Industrial Networking Solutions Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By Technology (Wireless Technology and Wired Technology), By Industry (Manufacturing, Energy & Utilities, Oil & Gas, Automotive, Telecom, Food & Beverage, Healthcare, and Others (Transportation and Logistics)), and Regional Forecast, 2026-2034

Industrial Networking Solutions Market Size and Future Outlook

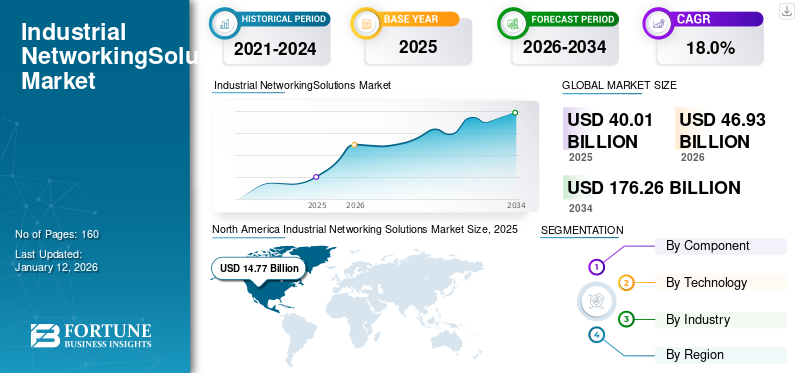

The global industrial networking solutions market size was valued at USD 40.01 billion in 2025 and is projected to grow from USD 46.93 billion in 2026 to USD 176.26 billion by 2034, exhibiting a CAGR of 18.0% during the forecast period. The North America dominated global market with a share of 36.9% in 2025.

Industrial networking solutions comprise networks of devices used for industrial automation, process control, industrial Ethernet, Machine-to-Machine (M2M) networking, and the Internet of Things (IoT). These solutions help businesses address rapidly evolving requirements of business while securely connecting assets in harsh environments, such as oil and gas, railway, energy and utilities, and manufacturing. Industrial network solutions include routers, gateways, Programmable Logic Controllers (PLCs), flow meters, sensors, Ethernet switches, short-range modems, multiplexers, device servers, and access points.

The major players in the market include Cisco, Juniper Networks, Inc., Dell Inc., Rockwell Automation, Red Lion, Siemens, Moxa Inc., Patton Electronics, and others. Key players in the market often collaborate with end users to develop advanced industrial networking solutions.

The market is majorly driven by the increasing adoption of Industry 4.0, smart manufacturing, advancements in wireless communication technologies, and integration of edge computing. Industry 4.0 involves the integration of digital technologies into manufacturing operations, resulting in increased automation and data exchange. Increasing industrial internet adoption in the manufacturing sector along with a growing emphasis on enhancing the efficiency of systems and machinery while lowering production costs are some of the major factors attributed to the increased adoption of Industry 4.0. This transformation is expected to drive the demand for industrial networking solutions, ensuring seamless connectivity between various devices and systems.

The COVID-19 outbreak significantly impacted the market growth in the first and second quarters of 2020. Stringent lockdowns and restrictions disturbed global supply chain management, causing delays in the production of essential components and impacting market growth. However, the pandemic augmented technological innovation, resulting in the increased adoption of wireless networking offerings, including Wi-Fi and wireless sensors.

IMPACT OF TECHNOLOGY ON MARKET

Proliferation of Artificial Intelligence (AI) to Augment Market Growth

The advantages of integrating Artificial Intelligence (AI) and Machine Learning (ML) technologies into industrial networks are becoming more common as networks become more complex and distributed. AI and ML can enhance troubleshooting, speed up issue resolution, and offer guidance on remediation. They provide essential insights that enhance the experience for users and applications. AI and ML are capable of addressing issues in real time and can also predict potential problems before they occur. Furthermore, AI and ML strengthen security by improving threat detection and response mechanisms. According to the Cisco’s State of Industrial Networking 2024 Report for Manufacturing, over 51% of surveyed respondents noted that they plan to adopt AI for enhancing network management across both Information Technology (IT) and Operational Technology (OT) in their organizations.

The integration of AI with networking solutions can enhance network optimization efforts. It can adjust bandwidth distribution in real-time and prioritize essential data streams, thus ensuring uninterrupted communication, even in complex operations. By enabling greater automation and more efficient data management, the integration of AI makes Industrial Ethernet more effective and adaptable, paving the way for advanced Industry 4.0 applications.

