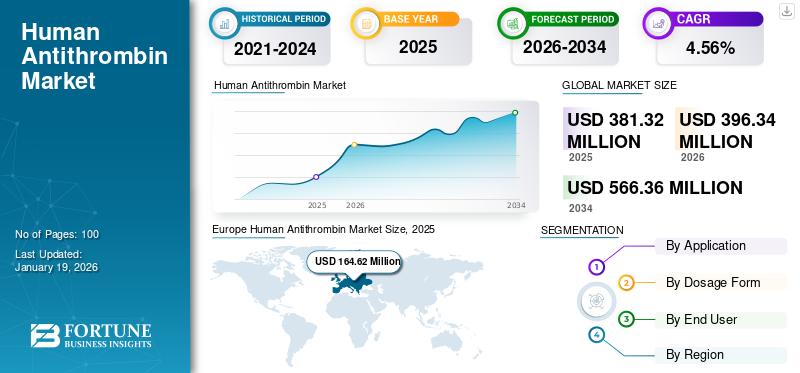

Human Antithrombin Market Size, Share & Industry Analysis, By Application (Therapeutic and Research & Diagnostic), By Dosage Form (Lyophilized Powder and Liquid), By End User (Hospitals & Clinics, Pharmaceutical & Biotechnology Industry, and Research Institutes), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global human antithrombin market size was valued at USD 381.32 million in 2025. The market is projected to grow from USD 396.34 million in 2026 to USD 566.36 million by 2034, exhibiting a CAGR of 4.56% during the forecast period. Europe dominated the human antithrombin market with a market share of 43.17% in 2025.

Human antithrombin, a glycoprotein that inactivates thrombin and other serine proteases is derived from human plasma. It is a plasma-derived medicinal product, which is crucial in prevention of abnormal blood clotting. The market is undergoing a significant transformation that is driven by growing awareness of rare clotting deficiencies, and increasing application in surgical and intensive care settings. Additionally, the growing prevalence of thrombophilia, disseminated intravascular coagulation (DIC), and complex surgical procedures requiring anticoagulants are some of the other factors driving the market growth.

Some of the major companies present in the market include CSL, Octapharma AG, Grifols, S.A., and others. The established market shares of these companies in the plasma fractionated products across the globe, including human antithrombin, supplements the global market growth.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Usage for Therapeutic Applications to Boost Market Growth

The human antithrombin market growth is majorly driven by the increasing usage of these products in several indications. Increasing number of cardiovascular surgeries, organ transplants, and patients on Extracorporeal Membrane Oxygenation (ECMO) is creating a direct demand for anticoagulant therapies, including human antithrombin. Hereditary antithrombin deficiency affects approximately 0.02% to 0.05% of the population, translating to thousands of patients globally requiring lifelong antithrombin supplementation. Thus, surgeons and ICU physicians are increasingly reliant on fast-acting antithrombin formulations. This surge in the application areas is projected to further bolster the growth of the market across the forecast period.

- For instance, in June 2024, an article was published in Annals of Thoracic Surgery Short Reports, which stated that the annual average total cardiac surgery volume in the U.S. was 271.5 per 100,000 population.

MARKET RESTRAINTS

Side Effects Related to Human Plasma Sourced Antithrombin to Limit Market Growth

Even though human plasma-sourced antithrombin concentrates are commonly used in therapeutic applications, there are certain concerns associated with their usage. Some of these concerns include allergic & anaphylactic reactions, the risk of bleeding, and thromboembolic complications. In addition, even with safety measures to prevent transmission, plasma-derived products might still contain unknown infectious agents, posing a risk of infection. Moreover, in severe sepsis, high doses of antithrombin III, especially when given with heparin, can increase the risk of hemorrhage. All these factors influence the adoption of human antithrombin concentrates, in turn, restricting the global human antithrombin market growth prospects.

MARKET OPPORTUNITIES

Inclusion of Antithrombin in Combination Therapies Leads to Market Growth Opportunities

In recent years, the healthcare professionals are focusing on the usage of human antithrombin in combination with other therapeutics such as heparin. This is aimed at enhancing anticoagulant effects. Such scenarios are expected to offer market expansion opportunities. There are various published research studies that have proved the potential of antithrombin in combination therapies.

