Industrial Burner Market Size, Share & Industry Analysis, By Type (Natural Gas Burners, Propane Burners, Oil Burners, Process Heating Burners, Multi-Fuel Burner, Low NOx Burners, and Others), By Operating Temperature, (Low (Below 1400°F) and High (Above 1400° F)), By Application (Metalworking, Glass Manufacturing, Power Generation, Refining and Petrochemicals, Iron and Steel Manufacturing, Food Processing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

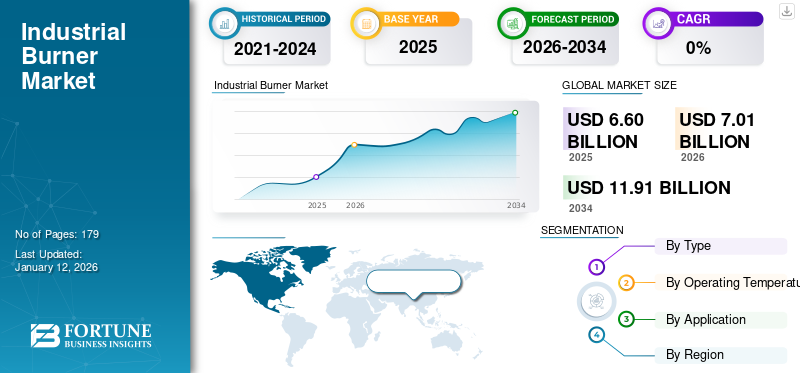

The global industrial burner market size was valued at USD 6.6 billion in 2025. The market is projected to grow from USD 7.01 billion in 2026 to USD 11.91 billion by 2034, exhibiting a CAGR of 6.85% during the forecast period. Asia Pacific dominated the industrial burner market with a market share of 44.58% in 2025.

An industrial burner is a specialized device that creates controlled flames by blending fuel such as natural gas, oil, coal, or biomass with air or oxygen. This process generates heat for various industrial applications. The U.S. Energy Information Administration (EIA) expects global energy use to grow about 50% between 2018 and 2050.

The Asia Pacific region is poised to become the top market for industrial burners. Lower labor costs and cheaper raw materials have pushed many international companies to set up manufacturing in India and China. That shift is likely to drive strong growth in the industrial burner systems market.

In December 2024, Zeeco Inc., a world leader in the design and manufacture of flares and other combustion and environmental systems, increased the scope of its relationship with ClearSign Technologies Corporation. Collectively, the companies have introduced a co-branded line of process burners that dramatically reduce industrial emissions. Newly designed burners, using ClearSign Core technology, can be operated on 100% natural gas or 100% hydrogen, but keep NOx emissions below 5ppm to satisfy stringent emissions requirements.

MARKET DYNAMICS

MARKET DRIVERS:

Industrialization in Emerging Economies to Propel Market Growth

Fast industrialization in emerging economies, including India, China, Southeast Asia, the Middle East, and Africa, fuels the growth of the industrial burner market. Rising industries such as cement, steel, chemicals, glass, food processing, and power generation rely on industrial burners for high-temperature heating and process efficiency. Growing urbanization, infrastructure, and manufacturing development are spurring energy requirements, which in turn are escalating the utilization of lean, clean, and fuel-flexible burners.

In March 2025, ClearSign Technologies Corporation, an emerging leader in industrial combustion and sensing technologies that support decarbonization, improve operational and energy efficiency, enable the use of hydrogen as a fuel and enhance safety while dramatically reducing emissions, announced that following the installation of a new burner technology into the Texas Gulf coast facility of a global chemical company, the company is reporting selective catalytic reduction ("SCR") level nitrogen oxide ("NOx") emissions in addition to high heat transfer efficiency within the heater. The new burner technology, the first of this new "M" series, will be marketed as ClearSign Core M1.

MARKET RESTRAINTS:

High Initial Investment and Operating Costs to Restrict Market Expansion

Implementing advanced industrial burners-like low-NOX models, regenerative types, or those with smart controls, generally requires a substantial initial investment. Moreover, fuel prices can be very unstable, and ongoing operating costs are significant. Many businesses hesitate to invest in expensive burner technology, which slows down overall market growth.

Operating costs remain high due to factors such as volatile fuel prices (natural gas, oil, and coal), regular maintenance and calibration requirements, and the need for a skilled workforce to ensure safe and efficient operation. These costs often lead industries to opt for retrofitting or old, less efficient systems, limiting the widespread adoption of new burner technologies and restricting overall market growth.

