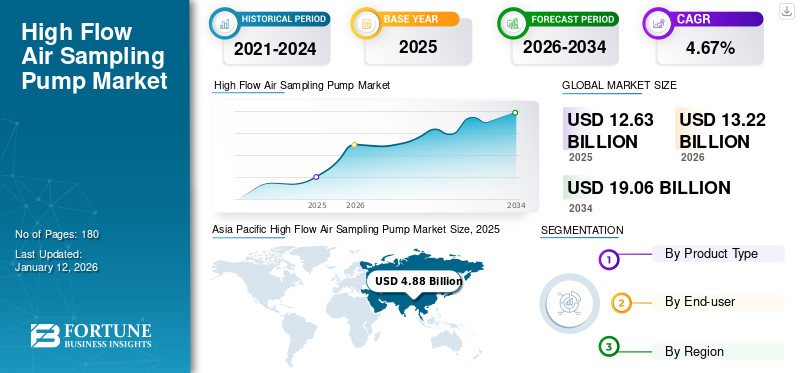

High Flow Air Sampling Pump Market Size, Share & Industry Analysis, By Product Type (Portable and Personal), By End-user (Industrial Manufacturing, Health Industry, Environment Industry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global high flow air sampling pump market size was valued at USD 12.63 billion in 2025. The market is projected to grow from USD 13.22 billion in 2026 to USD 19.06 billion by 2034, exhibiting a CAGR of 4.67% during the forecast period. Asia Pacific dominated the high-flow air sampling pump market with a share of 38.66% in 2025.

High flow air sampling pumps are devices used to draw a large volume of air through a filter or collection media to capture airborne particles or contaminants for subsequent analysis. The market is driven by increased industrial activities, urbanization, and construction, all of which raise air pollution levels.

SKC is the leading player in the market. It offers a wide range of sampling pumps, media, and accessories, with an emphasis on dependability and user-friendliness, making its products essential for industrial hygiene.

MARKET DYNAMICS

MARKET DRIVERS

Stringent Environmental Regulations is Driving Market Growth

Governments and regulatory agencies throughout the world are enacting stronger environmental restrictions due to growing awareness of air pollution and its harmful health effects. High-flow air sampling pumps are in greater demand as a result of these rules, which require air quality monitoring in a variety of industrial settings, metropolitan areas, and workplaces. These pumps are necessary for industries to precisely evaluate pollution levels, guarantee adherence, and put suitable mitigation strategies into place. The market for these sample pumps is anticipated to expand as environmental regulations become more stringent and enforcement becomes more intense. Thus this factor is expected to drive high flow air sampling pump market growth.

- For instance, in April 2024, the Environmental Protection Agency (EPA) amended the air toxics regulations for commercial sterilization facilities that use ethylene oxide. The EPA proposed a rule mandating fenceline monitoring to identify ethylene oxide emissions at commercial sterilization plants.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs Associated with Advanced Sampling Pumps to Hinder Market Growth

Advanced high-flow air sampling pumps are expensive to purchase initially and maintain over time, which limits market expansion, particularly for smaller companies and organizations with tighter budgets. The upfront cost of these pumps is raised by the complex features they frequently include, such as data logging, remote monitoring, and advanced flow control. Additionally, because of their complexity, these devices require frequent calibration, upkeep, and even repairs by qualified personnel, which raises the overall cost of ownership.

MARKET OPPORTUNITIES

Integration of IoT and Wireless Technologies for Real-time Monitoring Expected to Create Growth Opportunities

Real-time data transmission from IoT-enabled pumps to cloud-based platforms allows for remote monitoring, data analysis, and prompt notifications if allowable exposure limits are exceeded. This increases efficiency in data gathering and reporting while also improving workplace safety by facilitating proactive responses. IoT-enabled predictive maintenance features also lower maintenance expenses and downtime. The need for IoT-enabled high-flow air sampling pumps is being further increased by the growing acceptance of smart factory concepts and the increased focus on data-driven decision-making in environmental monitoring.