- For instance, the combination therapy comprising antithrombin and heparin shows a synergistic effect.

MARKET CHALLENGES

Complex Regulatory Framework Coupled with Poor Reimbursement Scenario to Hamper Market Growth

The stringent regulatory framework for products of antithrombin is one of the challenges faced by the operating players for market expansion. The complex regulatory approval processes across countries slow the commercial introduction of innovative biologics and delay time-to-market.

Additionally, limited reimbursement in low- and middle-income countries further restricts adoption. Reimbursement coverage differs significantly by country and disease state or therapy area (TA), creating severe inequalities among citizens, resulting in slower market growth.

Human Antithrombin Market Trends

Expanding Applications of Antithrombin are Market Trends

The applications of antithrombin have been expanded beyond the treatment of hereditary AT deficiency. The research community is actively engaged in the studies to demonstrate the potential of antithrombin in various applications. For instance, in Japan, as a part of standard care, anticoagulation therapy is commonly given to septic patients with DIC, with antithrombin concentrate being one of the anticoagulant agents of choice. The antithrombin dose of 1,500 IU/day has been approved by the Japanese healthcare system.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Wide Availability of Products for Therapeutic Procedures Encouraged Segmental Growth

Based on application, the global market is categorized into research and diagnostic and therapeutic.

The segment of therapeutic, held the leading global human antithrombin market share in 2024. The substantial usage of human plasma based antithrombin concentrates for efficient treatment that is for therapeutic purposes has increased the demand for these products around the globe. In addition, these products are also being used in the treatment of individuals with heparin resistance.

- For instance, in December 2024 the American Society of Hematology published a data which stated that antithrombin supplementation is one of the preferred treatment choices for managing patients with heparin resistance.

Comparatively, the research & diagnostic segment is projected to grow at a slower CAGR over the forecast period. Currently, there are only few products available on the market that are used for the research & diagnostic purposes.

By Dosage Form

Greater Presence of Products in Lyophilized Powder Supported the Segment’s Dominance

On the basis of dosage form, the market is segmented into lyophilized powder and liquid.

The lyophilized powder segment dominated the market by capturing the highest share in 2024. Currently, the marketspace comprises of products that are in the lyophilized powder form on majority. This is further supported by the benefits associated with this dosage form, such as enhanced stability, ease of handling, and others.

- For instance, currently marketed products such as Thrombotrol VF from CSL, THROMBATE III from Grifols, and others are in the form of lyophilized powder.

In contrast, the segment of liquid products, accounted for the minimal share of the market due to limited number of marketed products. Only one company is providing antithrombin concentrates in liquid form as of today.

By End User

Increasing Demand for Therapeutic Purposes from Hospitals & Clinics Propelled the Segment Growth

In terms of end users, the global market is divided into hospitals & clinics, pharmaceutical & biotechnology industry, and research institutes.

The hospitals & clinics segment accounted for the largest share of the global market in 2024. Factors boosting the segment growth include increasing usage of antithrombin-based treatments in various indications such as heparin resistance, antithrombin, and others.

On the other hand, the pharmaceutical & biotechnology industry segment is expected to witness a considerable growth in the coming years. The increasing research applications of antithrombin concentrates are likely to support the segment growth.

Human Antithrombin Market Regional Outlook

In terms of regions, the market is segmented into Asia Pacific, Europe, North America, and the Rest of the World.

Europe

Europe Human Antithrombin Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe Dominates Due to Strong Presence of Well-Established Players and High Number of Approved Products

The Europe market was valued at USD 164.62 million in 2025 and is projected to maintain its leading position over the study period. The presence of a significant number of approved products, rising number of antithrombin deficiency cases, and strong presence of well-established market players in the region are some of the factors driving the regional market growth. Along with this, notable growth in plasma-derived medicinal products manufacturing in the region also boosted the market growth. Countries such as France, Germany, and U.K. are highly supportive of plasma-based and recombinant therapeutics. LFB and Grifols have a strong manufacturing presence. Government support initiatives such as “France 2030” are allocating substantial funds to expand local production of biologics. Clinician awareness and healthcare access contribute to early diagnoses and improved patient outcomes. All these factors further support the European market growth.