MARKET OPPORTUNITIES:

Integration of Digitalization and Smart Controls to Create Lucrative Growth Opportunities

The use of digital tech and smart systems is changing the use of industrial burners. Smart burners are self-monitoring and powered by data and AI, helping companies save energy, cut pollution, and minimize downtime. As companies all over the world move to Industry 4.0 and adopt smart manufacturing practices, demand for smart burners will grow fast, offering significant opportunities for participants.

In August 2024, Pillard NANOxFLAM introduced Fives’ latest generation of Ultra-low NOx burners for the boiler industry. The European Union acknowledges this technology as a Best Available Technique (BAT) for preventing or reducing emissions. With outstanding NOx reduction and high thermal operation efficiency, Pillard NANOxFLAM burners maximize the performance of industrial plants. The Pillard NANOxFLAM is sold in two versions: a duoblock and a monoblock burner.

INDUSTRIAL BURNER MARKET TRENDS:

Customization and Modular Burner Designs Impels Market Growth

The rising need for flexible and application-specific heating solutions is motivating makers to produce customized and modular burner styles. Modular burners permit easier installation, scalability, and assimilation into different commercial arrangements such as cement, steel, petrochemical, food processing, and glass manufacturing. Customization guarantees ideal efficiency by resolving particular fuel kinds, discharge criteria, and operational needs. This shift toward tailored and flexible options is expected to promote larger use, thereby driving industrial burner market growth.

In March 2025, Oilon set new records for the amount of emissions coming out of its new LN30 burner. During a recent run in Germany, the burner measured NOx of below 20 mg/Nm³, which is way below the new EU limit of 100 mg/Nm³. The outcome is a major leap forward in the field of low-emission combustion solutions, especially on older boilers.

MARKET CHALLENGES:

High Fuel Price Volatility to Hamper Market Growth

The industrial burner market is highly dependent on fuels such as natural gas, oil, and coal, whose prices are subject to significant fluctuations due to geopolitical tensions, supply-demand imbalances, and energy transition policies. Rising fuel costs increase operational expenses for end-users, especially in energy-intensive sectors such as cement, steel, petrochemicals, and power generation. This volatility often discourages industries from investing in new burners or upgrading existing systems, thereby hampering market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Widespread Availability and Established Infrastructure to Drive Segment Growth

On the basis of type, the market is classified into natural gas burners, propane burners, oil burners, process heating burners, multi-fuel burners, low NOx burners, and others.

To know how our report can help streamline your business, Speak to Analyst

The natural gas burners segment holds the dominant industrial burner market share 45.65% in 2026. Natural gas is a prevalent and readily available fuel source worldwide, supported by extensive pipeline and distribution infrastructure. This makes it a dependable option for various industrial applications. Natural gas burners use natural gas (primarily methane, CH₄) as their fuel type. Natural gas burners have high efficiency, often achieving efficiency levels above 90%, due to clean combustion and optimized heat transfer.

- For instance, in March 2025, Oilon announced outstanding emission performance from its modern LN30 burner. During a recent setup and testing process in Germany, the burner produced NOx emissions under 20 mg/Nm³, a level far exceeding the European Union's new standard of 100 mg/Nm.

The multi-fuel burner is the fastest-growing segment in the market. Multi-fuel burners offer industries to use different energy sources such as natural gas, petroleum products, hydrogen, plant-based matter, and processed organic fuels. The choice of fuel depends on its cost, how easily it can be obtained, and any relevant government programs.

By Operating Temperature

High (above 1400°F) Segment Dominates as it is Essential for Energy-Intensive Applications

In terms of operating temperature, the market is categorized into low (below 1400°F) and high (Above 1400°F).

High (Above 1400°F) is the dominant and fastest-growing segment in the market contributing 66.86% globally in 2026. In 2025, the segment is anticipated to dominate with 66.46% share. Many industrial processes, such as metal melting, steel reheating, cement kilns, glass manufacturing, and petrochemical cracking, require very high temperatures, typically above 1400°F. Burners capable of reaching these temperatures are essential for efficient chemical reactions and material processing.

