Allergic Conjunctivitis Market Size, Share & Industry Analysis, By Drug Class (Antihistamines & Mast Cell Stabilizers, Corticosteroids, and Others), By Disease Type (Mild Allergic Conjunctivitis, and Severe Allergic Conjunctivitis), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Geographical Forecast, 2024-2032

Allergic Conjunctivitis Market Size & Trends

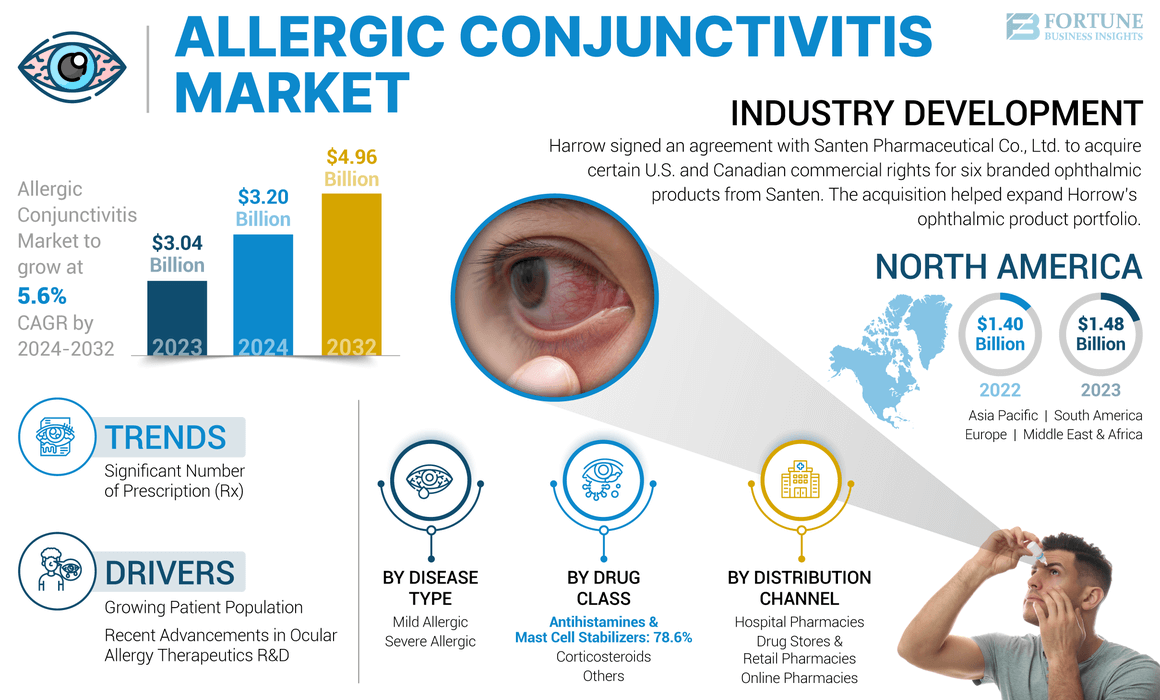

The global allergic conjunctivitis market size was valued at USD 3.04 billion in 2023. The market is projected to grow from USD 3.20 billion in 2024 to USD 4.96 billion by 2032, exhibiting a CAGR of 5.6% during the forecast period. North America dominated the allergic conjunctivitis market with a market share of 48.68% in 2023.

Allergic conjunctivitis is a common ophthalmic disorder where the conjunctiva of the eye develops an inflammation due to an allergic reaction resulting from an individual’s interaction with an allergen. This disease affects a significant proportion of the global population but may often be ignored and underdiagnosed, both by the patient and the healthcare professional. This, in turn, diminishes the patient population base seeking treatment for this disorder and often contributes to a reduced quality of life for the patient. Recently, the prevalence of ocular allergies has considerably increased due to several factors, such as rapid urbanization and an increasing number of allergens.

