India Tableware Market Size, Share & Industry Analysis, By Material (Earthenware, Bone China, Melamine, Ceramic, Porcelain, Glass, Bamboo, Sustainable Materials, Stainless Steel, and Others), By Type (Plates, Cups & Mugs, Bowls, Drinkware, and Others), By Application (Household and Commercial (HoReCa, Institutional Applications (Airlines, Railways, and School, College, and Corporate Canteens), and Others)), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores/Home & Kitchen Stores, Online/E-commerce, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

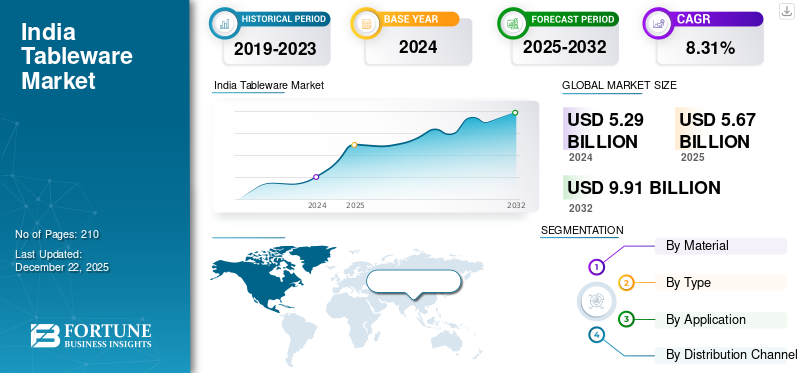

The global India tableware market size was valued at USD 5.29 billion in 2024. The market is projected to grow from USD 5.67 billion in 2025 to USD 9.91 billion by 2032, exhibiting a CAGR of 8.31% during the forecast period.

Tableware includes utensils and accessories used for dining, serving, and food presentation and comprises items such as plates, bowls, cutlery, glasses, serving trays, and other table accessories. The growing residential sector and commercial establishments such as restaurants and cafes, due to rapid urbanization and economic expansion, respectively, in the country, boost product adoption. A sizable number of consumers throughout India prefer home cooking, owing to financial considerations, health advantages, and cultural significance. This factor triggers India's tableware sales among residential consumers. Furthermore, a large middle-class population in the country is highly inclined toward inexpensive and multi-functional utensils and tools made of Bone China, ceramic, porcelain, among other materials, fueling market growth.

Key players in the market include Cello World Limited, La Opala RG Limited, Borosil Limited, Hamilton Housewares Pvt. Ltd., and Clay Craft. These players are offering diverse tableware products made from various raw materials, such as glass, porcelain, bone china, and others. They also focus on building a strong distribution network via retail and online channels. Moreover, players are undertaking continuous investment in technological upgradation and business partnerships to develop new product segments that meet evolving Indian customer needs and preferences, driving growth and revenue generation in the long run.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growth of Hospitality, Including Hotels, Restaurants, and Catering (HoReCa) Industry to Trigger Product Demand

The Indian hospitality industry is experiencing robust growth. According to the Indian Ministry of Tourism’s policy, published in July 2023, the Indian government intends to generate USD 400 billion in foreign exchange from tourism by 2047. Furthermore, the government projects that the Tourism and hospitality sector will earn USD 50.9 billion in visitor exports.

The hospitality industry has been a major driver of the India tableware market growth since hotels, restaurants, and catering (HoReCa) services invest heavily in superior-quality crockery sets to elevate the consumer experience. Commercial dinnerware, i.e., used in hotels, restaurants, cafes & eateries, demands durability to withstand heavy usage and cleaning. Furthermore, multi-functional tableware sets that can serve different purposes, such as trays that can also be used as platters, are becoming increasingly popular. Melamine ware is becoming widely prevalent among restaurants and caterers due to its lightweight, sturdiness, affordability, and resistance to breakage. Its durability, cost-effectiveness, and availability in various styles and patterns make it ideal for everyday use in the HoReCa industry.

Shift in Lifestyle and Consumer Preferences to Favor Market Expansion

The India tableware industry is witnessing exponential growth, driven by changing consumer lifestyles, increasing disposable incomes, and the influence of global trends. With rapid urbanization, more people are moving to cities and adopting modern lifestyles, which has triggered a rise in demand for compact, space-efficient, and elegant dinnerware. For instance, according to the Press Information Bureau (PIB), a nodal agency of the Government of India, it is expected that by 2030, more than 40% of India's population will likely reside in urban centers. Meanwhile, the Energy and Resources Institute (TERI) has projected India's urban population to grow from 410 million in 2014 to 814 million by 2050. Indian urban areas, especially nuclear families, prefer stylish tableware, sleek glassware, and lightweight, sturdy melamine-ware that complement contemporary dining and kitchen spaces, driving product sales.

