India Agricultural Biologicals Market Size, Share & COVID-19 Impact Analysis, By Type (Biopesticides, Biostimulants, and Biofertilizers), By Source (Microbial and Biochemicals), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment, and Others), By Crop (Row Crops, Fruits & Vegetables, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

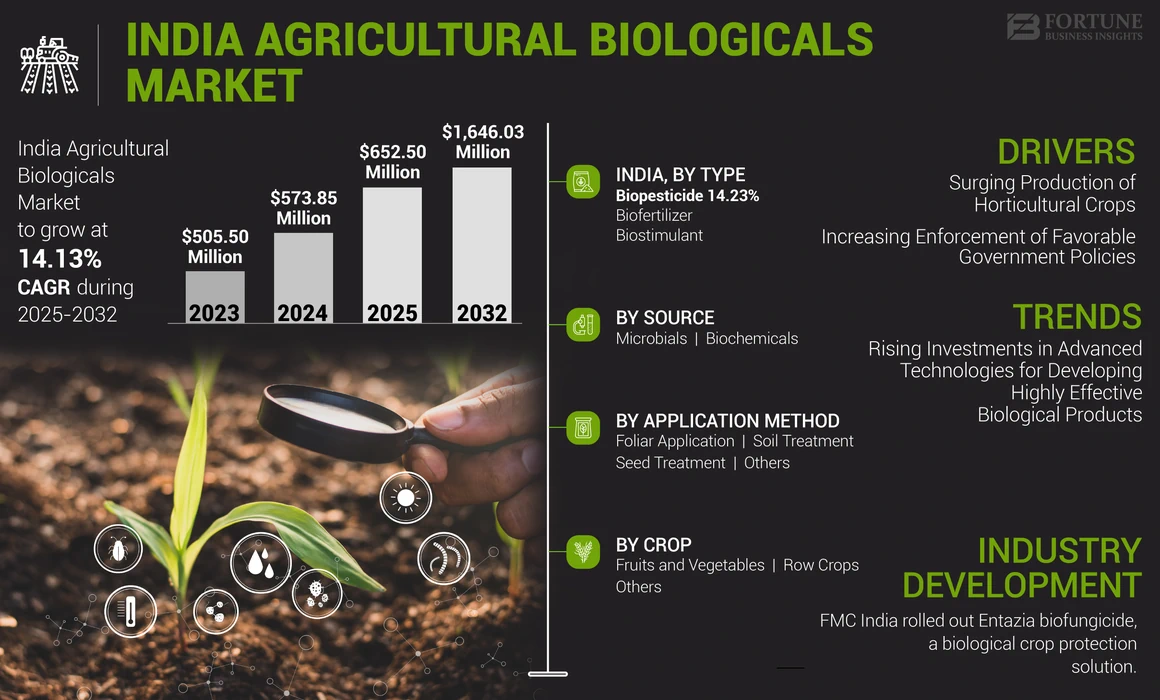

The India agricultural biologicals market size was valued at USD 573.85 million in 2024. The market is projected to grow from USD 652.50 million in 2025 to USD 1,646.03 million by 2032, exhibiting a CAGR of 14.13% during the forecast period.

Agricultural biologicals are agricultural inputs that are derived from biological sources such as food, plants, trees, and biological waste. They are a good substitute for conventional chemicals and will help to reduce our reliance on fossil fuels. Moreover, use of biologicals in agriculture can lead to reduced carbon emissions and maintain the ecological balance. The market in India is relatively smaller than the synthetic crop protection chemicals industry. Some of the major agricultural biological products are biofertilizers, biopesticides, and biostimulants.

The demand for environment-friendly products is increasing rapidly in the country. Furthermore, the adoption of policies, such as the National Farmer Policy, which supports sustainable farming, also creates favorable opportunities for biological manufacturers to expand their production. These factors are anticipated to support market growth in the coming years.

