Hydraulic Elevators Market Size, Share & Industry Analysis, By Type (Holed, Hole-less, and Roped), By Capacity (Up to 1000 KG, 1000-3000 KG, 3000-6000 KG, and More than 6000 KG), By Business Type (New Installation, Maintenance, and Modernization), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

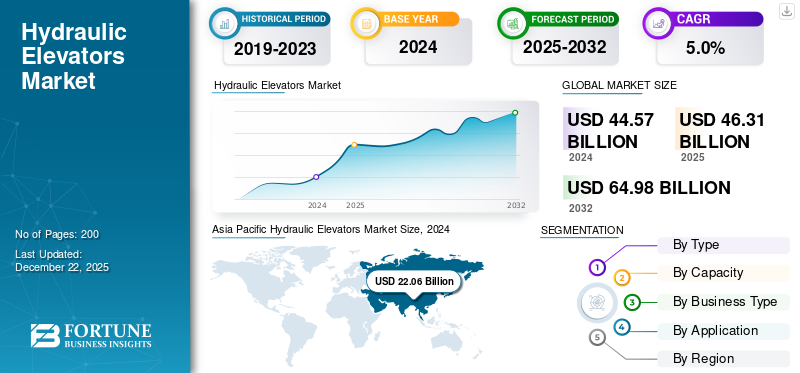

The global hydraulic elevators market size was valued at USD 44.57 billion in 2024 and is projected to grow from USD 46.31 billion in 2025 to USD 64.98 billion by 2032, exhibiting a CAGR of 5.0% during the forecast period. Asia Pacific dominated the global market with a share of 49.5% in 2024.

A hydraulic elevator uses a hydraulic system to raise and lower the elevator cab. It operates by pushing a piston through a cylinder filled with hydraulic fluid, pump or usually oil, which is pressurized by pumps by an electric motor. It offers features such as being suitable for low to mid-rise buildings, operating at a slower speed, being simple to install, and requiring low capital investment. It finds its application in residential, commercial, and industrial spaces. The increasing growth in construction for commercial and residential projects is driving a surge in demand for these lifts, which is contributing to the expansion of the market share.

- For instance, according to the source of Statistics Canada, the residential sector investment for Canada increased by 2.2% in 2024 as compared to 2023.

Download Free sample to learn more about this report.

Global Hydraulic Elevators Market Overview

Market Size:

- 2024 Value: USD 44.57 billion

- 2025 Value: USD 46.31 billion

- 2032 Forecast Value: USD 64.98 billion

- CAGR: 5.0% from 2025 to 2032

Market Share:

- Regional Leader: Asia Pacific accounted for approximately 36.5% market share in 2024, driven by rapid urbanization and infrastructure growth

- Fastest-Growing Segment (Type): Hole-less elevators led revenue in 2024 and are expected to grow at the fastest rate

- Capacity Leader: The 1,000–3,000 kg segment held the highest market share in 2024 due to demand in commercial and mid-rise residential sectors

- End-User Application Leader: The commercial segment was the largest in 2024, supported by new developments in malls, office complexes, and hotels

Industry Trends:

- Rising demand for compact and efficient elevator systems, especially hole-less hydraulic models

- Preference for mid-capacity elevators that offer flexibility in design and installation

- Strong growth in new installations driven by global infrastructure projects

Driving Factors:

- Increasing urban development and construction spending worldwide

- Expansion of commercial infrastructure including hotels, retail spaces, and institutional buildings

- Demand for space-saving and energy-efficient elevator solutions

- Maintenance and modernization of existing elevator systems in aging buildings

MARKET DYNAMICS

Hydraulic Elevators Market Trends

Adoption of Energy-Efficient and Smart Hydraulic Elevator Technologies Bolster the Market Demand

Growing demand for energy-efficient and smart technologies is elevating the hydraulic elevator market. Modern hydraulic elevator designs increasingly incorporate advanced pump units, including variable frequency drives (VFDs) and high-efficiency motors, to reduce energy consumption. Additionally, the IoT is making waves with its capabilities for remote monitoring, predictive maintenance, and connecting to building management systems (BMS). This trend is elevated by an increasing focus on sustainability and operational efficiency, which are reshaping the replacement of old systems and the installation of new ones in the construction field.

- For instance, in May 2024, a pioneering study introduced a contactless, TinyML-driven elevator prototype with onboard CNN-based person detection and keyword spotting that enabled real-time safety monitoring, remote control, and energy efficiency.

MARKET DRIVERS

Rising Retrofit and Modernization Projects Across the Globe to Fuels the Market Growth

Major government and local authorities plan to renovate or modernize hydraulic elevators globally. Many old buildings require hydraulic elevator renovation, which is simpler to install and requires minimal structural modification. Moreover, government investment in the expansion of renovation and modernization projects surges the demand for hydraulic elevators, driving the market growth.

- For instance, according to Hotel Magazine, the Amora hotel chain based in Australia planned to invest around USD 25.9 million to upgrade and renovate the Hotel Project Adelaide. All such investments in the expansion and upgradation that fuel the demand for hydraulic elevators.

