Immunosuppressive Drugs Market Size, Share & Industry Analysis, By Drug Class (Calcineurin Inhibitors, mTOR Inhibitors, Antimetabolites, Interleukin Antagonists, Corticosteroids, and Others), By Application (Organ Transplantation, Autoimmune Diseases, Oncology Indications, and Others) By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Online Pharmacies), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

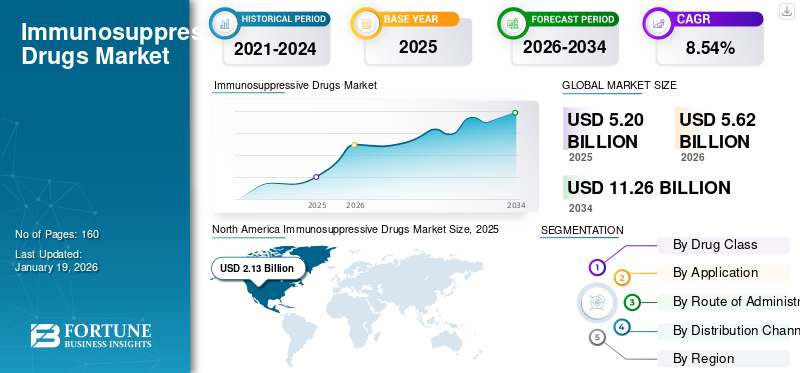

The global immunosuppressive drugs market size was valued at USD 5.2 billion in 2025. The market is projected to grow from USD 5.62 billion in 2026 to USD 11.26 billion by 2034, exhibiting a CAGR of 8.54% during the forecast period. North America dominated the immunosuppressive drugs market with a market share of 42.15% in 2025.

The global market is projected to grow with a significant CAGR in the forecast period, with an upward growth trajectory. Various established players such as AbbVie Inc., Pfizer Inc., and Bristol-Myers Squibb Company operating in the market are focusing on developing various pipeline candidates to support the rising demand for immunosuppressive drugs.

Immunosuppressive drugs are medications used to reduce or prevent the activity of the immune system to suppress the immune response of the body. They are mainly used for the treatment of autoimmune disorders such as rheumatoid arthritis, psoriasis, and prevention of allograft rejection during transplantation. These are either glucocorticoids, cytostatic, antibodies, or immunophilins. Thus, with the rising prevalence of autoimmune disorders and growing transplantation surgeries, the global market is expected to grow significantly during the forecast period.

- For instance, in April 2025, the Organ Procurement & Transplantation Network reported 27,759 kidney transplantation surgeries in U.S. in the year 2024. Such rising transplantation surgeries heighten the demand for immunosuppressants to prevent rejection of transplanted organs.

Furthermore, the emergence of novel agents and improvements in immunosuppression regimens after transplantation are significant factors leading to a rise in demand for immunosuppressants, thus expected to bolster the market growth during the forecast period.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Autoimmune Diseases and Advances in Immunosuppression for Patient Care to Propel the Market Growth

The increasing prevalence of autoimmune diseases such as rheumatoid arthritis and Crohn’s Disease, among others, augments the demand for immunosuppressive drugs in the forecast period. Genetic predisposition, stress, environmental factors, and changing lifestyles further affect the rise in autoimmune disease.

- For instance, in June 2023, WHO reported 18.0 million people had rheumatoid arthritis in 2019. Among these, approximately 70.0% of patients were women.

Such rising cases of autoimmune disorder further enhance the need for the advancement of diagnostic tools, further offering growth opportunities.

MARKET RESTRAINTS

High Prices of Immunosuppressants, Particularly Biologics, to Impede Growth of the Market

Many immunosuppressant, particularly biologics, are expensive due to federal barriers imposed due to the expensive and burdensome approval process by regulatory bodies. This creates an economic burden on both healthcare systems and patients, especially in low- and middle-income countries. Such high-cost treatment may hamper the growth of the market.