India Agricultural Biologicals Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 573.85 million

- 2025 Market Size: USD 652.50 million

- 2032 Forecast Market Size: USD 1,646.03 million

- CAGR: 14.13% from 2025–2032

Market Share:

- Biostimulants segment accounted for the highest share in 2024, driven by their ability to enhance nutrient efficiency, improve soil health, and stimulate plant physiological activity. Biochemicals are expected to retain the largest share by source, supported by their role in reducing carbon emissions and reliance on fossil fuels.

- By application, foliar spray dominated the market due to its ease of use across both organic and conventional farms. Row crops held the highest share by crop type, attributed to increasing demand for pesticide residue-free crops and sustainable farming inputs.

Key Country Highlights:

- India: Government schemes like Paramparagat Krishi Vikas Yojana (PKVY) and MOVCDNER are boosting the adoption of biologicals. Growing horticulture crop production and increasing exports of fruits and vegetables are further fueling market demand.

- India (COVID-19 Impact): Lockdowns disrupted supply chains, limiting product availability and inflating input costs. However, domestic manufacturers gained opportunities to expand due to China’s production halt.

- India (Technology Trends): Companies are investing in nanotechnology and R&D to develop more effective biopesticides. Regulatory bodies like CIB&RC are implementing quality guidelines to support innovation and product efficacy.

COVID-19 IMPACT

Lockdown Restrictions Hampered Product Availability Affecting the Market Growth

The COVID-19 pandemic had a negative impact on the agricultural sector and small-scale farmers suffered major problems due to supply chain disruptions. The price of commodities such as agri inputs, including biofertilizers, biopesticides, and biostimulants, increased during the pandemic.

The pandemic created several challenges for the farmers, who had to adopt new strategies to cope with such stresses. As movement was restricted, large farms suffered from labor unavailability, causing a loss in the production of vegetables, flowers, and crops. Farmers in remote areas faced severe problems in accessing agri products and services once the lockdown restrictions were imposed across the country.

The COVID-19 pandemic also created favorable opportunities for Indian agricultural biological manufacturers. Before the pandemic, China was one of the major manufacturers of such products, but the spread of the virus halted the production and transportation of these products to other countries. Thus, to fill the gap created by the supply chain disruption of China, countries such as India had the opportunity to expand their local production capabilities and meet the market demand.

LATEST TRENDS

Increasing Investment in Advanced Technologies to Develop Highly Effective Biological Products

Several public sector and private sector companies are investing in advanced technologies and the research and development of new biocontrol products for the Indian market. The Central Insecticide Board and Registration Committee (CIB&RC) has established specific guidelines to ensure that manufacturers produce high-quality biological products in laboratories. Despite rapid advancement in the production process, manufacturers face challenges related to survival rate and enhancing the microbial cell activity of carrier materials. Nanotechnology is one of the most effective technology for developing new biopesticide formulations to combat different pests and crop varieties. Manufacturers are adopting advanced nanotechnology production methods to develop different environment-friendly and cost-effective solutions. India is a key market for agri products manufacturers and several multinational companies such as Sumitomo Chemicals and others are diversifying their product portfolio and expanding their market share.

Download Free sample to learn more about this report.

DRIVING FACTORS

Increase in Production of Horticulture Crops to Drive India Agricultural Biologicals Market Growth

The use of intensive cultivation practices and the widespread use of chemical inputs have impacted soil fertility. This creates the need to adopt non-chemical alternatives such as biofertilizers for crop production. Using such products helps improve soil fertility and increase microbial content by replenishing the population of microorganisms in agricultural soils. Furthermore, the export of fruits and vegetables from India has increased significantly over the past few years. As per data provided by the Agricultural & Processed Food Products Export Development Authority (APEDA), the country exported USD 770.70 million worth of fresh fruits and USD 864.24 Million worth of vegetables in 2022-23. The application of biological inputs such as biostimulants significantly improves the size and structure of fruits. Thus, the country's potential growth in exports is expected to boost the adoption of agricultural biologicals in the country.

