chain.

- August 2024: SAFHAL Helicopter Engines Pvt. Ltd. (SAFHAL) and Hindustan Aeronautics Limited (HAL) signed an airframer agreement to begin jointly designing, developing, producing, supplying, and supporting a new generation high-power engine named Aravalli for the 13-ton Medium Lift class, Indian Multi-Role Helicopter (IMRH), and the Deck-Based Multi-Role Helicopter (DBMRH), which HAL is currently designing and developing.

REPORT COVERAGE

The global helicopter fasteners market analysis provides market size and forecast by all the segments included in the report. It includes details on the market segmentation, dynamics, and global trends that are expected to drive the helicopter fasteners market growth during the forecast period. It offers information on the prevalence in key regions/countries, key industry developments, new product launches, and details on partnerships, mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2031 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2031 |

|

Historical Period |

2021-2023 |

|

Growth Rate |

CAGR of 13.0% from 2025-2031 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By Product

|

|

|

By Type

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 66.4 million in 2024 and is projected to record a valuation of USD 156.5 million by 2031.

In 2024, the market value stood at USD 27.6 million.

The market is expected to exhibit a CAGR of 13.0% during the forecast period of 2025-2031.

The push for efficient transportation in urban environments is fueling demand for helicopters and related fastened solutions, which are anticipated to boost the growth of the market.

LISI Aerospace SAS, Precision Castparts Corp., Howmet Aerospace Inc., TriMas, Arconic Corporation, and others are the top players in the market.

North America dominated the market in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us