- For instance, in July 2022, plasma donor centers at London, Reading, and Birmingham, installed new donor machines that are ‘female-friendly’, further doubling the number of women who can donate lifesaving plasma.

Asia Pacific

The market in Asia Pacific region is expected to demonstrate the fastest growth throughout the study period. The demand for antithrombin derived from human plasma products is increasing in the region owing to the increasing incidence of congenital antithrombin deficiency. In addition, the companies operating in the region are focusing on undertaking various strategic initiatives, which further supplement the regional market growth.

- For instance, in September 2019, SK Pharma, a South Korean producer of blood products signed a Memorandum of Understanding (MOU) with the Indonesian pharmaceutical company, BioPharma and Indonesian Red Cross for the blood plasma production.

North America

The North America region accounted for a comparatively lesser share of the global market owing to the limited availability of antithrombin products in the region. This is due to the regulatory hurdles associated with the approval of plasma-derived products in the U.S.

Rest of the World

The rest of the world region comprises of Latin America and Middle East & Africa. These regions are witnessing a slower growth during the study period. The penetration of human plasma derived antithrombin in these regions is comparatively less resulting in lesser market share.

COMPETITIVE LANDSCAPE

Key Market Players

Strong Product Portfolio of Key Players to Support their Dominating Market Positions

The marketspace for human antithrombin is semi-consolidated, with 3-4 prominent players accounting for the notable market share. These players include CSL, Grifols S.A., Kedrion S.p.A., and Octapharma AG. The strong product offerings, coupled with wider regional presence of these companies, have strengthened their market positions in the global market. Additionally, these companies have a strong foot-hold in plasma-derived medicinal products, in turn supporting their leading positions.

Other key market players operating at the global level include Takeda Pharmaceutical Company Limited, Medix Biochemica, and others. These companies are the expansion of current applications of antithrombin concentrates and collaborations with pharmaceutical companies.

List Of Key Human Antithrombin Companies Profiled

- CSL (Australia)

- Octapharma AG (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Grifols, S.A. (Spain)

- Medix Biochemica (Finland)

- Kedrion S.p.A. (Italy)

- Scripps Laboratories (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2023: CSL ceased the production of THROMBOTROL-VF (human antithrombin III) for New Zealand Blood Service (NZBS) with current batch expiring in May 2024. This will be replaced by KYBERNIN by CSL Behring.

- June 2023: Octapharma AG represented a poster on a phase III, prospective study that demonstrated the safety, efficacy, and pharmacokinetics of a human antithrombin III concentrate that is used during surgery or childbirth in individuals with congenital antithrombin deficiency.

- May 2023: Plasma Gen Biosciences opened a new, state-of-the-art manufacturing facility for blood plasma products in Bangalore, India.

- June 2022: Endpoint Health Inc. announced a funding of USD 52 million to expand its precision immunology pipeline including Antithrombin III program, a Phase II clinical trial for the treatment of sepsis.

- February 2022: Grifols, S.A., and Endpoint Health entered into a collaboration and licensing agreement with, that provides exclusive rights for the development and commercialization of Antithrombin III (AT-III) in sepsis to the latter company.

- November 2021: The U.S. FDA provided an approval with the proceeding of the clinical studies of ATN-106ATN-106.

REPORT COVERAGE

The global human antithrombin market report comprises of comprehensive and detailed market analysis. This includes key market dynamics that have contributed to the market growth, impact of COVID-19 on the market among others. The report also includes key insights such as regulatory scenario for antithrombin concentrates, prevalence of key cardiac diseases by key countries, and recent industry developments. The report also encompasses the global competitive landscape along with the profiles of the prominent companies operating in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.56% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By Dosage Form

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 381.32 million in 2025 and is projected to record a valuation of USD 566.36 million by 2034.

The market is projected to grow at a CAGR of 4.56% during the forecast period.

In 2025, Europe stood at USD 164.62 million.

Based on the application, the therapeutic segment led the market.

Rising prevalence of antithrombin deficiency disorders is the key factor driving the market growth.

Grifols S.A., CSL, and Octapharma AG are the leading players in the market.

Europe held the dominating market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us