However, increasing awareness is expected to drive the adoption of drugs for ocular conditions during the forecast period. Considering these contributive factors, a number of biopharmaceutical companies are planning to invest in R&D initiatives to develop novel drugs and therapies for treating this disorder. For instance, Zhaoke Ophthalmology Pharmaceutical Limited and IACTA Pharmaceuticals signed an agreement in July 2020 to accelerate the development of drugs called IC 265 and IC 270. Also, a strong influx of generic versions of prominent drugs will likely create growth opportunities for the global market during the forecast period.

The COVID-19 pandemic had a negative impact on the global market growth as the lockdowns imposed across the world limited the visits to ophthalmologists. According to Alcon’s financial report for 2020, the company witnessed a decline of 0.3% in the ocular health business segment. However, in 2021, the market ramped up, witnessing pre-COVID-19 growth, owing to the recovery of delayed treatments and new product launches. Moreover, in 2022 and 2023, the market witnessed a pre-pandemic growth rate, and from 2024, it is projected to grow at a significant CAGR over the forecast period.

Allergic Conjunctivitis Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 3.04 billion

- 2024 Market Size: USD 3.20 billion

- 2032 Forecast Market Size: USD 4.96 billion

- CAGR: 5.6% (2024–2032)

Market Share:

- North America dominated the global allergic conjunctivitis market with a 48.68% share in 2023, driven by a high awareness of ocular allergies, increased prevalence of allergic conditions, and the presence of key pharmaceutical companies such as AbbVie, Alcon, and Bausch & Lomb.

- Antihistamines & Mast Cell Stabilizers segment is projected to grow at the fastest pace due to new product launches and widespread use as first-line therapy. These include prescription and OTC drugs such as Pataday Once Daily Relief and Zaditor, offering convenience and strong efficacy profiles.

Key Country Highlights:

- Japan: Rising R&D efforts by local companies like Santen Pharmaceutical and growing cases of seasonal allergic conjunctivitis are spurring demand for advanced drug formulations. Recent research identifying new therapeutic targets such as epithelial cell mechanisms is expected to improve treatment outcomes.

- United States: U.S. market growth is supported by FDA approvals for novel formulations and OTC switches. For example, Loteprednol Etabonate (Lupin Ltd) and ACUVUE Theravision with Ketotifen (J&J Vision Care) represent significant product innovations. Strong retail access and high diagnosis rates further bolster market size.

- China: Increasing urbanization and pollution are contributing to a surge in ocular allergies. While awareness remains comparatively lower, growth is expected due to expanding healthcare infrastructure and higher healthcare spending on chronic allergic conditions.

- Europe: The U.K. alone reports 10–15% of its population suffers from seasonal allergic conjunctivitis (SAC). With a solid base of diagnosed patients and increased use of sophisticated therapies, Europe is expected to maintain its position as the second-largest regional market.

Allergic Conjunctivitis Market Trends

Significant Number of Prescription (Rx) to Over-the-Counter Switches Drives Market Growth

One of the most prevalent market trends witnessed in this market is that several therapeutics, previously only available through prescriptions, are switching towards Over-The-Counter (OTC) drugs. There are numerous advantages to this process of switching from a prescription-only to an OTC drug. Some of the advantages of this process include greater availability of more convenient and affordable options, which leads to greater adoption of these therapeutics. For instance, in July 2020, the U.S. Food and Drug Administration (FDA) approved Alcon’s Pataday Once Daily Relief (olopatadine hydrochloride, 0.7%) to undergo the switch from prescription-only to an over-the-counter drug.

Furthermore, as this process of the switch is monitored by the U.S. FDA, it is considered to be a scientifically rigorous and highly regulated one that enables an increasing number of patients with ocular allergies to have direct access to a growing range of therapeutics. Hence, these new trends are expected to open up a new patient population base for companies engaged in this market and are expected to significantly contribute to the surge of the market in the forecast period.

Download Free sample to learn more about this report.