- For instance, a report published by the Australian Institute of Health and Welfare estimated that around 514,000 people in Australia had arthritis in 2022, and an estimated expenditure of USD 637.3 million on the treatment of rheumatoid arthritis—such a high prevalence bolsters the immunosuppressants market.

MARKET OPPORTUNITIES

Increasing Investment by Key Players for Advancement in Developing Immunosuppressive Drugs to Offer a Prominent Opportunity

Various emerging players in the immunosuppressive drug market are receiving investment and working on innovative immunosuppressive drugs and therapies. Novel immunosuppressant therapies are targeting specific immune pathways, offering localized delivery, and utilizing biomaterials to enhance transplant survival. Such investment promotes market expansion opportunities.

- For instance, in December 2024, Nuwig Therapeutics received USD 200.0 million in investment in Series B funding prompted by the safe results executed by its lead autoimmune disease candidate, NVG-2089, for the treatment of chronic inflammatory demyelinating polyneuropathy, or CIDP, as well as other unspecified autoimmune diseases.

MARKET CHALLENGES

Long-Term Toxicity and Severe Adverse Effects Associated Pose a Critical Challenge to Market Growth

Various long-term side effects are associated with immunosuppressive drugs as they increase the risk of infection, cardiovascular diseases, and bone marrow suppression. These factors pose a considerable challenge to the market.

- For instance, AFINITOR, administered for advanced renal cell carcinoma and giant cell astrocytoma, is associated with side effects such as breathing problems, ulcers, diarrhea, nose bleeds, and many more. Similarly, SKYRIZI, indicated for the treatment of plaque psoriasis, has side effects such as serious allergic reactions.

IMMUNOSUPPRESSIVE DRUGS MARKET TRENDS

Surge in Biosimilars is a Prominent Trend Observed in the Market

The immunosuppressive drug market witnessed the launch of various biosimilars in the immunosuppressive drug market. Biosimilars are complex molecules with an inherent level of microvariability and mimic the active ingredient of biologic drugs. Biosimilar provides better access for therapeutic purposes, supporting immunosuppressive drugs market growth by better availability. These factors created an opportunity for key players for strategic collaboration for the development of biosimilar and to expand the market reach of the treatment.

- For instance, in February 2021, Japan-based Fujifilm Kyowa Kirin Biologics collaborated with US-based Viatris to launch the first biosimilar of adalimumab in Japan. Mylan EPD G.K did the commercialization of the biosimilar.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug Class

Approvals by Various Regulatory Bodies for Calcineurin Inhibitors in Markets to Propel Segmental Growth

Based on the drug class, the market is divided into calcineurin inhibitors, mTOR inhibitors, antimetabolites, interleukin antagonists, corticosteroids, and others.

The calcineurin inhibitors segment is the leading segment across the forecast period. The growth is attributed to its effectiveness as an immunosuppressant as it selectively inhibits calcineurin, a protein crucial for T-cell activation, thereby preventing the production of key cytokines including IL-2. This targeted approach leads to a strong and specific reduction in T-cell function, making them particularly useful in preventing organ transplant rejection and managing certain autoimmune diseases.

Moreover, key companies are focusing on gaining approvals from various regulatory bodies to expand their offerings in emerging markets.

- For instance, in September 2024, Aurinia Pharmaceuticals Inc. received approval for its second-generation immunosuppressant voclosporin, a calcineurin inhibitor, in combination with mycophenolate mofetil (MMF) to treat lupus nephritis (LN) by the Japanese Ministry of Health, Labour, and Welfare.

mTOR inhibitors segment held a considerable market share in the immunosuppressant drug market in the forecast period. The segment is expected to grow due to positive results exhibited by mTOR inhibitors as immunosuppressants for allografts. Following these advantages, key market players focus on expanding their product offerings in the segment.