Low (below 1400°F) is the second dominating segment in the market. Low-temperature burners are utilized in industries such as food processing, textiles, pharmaceuticals, ceramics, and small-scale Metalworking. These sectors need heat for processes such as drying, baking, curing, sterilization, and annealing, which typically require operation temperatures below 1400°F. The Low (below 1400°F) segment is anticipated to grow at a CAGR of 5.34% during the forecast period.

By Application

Refining and Petrochemicals Segment Dominates the Market because it relies heavily on High-Performance Burners

In terms of application, the market is categorized into metalworking, glass manufacturing, power generation, refining and petrochemicals, Iron and steel manufacturing, food processing, and others. Iron & steel manufacturing held the largest industrial burners market share and accounted for a share of 26.40% in 2026 due to its energy-intensive processes, such as blast furnaces, reheating, and smelting. The sector consumes over 7% of global energy and accounts for nearly 8% of CO₂ emissions (IEA), driving continuous demand for industrial burners of high-capacity.

Refining and petrochemicals accounted for a CAGR of 8.15% as they are known for their high energy consumption, frequently running their operations around the clock. Burners are a common component in various equipment, such as boilers, heaters, furnaces, reformers, and incinerators, implemented broadly across these industries.

In September 2025, Bahrain's Bapco Energies announced that the company anticipates completing the modernization of its Sitra refinery before the close of the year. The project is in its final stages, and the upgrade would increase the refinery's processing capabilities from approximately 265,000 barrels per day to slightly less than 400,000 barrels per day.

Food processing is the fastest-growing segment with a growth rate of 9.03% in the market. As cities grow, people's habits evolve, and rising disposable income is fueling the need for pre-made and packaged foods. Food companies, therefore, need powerful and efficient heating equipment for cooking, toasting, drying, preserving, and sanitizing their products.

Industrial Burner Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

The Asia Pacific held the dominant share in 2026, valued at USD 3.16 billion, and maintained its lead in 2024, with a 44.10% share. The need for industrial burners is high in the region, attributed to its swiftly growing manufacturing and industrial sectors, which demand large-scale heat and energy solutions. This region constitutes over 50% of the world's manufacturing output, with leading countries such as China, India, Japan, and South Korea.

- For instance, China alone accounted for almost 30% of the global manufacturing value added, propelled by industries such as iron and steel, petrochemicals, cement, and power generation significant consumers of industrial burners. India's manufacturing sector is anticipated to reach USD 1 trillion by 2030 as part of its “Make in India” initiative, which will increase the need for high-efficiency burners in metalworking, refining, and food processing.

In addition, the Asia Pacific produces over 70% of the world's crude steel, establishing it as the largest user of burners for operations such as smelting, reheating, and casting. The ongoing rapid urbanization and infrastructure advancements are intensifying energy demands, while the enforcement of stricter emission regulations in Japan and South Korea is promoting the use of low-NOx and energy-efficient burners.

North America is anticipated to grow at a compound annual growth rate of 5.65% during the forecast period. The industrial burner market in North America is on the rise due to stricter rules on emissions, more use of natural gas and hydrogen-ready burners, and more demand from cement, steel, chemicals, and food firms. Additionally, digitalization, energy saving, and changing old systems help to grow this market. Government schemes that push clean energy are key factors boosting the industrial burner market in the region. In 2025, the U.S. market is estimated to reach USD 0.91 billion. The U.S. is experiencing significant growth in industrial burners due to increasing industrial production, enhancements to manufacturing facilities, and a significant emphasis on energy efficiency and reducing emissions. As sectors such as manufacturing, petrochemicals, and metal processing enhance their combustion systems to comply with tougher environmental regulations from the Environmental Protection Agency (EPA) and Department of Energy (DOE), there has been a notable rise in the demand for advanced low-NOx and high-efficiency burners.

- For instance, in December 2024, Wabtec Corporation made a public declaration that it had acquired Bloom Engineering, Inc., a provider of the leading applications of industrial heating, home. This takeover deepens Wabtec's offering of energy and heat transfer solutions, melding Bloom Engineering's cutting-edge technology in burners, combustion systems, and total service for industrial and process heating applications.

Other regions, such as Europe and the Asia Pacific, are anticipated to witness a notable growth in the coming years. During the forecasted period, the European region is projected to record a growth rate of 6.49%, which is the second highest amongst all the regions, and touch the valuation of USD 1.45 billion in 2025. The industrial burner market in Europe is expanding due to the region’s strong focus on decarbonization, energy efficiency, and compliance with stringent emission regulations. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 0.32 billion, Germany to record USD 0.48 billion in 2026. and France to record USD 0.62 billion in 2025.

