India Domestic Cookware Market Size, Share & Industry Analysis, By Category (Single Purpose Pressure Cookers, Pans, Pots, Cooktops, Other Kitchenware, and Other Small Domestic Kitchen Appliances), By Distribution Channel (GMS, Outlets, E-commerce Stores, Wholesale, Departmental Stores, TV Shopping, and Others), and Country Forecast, 2025-2035

KEY MARKET INSIGHTS

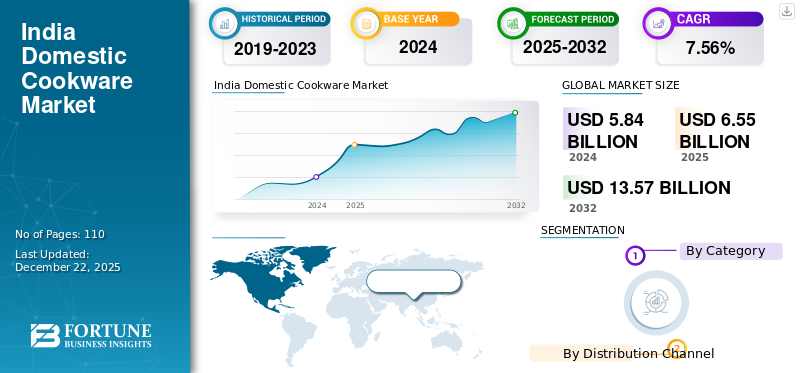

The India domestic cookware market size was valued at USD 5.84 billion in 2024. The market is projected to grow from USD 6.55 billion in 2025 to USD 13.57 billion by 2035, exhibiting a CAGR of 7.56% during the forecast period.

Domestic cookware includes a wide range of home cooking products, such as pots, pans, bakeware, pressure cookers, and non-stick cookware products. In recent times, there has been a growing trend towards healthy cooking options among Indian consumers, which supports the increased demand for innovative cooking utensils. Furthermore, rising disposable incomes, increased spending capacity, and increasing middle class population have led to more consumers investing in durable cookware products rather than traditional cookware, thus, boosting the market growth.

Key players, such as Hawkins Cookers Limited, TTK Prestige Limited, and Stovekraft, are focusing on developing non-stick and induction-compatible cookware utensils to meet the growing demand for healthy cooking within the country.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increased Interest in Home Cooking to Foster Market Growth

Recently, a growing number of Indian consumers are embracing home cooking, particularly driven by the desire to easting fresh and healthy food ingredients. Furthermore, rapid urbanization and small living spaces have led to the increased demand for compact and multi-functional cookware products, thus, augmenting the India domestic cookware market share. For instance, according to the Government of India, it is projected that by 2030, over 40% of India’s population will be residing in urban areas.

Market Restraints

Variations in the prices of Raw Materials to Restrict Market Growth

The increasing fluctuations in the prices of raw materials, such as stainless steel and cast iron, directly increase the production costs for cookware manufacturers, impacting the growth of the market. Higher input costs lead to declining profit margins of the producers, particularly for smaller firms that lack financial resilience. Therefore, as cookware becomes expensive, consumers tend to cut down their purchases or shift to lower-cost alternative products, further limiting the India cookware market growth .

Market Opportunities

Growing Demand for Advanced and Multi-functional Cookware Products to Support Market Expansion

Recently, Indian consumer preferences rapidly seek cookware that offers multi-functions, such as non-stick, induction compatible, and ceramic coated products, and have even heat distribution technology. Therefore, companies are increasingly innovating products, such as toxin-free non-stick pans and multi-layered stainless-steel pots, designed for urban kitchens, propelling the India domestic cookware market growth. For instance, in November 2022, TTK Prestige launched a hard-anodized cookware featuring a 6-layer non-stick coating called Durastone. The range includes multiple products such as fry pans, omni tawas, concave tawas, casseroles, kadais, woks, and tea pans.

India Domestic Cookware Market Trends

Rapid Shift of Consumers towards D2C Online Channels to Foster Market Growth

Online D2C stores showcase a wide range of product portfolios, including new launches, limited editions, or customizable cookware sets. Furthermore, consumers are able to shop anytime, anywhere at competitive pricing, with same-day or next-day delivery on platforms such as Amazon, Blinkit, and Zepto, among others. Additionally, D2C channels, and e commerce platforms use AI & data insights to provide personalized recommendations as per the consumer needs, thus boosting the market growth. For instance, in July 2024, Panasonic India's, a global consumer electronics company, authorized Direct-to-Consumer (D2C) platform has experienced significant growth, with visitor traffic surging by 160% and surpassing 4 million visitors within the past year.

