Aerostructures Market Size, Share & Industry Analysis, By Component (Wings, Nose, Fuselage, Nacelle & Pylon, Empennage, and Others), By Material (Alloys, Composites, and Metals), By Platform (Fixed-Wing Aircraft (Commercial, Military, Business Jet, and General Aviation Aircraft) and Rotary-Wing Aircraft (Commercial Helicopters, Military Helicopters, and UAVs)), By Aircraft Model (A320, A350, A330, A220, B737, B777, B787, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

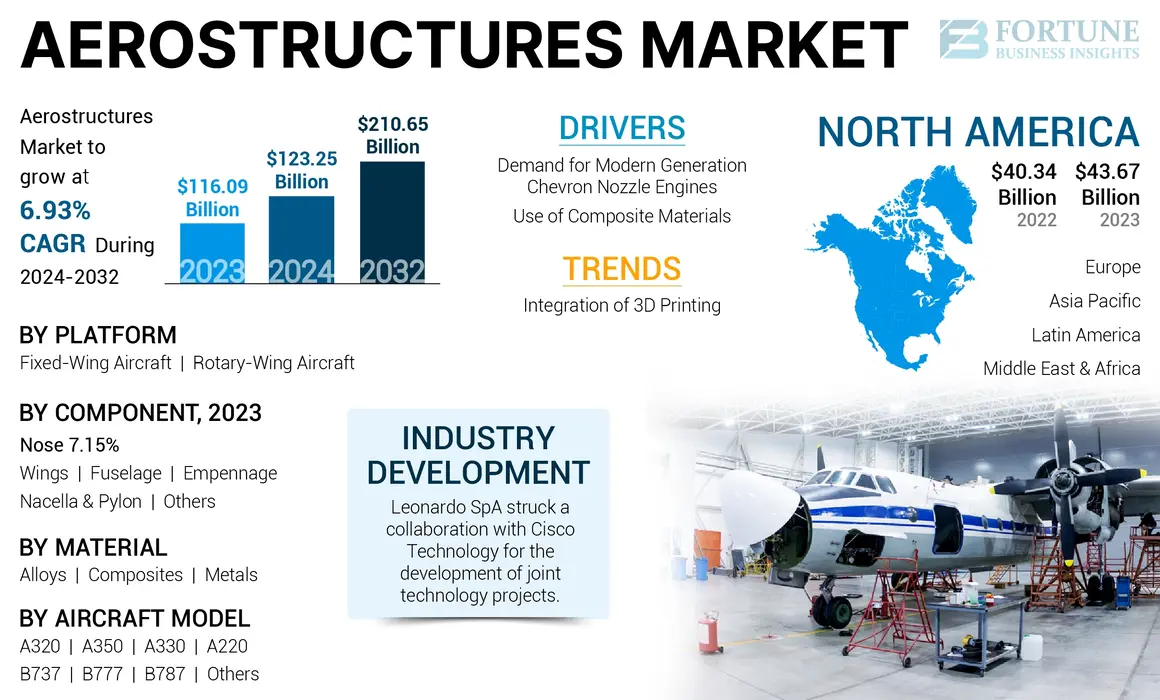

The global aerostructures market size was valued at USD 116.09 billion in 2023. The market is projected to grow from USD 123.25 billion in 2024 to USD 210.65 billion by 2032, exhibiting a CAGR of 6.93% during the forecast period. North America dominated the aerostructures market with a market share of 37.62% in 2023.

Aerostructures comprise aircraft airframe components that constitute the overall body or frame of an aircraft. The airframe has single parts of an airplane capable of flight, such as the nacelle, fuselage, and nose. An upsurge in air travel after the pandemic and the rapid expansion of key market players are expected to boost the global market growth over the forecast period.

The aircraft structure consists of components such as the nose, wings, nacelle & pylon, fuselage, landing gear, and doors. All these components join together to make a basic framework of an aircraft. Different aircraft consist of various airframes, structures, and components. The increasing demand and adoption for chevron nozzle exhaust, a part of the nacelle, is expected to boost the market growth during the forecast period.

The COVID-19 pandemic dramatically impacted the annual orders and deliveries of the world's two leading commercial aircraft manufacturers. For instance, global deliveries in 2020 totaled 723 aircraft, 42% behind 2019 and 55.3% behind 2018, and marked the second consecutive year that deliveries declined. However, over a couple of years, the market has compensated the decline and due to increased passenger traffic, will be able to retreat to pre-pandemic demand.