Allergic Conjunctivitis Market Growth Factors

Growing Patient Population to Fuel Demand for Effective Therapeutics

One of the most crucial and contributive market drivers to global market growth is the substantial patient population base suffering from ocular allergies. Allergy is a critical medical problem estimated to affect more than 15% of the global population. Allergic tendency tends to affect numerous body organs; hence, the patient may suffer from symptoms related to multiple organ systems. However, the ocular component is considered the most prominent and disabling feature of an allergy as it leads to chronic and disabling symptoms such as itching and watering of the eyes, which leads to significant irritation. The demand for therapeutics in treating, such as antihistamines & mast cell stabilizers, has increased tremendously over the past few years owing to the substantial growth in the patient population. Numerous research studies have indicated that the prevalence of this condition has considerably increased over the past 40 years.

For instance, according to the American Academy of Allergy, Asthma & Immunology, in 2022, about 100 million individuals in the U.S. suffered from various types of allergies. The growing prevalence of the disease has led to an increasing focus on the research and development (R&D) of effective therapeutics by major pharmaceutical companies, which is evident from the upcoming strong pipeline of the products. For instance, in June 2023, Aldeyra Therapeutics, Inc. announced phase 3 results for the INVIGORATE-2 clinical trial of 0.25% reproxalap ophthalmic solution for allergic conjunctivitis. Such developments will further propel the allergic conjunctivitis market growth in the near future.

Recent Advancements in Ocular Allergy Therapeutics R&D to Augment Market Growth

The overall prevalence of ocular allergy has increased dramatically over the past few decades owing to several factors, including rapid urbanization and industrialization coupled with an increase in the number of allergens.

This has led to the engagement of a number of biopharmaceutical companies in R&D initiatives for the development of effective therapeutics for the treatment of this type of conjunctivitis. For instance, in July 2020, FDA approved the first prescription-only antihistamine cetirizine for the treatment of allergic conjunctivitis. These R&D initiatives are anticipated to lead to robust growth for the market in the forecast period. The anatomy of the eye presents physiological limitations on drug bioavailability, which has led to an intensive interest in the development of new drug delivery technologies. Furthermore, other R&D initiatives for treatment options include over-the-counter antihistamine/mast cell inhibitor ketotifen delivered via a contact lens for ocular allergy. Various researchers across the world are focusing on the development of effective treatment for this medical condition by determining the underlying mechanism of the disease.

- For instance, according to data published by Minivision, the ophthalmic journal, in October 2023, Japanese researchers discovered that specialized epithelial cells play an important role in the development of conjunctival disease. This discovery aimed to uncover a novel therapeutic target for treating allergic conjunctivitis.

These robust R&D initiatives are expected to lead to considerable market growth opportunities in the future.

RESTRAINING FACTORS

Lack of Awareness of Ocular Allergies and Adverse Reactions towards Medications to Hinder Market Growth

Despite a critical and increased need for ocular allergy treatments, the awareness of ocular conditions and eye health is low among the general population. There is a considerable lack of understanding about various symptoms of eye allergies, along with other ocular diseases that can be treated or corrected easily with proper diagnostics and medications. Individuals do not visit ophthalmologists on a regular basis unless there is a major or severe symptomatic condition. The symptoms of eye allergies, such as chronic itching, are ignored in the majority of the cases and are not accurately diagnosed, which drastically reduces the patient pool that can be treated with prescription drugs. Similarly, due to a lack of awareness from both patients and healthcare professionals, allergic conjunctivitis may continue to be underdiagnosed and undertreated.

Adverse reactions to treatments are one of the major restraints restricting the global market's growth. While in most cases, the patients do not experience any fatal or life-threatening symptoms, some adverse reactions, such as burning/stinging/irritation of the eye, headache, stuffy/runny nose, bad taste in the mouth, and increased sensitivity to light, may occur.

- For instance, according to data published by the National Center for Biotechnology Information (NCBI) in January 2024, medications used to manage symptoms of allergic conjunctivitis, such as topical steroids, may carry the risk of adverse reactions, including the development of cataracts.

Hence, these factors may limit the greater adoption of these therapeutics, leading to diminished market growth in the forecast period.