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in this market. The market in Latin America is witnessing growth due to rising industrialization, infrastructure development, and increasing energy demand. Expanding industries such as cement, steel, food processing, petrochemicals, and power generation are driving the adoption of burners across the region. The Latin America market in 2025 is set to record USD 0.37 billion as its valuation. The industrial burner market in the Middle East and Africa is expanding due to rapid industrialization, large-scale oil & gas activities, and rising demand from sectors such as power generation, petrochemicals, cement, and steel. In the Middle East & Africa, GCC is set to attain the value of USD 0.33 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players:

Industrial Burner Vendors are Expanding Their Product Portfolios to Meet Evolving Customer Needs

NIBE Group and SAACKE GmbH have expanded as they offer energy-saving, emission-aligned, and high-tech burners that meet the worldwide industrial need for clean, intelligent, and adaptable combustion solutions. The Ebico company heavily invests in R&D, with a major focus on energy saving and emission-reduction technologies. Events as ISH2021 China Heating Exhibition increase their visibility in the headlining "Intelligent +" era for the environmental protection machinery industry.

In February 2025, Five reported that it had put in place its first e-Ductflame hybrid burner at the Saint-Gobain old site in Biandrate, Italy. This is a very forward-looking step expected to significantly reduce direct CO2 emissions. As a result of that, the company sees a progressive decarbonization of the site’s industrial processes. Additionally, as a part of the Saint-Gobain business family, the old plant has begun a path toward electrification, which will further improve its environmental performance through the use of on-site solar energy, which it generates on-site.

LIST OF KEY INDUSTRIAL BURNER COMPANIES PROFILED:

- ANDRITZ Group (Austria)

- NIBE Group (Sweden)

- Honeywell International Inc. (U.S.)

- Ariston Group N.V. (Italy)

- Fives (France)

- Weishaupt (Germany)

- Selas Heat Technology Company (U.S.)

- Oilon Group Oy (Finland)

- EBICO (Italy)

- Baltur S.p.A. (Italy)

- Sookook Corporation (South Korea)

- John Zink Hamworthy Combustion (U.S.)

- Bloom Engineering (U.S.)

- Zeeco (U.S.)

- Faber Burner Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In September 2025, Shanghai Daiding Industrial Equipment Co., Ltd, launched the Superflame dual-fuel burner, which is a powerful combustion solution crafted for demanding industrial operations that require intense heat.

- In May 2025, Fives successfully finished its initial oxygen enrichment project using the PREMIX system on a billet reheating furnace already in operation in Portugal. PREMIX is an oxygen delivery system designed to improve combustion. It achieves this by injecting oxygen into the air supply duct before it reaches the burners, thereby increasing the efficiency of the burning process.

- In March 2024, Baltur S.p.A. created a new series of burners designed for industrial use that run on multiple fuels, primarily biogas. These medium-power burners, ranging from 800 to 3600 kW, are ideal for operations where biogas is the main energy source. This biogas is often produced in on-site fermentation facilities that process plant matter or organic waste.

- In February 2023, Riello's launched the newest hydrogen burners, which are engineered to support the shift towards sustainable energy sources. The European Commission is committed to tackling climate change through decarbonization. Their "Fit for 55" plan, launched in July 2021, sets a goal to reduce carbon dioxide and nox emissions by 55% by 2030.

- April 2024: ANDRITZ upgraded its system with new components, including a gas valve assembly and a burner management system. This new system allows for electronic regulation of the air and gas mixture, optimizing the combustion process across all burner output levels.

REPORT COVERAGE

The global industrial burner market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 6.85% from 2026-2034 |

| Unit | Value (USD Billion) |

| Segmentation |

By Type

By Operating Temperature

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.6 billion in 2025 and is projected to reach USD 11.91 billion by 2034.

In 2025, the market value stood at USD 6.6 billion.

The market is expected to exhibit a CAGR of 6.85% during the forecast period of 2026-2034.

The natural gas burners segment is the leading segment in the market by type.

The key factors driving the market are the industrialization in emerging economies to propel the market growth.

ANDRITZ Group, Honeywell International Inc., Nibe Group, Fives, and others are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Integration of digitalization and smart controls to create lucrative growth opportunities and product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us