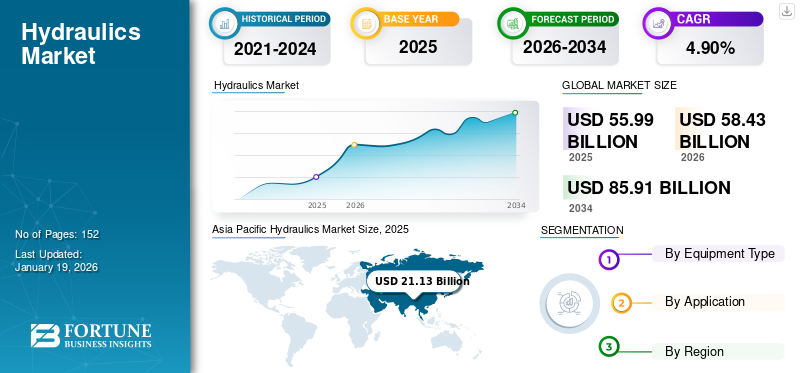

Hydraulics Market Size, Share & Industry Analysis, By Equipment Type (Pumps, Motors, Cylinders, Transmissions, Valves, and Others), By Application (Mobile Hydraulics and Industrial Hydraulics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global hydraulics market size was valued at USD 55.99 billion in 2025 and is projected to grow from USD 58.43 billion in 2026 to USD 85.91 billion by 2034, exhibiting a CAGR of 4.90% during the forecast period. The Asia Pacific dominated the global market with a share of 37.70% in 2025.

The market encompasses the production and design of systems that apply fluid power to do work, such as hydraulic pumps, valves, cylinders, motors, and electro hydraulic systems. Spurred by surging demand for energy efficient hydraulic technologies and high-precision control, the market is expected to expand considerably in the future years. Surging demand for hydraulic equipment is spurred by infrastructure activities and sectors such as construction, automotive, and manufacturing. New technologies such as predictive maintenance and real-time monitoring are improving system efficiency and reliability and strengthening market prospects further.

Furthermore, the market encompasses several major players with Danfoss Power Solutions, Parker Hannifin Corporation, and Bosch Rexroth AG at the forefront. Broad portfolio with innovative product launch, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Technological Innovation and Electrohydraulic Integration Drive Precision, Efficiency, and Automation in Hydraulic Systems

The market is growing rapidly due to technological advances and the integration of electrohydraulic systems, which improve industrial applications with precise control, programmability, and energy efficiency. For instance,

- At Bauma 2025, Bosch Rexroth introduces new hardware and software products for advancing automation, electrification, connectivity, and efficiency in mobile machines, such as hydraulic solutions from Bosch Rexroth and HydraForce.

Hydraulics market growth is being driven as top producers keep pumping funds into emerging technologies and intelligent solutions to maintain a competitive edge amid changing market dynamics.

MARKET RESTRAINTS

High Initial Costs, Increasing Raw Materials Price, and Environmental Concerns Hampering Market Growth

The exorbitant initial capital outlay needed for advanced hydraulic systems is still one of the major market restraints, particularly to SMEs in developing countries. In addition to the capital outlay of purchasing smart valves, precision pumps, and electrohydraulic actuators, companies incur additional costs in terms of energy usage, expert maintenance, and technical training.

Compliance with regulations contributes additional cost pressure. Regulations including the Europe Union Machinery Regulation 2023/1230 and the ISO 4413 prescribe strict guidelines in respect to safety, system design, and noise control.

Furthermore, increases in raw material costs including steel, aluminum, and seals are putting pressure on both the manufacturers and consumers.

- For instance, the doubling of U.S. tariffs on steel and aluminum in June 2025 is expected to increase production costs by 10 to 25 percent, further discouraging investment in new systems.

MARKET OPPORTUNITIES

Growing Applications across Agriculture, Defense and EVs Creating Substantial Market Opportunities

Electric vehicles are becoming increasingly popular across geographies as a result of policy shifts, investment in infrastructure, and increased consumer demand. In the mobile hydraulics division, the demand for tractors, harvesters, and other farm equipment increased on account of the mechanization of agriculture operations. Use of precision agriculture and smart farming systems is generating stable demand.