- For instance, in January 2025, Camber Pharmaceuticals launched Sirolimus oral solution, an mTOR inhibitor indicated for the prophylaxis of organ rejection in patients aged greater or equal to 13 years receiving renal transplants.

Antimetabolites hold a considerable market share. They interfere with the synthesis of nucleic acids (DNA and RNA), which are essential for cell growth and division. By disrupting these processes, they can suppress the immune response, making them useful to prevent organ rejection and treating certain autoimmune diseases.

Interleukin antagonists, corticosteroids, and others also hold significant market share in the immunosuppressive drug market in the forecasted years. The segments are expected to witness significant growth due to limitations of current immunosuppressive therapies and ongoing research to overcome them.

By Application

Increasing Number of Solid Organ Transplantation Surgeries to Bolster Segment’s Growth

By application, the market is further segmented into organ transplantation, autoimmune diseases, oncology indications, and others.

Organ transplantations to hold the maximum share in the market. The administration of immunosuppressant drugs is crucial in preventing organ transplantation rejection of acute allograft rejection by the body. Furthermore, the rising number of transplantation surgeries, particularly of the kidney and liver, augments the demand for immunosuppressants in the market.

- For instance, in 2024, the Government of India reported that the total number of solid organ transplants done per year in the country increased from 4,990 in the year 2013 to 18,378 in the year 2023. Such an increasing number of transplantation surgeries to propel the demand for immunosuppressant drugs and drive market growth.

Additionally, immunosuppressants are also administered for the treatment of autoimmune disorders such as rheumatoid arthritis, Crohn’s Disease, and Lupus, among others. They suppress the immune response to prevent attacks on the body’s tissues and prevent further damage. Key market players are launching new products for the treatment of autoimmune diseases and further driving growth.

- For instance, in January 2023, Amgen launched AMJEVITA (adalimumab-atto), a biosimilar to Humira, in the U.S. for the treatment of rheumatoid arthritis and psoriatic arthritis.

Oncology indications also have found relevance with immunosuppressive therapies, with drugs including Everolimus used for the treatment of certain cancers, such as breast cancers and renal cancers. Immunosuppressants are administered to reduce the side effects of cancer therapies such as chemotherapy and radiation that prolong treatment duration.

By Route of Administration

Novel Product Launches in Oral Drugs to Propel the Growth of the Oral Segment in the Market

On the basis of the route of administration, the market is segmented into oral and parenteral.

The oral segment is expected to hold the maximum market share due to easy administration and ease of access for usage in various indications such as allergic reactions and autoimmune disorders. They also assist in maintaining drug regimes in post-transplantation care. Catering to its high market share, many companies are focusing on approval by various regulatory bodies for the launch of their oral immunosuppressants.

- For instance, in August 2023, Strides Pharma Global Pte. Limited, Singapore, received approval for Mycophenolate Mofetil for Oral Suspension, a biosimilar of Cellcept, from the U.S. FDA, indicated for prophylaxis of organ rejection in adult and pediatric recipients 3 months of age and older of allogeneic kidney, heart, or liver transplants, in combination with other immunosuppressants.

On the other hand, the parenteral segment is expected to grow with a significant CAGR in 2024. The growth of this particular segment is attributed to its efficiency and speedy results demonstrated when compared to other routes. The growth can be attributed to various new product launches in the market by key industry players and research and development in the segment.

- For instance, in October 2023, Novartis received approval from the U.S. FDA for an intravenous (IV) formulation of Cosentyx (secukinumab), an interleukin inhibitor for the treatment of adults with psoriatic arthritis (PsA), ankylosing spondylitis (AS), and non-radiographic axial spondyloarthritis (nr-axSpA).

By Distribution Channel

Government Regulations and Major Application of Immunosuppressant Drugs in Transplantation to Position Hospital Pharmacies in a Leading Position

On the basis of end-users, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The hospital pharmacies are expected to dominate the immunosuppressive drug market in the forecasted period. The significant market share is attributed to major applications of immunosuppressant drugs for organ transplantations taking place in hospitals. Moreover, the rules and regulations that mandate the availability of transplantation drugs in government hospital pharmacies further reinstate the market share.

