Industrial Battery Management System Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By System Integration (Centralized, Distributed, and Modular), By Battery Type (Lithium-Ion, Lead-Acid, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

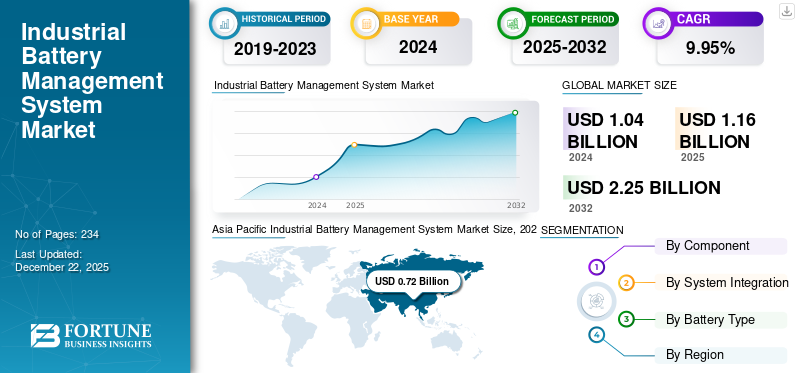

The global industrial battery management system market size was valued at USD 1.04 billion in 2024. The global market is projected to grow from USD 1.16 billion in 2025 to USD 2.25 billion by 2032, exhibiting a CAGR of 9.95% during the forecast period.

An industrial battery management system (BMS) is a critical technology used to monitor, control, and optimize the performance, safety, and lifespan of battery systems deployed in industrial environments. These environments include manufacturing plants, data centers, telecom infrastructure, renewable energy storage sites, and backup power systems.

Governments and corporations are pushing for net-zero emissions and energy efficiency. BMS supports efficient battery usage and longer lifespan, contributing to sustainability and compliance with energy regulations. Monitoring and controlling in industrial battery management systems are growing rapidly due to technological, economic, and operational drivers.

Sensata Technologies, Inc., Infineon, and NXP are the major vendors in the market due to their advanced semiconductor solutions, strong industry integration, and focus on safety, efficiency, and scalability.

MARKET DYNAMICS

MARKET DRIVERS

Rising Adoption of Renewable Energy in Industrial Settings to Drive Market Growth

The growing demand for renewable energy sources such as solar and wind in industrial facilities and reducing reliance on fossil fuels, is a major driver of the market. Renewable energy is intermittent and variable, which creates the need for battery energy storage systems (BESS) to ensure a stable, reliable power supply. As industries deploy larger and more complex BESS to store and manage this energy, advanced BMS solutions become essential for monitoring, controlling, and optimizing battery performance.

In May 2025, ABB declared the beginning of its modern Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service), a resilient, zero-CapEx solution created to increase the shift to clean, resilient, and accessible energy. BESS-as-a-Service is the first in a series of future-generation service models designed to break the blockade to clean technology adoption and increase industries’ transition to net zero.

MARKET RESTRAINTS

Complex Integration and Lack of Standardization to Hinder Market Growth

The complex integration process and lack of standardization across systems and components hinder the industrial battery management system market growth. Industrial environments typically involve legacy power systems, diverse battery chemistries, and varied communication protocols, making the implementation of a unified BMS solution challenging.

The absence of common standards for hardware interfaces, data communication, and software compatibility leads to increased installation time and cost, greater dependence on custom engineering, and difficulty scaling systems across sites or facilities.

MARKET OPPORTUNITIES

Emerging Demand for AI-Enabled and Predictive Battery Management to Offer Growth Opportunities

Integrating artificial intelligence (AI), machine learning, and advanced analytics into industrial battery management systems creates a significant growth opportunity. As industries shift toward data-driven operations and predictive maintenance, there is a rising demand for smart BMS platforms that can predict battery failures before they occur and optimize charge/discharge cycles based on usage patterns.

In June 2025, as AI applications become growingly integrated in evaluative infrastructure, the demand for stable, uninterrupted power systems have increased substantially. Data centers managing AI workloads, renewable energy storage, telecommunications base stations, and industrial automation systems all depend on dependable battery management solutions to maintain functional progression and equipment credibility.