MARKET DYNAMICS

Industrial Networking Solutions Market Trends

Advancements in Wireless Communication Technologies to Propel Market Growth

Advancements in wireless communication technologies are key market trends. The rapid development of wireless technologies, including 5G and Wi-Fi6/6E, offers the high-speed, low-latency connectivity required for real-time industrial operations. 5G and Wi-Fi6/6E enable real-time communication in control processes, which was previously limited to wired communication. This shift is opening up new opportunities for industrial automation and smart manufacturing operations. Manufacturing networking has some of the most stringent requirements among various industrial use cases. Any fault in the operational network leads to a stoppage of the production line, resulting in lost revenue and wasted materials. Earlier, wireless networking solutions were mostly utilized to connect sensors, non-critical tools, and handhelds devices. With the advent of more reliable wireless networking technologies, critical infrastructure and applications can now be connected wirelessly. Furthermore, wireless communication technology advancements are also making it possible to deploy more Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), further enhancing industrial productivity.

Download Free sample to learn more about this report.

Market Drivers

Integration of Edge Computing in Manufacturing Sector to Boost Market Growth

The manufacturing sector is undergoing a technological transformation with the emergence of edge computing technology. This innovation brings data processing closer the source and transforming, how manufacturers operate. Edge computing provides a groundbreaking method for managing the large volumes of data produced by modern manufacturing activities. Moreover, edge computing enables manufacturers to automate factory floor operations and streamline supply chains by utilizing advanced robotics and facilitating machine-to-machine communication. By processing data closer to the data source, rather than transmitting to a server for analysis, edge computing enhances responsiveness. This, in turn, augments demand for reliable networking solutions to ensure seamless data flow in manufacturing operations.

In addition, edge computing processes improves data security and privacy by processing locally generated sensitive manufacturing data at the network’s edge. This increases the demand for low-latency and secure industrial networking solutions with cybersecurity features.

Market Restraints

High Initial Costs Coupled with Cybersecurity Concerns to Hamper Market Growth

Industrial networking solutions require a high upfront investment in software and hardware. Additionally, maintenance and upgrade also add to ongoing costs, which may deter businesses with budget constraints from adopting these solutions. In addition, integrating legacy systems with modern connectivity solutions often needs customizations, further raising implementation costs and complexity.

Furthermore, greater industrial connectivity exposes critical operational information to cyberattacks, increasing concerns about data privacy and security. In recent times, industrial infrastructure has become one of the major targets for cyberattacks, posing a significant challenges to the adoption of networking solutions in critical infrastructure sectors.

Market Opportunities

Rapid Industrialization in Asia Pacific Region to Offer Ample Growth Opportunities

In the past few years, the developing countries' share in global manufacturing exports has increased significantly. Several economies in the Asia Pacific region are expected to register healthy GDP growth as the region emerges as a hub for tech innovation. Currently, Indonesia, Singapore, India, South Korea, Taiwan, and Vietnam are emerging as key economies in the international value chains. The Indian economy's nominal GDP is expected to surpass Japan's by 2025 and by 2030. Germany to become the third-largest economy globally. Due to changing geopolitical landscapes, India’s external trade is anticipated to rise by approximately USD 393 billion over the next decade. By 2030, China’s GDP is forecasted to be about USD 5 trillion higher than in 2022, exceeding the combined GDP of the European Union, ASEAN, South Korea, and Japan.

Rapid industrialization is fueling the adoption of the Industrial Internet of Things (IIoT) for better connectivity and automation. This, in turn, necessitates demand for networking solutions required for real-time data communication and remote monitoring.

SEGMENTATION ANALYSIS

By Component

Proliferation of IIoT and Industry 4.0 to Augment Networking Software Demand

Based on component, the market is classified into hardware, software, and services.

The software segment is expected to grow at the highest CAGR of 19.66% during the forecast period (2025-2032), due to the proliferation of IIoT, Industry 4.0, and the increasing need for emergency incident management. As industrial networks expand, the risk of sophisticated cyber threats is rising, fueling demand for networking software with strong security protocols, authentication, encryption, and intrusion detection systems.

The hardware segment is expected to hold the largest market share of 60.64% in 2026. Hardware components, including switches, routers, and gateways play an important role in industrial connectivity, facilitating high-speed data communication. Hardware components are critical for linking various sensors, devices, and systems, facilitating real-time communication in Industry 4.0 environments.

