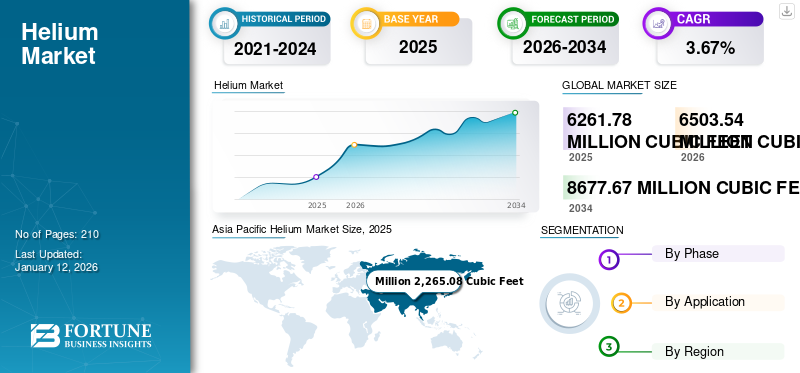

Helium Market Size, Share & Industry Analysis, By Phase (Liquid and Gas), By Application (Cryogenics, Lifting, Electronics, Welding, Leak Detection, Analytical, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global helium market size was valued at 6,261.78 Mcf (Million Cubic Feet) in 2025 and is projected to grow from 6,503.54 Mcf by 2026 and expected to reach 8,677.67 Mcf by 2034, exhibiting a CAGR of 3.67% during the forecast period. Asia Pacific is accounted for largest market share of 36.17% in 2025 owing to the high demand from healthcare and aerospace industries in the region.

Helium is a byproduct of natural gas processing, and its availability is associated with natural gas production levels. Disruptions in natural gas production or geopolitical events can impact helium supply, leading to shortages and price volatility.

- In June 2025, Helium Exploration announced drilling for the Inez-1 well at the Rudyard Project in northern Montana, U.S. Moreover, the company also revealed plans to target the southern dome with a target to recover 280.0 million cubic feet of helium. Increased helium exploration and production are expected to propel market growth.

The market is primarily driven by its crucial role in various high-tech industries and healthcare. Specifically, the semiconductor and electronics industries rely on helium for cooling and precision in manufacturing processes. Additionally, the healthcare sector utilizes helium for MRI machines, and space exploration programs require helium for propulsion and cooling systems. Growing demand in these sectors and limited global supply create consistent market growth.

Air Liquide is a prominent player and global leader in the market, particularly due to its comprehensive portfolio, advanced technologies, and investments in sustainable practices. The company is known for ensuring a reliable helium supply chain for various sectors, including healthcare, electronics, and space exploration.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand in Semiconductor and Electronic Industry to Boost Market Growth

The growing demand for the product in semiconductors and advanced electronics is a major driver of the helium market growth. Helium plays a vital role in semiconductor manufacturing processes such as water cleaning and cooling, especially in high vacuum environments. The need for high-purity helium continues to grow as the world shifts toward more powerful computing, AI chips, and 5G infrastructure.

- In March 2025, TSMC announced plans to invest USD 165 billion in semiconductor manufacturing in the U.S. to cater to demand from the AI industry by developing two advanced packaging facilities and a R&D center.

Countries with significant electronics production, such as South Korea, Taiwan, and China, drive the consumption, while global supply remains limited. The increasing complexity and miniaturization of electronics are also expected to fuel the market growth over the forecast period.

Increasing Demand for Medical Imaging Drives the Market Growth

Helium is essential in the healthcare industry, particularly in magnetic resonance imaging (MRI) machines, where it is used to cool superconducting magnets. As global healthcare infrastructure improves and access to advanced diagnostics increases, the demand for MRI systems is expanding in developed and emerging economies. Additionally, the rising prevalence of chronic diseases drives consistent demand for medical imaging. With no viable substitute for helium in MRI technology, the healthcare sector remains a dependable and growing end-use market, supporting helium prices and production investments in the coming years.

MARKET RESTRAINTS

Limited Supply to Restrain Market Demand & Growth

The market growth is restrained due to its limited supply globally. Helium is a byproduct of natural gas extraction and is found in economically recoverable quantities and in only a few regions, notably the U.S., Qatar, and Algeria. Helium is also a remarkably uncooperative element. Over the past few decades, the extraction and combustion of fossil fuels have caused increasing amounts of helium to accumulate in Earth's atmosphere, depleting this resource bound to the planet.