Market Restraints

High Cost of Premium Tableware and Availability of Low-Cost Substitutes to Hamper Market Growth

Indian consumers prioritize functionality and value over exclusivity and luxury while selecting tableware. The high cost of premium crockery sets makes affordability a significant concern among budget-conscious consumers, limiting market growth. Premium dinnerware made of bone china, porcelain, or stoneware is often considered non-essential, restricting its demand among middle- and lower-income segments in a developing economy such as India.

Moreover, the hefty pricing of the finest quality Indian tableware can influence consumers' purchasing decisions. This leads them to opt for lower-priced, poor-quality alternatives or postpone their tableware purchase altogether. Inflation and economic uncertainty further reduce discretionary spending, leading to a preference for basic substitutes.

Market Opportunities

Kitchenware Products as Gifting Options to Create Lucrative Growth Opportunities

Kitchenware and dining ware products have become an increasingly popular gifting option in India, especially for weddings, festivals, and corporate events. There is a growing demand for handcrafted and artisanal dining ware showcasing traditional Indian craftsmanship. These unique pieces add a personal touch and are highly valued for their authenticity and cultural significance. The bright and vibrant colors, along with intricate patterns and bold designs inspired by traditional motifs and modern aesthetics, appeal to the majority of consumers who are willing to pay a premium price for the same. These appealing pieces are perfect for festive and wedding gifting options. For instance, Nicobar, a contemporary Indian lifestyle brand known for its minimalist designs and stylish homeware, can serve as a versatile gifting option suiting various tastes and adding a touch of sophistication to any occasion. Thus, kitchenware items can be great gifting choices, generating multiple growth prospects in the market.

Market Challenges

Unorganized Competitive Landscape of Tableware Impede Market Expansion

The Indian market for kitchenware is highly fragmented, with many unorganized players dominating regional and local sales. These small-scale manufacturers and local artisans offer a wide range of inexpensive products, often using low-cost materials and traditional manufacturing methods. Consequently, branded companies face tough competition, especially in Tier II and Tier III cities, where price sensitivity often outweighs quality or design appeal. Also, lack of standardization, low brand loyalty, pricing pressure, and challenges in distribution and retail visibility further create market barriers.

India Tableware Market Trends

Customization and Personalization of Kitchenware Products

Personalization in Indian tableware, such as monogrammed plates or custom-engraved utensils, is also gaining traction. Such items make gifts more meaningful and are especially favored for special occasions such as birthdays, farewells, and housewarming parties. Moreover, consumers are increasingly opting for eco-friendly tableware made using materials such as recycled glass, bamboo, and organic ceramics. These choices reflect a commitment to environmental responsibility while offering elegance and durability. For instance, Mumbai-based Brown Living Studio offers tableware made from sustainable materials, including coconut shells, bamboo, stainless steel, ceramic, and plant-based biodegradable tableware materials, and serves primarily eco-conscious consumers. Another brand from Hyderabad, Yellow Verandah, offers handcrafted, earth-friendly India tableware pieces made using stone, clay, brass, copper, teak wood, and palm leaf for modern and mindful living.

Impact of COVID-19

The COVID-19 pandemic significantly impacted the market, causing production halts, disrupted supply chains, and a decline in sales through traditional retail channels. However, with people confined to their homes, demand for household kitchenware saw a moderate rise, particularly through e-commerce platforms. Restaurants and hospitality closures reduced commercial demand, while hygiene concerns temporarily boosted the use of disposable dining ware items. Although home dining trends offered some relief, overall market growth slowed, and segments such as eco-friendly and luxury kitchenware items faced setbacks due to economic uncertainty.

Segmentation Analysis

By Material

Unique Characteristics and Longer Durability to Fuel Stainless Steel Segment Growth

Based on type, the market is divided into earthenware, bone china, Melamine, ceramic, porcelain, glass, bamboo, sustainable materials, stainless steel, and others. Melamine category is subdivided into 100% melamine and combination of materials.

The stainless steel segment dominates the market. The material is widely used across households and the hospitality sector due to the durability and affordability of these products. They are also resistant to damage, withstand high temperatures, and are easy to clean, making them a suitable option for daily use. Moreover, the increasing launch of new stainless steel products to meet rising consumer demand favors the segment's growth.