HIGH FLOW AIR SAMPLING PUMP MARKET TRENDS

Extended and Efficient Run Time for Uninterrupted Sampling is the Latest Trend

Extended run duration allows users to execute lengthy monitoring sessions, cover bigger areas, and carry out long-term studies without sacrificing sampling efficiency or data integrity. Many sampling applications allow for sample times longer than 12 hours, and in some cases, sample times longer than 24 hours are feasible. For instance, Sensidyne’s latest GilAir Plus pumps include a strong NiMH battery that can operate for longer periods of time without the need for a heavy-duty battery or an external secondary battery. In addition to being ecologically benign, NiMH chemistry does not have the shipping or disposal restrictions associated with lithium-based batteries.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Portable Segment Dominate Market Due to their Adaptability and Wide Applications

Based on product type, the market is classified into portable and personal.

Portable segment dominate the market due to their adaptability and their application at different sampling sites within a workplace or environment. It is suitable for short-term monitoring and a variety of applications due to its ease of setup and relocation.

The need for worker exposure monitoring drives the demand for personal air sampling pumps. This segment's growth stems from occupational health and safety regulations that require continuous personal sampling to assess individual team members' exposure to airborne hazards in real time.

By End-user

Environment Industry Leads Market Due to Growing Regulatory Emphasis on Air Quality Monitoring

Based on end-user, the market is classified into industrial manufacturing, health industry, environment industry, and others.

The environment industry dominates the high flow air sampling pump market share due to growing regulatory emphasis on air quality monitoring, especially with regard to contaminants such as particulate matter and volatile organic compounds. Moreover, the increasing demand for precise data for air quality modeling and forecasting, research on air pollution and climate change, evaluation of polluted areas, and environmental compliance requirements drive the demand in this sector.

In industrial manufacturing is the fastest growing segment over the forecast period. In industrial manufacturing segment, the workplace safety is driven by monitoring exposure to hazardous substances and streamlining industrial processes to minimize emissions, all of which are necessary for regulatory compliance.

The heathcare segment is grow modereatly over the forecast period. The demand from the this industry is driven by increasing research on the health consequences of air pollutants, evaluating exposure levels in healthcare settings, and monitoring air quality in hospitals and clinics to stop the spread of airborne infections.

High Flow Air Sampling Pump Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is the dominating as well as the fastest growing region in the market.

North America

Asia Pacific High Flow Air Sampling Pump Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America is undergoing a complex transition, influenced by the growing use of sophisticated sensor technologies, the ever-increasing significance of indoor air quality (IAQ), and regulatory requirements. Demand is rising for specialized applications, including mold remediation and wildfire smoke monitoring, in addition to the historically dominated industries such as industrial hygiene and environmental monitoring. Manufacturers are being forced to provide more specialized pumps with features such as improved particulate filtration and real-time data logging capabilities in response to this niche demand.

The U.S. market is mature and highly regulated, making it the dominant country for market in North America. Strict regulations such as OSHA, EPA, and NIOS, are driving the demand for high flow air sampling pump in the industrial sector of the country.

Europe

In Europe, the market is characterized by distinguished strict regulations pertaining to environmental monitoring and occupational safety, which are frequently more demanding than in other areas. In countries such as Germany and France, the demand for reliable sample equipment is largely driven by strong environmental protection agencies and well-established industrial hygiene regulations.

- For instance, in October 2022, as part of its European Green Deal, the EU Commission proposed amending the Ambient Air Quality Directives that bring air quality requirements closer to the World Health Organization's recommendations released in September 2021. With this amendment, there will be a more than 50% reduction in the yearly limit value for fine particulate matter (PM2.5).

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 4.88 billion in 2025 and USD 5.11 billion in 2026. and is expected to grow at the fastest rate in the forecast period owing to the rising, demand for high-flow air sampling pumps in the manufacturing and construction sectors of some emerging economies. Furthermore, there's a growing demand for affordable, locally manufactured pumps. This price sensitivity, coupled with increasing government initiatives to improve air quality monitoring in urban areas, creates market conditions catering to both budget-conscious local industries and international companies demanding higher-end equipment.

