Chronic Lower Back Pain Treatment Market Size, Share & COVID-19 Impact Analysis, By Drug Class (Non-steroidal Anti-Inflammatory Drugs, Antidepressants, Analgesic, Opioids, and Others), By Route of Administration (Oral, Topical, and Others), By Distribution Channel (Hospital Pharmacies and Retail & Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

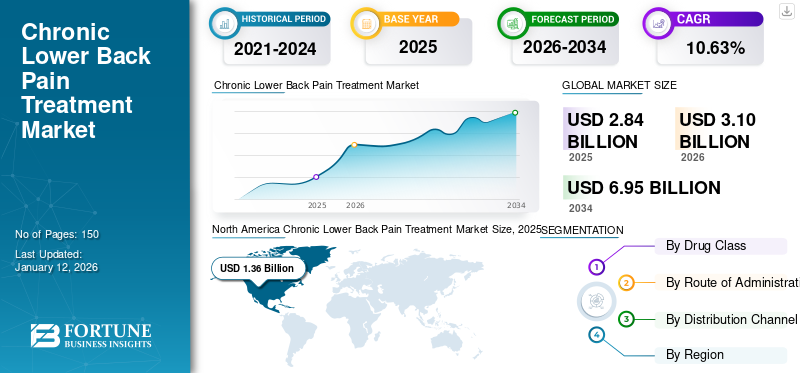

The global chronic lower back pain treatment market size was valued at USD 2.84 billion in 2025. The market is projected to grow from USD 3.1 billion in 2026 to USD 6.95 billion by 2034, exhibiting a CAGR of 10.63% during the forecast period. North America dominated the chronic lower back pain treatment market with a market share of 47.90% in 2025.

Chronic Lower Back Pain (CLBP) is the most prevalent chronic pain condition and the major cause of disability worldwide. Osteoarthritis and degenerative disk disease are the most common underlying cause of this condition. Management of this condition includes various intervention strategies, including surgery, drug therapy, and non-medical interventions such as rehabilitation. According to a study published by the JAMA Network in February 2021, low back pain is the leading cause of disability in the U.S., accounting for 4.3 million years lived with disability and nearly twice the burden of any other health conditions. Of this, 13% of adults have chronic lower back pain in the U.S.

This condition is more prevalent among the population with comorbidities such as obesity, anxiety, and hypertension. Moreover, the increasing aging population with age-related disorders across the globe is also contributing to the rising patient population suffering from this disease. Furthermore, the economic burden of this disease is increasing due to the low diagnosis rate and lack of awareness related to its treatment. To reduce this economic burden, government bodies are taking initiatives to introduce guidelines, policies, and recommendations to manage this condition. In 2022, the Australian government introduced the Australian Atlas of Healthcare Variation, which provides guidelines for the early management of low back pain and ensures that patients are informed about the range of treatment options available for this condition. Such initiatives are anticipated to surge the demand for chronic lower back pain treatment.

To meet this growing demand for treatment, drug developers are making continuous and steady efforts to integrate multiple innovations that can lead to the transformation of drugs and provide immediate relief. To support this effort, research institutes are collaborating with pharma companies to accelerate their development process. This will lead to the introduction of innovative drugs. Such initiatives are anticipated to shift the preference of healthcare providers toward innovative medications, which is anticipated to drive the demand for these drugs.

Chronic Lower Back Pain Treatment Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 2.84 billion

- 2026 Market Size: USD 3.10 billion

- 2032 Forecast Market Size: USD 6.95 billion

- CAGR: 10.63% from 2026 to 2034

Market Share:

- North America dominated the chronic lower back pain treatment market with a 47.90% share in 2025. This dominance is driven by high disease prevalence, advanced healthcare infrastructure, and strong R&D activities by pharmaceutical companies focusing on innovative drug development and progressive therapies.

- By drug class, Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) held the largest share in 2025, supported by their over-the-counter availability, affordability, and effectiveness for long-term pain relief.

Key Country Highlights:

- Japan: Demand is propelled by a rising elderly population requiring chronic pain management and adherence to stringent healthcare guidelines supporting innovative therapies.

- United States: The high prevalence of chronic lower back pain, combined with ongoing clinical trials and drug innovation, particularly in opioids and novel analgesics, is driving market growth. The healthcare system’s emphasis on addressing opioid dependency is also encouraging the development of alternative treatments.

- China: Growth is supported by the expanding generic drug market that offers cost-effective treatment options and an increasing elderly demographic prone to musculoskeletal conditions. Government initiatives to enhance healthcare access further fuel market demand.

- Europe: The growing incidence of sedentary lifestyles and musculoskeletal disorders among an aging population boosts demand. Regulations encouraging novel drug introductions and effective pain management solutions drive the market.

COVID-19 IMPACT

Drop in Non-Essential Treatment During COVID-19 Led to Slower Market Growth

The outbreak of the COVID-19 pandemic led to slower growth of the global chronic lower back pain treatment market in 2020. Many countries across the globe witnessed a decline in the diagnosis and treatment of this condition due to limited availability of resources and social distancing measures imposed by government authorities. Moreover, consultations for all non-essential therapeutic measures declined during the pandemic, which decreased the demand for these therapeutics.