- For instance, in June 2025, the Ministry of Health and Population in Nepal issued a circular that required government-run pharmacies to stock all necessary supplies for organ transplantation and provide better patient care.

Such developments to propel the growth of the hospital pharmacies segment in the forecasted period.

The retail pharmacies & drug stores are expected to grow substantially during the forecast period, with the increasing number of collaborations and ease of access to medicine to further drive the market growth.

Additionally, an increasing number of specialty pharmacies that focus on complex pharmacological products are on the rise to further heighten the market growth.

- In July 2024, Walmart expanded its autoimmune-focused specialty retail pharmacies in collaboration with Community Pharmacist to more than 30 locations across nine states of the U.S.—such developments to further augment the growth of the segment in the forecast period.

The online pharmacies are anticipated to grow with a moderate CAGR during 2025-2032. The convenience offered by the utilization of online pharmacies, accompanied by benefits such as cost-saving, privacy, and heightened accessibility to favor its easy adoption.

IMMUNOSUPPRESSIVE DRUGS MARKET REGIONAL OUTLOOK

By region, this market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Immunosuppressive Drugs Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 2.13 billion in 2025 and is anticipated to continue to dominate the global market during the forecast period. Increasing efforts for the development of organ transplantation infrastructure to bring efficiency and transparency in government operations, various program initiatives to strengthen organ transplantations, to positively affect the market in North America.

- For instance, in March 2023, the Health Resources & Services Administration (HRSA) launched its OPTN Modernization Initiative to strengthen accountability and the performance of the nation’s organ transplant system by focusing on improving the OPTN’s governance, technology, and operations.

U.S.

U.S. is dominating the market in the North America region. There is a rise in the number of end-stage organ failures creating demand for transplantations in the region. These developments augment the need for effective immunosuppressive drugs.

- For instance, in March 2022, the Centers for Disease Control & Prevention reported in its weekly editorial that during 2000–2019, in the general U.S. population, the number of reported incident End Stage Kidney Diseases (ESKD) cases increased 41.8%, and the number of prevalent cases approximately doubled.

Furthermore, various government plans to enhance patient care and expand access to advanced surgeries including transplantation for patients, to support the growth in the coming years.

- For instance, in November 2024, the U.S. Department of Health and Human Services (HHS), through the Centers for Medicare & Medicaid Services (CMS), finalized a six-year mandatory model aimed at increasing access to kidney transplants and improving patient care.

Europe

Europe is anticipated to hold the second-largest position in terms of revenue share. The region witnessed a rise in the prevalence of autoimmune diseases. High volumes of immunosuppressant are used for the treatment of autoimmune disorders as they interfere with DNA synthesis to limit the immunologic response of the body. The established players in the region are streamlining their focus into strategic collaborations to combat autoimmune diseases and seeking approvals for new product launches.

- For instance, in April 2025, AbbVie Inc. received marketing authorization by the European Commission for RINVOQ, a JAK inhibitor for the treatment of giant cell arteritis (GCA) in adult patients. RINVOQ is the first and only oral JAK inhibitor approved in the EU, as well as Iceland, Liechtenstein, and Norway, for the treatment of adult patients with GCA.

Asia Pacific

The Asia Pacific market is projected to witness the highest CAGR, especially in the developing countries such as China, Japan, and India. The rising number of transplant surgeries and the growing prevalence of autoimmune diseases foster the regional growth. Underscoring this rising demand in these drugs, many established players are focusing on gaining marketing approval from regulatory bodies to further propel the market growth.