Industrial Battery Management System Market Trends

Digitalization and Smart Energy Infrastructure to Drive Market Growth

The growing adoption of digital technologies and the development of smart energy infrastructure are major drivers of the industrial battery management system market. Digitalization enables real-time monitoring, predictive analytics, and remote management of large-scale battery systems, improving operational efficiency, safety, and battery life. Integrating smart energy infrastructure, such as renewable energy systems, microgrids, and industrial IoT platforms, requires intelligent BMS solutions to manage energy flows, ensure grid stability, and support energy optimization.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Component

Growing Deployment of Large-Scale Battery Energy Storage Units to Lead Hardware’s Segment Growth

The market, by component covers hardware, software, and services.

Hardware is the dominating segment in the market. The hardware segment, which includes battery control units, sensors, microcontrollers, communication interfaces, and power management ICs, is witnessing significant growth in the industrial BMS market due to the growing deployment of large-scale battery energy storage systems.

Software also holds a remarkable share of the market as it enables continuous tracking of voltage, current, temperature, and state of charge, which is vital for safe and efficient battery operations driving market growth.

By System Integration

Lower Initial Cost and System Simplicity to Drive Centralized Segment Growth

By system integration, the market is segmented into centralized, distributed, and modular.

The centralized segment dominates the industrial battery management system market share. The centralized BMS segment is experiencing strong growth in industrial applications due to simplified architecture, ease of installation, and lower cost, especially in small and medium–scale energy storage systems. Centralized BMS uses a single control unit to manage all battery cells, making the system cheaper than modular or distributed BMS architectures.

Distributed BMS is the fastest growing segment in the market. It allows each battery module or block to have its own dedicated control unit, making it easier to scale for large industrial setups such as data centers, warehouses, and microgrids.

By Battery Type

High Energy Density and Efficiency to Boost Lithium-ion’s Market Share

By battery type, the market is segmented into lithium-ion, lead-acid, and others.

Lithium-ion segment dominates the market as these batteries offer greater energy storage per unit volume/weight, making them ideal for space-constrained industrial setups. This leads to more compact and efficient energy storage systems, especially for critical backup and load management applications.

Additionally, lead-acid batteries are rapidly growing in the market due to its cost effectiveness, widespread industrial use, and evolving need for battery optimization and monitoring heavy duty applications.

INDUSTRIAL BATTERY MANAGEMENT SYSTEM MARKET REGIONAL OUTLOOK

The market has been analyzed geographically into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific was the leading region in 2024 in the market.

North America

Asia Pacific Industrial Battery Management System Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid growth of the solar and wind energy in U.S. and Canada has led to numerous scale battery energy storage system deployments. These systems require advanced BMS to manage charging, discharging, safety, and battery life.

In February 2021, Johnson Controls, the worldwide leader for smart, healthy, and sustainable buildings, declared the setup of its Lithium-Ion Risk Prevention System. The system is designed to offer advance notice of observation of battery failure in Lithium-Ion Energy Storage Systems (ESS) and other applications utilizing Lithium-Ion batteries, such as UPS systems in data centers and manufacturing facilities.

U.S.

Increasing use of electric forklifts, AGVs (automated guided vehicles), backup power systems, and material handling equipment in manufacturing and logistics is boosting demand for advanced battery monitoring and controlling. U.S. industries are under pressure to reduce energy costs and increase operational efficiency. Battery management system enables real time monitoring, predictive maintenance, and optimized battery usage, leading to lower total cost of ownership.

Europe

Europe is rapidly expanding its solar and wind energy capacity. Utility-scale and industrial facilities use battery energy storage systems (BESS) to stabilize the grid. BESS requires advanced BMS to manage energy flow, monitor battery health, and ensure safety. Factories, warehouses, and data centers are digitizing operations and installing battery-powered systems for uninterrupted power supply, load balancing, and peak shaving.

In April 2025, Europe has extended 89 GW of installed energy storage capacity by the end of 2025 with pumped hydro considering 53 GW of it, per the European Association for Storage of Energy (EASE) and LCP Delta report.

Asia Pacific

Asia Pacific is the dominating region and has the highest market share in the market. Asia Pacific leads global EV sales, especially in China, Japan, South Korea, and India, driving heavy demand for automotive and industrial-grade BMS. Governments in India and China are rolling out incentive-heavy policies, further accelerating this trend.