However, helium is light and it slowly escapes from Earth's atmosphere and into space. In its superfluid state, it has a habit of escaping from even the smallest cracks and holes. It can even flow up walls in this superfluid state. This makes it difficult to handle and store as it can easily be lost after use. These properties makes the helium supply chain vulnerable, leading to global helium shortages in the last twenty years.

MARKET OPPORTUNITIES

Rising Helium Exploration Activities are expected to Create Lucrative Opportunities for the Market

The global supply gap is driving the exploration for helium in non-traditional sources such as helium-only fields or low hydrocarbon regions. Technological advancements in geophysical mapping and drilling makes it increasingly feasible to identify and tap into helium-rich reserves, independent of natural gas production.

- In June 2025, DiagnaMed Holdings Corp. announced plans to conduct geological targeting for natural hydrogen & helium exploration in Ontario, Canada.

Countries such as Tanzania and Canada are emerging as potential helium hubs, with companies investing in dedicated exploration projects. These discoveries can diversify the supply base and reduce dependency on few countries. As the demand for helium increases, especially in high-tech industries, effective exploration will create profitable opportunities for new producers and investors.

MARKET CHALLENGES

Price Instability Creates Challenges for Market Players in the Future

Price instability caused by periodic shortages and supplier dominance limits end-users' ability to forecast costs or sign long-term agreements. This unpredictability deters investments by manufacturers in helium-dependent technologies or production processes, especially small and medium enterprises. Moreover, in 2024, the decommissioning of the U.S. Federal Helium Reserve, which once acted as a stabilizing force, has further increase the price instability with a direct impact on industries such as semiconductors and healthcare, where helium can not be substituted easily. Hence, the helium process remains highly volatile globally, as few large producers and distributors dominate the market. Any geopolitical, technical, or regulatory disruption can significantly impact the global helium supply. These disruptions include geopolitical instability affecting production and distribution, high production costs, competition from alternative gases, and others. Hence, the market faces a complex interplay of factors that create supply and demand-side challenges.

HELIUM MARKET TRENDS

Growth in Helium Recovery and Recycling Technologies to Influence Helium Supply

With growing helium prices and environmental concerns, recovery and recycling technologies are gaining traction across medical, industrial, and scientific sectors. Institutions using MRI machines, particle accelerators, and semiconductors are investing in on-site helium recovery systems. These systems help reduce dependence on new supply while ensuring cost stability. Moreover, the market players are engaged in the development of helium recovery technologies. For instance, in April 2024, Bluefors launched Cryomech HeRL02-RM, a Helium Reliquefier designed for helium recovery from Nuclear Magnetic Resonance (NMR) units. As governments and organizations push for circular economy models, helium recycling is expected to increase from large facilities to mid-sized users over the forecast period.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

The U.S. imposed tariffs on goods from other countries; major countries might retaliate by imposing tariffs on U.S. goods. The U.S. is a major exporter of helium. The supply is limited, and in this scenario, if any countries impose tariffs on any goods of the U.S., it might limit the helium export, making it more expensive for countries to purchase not only from the U.S., but also from any other country. As there are limited suppliers, this would increase prices. This also creates a trade war scenario where both sides impose tariffs, making it more expensive for businesses and consumers in both countries. The semiconductor industry, which relies heavily on helium, is already facing cost pressures due to tariffs on other goods. Tariffs on helium could further increase costs for semiconductor manufacturers, potentially impacting the broader technology sector.

SEGMENTATION ANALYSIS

By Phase

Ease of Handling and Versatility of Helium to Drive the Gas Segment Growth

Based on the phase, the market is segmented into gas and liquid.

The gas segment is expected to dominate the market. It is widely adopted due to its versatility and ease of handling. It is used for balloons, welding, leak detection, and as a carrier gas in chromatography. Moreover, Liquid helium is helium that has been cooled to a very low temperature, specifically below its boiling point. At even lower temperatures, it exhibits superfluidity, a state where it flows without any viscosity.