By Technology

Shifting Focus Toward Enhancing Operational Productivity and Security to Fuel Wireless Technology Segment Growth

Based on technology, the market is segmented into wireless technology and wired technology.

The wireless technology segment is expected to grow with the highest CAGR during the forecast period. Wireless networking solutions provide a comprehensive approach to connecting network devices, streamlining operations, enhancing productivity and security, and minimizing overall cost. One of the key advantages of wireless technology is increased mobility. With wireless networking, devices and equipment can be repositioned and reconfigured without the constraints of cables. This flexibility enables more efficient layout changes and optimal space utilization. The segment is likely to attain 60% of the market share in 2025.

The wired technology segment is expected to hold the largest market share during the forecast period, as it is considered more secure and reliable than wireless technology in industrial environments. Additionally, wired technology is less susceptible to interference and signal loss compared to wireless technology, making it a preferred choice for crucial industrial applications. The segment is set to grow with a considerable CAGR of 19.09% during the forecast period (2026-2034).

By Industry

Increasing Adoption from Oil & Gas Sector to Augment the Market Growth

Based on industry, the market is segmented into manufacturing, energy & utilities, oil & gas, automotive, telecom, food & beverage, healthcare, and others.

The oil & gas is expected to grow with the highest CAGR during the forecast period. Industrial networking solutions are essential for various operations in the oil and gas industry, enabling critical use cases and process IoT and Operational Technology (OT) data at the edge of system. The oil and gas sector requires network connections that comply with the highest standards in harsh working environments. Any errors in such environments can lead to significant outcomes, such as reduced operational efficiency and compromised safety of on-site personnel.

The manufacturing segment captured 31.60% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

The manufacturing segment led the market and is also expected to hold the largest market share during the forecast period, driven by increasing demands for improved product quality and minimize production cycle times. Various networking solutions enable seamless connectivity among equipment and various systems.

INDUSTRIAL NETWORKING SOLUTIONS MARKET REGIONAL OUTLOOK

By geography, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Industrial Networking Solutions Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 14.77 billion in 2025 and USD 17.34 billion in 2026. The North American region is expected to account for a majority share of the global market due to the increasing industrial automation, growth in cloud and edge computing, and robust investment in cybersecurity. With increased industrial connectivity, businesses in the region are investing in reliable and secure networking solutions to fight against cyberattacks. This, in turn, is increasing the demand for industrial networking software in the region. According to the International Federation of Robotics (IFR), North America's total robot installations in the manufacturing sector increased by 12% and reached 41,624 units in 2022. Increased installations of industrial robots is further fueling demand for various industrial networking solutions.

U.S. Set to Dominate Market Due to Robust Economic Progress

The U.S. is set to dominate the market during the forecast period, driven by the robust economic progress. The manufacturing sector contributed around USD 2.8 trillion to the U.S. GDP in 2023, representing about 11% of the total U.S. GDP. The manufacturing sector is propelling demand for Industrial Ethernet, wireless networks & gateways, and edge computing solutions as real-time monitoring and predictive maintenance demand seamless networking infrastructure. The U.S. market is expanding and is estimated to acquire USD 12.08 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the third largest market poised to gain USD 12.75 billion in 2026. The industrial networking solutions market in the Asia Pacific region is expected to experience the fastest growth due to the rapid growth in the Internet of Things (IoT), digital transformation, the adoption of 5G, and the requirement for connected solutions across various sectors, such as healthcare, manufacturing, and smart cities. China is set to grow with a valuation of USD 3.39 billion in 2026. Furthermore, AI-powered industrial applications, such as predictive maintenance and digital twins, require high-speed, low-latency industrial networks, further fueling market demand. India is projected to hit USD 2.32 billion in 2026, while Japan is expected to stand at USD 2.11 billion in the same year.

Europe

Europe is the second largest region anticipated to hit USD 12.83 billion in 2026, registering a CAGR of 15.80% during the forecast period (2026-2034). The industrial networking solutions market growth in Europe is majorly driven by stringent GDPR and EU cybersecurity laws, which are increasing the demand for secure industrial networking solutions. The U.K. market is forecasted to reach USD 1.74 billion in 2026. Additionally, renewable energy projects and smart grid infrastructure further fuels demand for advanced industrial networking solutions. Technologies such as grid automation, energy management systems, and remote monitoring require robust industrial connectivity. Germany is anticipated to reach a market value USD 2.58 billion in 2026, while France is estimated to be worth USD 1.76 billion in 2025.