Allergic Conjunctivitis Market Segmentation Analysis

By Drug Class Analysis

Antihistamines & Mast Cell Stabilizers Segment to Grow at Faster Pace Owing to New Product Launches

The global market can be segmented by drug class into antihistamines, mast cell stabilizers, corticosteroids, and others.

The antihistamines and mast cell stabilizers segment is anticipated to grow at a significant CAGR over the forecast period, attributable to its reputation as the gold standard treatment for ocular allergy. Furthermore, new product launches in this segment are also anticipated to drive the segment's growth during the forecast period.

The corticosteroids segment accounted for the second-highest market share in 2023, owing to their use in severe ocular allergy cases. Corticosteroids are still considered among the most potent pharmacologic agents used in treating chronic ocular allergy.

Furthermore, the increasing number of clinical trials to develop effective drugs for ocular conjunctivitis is one factor responsible for segment growth.

- In April 2020, Ocular Therapeutix announced topline results from its phase 3 clinical trial to evaluate the safety and efficacy of Dextenza. This drug belongs to the corticosteroids class and is being evaluated for the treatment of ocular itching associated with allergic conjunctivitis (AC).

To know how our report can help streamline your business, Speak to Analyst

By Disease Type Analysis

Higher Treatment Costs of Severe Allergic Conjunctivitis to Enable the Segment’s Dominance

On the basis of disease type, the market can be segmented into mild and severe.

The severe allergic conjunctivitis segment holds the highest market share for a number of reasons. Treating this form of conjunctivitis necessitates the usage of strong and advanced prescription pharmaceuticals over a prolonged period of time. This sharply increases the medical expenditure attributed to treating this type of conjunctivitis, leading to a higher market share of this segment.

The mild allergic conjunctivitis segment accounted for a lower market share in 2023, owing to the comparatively lower treatment costs attributed to this type of disease compared to its severe counterpart.

By Distribution Channel Analysis

Online Pharmacies to Grow at the Highest CAGR in 2024-2032 Due to Easy Convenience

Based on distribution channel, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies. The hospital pharmacies segment is anticipated to account for the largest market share during the forecast period. The dominance of the segment is attributable to the fact that the majority of ocular allergy medications can only be prescribed after thorough examinations by trained medical professionals at these institutions.

The drug stores and retail pharmacies segment accounted for the second-highest market in 2020, owing to the rising demand for over-the-counter (OTC) medications for ocular allergy in these settings.

The online pharmacies segment is expected to witness the highest growth rate because of the convenience and ease in terms of the procurement of ocular allergy drugs.

REGIONAL INSIGHTS

The global market can be segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America Allergic Conjunctivitis Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 1.48 billion in 2023 and is anticipated to continue to dominate the global allergic conjunctivitis market share during the forecast period. This is attributable to the region's widespread awareness of ocular allergies, the strong prevalence of this disease, and the presence of major players resulting in the launches of advanced drugs.

- For instance, in December 2023, Lupin Ltd received the U.S. FDA approval for Loteprednol Etabonate. This drug is used for the temporary relief of signs and symptoms associated with seasonal allergic conjunctivitis.

Europe is anticipated to emerge as the second-largest region in the global market owing to the rising potential patient population and the increasing usage of sophisticated drugs. For instance, according to the British Journal of Ophthalmology, seasonal allergic conjunctivitis (SAC) is the commonest and one of the mildest forms of allergic conjunctivitis occurring in the U.K. It accounts for 25.0%–50.0% of all cases of ocular allergy and is estimated to affect between 10.0% and 15.0% of the UK population. Such strong trends in prevalence are anticipated to further contribute to the growth of the market in the country.

The Asia Pacific market is expected to register the highest CAGR due to rising awareness, substantial improvements in healthcare expenditure and a growing prevalence of ocular allergies in the region. For instance, according to Clinical Epidemiology and Global Health, in 2019, the prevalence of eye allergies in India was estimated to be 12.22%. The prevalence was estimated to be higher in males (13.44%) than in females (10.71%). Such trends are expected to contribute to the growth of the country’s market in the forecast period.