Global Aerostructures Market Key Takeaways

Market Size & Forecast:

- 2023 Market Size: USD 116.09 billion

- 2024 Market Size: USD 123.25 billion

- 2032 Forecast Market Size: USD 210.65 billion

- CAGR: 6.93% (2024–2032)

Market Share:

- North America dominated the global aerostructures market with a 37.62% share in 2023, driven by strong presence of OEMs like Boeing and Spirit AeroSystems, rising commercial aircraft deliveries, and defense procurement programs.

- By component, fuselage leads due to its high cost and structural significance, while wings are expected to post the fastest growth owing to increased use of composite materials in next-generation aircraft.

Key Country Highlights:

- United States & Canada: Dominance attributed to Boeing’s high production volumes, major defense contracts (e.g., surveillance aircraft for Canada), and expansion in passenger fleets like Air Canada’s post-2022 deliveries.

- Europe (France, U.K., Sweden, Italy): Airbus SAS and Leonardo drive market share through advanced composite fuselage and wing programs (e.g., A320, A350). ESA-backed R&D initiatives and regional partnerships support growth.

- Asia Pacific (China, India, Japan): Fastest growth driven by rising airline fleets (e.g., IndiGo’s 500 Airbus A320 order), government UAV programs, and regional OEM expansions. Japan’s record $40 billion defense budget for attack drones adds momentum.

- Middle East & Africa: Growth supported by increasing defense spending and business jet demand; governments fostering local aerostructure manufacturing partnerships.

- Latin America: Emerging market with rising aircraft deliveries and growing role in aerostructure production hubs, particularly in Brazil and Mexico.

Aerostructures Market Trends

Integration of 3D Printing to Act as a booster for Market Growth

OEMs (Original equipment manufacturers) of aerostructure components have begun leveraging emerging technologies, such as 3D printing, for efficient component manufacturing. 3D printing primarily manufactures components, such as wings, panels, ducts, and others. 3D technology is used to reduce the number of components by printing two adjacent parts into one single component and producing lightweight parts. Other technologies, such as machine learning used in the production and integration of 3D printing help in the production, design, and manufacturing process of aerostructures and makes a whole component using a 3D model. For instance,

- North America witnessed aerostructures market growth from USD 40.34 Billion in 2022 to USD 43.67 Billion in 2023.

- In September 2022, GKN Aerospace, a global aerospace component manufacturer, unveiled the completion of its largest titanium structural aerostructure. The aerostructure manufacturing was aided with 3D printing and analytics to support effective and efficient utilization.

Download Free sample to learn more about this report.

Aerostructures Market Growth Factors

Soaring Demand for Modern Generation Engines with Chevron Nozzle Supports Market Growth

There is an escalation in the demand for a chevron nozzle, a triangular pattern exhaust nozzle extension that is equipped on modern jets and helps in the reduction of noise and improve fuel efficiency. Chevron is used in the reduction of acoustics levels in the exhaust. This technology is adopted by the modern generation Boeing 747 and 787 and is found to reduce about 15 decibels of fan tones. The muzzle with a teeth-like structure reduces pressure variation, ultimately reducing jet noises. Growing demand for modern engines is a key factor driving the market expansion. Moreover, airline operators across the world have placed bulk orders of aircraft and their engines. For instance,

- In January 2024, Akasa Air, one of India’s emerging airlines, placed a firm order of 300 CFM LEAP-1B engines for its recently ordered 150 Boeing 737 MAX aircraft. According to CFM International, the order was valued at USD 4.5 billion.

Increasing Use of Composite Materials to Drive Market Growth

Composite materials are the first preference by OEMs to manufacture the airframe of airplanes owing to their relative properties such as durability, reliability, and toughness. Glass-reinforced plastics (GRP) and fiber-reinforced plastics (FRP) are composites mainly used to fabricate the skin and outer layers of the aircraft. GRP composite materials are produced using glass fibers and contain vinyl, epoxy, and polyester composites. FRP includes fibers and polymer resin. The fiber mainly provides strength to the material, and if related to polymer, it increases its inter-laminar shear strength. Thus, using composite material for aircraft structures reduces the overall weight of an aircraft.

- In February 2023, GKN Fokker, a Mexico-based manufacturer, delivered a thermoplastic composite aerostructure of 8m x 4m size. The aerostructure was made as a part of the multi-functional fuselage demonstrator (MFFD) project led by Airbus.

RESTRAINING FACTORS

High Cost of Maintenance and Repair to Limit Market Growth

Despite a rise in the demand for components, the high cost associated with procuring the components is predicted to restrain the market growth. The high cost associated with the maintenance and repair limits the market growth since, aerostructure components are not refurbished after wear and tear. Therefore, any damage to the aerostructure directly leads to a complete change in the component and hence is cost consuming.