The region is adding massive solar wind projects and microgrids; industrial energy storage uptake is growing rapidly. BMS ensures safe, efficient operation of these systems across fluctuating energy conditions.

Latin America

Brazil’s booming data center landscape (e.g., Rio, Hortolandia expansions) is driving installations of UPS and backup battery systems, all managed by BMS. With access to essential materials such as lithium and growing partnerships with global EV and battery manufacturers, Latin America is well-positioned to develop cost-effective, locally tuned BMS solutions. For EV fleets, utility-scale BESS applications, data centers, and microgrids, industrial-grade BMS systems are increasingly in demand.

Middle East & Africa

Countries in the Middle East & Africa such as the UAE, Saudi Arabia, and Egypt are scaling up solar and wind power massively, requiring BESS with intelligent BMS for grid balancing and stability. The UAE aims for 50% energy by 2050, and Saudi Arabia for 50% by 2030, backed by multi-GWh storage projects. Many African regions lack consistent grid access, boosting demand for off-grid solar battery BMS solutions (e.g., Kenya’s rural PV systems).

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Vendors are Launching and Adopting Smart Products to Drive Market Growth

In May 2023, Sensata Technologies declared the launch of the c-BMS24X. This modern, close-packed battery management system handles the recent market demands for industrial applications, energy storage systems, and low-voltage electric vehicle EV.

The c-BMS24X utilizes modern software that permits developments in vehicle range, uptime, battery health, and production in applications of up to 24 cells in series and 2000 amps, such as energy storage systems, forklifts, AGVs, and 3-wheelers. The BMS will be demonstrated initially at the battery show in Germany, Europe.

List of Key Industrial Battery Management System Companies Profiled

- Sensata Technologies, Inc. (U.S.)

- Infineon Technologies (Germany)

- Amphenol Communication Solution (U.S.)

- TRINETRA T-Sense (India)

- eInfochips (U.S.)

- Rutronik Elektronische Bauelemente GmbH (Germany)

- Eatron Technologies (U.K.)

- NXP (Netherlands)

- AMETEK.Inc. (U.S.)

- Zhejiang Benyi New Energy Co, Ltd. (China)

- STMicroelectronics (Switzerland)

- Nuvation Energy (U.S.)

- Texas Instruments Incorporated (U.S.)

- Panasonic Industry (Japan)

- Flash Battery (Italy)

KEY INDUSTRY DEVELOPMENTS

- In May 2025, Romania’s Prime Batteries Technology revealed a high‑voltage battery energy storage system platform in partnership with Arrow Electronics and NXP Semiconductors. The platform reinforces up to 1500 V. It is assembled to meet European functional safety standards such as ISO 26262 and IEC 61508 SIL 2.

- In February 2025, Infineon Technologies AG, a global semiconductor leader in power systems and IoT, and Eatron, a leading supplier of AI-powered battery optimization software, expanded their existent collaboration for battery management solutions (BMS) in automotive to a complete BMS portfolio comprising several industrial and consumer applications.

- In February 2025, Nuvation Energy, a global contributor of battery management systems (BMS), declared that their solutions have exceeded 1 gigawatt-hour (GWh) of energy storage deployments worldwide.

- In June 2024, Eatron Technologies launched a new battery management system-on-chip with US-based Company Syntiant for light mobility, industrial, and consumer electronics applications.

- In June 2023, AMETEK Scientific Instruments, a global technology solutions provider, built its portfolio of battery cyclers with the inauguration of AMETEK Solartron Analytical's SI-6200 Battery Analyzer.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product processes, competitive landscape, and leading sources of industrial battery management systems. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.95% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By System Integration

|

|

|

By Battery Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1.04 billion in 2024.

In 2024, the Asia Pacific market value stood at USD 0.72 billion.

The market is expected to exhibit a CAGR of 9.95% during the forecast period.

The hardware segment led the market, by component.

Rising adoption of renewable energy in industrial settings are driving market growth

Some of the top major players in the market are Sensata Technologies, Infineon, and eInfochips.

Asia Pacific dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us