The melamine is expected to be the fastest-growing segment over the assessment period 2025-2032. Characteristics of melamine products, such as dishwasher safety and heat resistance, are expected to increase consumer inclination. The durability and damage-resistant properties of these products also make them suitable for daily use. Moreover, the hardwearing nature and lightweight design make them easy to handle and transport, which increases their use in setups such as workplace canteens, hospitals, schools, and restaurants.

To know how our report can help streamline your business, Speak to Analyst

By Type

Ability of Bowls to Elevate Dining Experience to Boost Segment Growth

Based on the type, the market is segmented into plates, cups & mugs, bowls, drinkware, and others.

The bowls segment holds the major share of the market and is expected to grow at a CAGR of 9.25%, maintaining its leading position throughout the forecast years. Indian dining traditions involve multiple dishes, such as soups, curries, and desserts, served in bowls. The product is developed in various types, such as mixing bowls, serving bowls, and dip bowls, to fulfill end users' needs.

Industry participants emphasize collaboration with other players to increase growth opportunities. For instance, in February 2022, Blinkit, an India-based quick commerce company, partnered with CHUK, an India-based brand, to offer a new product range, including bowls developed using sustainable materials. Consumer preference for such green tableware is considerably increasing in the country owing to rising knowledge regarding ecological concerns.

The plates segment is predicted to be the second fastest-growing segment in the market. Plates are an essential item for various meals. The product is developed in multiple types, including dessert, salad, and dinner plates. Increasing adoption of the latest food presentation trends triggers demand for these products.

By Application

Expanding Horizons of HoReCa Industry and Rise in Tourism Supported Commercial Segment Growth

Based on application, the market is divided into household and commercial. The commercial application is sub-segmented into HoReCa, institutional applications, and others. Further, the institutional application is sub-segmented into airlines, railways, schools, colleges, and corporate canteens.

The commercial application segment led the market in 2024. The HoReCa segment includes hotels, restaurants, and catering services using high-quality tableware to provide better customer service. The HoReCa industry is rapidly growing throughout India, favored by growing tourism, rising interest in dining out, and trying new dishes in themed restaurants and cafes. Furthermore, the increasing opening of new restaurants is expected to accelerate segmental growth in the coming years. For instance, in November 2024, Sigdi Restaurant, an India-based non-vegetarian restaurant chain, announced plans to expand its footprint by launching 100 new branches by 2026. The brand operates branches across major cities in India, such as Ahmedabad, Bikaner, and Mumbai.

The household is estimated to be the fastest-growing segment in the market. The growing Western dining culture influence has resulted in Indian consumers experimenting with different cuisines, including French and Italian. This factor increases the adoption of different dinnerware, such as forks, wine glasses, and bowls, required for these cuisines across Indian households.

By Distribution Channel

Excellent Pre and After-Sales Support and Curated Selection of Product Range to Fuel Specialty Stores/Home & Kitchen Stores Segment Growth

In terms of distribution channel, the market is subdivided into supermarkets & hypermarkets, specialty stores/home & kitchen stores, online/e-commerce, and others.

The specialty stores segment led the global market. The specialty stores segment includes brand, home, and kitchen stores. These retailers typically feature exclusive and curated selections of Indian tableware in innovative designs and high quality, making them an appealing option for individuals who prefer unique tableware. In addition, the increasing launch of these retail establishments providing premium tableware throughout the country triggers segmental expansion. For instance, in November 2024, Sobé Décor, an India-based tableware and home products retailer, unveiled a new shop in Gurgaon, India. The new 400-square-foot shop offers selected tableware, such as a unique blue porcelain collection from high-end brands, and is suitable for premium retail shopping.

The online/e-commerce segment is projected to capture the fastest-growing share during the forecast period. These platforms provide a diverse selection of products in various materials, styles, and brands. In addition, the time-saving benefits and convenience of home delivery accelerate online sales of dinnerware. Industry participants aim to offer products online through partnerships with key online retailers. For instance, in October 2023, Good Earth, an India-based design house, collaborated with Tata CLiQ Luxury, an India-based e-commerce platforms, to offer its products, including dinnerware, Serveware, and cutlery, online—the design house aimed at expanding its online presence and escalating product sales with the partnership.