In aerospace and defense applications, light, corrosion-resistant hydraulic actuators are picking up speed as components of next-generation aircraft and UAVs. For instance,

- In May 2024, Bell selected Eaton's hydraulic technology to power the U.S. Army's Future Long-Range Assault Aircraft. Eaton will deliver the hydraulic power generation and transmission components, oil swivels, hydraulic panels, and accumulators that need no maintenance.

HYDRAULICS MARKET TRENDS

Automation and Clean Technologies Creating Growth Potential

The market is witnessing a boom in demand with the global upsurge in industrial automation and smart manufacturing. Industries are using precision-based hydraulic systems more and more for heavy-duty operations in industries such as automotive, aerospace, and steel production. For example,

- According to IFR, in 2023, Global industrial robot installations totaled more than 590,000 units, with numerous ones incorporating hydraulic power for improved payload handling and motion control.

The industry is embracing clean technologies to increase sustainability with emphasis on energy-efficient parts including electro-proportional valves and regenerative systems.

Download Free sample to learn more about this report.

Segmentation Analysis

By Equipment Type

Growing Demand for Precise Linear Motion Drives Dominance of Hydraulic Cylinders in Industrial Applications

On the basis of the segmentation of type, the market is classified into pumps, motors, cylinders, transmissions, valves, and others.

To know how our report can help streamline your business, Speak to Analyst

The cylinders segment accounted for the significant hydraulics market share 26.41% in 2026. Hydraulic cylinders are the most used component in many industries owing to their pivotal function of converting hydraulic energy into linear mechanical force, which is vital in a vast diversity of industrial as well as mobile applications. Their ease of design, their high loads handling capacity, and reliability make them a necessity in industries such as construction, agriculture, manufacturing, and mining. Furthermore, the growing use of automation and the need for accurate linear motion in heavy-duty applications have further solidified the domination of hydraulic cylinders.

By Application

Rising Demand for High-Power Compact Systems Boosts Dominance of Mobile Hydraulics

In terms of application, the market is categorized into mobile hydraulics and industrial hydraulics.

The mobile hydraulics segment captured the largest share of the market in 2025. In 2026, the segment is anticipated to dominate with 56.48% share. Such dominance of mobile application is fueled by its extensive application in construction equipment, farming machinery, mining equipment, and material handling equipment. Such applications require high power density, minimal space, and effective energy transmission, all of which are inherent areas of strength for mobile hydraulic systems. Moreover, the investments in infrastructure development and agricultural mechanization in emerging countries are also growing, further increasing adoption of mobile hydraulics. The incorporation of cutting-edge technologies such as electrohydraulic controls is also increasing performance, dependability, and accuracy, thus cementing the supremacy of this segment in the global market.

The Industrial Hydraulics segment is expected to grow at a CAGR of 4.47% over the forecast period. The growth of the industrial hydraulics segment is driven by rising demand from manufacturing industries and increasing adoption in automation and material handling applications.

Hydraulics Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

ASIA PACIFIC

Asia Pacific Hydraulics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the dominant share in 2025 valuing at USD 21.13 billion and also took the leading share in 2026 with USD 22.19 billion. The region's dominance is supported by intense industrialization, major infrastructure undertakings, and growing construction and farm industries in nations such as China, India, and Southeast Asia. The availability of large manufacturing centers and growing investments in automation in many sectors further lend dominance to the region. Besides, the demand for mobile hydraulic equipment in mining and transportation keeps increasing, further cementing dominance in the region. In 2026, the China market is estimated to reach USD 9.58 billion.

EUROPE & NORTH AMERICA

Other regions such as Europe and North America are anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 4.11% and touch a valuation of USD 14.27 billion in 2025. Europe maintains a strong presence in the market, driven by advanced manufacturing, automotive, and industrial automation sectors. Backed by these factors, countries including the U.K. anticipate to record the valuation of USD 2.59 billion, Germany to record USD 3.77 billion, and France to record USD 1.78 billion in 2026. After Europe, the market in North America is estimated to reach USD 12.83 billion in 2025 and secure the position of third-largest region in the market. North America follows closely, supported by ongoing technological advancements, adoption of smart hydraulics, and a well-established construction and mining industry. In the region, U.S. and Canada both are estimated to reach USD 11.13 billion and 2.18 respectively in 2025.