Enforcement of Favorable Government Policies to Support Market Growth

The government of India is encouraging farmers to gradually switch from chemical agricultural inputs to biological inputs. As per data provided by the Ministry of Agriculture & Farmers Welfare, several schemes have been launched in different parts of the country to assist farmers in adopting these products. The government is also launching several subsidy programs such as Paramparagat Krishi Vikas Yojana (PKVY), Mission Organic Value Chain Development for North Eastern Region (MOVCDNER), and others to support the adoption of biofertilizers and biological inputs among local farmers. The launch of such programs is set to drive the industry expansion over the forecast period.

RESTRAINING FACTORS

Limited Shelf Life and High Cost of the Products to Hamper Market Growth

Biological inputs are composed of live organisms and these organisms need to be stored in optimum temperature and environment to ensure that they remain effective during their application on crops. These products have limited shelf life. Therefore, their effectiveness may decline if proper temperature is not maintained during transportation. This creates a significant problem in importing or exporting live organisms to and from other countries, impacting their availability, application, and market growth. The production cost of some of the biological inputs such as biostimulants and biopesticides is high compared to their chemical counterparts. This high cost of production acts as a major barrier that prevents new manufacturers from entering the market. It also makes the product less favorable to cost-conscious farmers, hampering the adoption rate and impacting the Indian agricultural biological market forecast.

SEGMENTATION

By Type Analysis

Biostimulants Segment Accounts for the Highest Market Share Owing to Increased Product Adoption for Improving Soil Health

By type, the market has been segregated into biofertilizers, biopesticides, and biostimulants. The biostimulants segment holds the highest market share. Biostimulants are complementary to fertilizers and improve nutrient use efficiency by supporting better root development. They help stimulate the physiological activities of plants, and improve soil health and fertility by enhancing soil parameters and functions.

The demand for biofertilizers has been witnessing steady growth and is expected to register a CAGR of 12.05% during the forecast period. This is due to growing awareness regarding sustainable agriculture practices and the need to reduce chemical inputs. Biofertilizers are beneficial microorganisms that enhance soil fertility and plant growth. The rising demand for organic products has boosted the use of biofertilizers as they are essential components of organic farming.

To know how our report can help streamline your business, Speak to Analyst

By Source Analysis

Biochemicals Segment to Record the Highest Market Share as their Use Helps Reduce Carbon Emissions

Based on source, this market is segmented into two categories: biochemical and microbial.

The biochemicals segment is expected to hold the largest market share over the forecast period. Biochemicals are agricultural inputs that are a good substitute for conventional chemicals and can help to reduce our reliance on fossil fuels. Moreover, the use of biochemicals in agriculture can help to reduce carbon emissions and also maintain the ecological balance in soil.

The microbial segment is expected to register significant growth over the study period. This is due to the increasing adoption of microbial agri-inputs by farmers to solve various major agricultural issues such as plant protection, soil health maintenance, and crop productivity. There has been an increase in research activities focused on diverse microbes by companies such as UPL Limited, IFFCO, and others. Such initiatives are being undertaken to identify active ingredients and develop crop protection inputs. This is predicted to enhance the demand for microbes for the formulation of agricultural biologicals throughout the forecast period.

By Application Method Analysis

Foliar Spray Segment to Hold Major Market Share as it Promotes Easier Application of Biologicals on Agricultural Crops

On the basis of application method, the market is segmented into foliar spray, soil treatment, seed treatment, and others.

The foliar spray segment is predicted to hold the major share in the market as the agri inputs can be easily applied to the crops using this method. Furthermore, the segment share is poised to rise due to the increased adoption of foliar spray by large and small-sized organic and conventional Indian farms.

The decreasing availability of agricultural land for crop cultivation is driving the demand for soil treatment. The popularity of this segment is expected to increase in the future and it is expected to register a growth of 11.94% during the forecast period. There is also a growing demand for organic food in the Indian market. This is also driving the demand for soil treatment, as there is a growing need to reduce nutrient deficiencies in the soil.