Competitive Landscape

Key Market Players

Product Innovation and Stronger Focus on Distribution Channel Strengthening Market Position of Key Players

The Indian tableware players compete through pricing strategies, distribution reach, design innovation, and branding efforts. Local and unorganized manufacturers attract price-sensitive consumers by offering low-cost products with trendy designs. At the same time, organized brands focus on durability, quality, brand loyalty, and aesthetic appeal of products and packaging. Leading players in the market are robustly investing in modern designs, premium materials such as bone china and stoneware, and collaborations with designers to differentiate their offerings. Moreover, the strategy of e-commerce is being increasingly used to target urban millennial consumers, while offline retail partnerships help improve shelf visibility. Sustainability, customization, and gifting solutions are also becoming key competitive tools to penetrate deeper into the market.

Major Players in the Market

To know how our report can help streamline your business, Speak to Analyst

Cello World Limited, La Opala RG Limited, Borosil Limited, Hamilton Housewares Pvt. Ltd., and Clay Craft are a few of the leading players in the Indian market. The Indian market is extremely fragmented, with the top 5 players accounting for 28.56% of the India tableware market share in 2024.

List of Key India Tableware Companies Profiled

- Clay Craft India (India)

- Azcor Tableware India Pvt. Ltd (India)

- Borosil Limited (India)

- Cello World Limited (India)

- Signoraware (India)

- Metinox International (India)

- Hamilton Housewares Pvt. Ltd. (India)

- Blue Stone Ceramics (India)

- Ariane Fine Porcelain (India)

- Servewell Dinnerware (India)

- La Opala RG Limited (India)

- Srithai Superware Manufacturing Private Limited (SSMP) (India)

- Tibros (India)

- Stehlen (India)

Key Industry Developments

- September 2024 – CHUK, an India tableware brand, introduced new items under its compostable tableware product line. The new sustainable products include a snack tray, bowl, and beverage cup. The products are suitable for food chain and catering services businesses.

- August 2024 – Mintage, a New Delhi-based corporate gifting company, introduced its new stainless steel utensils collection. The gifting series was launched for the festive season and includes tableware, water bottles, and cutlery.

- January 2024 – Clay Craft India Pvt Ltd announced a collaboration with prominent retailers, including D Mart, Nykaa, and Myntra, to increase its product sales. With this expansion, the company is striving to create a strong presence in the Indian market via both online and offline presence while aiming to increase its overall market share.

- November 2022 - TTK Prestige Limited, an Indian cookware and appliance manufacturer, unveiled Durastone, a cookware product range featuring a non-stick coating. The collection is also durable and available in aesthetic finishes. It includes tea pans, WOKs, fry pans, and Casseroles.

- February 2022 - Blinkit, an India-based quick commerce company, partnered with CHUK, an India-based tableware brand, to offer a new tableware range, including bowls developed using sustainable materials.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key market players significantly focus on investing in advanced machinery and automatic setups to develop high-quality tableware in large volumes. For instance, in December 2022, Clay Craft India, an India-based tableware manufacturer, unveiled its new production facility in Jaipur, India. The new plant covers approximately 1,75,000 square feet, incorporating fully automatic setups and the latest technologies, including fully automatic glazing lines, flatware machines, and automatic cup plants. Moreover, the new factory manufactures more than 200,000 pieces of tableware daily. Furthermore, the company is also increasing investment in advanced technologies to accelerate growth. For instance, in February 2024, Clay Craft announced the implementation of digital printing for its ceramic tableware. It sourced printers from KeraJet, a Spain based machine supplier for the printing process. The digital printing process assisted the company in meeting evolving consumer preferences in terms of tableware design. Thus, there are numerous investment opportunities for venture capitalists as there is growing demand for smart and technologically advanced products.

REPORT COVERAGE

This India tableware market research report provides a comprehensive market analysis, focusing on key elements such as India tableware market forecast, along with major companies, market segmentation, competitive dynamics, materials, type, application, and distribution channels. Additionally, it offers insights into market trends and highlights significant developments within the industry. Beyond these aspects, it also examines various factors that have contributed to market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.31% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

By Type

By Application

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 5.67 billion in 2025 and is anticipated to record a valuation of USD 9.91 billion by 2032.

Fortune Business Insights says that the global market value stood at USD 5.29 billion in 2024.

The global market will exhibit a CAGR of 8.31% during the forecast period of 2025-2032.

By material, the stainless steel segment dominates the market.

Growth of hospitality, including hotels, restaurants, and catering (HoReCa) industry, and shifts in lifestyle and consumer preferences a key factors driving the global market.

Cello World Limited, La Opala RG Limited, Borosil Limited, Hamilton Housewares Pvt. Ltd., and Clay Craft are some of the leading players in the Indian market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us