- For instance, in January 2025, Biocon Pharma received approval for Tacrolimus capsules in 0.5mg, 1mg, and 5mg strengths from the National Medical Products Administration (NMPA), China.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa accounted for moderate market revenue during the forecast period. However, to address the rising demand for immunosuppressants in the region, various key companies are focusing on strategic activities such as collaborations and mergers. Such developments to bolster the market growth

- For instance, in September 2024, Eli Lilly and Company collaborated with EVA Pharma to expand access to baricitinib, an immunosuppressant indicated for rheumatoid arthritis, to approximately 20,000 people in 49 low- to middle-income countries in Africa by 2030.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Focus on Strategic Expansion Opportunities by Key Players to Propel Market Progress

The global immunosuppressive drugs market holds a semi-consolidated market structure featuring prominent players such as Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, and GSK plc. The substantial share of these companies in the market is due to the strategic activities with the mergers and acquisitions for robust product offerings, with a focus on research and development to enhance their market positions.

- For instance, in July 2023, CareDX Inc. acquired MediGO, Inc. for the expansion of its digital health portfolio to serve the organ procurement organization (OPO) market while also bolstering its pre-transplant offerings aimed at shortening transplant wait times and increasing access to donated organs.

Other notable players in the global market include Bristol-Myers Squibb Company, AbbVie Inc., and Astellas Pharma Inc. These companies are anticipated to prioritize new product launches and collaborations to boost their global immunosuppressive drugs market share during the forecast period.

LIST OF KEY IMMUNOSUPPRESSIVE DRUGS COMPANIES PROFILED

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Hoffmann-La Roche Ltd (Switzerland)

- GSK plc. (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- AbbVie Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Teva Pharmaceuticals USA, Inc. (Israel)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Eledon Pharmaceuticals, Inc. announced tegoprubart, the company’s investigational anti-CD40L antibody, used as a key component of the immunosuppression therapy regimen in a patient who received a transplanted kidney from a genetically modified pig in collaboration with eGenesis.

- June 2024: Biogen Inc. acquired Human Immunology Biosciences (HI-Bio), a clinical-stage biotechnology company focused on targeted therapies for severe immune-mediated diseases (IMDs). The acquisition aimed at the addition of felzartamab, strengthening the company’s presence in immunology.

- April 2024: Takeda Pharmaceutical Company Limited received approval for ENTYVIO (vedolizumab) for maintenance therapy in adults with moderately to severely active Crohn’s disease (CD) by U.S. FDA.

- April 2024: Vertex Pharmaceuticals Incorporated acquired Alphine Immune Sciences, Inc. The acquisition aimed for exclusive rights to alpine’s lead molecule, povetacicept (ALPN-303), a proliferation-inducing ligand that showed potential efficacy in progressive, autoimmune disorder of nephropathy IgA (IgAN).

- June 2020: Sandoz launched generic tacrolimus capsules known as Dailiport, which are indicated for the prophylaxis of transplant rejection in adult kidney or liver allograft recipients in Germany, the U.K, Netherlands, Finland, Sweden, Estonia, Latvia, and Slovakia and as Conferoport in Italy and Spain.

REPORT COVERAGE

The global immunosuppressive drugs market report comprises of total global immunosuppressive market analysis that emphasizes key aspects such as an overview of technological advancement, pipeline candidates, regulatory environment, and product launches. The report also examines the applications of novel therapeutics alongside notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, it detailed regional analysis of various segments and the impact of COVID-19 on the market is covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.54% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Class

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 5.62 billion in 2026 and is projected to reach USD 11.26 billion by 2034.

In 2025, North America stood at USD 2.13 billion.

Registering a CAGR of 8.54%, the market will exhibit rapid growth over the forecast period.

Based on drug class, the calcineurin inhibitor is expected to lead the market during the forecast period.

The rising prevalence of autoimmune diseases and leading transplantation surgeries are the driving factors in the market.

Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, and GSK plc. are the major players in the global market.

North America dominated the immunosuppressive drugs market with a market share of 42.15% in 2025.

Innovation in immunosuppressant therapies and increasing investment to offer better products that assist the adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us