LATIN AMERICA & MIDDLE EAST & AFRICA

Over the forecast period, Latin America and Middle East & Africa regions would witness a moderate growth in this marketspace. The Latin America market in 2025 is set to record USD 3.34 billion as its valuation. In Middle East & Africa, GCC is set to attain the value of USD 4.42 billion in 2025. The region is witnessing steady growth, primarily fueled by investments in oil and gas and infrastructure projects, and the modernization of industrial operations.

COMPETITIVE LANDSCAPE

Key Industry Players

High Investment In Technology, Strategic Partnerships, And Global Trade Show Presence Drive Market Dominance In Fragmented Hydraulic Systems Industry

The market is very fragmented, as many players operate in it. Some major players in the industry include Danfoss Power Solutions, Parker Hannifin Corporation, and Bosch Rexroth AG.

These players owe their dominance to their vast product portfolios, high investment in the latest technologies, and affordable and long-lasting product launches that satisfy end-user requirements. One thing that helps them, too, is that key manufacturers go to trade shows and exhibitions and have plans to grow their businesses. For instance,

- In April 2025, several market players, including Hydraforce Hydraulics and Bosch Rexroth, showcased their offerings at the BAUMA TRADE FAIR in Munich, Germany.

Players such as Daikin Industries and Yuken Kogyo Co., Ltd. are growing by setting up authorized service and distribution centers, partnering with dealer and distributor networks, etc. Due to increased investment in infrastructure, the industry players are emphasizing increasing their base in emerging nations, such as India, Thailand, the Middle East, etc.

LIST OF KEY HYDRAULICS COMPANIES PROFILED

- Bosch Rexroth AG (Germany)

- Bucher Hydraulics (Switzerland)

- Danfoss A/S (Denmark)

- Dover Corporation (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- KYB Corporation (Japan)

- Moog Inc. (U.S.)

- Parker Hannifin Corporation (U.S.)

- SMC Corporation (Japan)

- Weichai Power Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Danfoss Power Solutions introduced its X1P family, the first update to its open-circuit piston pump line. The X1P series uses a brand new design, made to work better and be more efficient in hydraulic applications.

- April 2025: Bosch Rexroth showed off new hardware and software. These updates help with automation, electrification, connecting things, and making mobile equipment work better. This includes hydraulic tech from both Bosch Rexroth and HydraForce.

- January 2025: Dover Corporation's PSG has acquired Cryogenic Machinery Corp. ("Cryo-Mach"), a prominent producer of cryogenic pumps and seals, to broaden its capabilities in industrial gas and liquefied oxygen, argon, and nitrogen.

- October 2024: Danfoss expanded Vickers' product line and launched the KBRFG4-5 industrial hydraulic valve. It can handle a lot of power and is built to last in tough hydraulic jobs.

- August 2024: Bucher Hydraulics has collaborated with ME Mobil Elektronik to provide custom electrohydraulic steering systems for farm equipment. This project combines their hydraulic know-how with electronic steering tech.

REPORT COVERAGE

The global hydraulics market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The hydraulics market research report also encompasses detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.90% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The global hydraulics market size was valued at USD 55.99 billion in 2025 and is projected to grow from USD 58.43 billion in 2026 to USD 85.91 billion by 2034, exhibiting a CAGR of 4.90% during the forecast period

In 2025, the market value stood at USD 12.83 billion.

The market is expected to exhibit a CAGR of 4.90% during the forecast period of 2026-2034.

The cylinders segment led the market by equipment type.

The key factors driving the market are technological innovation and electrohydraulic integration, which enhance precision, efficiency, and automation in hydraulic systems.

Danfoss Power Solutions, Parker Hannifin Corporation, and Bosch Rexroth AG are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Key factors driving hydraulics adoption are tech advances, automation, infrastructure growth, and strong service networks.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us