Other regions, such as Latin America, the Middle East, and Africa, accounted for a comparatively lower market share in the forecast period. However, the increased market presence of prominent companies and a large proportion of the population suffering from ocular allergies in these regions are expected to lead to growth in the future.

List of Key Companies in Allergic Conjunctivitis Market

Robust Product Portfolio of Leading Players to Ensure Apex Position

In terms of the competitive landscape, the market is monopolistic due to the presence of key players of various sizes, with a number of players targeting the generic drug space for the treatment of eye allergies. In the present scenario, Allergan (AbbVie Inc.), Bausch & Lomb, and Alcon are dominating the global market, accounting for a strong market revenue share. This is primarily owing to the presence of a strong product portfolio. For instance, widely adopted products include Lastacaft in Allergan’s portfolio, Bepreve in Bausch & Lomb’s portfolio, and SYSTANE ZADITOR in Alcon’s portfolio.

Further, companies such as Sun Pharmaceuticals and Alembic Pharmaceuticals Limited are increasing their presence in the global market by focusing on product approvals and the launch of generic versions of existing drugs. In addition, emerging players such as Ocular Therapeutix, Inc. and Eton Pharmaceutical are also aiming to gain regulatory approvals for their pipeline candidates and this is expected to enable them to increase their revenues during the forecast period.

LIST OF TOP ALLERGIC CONJUNCTIVITIS COMPANIES:

- Allergan (AbbVie Inc.) (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Bausch & Lomb Incorporated (Canada)

- Alcon (Switzerland)

- Novartis AG (Switzerland)

- Eyevance Pharmaceuticals LLC (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Ocular Therapeutix, Inc. (U.S.)

- Eton Pharmaceutical (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 – Harrow signed an agreement with Santen Pharmaceutical Co., Ltd. to acquire certain U.S. and Canadian commercial rights for six branded ophthalmic products from Santen. The acquisition helped expand Horrow’s ophthalmic product portfolio.

- March 2022 – Johnson & Johnson Vision Care, Inc. announced the U.S. FDA approval of ACUVUE Theravision with Ketotifen (etafilcon a drug-eluting contact lens with ketotifen).

- February 2021 – Alcon announced the broad retail availability of Pataday Once Daily Relief Extra Strength in the U.S.

- February 2021 – Bausch & Lomb launched the first over-the-counter (OTC) preservative-free formulation eye drop named as Alaway Preservative Free antihistamine eye drops.

- January 2020 – Eyevance Pharmaceuticals LLC announced the launch of ZERVIATE (cetirizine ophthalmic solution) 0.24%, the first novel prescription-only treatment for allergic conjunctivitis in 10 years in the U.S.

- February 2019 – Bausch Health acquired Eton Pharmaceuticals' EM-100 investigational eye drop for the treatment of itchy eyes associated with allergies.

REPORT COVERAGE

The market report covers a detailed analysis and overview. It focuses on key aspects such as the competitive landscape, drug class, disease type, distribution channel, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, and other key insights. The market is forecasted based on these factors. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Revenue Forecast in 2032 |

USD 4.96 Billion |

|

Growth Rate |

CAGR of 5.6% from 2024-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Class

|

|

By Disease Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 3.04 billion in 2023 and is projected to reach USD 4.96 billion by 2032.

In 2023, the North America market stood at USD 1.48 billion.

The market is expected to exhibit a CAGR of 5.6% during the forecast period (2024-2032).

The antihistamines & mast cell stabilizers segment is set to lead the market by drug class.

The key factors driving the market are the increasing prevalence of ocular allergies, the launch of new allergic conjunctivitis medications, and the increasing focus towards over-the-counter (OTC) medications as compared to prescription once.

Allergan (AbbVie Inc.), Bausch & Lomb, and Alcon are the top players in the market.

North America region dominated the market in 2023.

The growing awareness about this condition among population coupled with innovative product launches are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us