For instance, in December 2022, the International Air Transport Association (IATA) unveiled the annual cost of ground damage to aircraft would reach about USD 10 billion. Additionally, it is costly to acquire new components due to the complexity of the design and development and design. The integration and development of components across the aircraft and the maintenance of these components are expensive. Hence, these factors may negatively affect aerostructures market growth.

Aerostructures Market Segmentation Analysis

By Component Analysis

High Cost of Aircraft’s Body Structure Led to the Dominance of Fuselage Segment in this Market

Based on component, the market is categorized into wings, nose, fuselage, nacelle and pylon, empennage, and others.

The fuselage segment accounted for the largest market share in 2023. The fuselage refers to the aircraft’s main body section that holds the cabin and cargo. The high cost associated with the aircraft’s body structure is a significant reason for the dominance of fuselage components in the market.

- The nose segment is expected to hold a 7.15% share in 2023.

The wings segment is predicted to grow at the fastest rate during 2024-2032. The growth is due to the rising demand for replacing conventional metal wings with composite aircraft wings. New-generation aircraft are lighter and demand lighter composite materials for their wings. Therefore, the segment is expected to experience the highest growth.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Alloys Segment Dominates the Market Due to High Adoption Rate and Demand

By material, the market is classified into alloys, composites, and metals.

The alloys segment accounted for the largest market share in 2023 owing to the high demand for alloy material used in major aircraft components. There are several aerospace alloys, including Aluminium and Manganese, Nickle, Copper, and Titanium-based alloys. Aluminum is the predominant metal in the system in aluminum-based alloys and alloying elements such as Manganese, Copper, Silicon, Zinc, and Magnesium.

Furthermore, the composite material segment is expected to grow at the highest compound annual growth rate over the forecast period. The rapid growth in the segment is due to increasing endeavors focused on the development of aircraft components. For instance, according to Boeing, the company has extensive use of composite materials in its airframe and primary structure sets the Boeing 787 apart from all previous Boeing commercial airplanes. The outcome is an airframe made up of almost fifty percent carbon fiber reinforced plastic and various composites. This method typically results in weight savings averaging around 20% when compared to traditional aluminum designs. Components built with composite materials offer high design strength, durability, flexibility, and low weight. These properties enable improved aircraft performance and reduce the overall weight. For example, for A350, 53% is composite content. For B787, 50% has composites content and the Bombardier C-Series has 40% composites content.

By Platform Analysis

Fixed Wing Segment Dominated the Market Owing to Broader Applications and Rising Fleet

Based on platform, the market is divided into fixed-wing and rotary-wing aircraft.

The fixed-wing aircraft is further divided into commercial, military, business jet, and general aviation aircraft. The rotary-wing aircraft comprises commercial helicopters, military helicopters, and unmanned aerial vehicles (UAVs).

The fixed-wing segment dominated the market share in 2023 owing to wide availability and production prioritization for fixed-wing due to high demand. The growing air passenger traffic and expanding airline fleet were the major factors driving the segment growth in the year. For instance,

- In November 2023, at the Dubai Air Show, airBaltic, the national carrier of Latvia, became the largest customer of Airbus A220 in Europe. The airline placed a confirmed order of an additional 30 A220-300s, taking the airline’s total firm order book to 80 aircraft.

The rotary-wing segment is predicted to record the highest CAGR during the forecast period. The rising procurement of military UAVs such as MALE and HALE for ISR applications supports the market expansion during the forecast period.

By Aircraft Model Analysis

A320 Segment Dominated the Market Owing to Strong Market Demand and Increase in Production

Based on aircraft model, the market is divided into A320, A350, A330, A220, B737, B777, B787, and others.

The A320 segment dominated the market share in 2023 due to rising demand for aerostructures. The A320 family has received over 18,000 orders, with a backlog exceeding 7,000 aircraft as of 2023. In June 2023, IndiGo has placed the order of 500 Airbus A320 Family aircraft. This order of 500 aircraft is IndiGo's largest order and the largest aircraft purchase by an airline and Airbus. The engine selection for this order would be made in due course and have the same mix of A320 and A321 aircraft.

The A350 segment is anticipated to record a significant market share during the forecast period. The A350 has an advance airframe design and unparalleled aerodynamics that further reduce weight and fuel burn, lowering CO2 emissions by 25% compared to previous generation aircraft. Owing to this, there is a significant in rise in market value during the study period. In April 2024, IndiGo placed an order for A350-900 wide-body jets with European airline manufacturer Airbus in a deal worth between USD 4 billion and USD 5 billion.