Latin America

The market in Latin America is driven by higher reliance on imported technologies and uneven regulatory enforcement across nations. Regional sectors such as mining and oil and gas are major end-users of these pumps. Smaller businesses and local governments frequently choose more reasonably priced yet dependable pump models due to financial constraints.

Middle East & Africa

In the Middle East & Africa, stricter environmental restrictions in the oil and gas and petrochemical sectors, especially in countries such as Saudi Arabia, the UAE, and Qatar, are driving the market for high-flow air sampling pumps.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Position in the Market

The global high-flow air sampling pump market is moderately competitive, with several established market players and smaller niche companies. Competition revolves around pump performance, such as flow rate and pressure, and features, such as data logging, programmability, portability, durability, and price.

SKC is a well-established company in the market known for its wide range of reliable and durable air sampling pumps. The company serves diverse industrial and environmental monitoring applications, offering both basic and advanced models, emphasizing ease of use and comprehensive support.

Sensidyne's emphasis on strong, inherently safe designs that are tailored for demanding industrial settings strengthens its market position in the high-flow air sampling pump sector. Their ability to provide defensible data that is essential for compliance in regulated businesses, along with their very accurate flow control and data logging capabilities, set them apart.

Additionally, AP BUCK, SIBATA, GASTEC CORPORATION, GL Sciences, TSI Incorporation, AC, Sperhi, and Thermo Fisher Scientific Inc. are among the other major players in the market.

LIST OF KEY HIGH-FLOW AIR SAMPLING PUMP COMPANIES PROFILED

- AP BUCK (U.S.)

- SKC Ltd (U.K.)

- SIBATA (Japan)

- GASTEC CORPORATION (Japan)

- GL Sciences (Japan)

- TSI Incorporation (U.S.)

- AC-Sperhi (France)

- Casella (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- SENSIDYNE (U.S.)

- PerkinElmer (U.S.)

- NextTexh (Romania)

KEY INDUSTRY DEVELOPMENTS

- April 2025: SKC announced an upgrade to its FreePumpLoan Program with the addition of the SKC AirChek Essential Sampling Pump. This new launch features a safe and technologically advanced pump that supports air sampling initiatives in diverse industrial and environmental settings. The pump is upgraded for enhanced efficiency, extended battery performance, and simplified use, boasting features.

- May 2024: Thermo Fisher Scientific announced the commencement of its manufacturing of Air Quality Monitoring System (AQMS) analyzers in India. The analyzers will be engineered, manufactured, and validated at Thermo Fisher’s facility in Nasik, Maharashtra.

- March 2024: IIT Kanpur launched its 'Multiple Slit Nozzle-based High Volume PM2.5 Impactor Assembly, which is an air sampling device developed. This device, which collects air samples for assessing respirable air quality, ambient air, substances, and microbial colonies, is the result of a 2020 technology transfer MoU with Airshed Planning Professionals Private Limited. The partnership aims to enable local manufacturing and replace expensive, imported air sampling equipment.

- August 2022: Casella's Cyclone air sampling heads were tested and confirmed to meet the ACGIH/ISO/CEN (EN 481) standard for respirable fractions. Casella worked with the HSE to undertake this intensive testing of its Cyclone Air Sampling.

- July 2021: Casella introduced its innovative high-flow air sampling pump, known as the Apex2. This battery-powered device delivers a flow rate of up to 20 liters per minute. It includes a spacious color touchscreen interface, along with real-time data tracking and comprehensive data logging features.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.67% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 13.22 billion in 2026 and is projected to record a valuation of USD 19.06 billion by 2034.

In 2025, the market value stood at USD 4.88 billion.

The market is expected to exhibit a CAGR of 4.67% during the forecast period.

Based on end-users, the environment industry segment leads the market.

The key factor driving the market is strict occupational health and safety regulations.

AP BUCK, SKC Ltd, and SIBATA are the top players in the market.

Asia Pacific dominated the high-flow air sampling pump market with a share of 38.66% in 2025.

Technological developments in wireless communication and miniaturization are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us