In March 2025, Renergen announced liquid helium production in South Africa, contributing to the global helium supply and production. Hence, it indicates the increasing demand for liquid helium in various applications across the globe. While crucial for specific applications such as cryogenics and MRI, liquid helium is less commonly used due to the challenges of handling extremely low temperatures. However, rising demand for healthcare and space exploration is expected to propel market growth over the forecast period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Rising Helium Demand in Cryogenic Applications to Boost Market Growth

Based on the application, the market is categorized into cryogenics, lifting, electronics, welding, leak detection, analytical, and others.

The cryogenics segment dominated the helium market share, specifically for achieving and maintaining extremely low temperatures in various scientific and industrial processes. This includes its use in MRI scanners, scientific research, and the preservation of biological samples. While helium has many other uses, cryogenics represents the largest market share.

Furthermore, the electronics segment is expected to grow significantly. Helium is crucial in electronics, primarily used in semiconductor manufacturing and as a coolant. It is used in producing semiconductors and flat screens and for cooling superconducting magnets in MRI machines and particle accelerators. Additionally, helium acts as a leak detector, diluent gas in plasma etching, and carrier gas for deposition in semiconductor manufacturing. Increasing semiconductor production is expected to propel the segment growth over the forecast period.

HELIUM MARKET REGIONAL OUTLOOK

The market has been studied geographically across main regions: North America, Europe, Asia Pacific, and the Rest of the World.

North America

Asia Pacific Helium Market Size, 2025 (Million Cubic Feet)

To get more information on the regional analysis of this market, Download Free sample

Increasing Helium Export Drives Market Growth in the Region

The North American market is substantial and projected to grow significantly, with the U.S. leading in helium production and consumption. The market is driven by increasing demand for the product across various healthcare, electronics, and aerospace sectors. Moreover, nine helium purification facilities in Saskatchewan, including Canada's largest, contribute significantly to the regional and global supply.

- According to the National Aeronautics and Space Administration, the U.S government allocated more than 7 Bcf for space exploration initiatives as of 2024, which is expected to propel demand for helium in the region in the near future.

U.S.

Robust Helium Production in the Country Drives the Market Growth

The U.S. contributes significantly to the global market. It is one of the largest helium producers and has an established consumer base. Its few major demand sectors are healthcare, electronics, and aerospace. For instance, in May 2025, Mosman Oil and Gas Limited announced drilling operations in the Vecta project, Colorado, U.S., for helium extraction. Such developments in the country indicate the robust production of helium to cater to the demand from end-use industries. The US market is projected to reach 1,666.49 Mcf by 2026.

Europe

Increasing Demand from the Healthcare Industry in the Region to Foster the Market Growth

The European market, a significant segment of the global market, is experiencing steady growth, fueled by demand across the healthcare and aerospace industries. While Europe lacks substantial domestic reserves, strategic imports and investments in recycling and conservation technologies help offset supply challenges. Key drivers include the use of helium in MRI machines, aerospace applications, and research facilities. Germany, U.K., and France are major consumers, with Germany projected to maintain its leading position in the European market. The market is expected to continue its growth trajectory, with liquid helium showing the fastest growth potential. The UK market is projected to reach 102.89 Mcf by 2026, while the Germany market is projected to reach 271.97 Mcf by 2026.

Asia Pacific

Robust Helium Consumption in the Semiconductor and Healthcare Industries in the Region Drives the Market Growth

The Asia Pacific market is experiencing robust growth, driven by the expanding electronics and semiconductor industries in China, Japan, and India, with the market size valued at 2,265.08 Mcf in 2025 and increasing to 2,364.62 Mcf in 2026. The demand is also increasing in healthcare (MRI machines) and aerospace. This growth is fueled by the region's large manufacturing base, particularly for electronics, and increasing investments in healthcare and aerospace. The market is expected to continue growing, with China being a major consumer and India projected to have the highest growth rate. The Japan market is projected to reach 311.41 Mcf by 2026, and the India market is projected to reach 139.88 Mcf by 2026.