Segmentation Analysis

By Category

Rising Popularity of Induction Compatible Pots to Support the Segment Growth of Pots

Based on category, the market is divided into single-purpose pressure cookers, pans, pots, cooktops, other kitchenware, and other small domestic kitchen appliances.

The pots segment dominates the market. Pots, including saucepans, stockpots, and stewpots, are highly versatile and essential for daily cooking practices in Indian households. Furthermore, the increasing popularity of induction cooktops has accelerated demand for induction-compatible pots made from stainless steel and other advanced materials, which also boosts the segment growth.

For instance, in September 2025, Airlock India Pvt. Ltd, an Indian kitchen utensil manufacturer, launched its tri-ply cookware collection, including pots, named ‘Trivedh’ across more than 15 cities in India, which are featured as be of their premium product range.

The single-purpose pressure cookers segment is expected to grow at the fastest CAGR during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Deep Penetration of GMS into Rural Regions to Augment its Segment Growth

Based on distribution channel, the market is subdivided into GMS, outlets, e-commerce stores, wholesale, departmental stores, TV shopping, and others.

The GMS segment led the global market with a share of 22.89% in 2024. GMS channels include physical retail stores, which have a deep penetration in small towns and rural regions. These stores provide in-person shopping experiences where consumers can physically examine cookware products, in terms of weight and quality, before purchasing, fueling the segment growth.

For instance, according to the annual report of Borosil, as of 2020, the company has around 14,000 retail outlets and around 200 distributors across India.

The e-commerce stores segment is expected to grow at the fastest CAGR of 15.13% during the forecast period.

Competitive Landscape

Key Market Players

Expanding Focus towards Partnerships with Local Brands by Key Market Players to Boost Market Growth

Key players operating in the India domestic cookware market are increasingly undertaking partnerships with local cookware brands to increase their brand reach and leverage their distribution network. Local cookware and kitchen utensil brands possess a deep understanding of regional cooking trends, helping the brands to customize their products for diverse Indian markets. Additionally, local sourcing and production provide price competitiveness and supply chain resilience to the companies, thus helping them to gain a competitive edge within the overall market. For instance, in October 2023, Usha International, an Indian consumer durables company, launched a new range of premium kitchen appliances under its iChef brand, partnering with Reliance Digital, an Indian consumer electronics retailer, for the rollout of these products across India.

List of Key Companies Profiled in the Report

- Hawkins Cookers Limited (India)

- TTK Prestige Limited (India)

- Stovekraft (India)

- Hamilton Housewares Pvt. Ltd. (India)

- Signoraware (India)

- Nova India (India)

- Cello World Limited (India)

- Borosil Limited (India)

- GROUPE SEB (Germany)

- Electrolux AB (Sweden)

Key Industry Developments

- July 2025 – Cumin Co., an Indian cookware manufacturing company, launched a 100% toxin-free enamel cast iron cookware range, including Tawas, Skillets, and Dutch ovens.

- December 2024- Stovekraft entered into a strategic partnership with IKEA, a global retail and manufacturing company of household products, to develop a range of cookware that will be sold through IKEA's global network of stores starting from 2026.

- September 2024 – Daewoo Group, a South Korean chaebol and automobile manufacturer, expanded into the Indian market by launching a new range of induction cooktops as part of its foray into the kitchen and home appliances segment.

- August 2024 – Hawkins Cookers Limited partnered with Swiggy Instamart, an Indian quick commerce platform. The company has launched its products on the Swiggy Instamart platform, enabling customers to order their preferred Hawkins cookware and other kitchen essentials and get them delivered in under 10 minutes.

- April 2023 – TTK Prestige launched the Endura 1000W Mixer Grinder, which is featured to be a versatile kitchen appliance designed to handle a variety of food preparation tasks efficiently.

REPORT COVERAGE

The market research report provides a comprehensive analysis, focusing on key elements such as major companies, market segmentation, country analysis, supply chain analysis, competitive dynamics, category, and distribution channels. Additionally, it offers insights into market trends and highlights significant developments within the industry. Beyond these aspects, it also examines various factors that have contributed to market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2035 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2035 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.56% from 2025 to 2035 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Category

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the market size stood at USD 6.55 billion in 2025 and is anticipated to record a valuation of USD 13.57 billion by 2035.

Fortune Business Insights says that the global market value stood at USD 5.84 billion in 2024.

The India market will exhibit a CAGR of 7.56% during the forecast period.

By category, the pots segment is dominating the market.

The increased interest towards home cooking is a key factor driving the Indian market.

Hawkins Cookers Limited, TTK Prestige Limited, and Stovekraft are some of the leading players in India.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us