REGIONAL INSIGHTS

By region, the global market is segmented as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Aerostructures Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market was valued at USD 43.67 billion in 2023 and is expected to dominate the market due to the presence of top OEMs in the U.S. and Canada. For instance, in June 2023, the U.S. government approved the sale of 16 surveillance aircraft to Canada at cost of USD 6 billion. Similarly, the rising demand across commercial airlines also catalyze the market across North America. For instance, since January 2022, Air Canada has received more than 15 new aircraft owing to the expansion of their business activities.

The Asia Pacific region is anticipated to grow at the highest CAGR during the forecast period due to the growing number of OEMs in the region. The region has been witnessing huge demand for aerostructures lately owing to a rise in UAV applications. The supportive government initiatives and increasing defense budget further fuels the market growth. The upsurge in the region's commercial and military aircraft development and procurement programs is anticipated to boost the market growth.

- For instance, in August 2022, Japan sought the biggest order of attack drones in a record USD 40 billion defense budget request.

Europe accounted for the second-highest global aerostructures market share in 2023. The region’s large share is due to the growing demand for advanced composite aerostructures. Additionally, key regional players are expected to boost the market over the forecast period.

The Middle East & Africa region will grow notably during the forecast period owing to increasing initiatives by the government and global players entering the market. A rise in military spending, growing product demand, and emerging partnerships with global players and business jets market are expected to boost the market growth.

The Latin America is expected to grow at a significant CAGR, owing to the budding market for aerostructures manufacturing. Additionally, frequent flyers are a major reason for the high number of aircraft deliveries driving market growth over the forecast period.

Key Industry Players

Key Market Players are Focused on Providing Advanced and Light Weight Aerostructures

The aerostructures market analysis is consolidated, with several global and regional players operating in this industry. Key market players have varied product portfolios, significantly focusing on producing lightweight aerostructures for OEMs. The top players in the industry are Airbus SAS, Bombardier Inc., and other listed companies in the ranking analysis. Leonardo SpA is expected to lead the market owing to its global presence.

Other prominent players involved in the market include SAAB AB, Triumph Group Inc., Cyient Ltd, and other market players that are highly involved in new product launches and frequent partnerships and acquisitions to sustain their market position.

List of Top Aerostructures Companies:

- AAR Corp (U.S.)

- Bombardier Inc (U.S.)

- SAAB AB (Sweden)

- Spirit Aerosystems Inc. (U.S.)

- Triumph Group Inc. (U.S.)

- Cyient Ltd (India)

- Elbit Systems Ltd (Israel)

- GKN Aerospace (U.K.)

- Leonardo SpA (Italy)

- The Boeing Company (U.S.)

- Airbus SAS (France)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – Airbus signed a contract with Tata Advanced Systems Limited and Mahindra Aerospace Structures Private Limited to procure and manufacture commercial aircraft components and parts. According to the contract, TATA and Mahindra Aerospace Structures would manufacture parts, components, and assemblies for aircraft including Airbus' A320neo, A330neo, and A350.

- May 2023 – The Massachusetts Institute of Technology, a prestigious institute, unveiled a technological advancement and inexpensive development to strengthen essential materials used today in aerospace and energy generation.

- April 2023 – Leonardo SpA, an Italian aerospace components and aircraft conglomerate, forged a partnership with Cisco Technology to develop joint technology projects. The partnership aims to develop joint products and solutions as a green transition to secure logistics and transportation solutions.

- February 2023 – Heart Aerospace, a Sweden-based electric aircraft developer, unveiled its selection as a long-term partner for air-New Zealand next-gen mission aircraft partnership. The partnership would bolster the replacement process of the airline’s Q300 domestic fleet.

- January 2023 – General Atomics Aeronautical Systems, Inc. (GA-ASI), a pioneer aerospace conglomerate, partnered with Bharat Forge, a forging company, to boost airframe manufacturing in India. The partnership includes manufacturing subassemblies, landing gear components, and remote-pilot aircraft assemblies.

REPORT COVERAGE

The market report provides detailed information on the market and focuses on leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and competitive landscape of aerospace industries and highlights key industry developments. In addition to the above factors, it contains several factors that have contributed to the sizing of the global market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.93% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

|

|

By Component

|

|

|

By Material

|

|

|

By Aircraft Model

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was valued at USD 116.09 billion in 2023 and is projected to reach USD 210.65 billion by 2032.

The market is anticipated to grow at a CAGR of 6.93% during the forecast period.

By platform, the rotary-wing type segment is expected to have the fastest growth rate market during the forecast period.

Airbus SE, Bombardier Inc., and The Boeing Company are the leading players in the market.

North America is anticipated to dominate the market in terms of share.

The U.S. dominated the market in 2023

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us