Middle East & Africa

The Middle East & Africa is the fourth leading region set to gain USD 2.16 billion in 2026. The Middle East & Africa region is expected to contribute significantly to market growth, driven by the focus on digital transformation and industrial automation. Governments and businesses in the region are making substantial investments in connectivity infrastructure to modernize industries and enhance operational efficiency. The GCC market is poised to acquire USD 0.56 billion in 2025.

South America

In South America, the industrial networking solution market growth is attributed to various factors, highlighting both regional and global trends. As South American countries actively participate in international trade, there's a growing need for efficient networking infrastructure in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focused on Establishing Strong Distribution Channels to Strengthening their Market Positions

The industrial networking solutions market is fairly distributed with well-established players, such as Cisco, Juniper Networks, Inc., Dell Inc., Rockwell Automation, Red Lion, Siemens, Moxa Inc., Patton Electronics, and others. These key players have a global presence across the regions, including the European countries, Asia Pacific, North America, and the Middle East & Africa.

Other major players in the market include Sierra Wireless, ANTAIRA TECHNOLOGIES, LLC., Digi International, Siretta, Renesas Electronics, and other regional and local players. These players are maintaining their positions in their respective markets and are trying to establish strong distribution channels to solidify their position.

List of Key Industrial Networking Solutions Companies Profiled:

- Cisco (U.S.)

- Juniper Networks, Inc. (U.S.)

- Dell Inc. (U.S.)

- Rockwell Automation (U.S.)

- Red Lion (U.S.)

- Siemens (Germany)

- Moxa Inc. (Taiwan)

- Patton Electronics (U.S.)

- Sierra Wireless (Canada)

- ANTAIRA TECHNOLOGIES, LLC. (U.S.)

- Digi International (U.S.)

- Siretta (U.K.)

- Renesas Electronics (Japan)

- Schneider Electronic (France)

- Jove Electronics (India)

- HMS Networks (Sweden)

- Belden Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2025: Industrial Networking Solutions (INS) acquired Source Inc., a company specializing in wireless networking and IoT solutions. This acquisition improves INS’s capability to deliver safe, scalable, and advanced connectivity solutions across various end-user industries.

- March 2023: Huawei announced the launch of a lossless optical network solution for industrial use, based on Fifth-generation fixed network (F5G) technologies. This solution enables customers to establish highly dependable industrial networks, enhancing both production quality and efficiency.sss

- March 2023: Moxa Inc. announced the launch of AWK series of wireless industrial networking solutions that are developed to help with Automated Guided Vehicles (AGVs) and Automated Mobile Robots (AMRs).

- September 2022: Reichle & De-Massari AG (R&M), a leading Global cabling and connectivity solution provider announced the expansion of its industrial networking application portfolio. The company’s portfolio covers a wide range of copper and fiber-based connectivity solutions used in LAN, telecom, and data centers among others.

- March 2022: Moxa Inc., an industrial communications and networking company announced the launch of its advanced industrial networking solutions to help seamless industrial automation.

REPORT COVERAGE

The industrial networking solutions market analysis report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on technology, end user, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021–2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021–2024 |

|

|

Growth Rate |

CAGR of 18.0% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Component

By Technology

By Industry

By Region

|

|

|

Key Market Players Profiled in the Report |

Cisco (U.S.), Juniper Networks, Inc. (U.S.), Dell Inc. (U.S.), Rockwell Automation (U.S.), Red Lion (U.S.), Siemens (Germany), Moxa Inc. (Taiwan), Patton Electronics (U.S.), Sierra Wireless (Canada), and ANTAIRA TECHNOLOGIES, LLC. (U.S.). |

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 40.01 billion in 2025.

In 2034, the market is expected to record a valuation of USD 176.26 billion.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.0% during the forecast period.

The hardware segment is expected to lead the market during the forecast period.

Advancements in wireless communication technologies are key factor propelling market growth.

Cisco, Juniper Networks, Inc., Dell Inc., Rockwell Automation, and Red Lion are the leading companies in this market.

North America dominated global market with a share of 36.9% in 2025 due to the increasing industrial automation, growth in cloud and edge computing, and robust investment in cybersecurity.

Advancements in wireless communication technologies is a key market trend.

Based on technology, wired technology are projected to lead the market.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us