MARKET RESTRAINTS

Limited Travel Height and Moderate Speed of Operation to Restrict the Market Growth

Hydraulic elevators are generally adopted in buildings with a floor of 6 to 8 stories. These elevators have low speed and mechanical limitations, which makes them unsuitable for high rise buildings, and suitable for low-rise as well as medium rise buildings. Moreover, traction elevators are gaining traction in residential, commercial, and industrial sectors, restricting the market growth.

MARKET OPPORTUNITIES

Technological Advancements in Products Provides Lucrative Opportunities for the Market Growth

Major players such as Fujitec, Hitachi Ltd, Hyundai Elevator Company, and Joylive Elevator Co Ltd, among others, are engaged in offering new, technologically advanced elevators to the market. Moreover, the integration of energy-efficient components such as intelligent control systems and regenerative drives makes hydraulic elevators more sustainable and cost-effective solutions.

- For instance, in March 2025, BRIO Elevators launched a new Brio BE360 hybrid hydraulic elevator into the market. It has features such as a 3600 panoramic angle, space-efficient design, eco-friendly, predictive maintenance, safety features, no machine room required, and provides maximum comfort. It is utilized in residential and commercial spaces are the latest market trends in the market.

Segmentation Analysis

By Type

Hole-less Elevators Dominate the Market Owing to Suitable for Residential and Commercial Sectors

Based on type, the market is classified into holed, hole-less, and roped.

As per our estimates, the hole-less elevators dominated the market in terms of revenue market share in 2024 and are projected to grow at the highest growth rate during the forecast period. As it is compact in space, popular in low to medium rise buildings, ideal for both renovation and new installation of structures.

Hollow hydraulic elevators are anticipated to grow at a moderate rate during the forecast period, owing to rising demand for elevator systems from residential, commercial, and industrial premises.

Roped elevators are also anticipated to grow moderately during the forecast period owing to factors such as growing construction activities and rising investment in building renovation, which fuel the market's growth.

By Capacity

1000-3000 KG of Elevators Dominated the Market Owing to Rising Demand from Commercial Applications

Based on capacity, the market is divided into up to 1000 KG, 1000-3000 KG, 3000-6000 KG, and more than 6000 KG.

1000-3000 KG of elevators dominated the market in terms of revenue market share in 2024, owing to factors such as their application in hotels, retail centers, commercial buildings, and mid-rise residential complexes. Moreover, demand is driven by new construction and renovation activities, which surge the demand for these elevators, dominating the market growth.

Up to 1000 KG of elevators is projected to grow at a significant growth rate during the forecast period, owing to their features such as being space-efficient, comfortable, able to handle and transport a low number of people, and high-speed in operation. Also, this type of elevator is commonly used in residential buildings and small-scale commercial sector.

3000-6000 KG of hydraulic elevators are projected to grow moderately during the forecast period due to factors such as their application in industrial warehouses, manufacturing plants, and commercial malls. They offer features such as being able to handle heavy loads and being operationally efficient.

More than 6000 KG of hydraulic elevators are anticipated to grow decently during the forecast period, owing to decent demand from logistics, manufacturing plants, and infrastructural sectors. All such factors drive the market growth.

By Business Type

New Installation Set to Grow at Highest Rate Owing to Rising Demand from Residential and Commercial Sectors

Based on business type, the market is classified into new installation, maintenance, and modernization.

New installations are set to grow at the highest growth rate owing to factors such as rapid urbanization and investment in construction activity across North America, Europe, and Latin America, which creates the demand for new elevators to move from one floor to another smoothly and effectively.

Maintenance is expected to dominate the market during the forecast period due to the existence of various old buildings in the global market. These require continuous upgradation and replacement of spare parts, which contribute positively to the market share.

Modernization is expected to grow moderately during the forecast period, owing to factors such as moderate demand for replacing current elevators with new energy-efficient machines, reduced energy consumption, faster operation, and smooth operation. All such factors drive market growth.

By Application

Commercial Sector Dominates the Market Due to Rise in Investment for Shopping Centers, and Commercial Malls

Based on application, the market is classified into residential, commercial, and industrial spaces.

The commercial sector dominated the market in terms of revenue market share in 2024, owing to factors such as investment in expanding shopping centers, high-rise buildings, commercial malls, and government institutes, which drive market growth.

- For instance, according to CBRE India, commercial sector investment in India increased by 43% in 2024 compared to 2023.

The residential sector is expected to grow at a moderate rate during the forecast period due to rising investment in residential and multi-family homes, which triggers market growth.

The industrial sector is projected to grow at a decent rate during the forecast period due to rising demand for these lifts in industrial, logistics, and manufacturing plants. Moreover, the rising expansion of industrial and manufacturing plants, which is driving the demand for efficient vertical transportation, will drive the hydraulic elevators market growth.

Hydraulics Elevator Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Hydraulic Elevators Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region is projected to dominate the market with a 36.5%, and is projected to grow at the highest growth rate during the forecast period. It is owing to growing urbanization, rising middle-class population, and growth in infrastructure development, which is increasing demand for these elevators, driving the market growth. Moreover, rising construction sector investment across Japan which in turn, creates the demand for more elevator systems for the market.