China

The Growing Electronics Manufacturing Industry is expected to propel the Market Growth

The China market is experiencing robust growth, driven by increasing demand in the semiconductors, healthcare, and aerospace sectors. China is the world's second-largest consumer of helium, with a significant reliance on imports, particularly from the U.S. Despite this reliance, China is actively working to diversify its helium supply sources and develop domestic production. The China market is projected to reach 937.19 Mcf by 2026

Rest of the World

Limited Helium Production and Consumption lead to Moderate Market Growth in the Region

Helium demand in Latin America and Middle East & Africa is growing, driven by industrialization, healthcare advancements, and aerospace projects, with Brazil and Saudi Arabia showing the most significant growth potential. While both regions are smaller markets compared to others, they are expected to offer increasing first mover advantage opportunities in various sectors such as healthcare, oil & gas, and mining over the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Focused on Acquiring Long-term Helium Supply Contracts, Boosting the Market Growth

The global market is characterized by consolidation, with a few key players controlling a large share of production and distribution. These players, primarily industrial gas companies, have direct access to helium sources and thus significantly influence supply and helium pricing. Along with national energy companies such as QatarEnergy LNG, Gas Authority of India Ltd (GAIL), and Petronet LNG Limited.

In February 2025, QatarEnergy signed 20-year helium supply agreement with Guangzhou Guanggang Gases & Energy Co., Ltd (G-gas). Under this agreement, QatarEnergy will supply G-Gas with 100 million cubic feet per annum. Supply agreements, collaborations, and mergers & acquisitions are common strategies for these companies to expand their market share and integrate supply chains.

List of the Key Helium Market Companies Profiled

- Air Products and Chemicals, Inc. (U.S.)

- Air Liquide (France)

- Gazprom (Russia)

- ExxonMobil Corporation (U.S.)

- HeliumOne (U.K.)

- Renergen (South Africa)

- Messer Group (Germany)

- Taiyo Nippon Sanso Corporation (Japan)

- QatarEnergy (Qatar)

- Iwatani Corporation (Japan)

- Matheson Tri-Gas Inc (U.S.)

- North American Helium (Canada)

- Gulf Cryo (UAE)

- Linde Plc (Ireland)

KEY INDUSTRY DEVELOPMENTS

- In May 2025, Global Gases Group announced the upgradation of its helium production facility located in Doha, Qatar, with the expansion of its operations in the Middle East region. The facility is expected to support the increasing requirement for diving in the region’s offshore oil and gas sector.

- In April 2024, Royal Helium and Sparrow Hawk developments entered into a partnership with an investment of USD 25 million for a new helium production facility in Saskatchewan, Canada.

- In August 2022, North American Helium Inc. announced the initiation of operations in its new helium production facility in Saskatchewan, Canada.

- In April 2022, Linde Plc signed a long-term contract for a helium off-take agreement to recover helium from the LNG production site in Texas, U.S. The company also announced plans to construct a new helium processing plant in Freeport, securing an additional source of liquid helium in the country.

- In April 2021, Air Liquide announced an agreement with Laurentis Energy Partners to produce and distribute helium-3 (3He) globally, which is used in quantum science, quantum computing, neutron detection, astrophysics, and medical imaging.

Investment Analysis and Opportunities

The developing economies present a significant investment opportunity in the helium market:

- In March 2025, Helium Evolution Inc. announced a strategic partnership with an investment of USD 2.7 million in ENEOS Xplora Inc., a subsidiary of EnEOS Group.

- In November 2024, Reliance announced an investment in Wavetech Helium, Inc., acquiring a 21% stake to promote its strategy to enhance its presence in developing low-carbon solutions, focusing on helium extraction from underground reservoirs.

REPORT COVERAGE

The market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the Helium market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.67% from 2026 to 2034 |

|

Unit |

Volume (Million Cubic Feet {Mcf}) |

|

Segmentation |

By Phase

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was 6,261.78 Mcf in 2025.

The market will likely to grow at a CAGR of 3.67% over the forecast period.

Cryogenics segment is expected to lead the market over the forecast period.

The market size of Asia Pacific stood at 2,265.08 Mcf in 2025.

Increasing Demand in Semiconductor and Electronic Industry to Boost Market Growth

Some of the top players in the market are Gazprom, ExxonMobil Corporation, HeliumOne, QatarEnergy, and others.

The global market size is expected to reach 8,677.67 Mcf by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us