By Crop Analysis

Row Crops Segment to Dominate Owing to Rising Demand for Pesticide Residue-free Crops

On the basis of crop, the market is segmented into row crops, fruits & vegetables, and others.

The row crops segment is expected to dominate the market in terms of revenue share. The consumer demand for biological row crops has undergone significant growth owing to a shift in consumer preference for natural cereals and foods. There is an increasing demand for pesticide residue-free crops among consumers. Moreover, farmers are looking for environmentally sustainable products that reduce the chemical residue on the crops and also make their products favorable for export to European and North American countries.

The fruits and vegetables segment is likely to maintain its steady growth during the forecast period. This is owing to the growing popularity of the fruits and vegetables among consumers. The demand for agricultural biologicals in the production of various fruit and vegetable varieties is expected to rise. This can be credited to an upsurge in the demand for organic seasonal and continental fruits and vegetables, particularly among consumers with higher disposable income.

KEY INDUSTRY PLAYERS

Manufacturers Focus on Product Diversification and Expansion to Strengthen Market Presence

Some of the key players operating in this market include Coromandel International Limited, SOM PHYTOPHARMA (INDIA) LIMITED, UPL Limited, and PI Industries Ltd, among others. Prominent manufacturers such as UPL Limited and PI Industries Ltd. focus on expanding their footprint by expanding their product portfolio. These players also collaborate and acquire regional and local brands to diversify their product portfolio. The industry leaders are also embarking on base expansion to penetrate the potential Indian marketplace effectively. Manufacturers are actively capitalizing on R&D activities to develop high-quality products. The growing focus on research and development of innovative product solutions is expected to support the India agricultural biologicals market growth.

LIST OF KEY COMPANIES PROFILED:

- Coromandel International Limited (India)

- SOM PHYTOPHARMA (INDIA) LIMITED (India)

- UPL Limited (India)

- PI Industries Ltd (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- Indian Farmers Fertilizer Cooperative Limited (India)

- Ajay Bio-Tech (INDIA) Ltd. (India)

- Biotech International Ltd. (India)

- IPL Biologicals (India)

- T. Stanes and Company Limited (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: FMC India launched biological crop protection solution Entazia biofungicide in the country. The product has been formulated with Bacillus subtilis, which helps to control bacterial leaf blight in rice.

- July 2023: Dhanuka Agritech Ltd., an India-based agri-input manufacturer, launched DEFEND, a new insecticide for the Indian market. The product contains Triflumezopyrim 10% SC, which provides protection against hoppers.

- June 2023: IPL Biologicals backed Unnati Agri, an agriculture supply chain and financial services startup, to focus on climate-ready products. The company invested nearly USD 3.5 million to expand its sustainable product portfolio across India.

- October 2022: Chambal Fertilizers and Chemicals Limited (CFCL) partnered with The Energy and Resources Institute's (TERI) SMART Agrisolutions and launched “UTTAM SUPERRHIZA” and Mycorrhiza-based biofertilizer.

- August 2022: Tosla Nutricosmetics, a Slovenia-based company, expanded and completed the construction of a new production facility aimed at increasing the production of collagen supplements.

REPORT COVERAGE

The market research report includes quantitative and qualitative insights into the market. It also offers the market size and growth rate for all possible market segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, company profiles, and key industry trends.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 14.13% from 2025 to 2032 |

|

Segmentation |

By Type

|

|

By Source

|

|

|

By Application Method

|

|

|

By Crop

|

Frequently Asked Questions

Fortune Business Insights says that the India market size was valued at USD 573.85 million in 2024.

The market is projected to grow at a CAGR of 14.13% during the forecast period (2025-2032).

By type, the biostimulant segment is expected to be the leading segment in the India market.

An upsurge in the production of horticulture crops is a key factor supporting the market growth.

UPL Limited, IFFCO, and Coromandel International Limited are a few of the top players in the India market.

The high cost and limited shelf life of the products may hamper market growth to some extent.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us