- For instance, according to the World Bank Group, the urbanization rate of Australia increased by 1.2% in 2024 as compared to 2023.

China contributed the highest share in the Asia Pacific market owing to factors such as growth in the residential and commercial sectors, and growth in urban infrastructure, which surges the demand for such products, bolstering the market growth

- According to statistics, the Chinese government planned to invest around USD 234 million in the residential and commercial sectors in 2024.

Europe

The Europe region is projected to grow steadily during the forecast period by rising aging population across Europe, which in turn, drives the demand for more lifts for vertical transportation of the aged population, driving the market growth.

- For instance, according to Ageing EURO, the aging population across Europe is anticipated to grow by 30% in 2050 as compared to 20% in 2019.

North America

The North America region is projected to grow at a potential growth rate during the forecast period owing to increased construction activity and growth in residential and commercial spaces across the U.S. and Canada, which fuels the market growth.

- For instance, according to Harvard University Joint Center of Housing Studies, the residential sector investment in U.S. is projected to reach USD 509 billion in 2025 as compared to USD 487 billion by 2023.

Middle East & Africa

The Middle East & Africa region is projected to grow at a moderate rate due to rising investment in renovation and new construction across GCC, South Africa, and North Africa, which fuels the demand for hydraulic elevators, driving the market growth.

Latin America

Latin America is projected to grow decently during the forecast period due to rising demand from commercial and industrial sectors, which fuels the market growth. Moreover, growth in residential and industrial spaces that bolster the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Engaged in Adopting Product Development, Product Launch, and Acquisition to Intensify the Market Competition

Major players such as TK Elevator GmbH, BRIO Elevators, Hitachi Ltd, Hyundai Elevator Company, and Joylive Elevator Co Ltd, among others, are engaged in adopting product development, acquisition, and product launches as key developmental strategies to strengthen market competition and expand the hydraulic elevators market share.

- For instance, in January 2024, TK Elevator GmbH launched a new EOX-H low-rise hydraulic elevator. The design can meet the demand for buildings with three floors and a height of 28 feet. It offers features such as technological advancement, space efficiency, cost efficiency, and reduced lead time.

LIST OF KEY HYDRAULIC ELEVATORS COMPANIES PROFILED

- BRIO Elevators (Japan)

- Hitachi Ltd (Japan)

- Hyundai Elevator Company (South Korea)

- Joylive Elevator Co Ltd (China)

- Kone Corporation (Finland)

- Mitsubishi Electric Corporation (Japan)

- Otis Elevator Company (U.S.)

- Sanyo Elevators & Escalators Co Ltd (Japan)

- Morris Vermaport Ltd (U.K.)

- TK Elevator GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Mitsubishi Electric Corporation acquired Ascension Lifts Limited based in Dublin deals in elevator, hydraulic elevators and escalator. The main aim of the acquisition was to improve the product portfolio of hydraulic elevators.

- March 2025: BRIO Elevators launched the Brio BE360, India's first hybrid hydraulic elevator featuring a 360-degree panoramic view. Introduced in Hyderabad, this space-efficient, pit-free, machine-room-free solution combines hydraulic technology with a sleek design, targeting luxury residential and boutique commercial applications.

- December 2024: Kone India, a subsidiary of Kone Corporation introduced a new series of Kone I Mini Space smart elevators at International Sourcing Exposition for Elevators in India. It offers features such as AI-powered machine, 24/7 monitoring, and have compatible to ensures seamless transition. It found application in residential, commercial and industrial spaces.

- January 2024: TK Elevators expanding its EOX platform of products with EOX-H, its new low-rise hydraulic elevator. This innovation is uniquely engineered to meet the demands of buildings with up to three landings or 28 feet of rise. The EOX-H offers space saving design, advanced technologies, reduced lead times and is optimized for most budgets.

- May 2023: TK Elevator GmbH unveiled the EOX in North America. The eco-efficient elevator platform is designed to fulfill the challenges of 2 to 10-story buildings with its compact design, technology, and shorter lead times. EOX runs on features including Eco-mode, which reduces the elevator's speed and acceleration at low traffic times, and an enhanced in-car sensor that improves entrance safety and ride quality.

REPORT COVERAGE

The global hydraulic elevators market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics, market opportunities and market trends expected to drive the market in the forecast period. It offers information on the market in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions in key countries. The report covers detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.0% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Capacity

|

|

|

By Business Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 44.57 billion in 2024 and is projected to reach USD 64.98 billion by 2032.

In 2024, the market value stood at USD 22.06 billion.

The market is expected to exhibit a CAGR of 5.0% during the forecast period.

Based on business type, maintenance dominates the market.

Rising retrofit and modernization projects across the globe to fuels the market growth.

Fujitec, Hitachi Ltd, Hyundai Elevator Company, Joylive Elevator Co Ltd, Kone Corporation, Mitsubishi Electric Corporation, Otis Elevator Company, Sanyo Elevators & Escalators Co Ltd, Morris Vermaport Ltd, and TK Elevator GmbH are the top players in the market.

Asia Pacific dominated the market in 2024.

Technological advancements in products provides lucrative opportunities for the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us