- According to a study published by the Journal of Osteopathic Medicine in 2021, non-pharmacological and pharmacological for chronic lower back pain treatment decreased during the pandemic. In terms of pharmacological treatment, a sample of 476 participants who suffered from chronic lower back pain proved a significant reduction of Non-steroidal Anti-Inflammatory Drugs (NSAIDs) for low back pain during the pandemic, whereas opioid use remained unchanged.

However, the demand for these therapeutics increased post-pandemic. In the post-pandemic scenario, the revenues of market players exhibited positive growth due to surge in demand for these medications.

- In 2021, Johnson & Johnson Services, Inc.'s consumer health segment witnessed an increase in OTC product sales by 8.4% from the prior year. This growth was attributed to the higher sales of analgesics such as Tylenol and Motrin prescribed off-label for pain management.

Furthermore, as lockdown restrictions were eased, market players focused on accelerating research & development activities to introduce novel products to meet the growing demand for effective therapeutic measures. In November 2022, iNova Pharmaceuticals launched Norflex gel in South Africa. It is an anti-inflammatory gel that relieves pain and inflammation. Such launches will surge the demand for innovative drugs and drive market growth at a steady rate during the forecast period.

Chronic Lower Back Pain Treatment Market Trends

Use of Advanced Technology for Drug Delivery to Offer Market Growth Potential

One of the key trends witnessed in the global market is incorporating advanced technology for drug delivery in treating back pain. The chronic lower back pain treatment includes prescribed opioids which can lead to addiction and dependence over time. These medications are administered orally or injected into the bloodstream. They are often prescribed to provide short-term relief from severe back pain, but long-term use may cause side effects such as physical dependency.

To overcome this severe condition, researchers are focusing on developing innovative solutions for patients seeking relief from chronic lower back pain and those who have undergone surgery.

- In August 2022, Sorrento Therapeutics received fast-track designation for SP-103. The drug candidate is under phase 2 clinical trial, and if approved, this candidate SP-103 may address lower back pain.

- According to the results posted by ClinicalTrials.gov, Teikoku Pharma USA, Inc. is developing a Flurbiprofen tape for chronic lower back pain treatment. The study is under phase II clinical trials. Such studies imply that researchers are constantly focusing on developing advanced drugs with new modes of drug delivery.

Download Free sample to learn more about this report.

Chronic Lower Back Pain Treatment Market Growth Factors

Growing Prevalence of Chronic Lower Back Pain is Likely to Drive the Market Growth

A critical driver positively impacting the global market growth is increasing prevalence of this condition among the general population due to obesity, sedentary lifestyle, and psychological distress.

- According to an article published by Cross River Therapy in December 2022, globally, 540 million people suffer from back pain at any point, among which 5.0% of people are on the verge of developing chronic lower back pain.

Therefore, increase in prevalence of this condition among the general population is surging the demand for chronic lower back pain treatment. To meet the growing demand for effective therapeutic measures, the manufacturers are emphasizing on introducing novel drugs by accelerating the R&D activities. The market players are introducing drugs at comparatively lower price and emphasizing on increasing its availability across the globe. This is influencing the treatment preference of the patient population toward medication therapy, which is driving the market growth.

Emphasis of Key Players on R&D Activities of Novel Drugs to Boost the Market Growth

Market players, both established and new entrants, are strengthening their product portfolio to meet the growing demand of patient population suffering from this condition. The key players are focusing on strategic collaborations and acquisitions to leverage the benefits of competitors' pipeline products and strengthen their position in the market.

- For instance, in November 2022, Kyowa Kirin Co., Ltd., a Japan-based pharmaceutical company, collaborated with Grünenthal GmbH to strengthen its established medicines portfolio. This collaboration comprised 13 brands across six therapeutic areas primarily focused on pain management. The company also has EN3324 (axomadol) under phase 2 clinical trials for determining its safety and efficacy for severe chronic lower back pain.

Such strategic initiatives to accelerate R&D activities and introduction of novel drugs will broaden the range of treatment options for the patient population. This will surge the demand for medications, especially from emerging countries, citing the comparatively lower cost of medications.

RESTRAINING FACTORS

Availability of Alternative Treatment Options to Hinder the Market Growth

One critical factor restricting the growth of the market is the availability of treatment options other than medications, such as physical therapy, meditation, diet, lifestyle modifications, or alternative treatments such as acupuncture, biofeedback therapy, laser therapy, or electrical nerve stimulation. Compared to pharmacological treatment, these options have demonstrated better outcomes with limited to negligible side effects.

Few drugs, such as muscle relaxants and narcotics, can be habit-forming and may interact with other medications, worsening the medical condition. Therefore, the introduction of novel therapy such as intracept procedure, which gives long-lasting relief from chronic lower back pain compared to standard low back treatment, is significantly proving itself as one of the superior treatments among the patient population.

- For instance, as per an article published by The University of Texas Southwestern Medical Center in June 2022, 64% of the patients suffering from chronic lower back pain demonstrated more than 50% pain relief, and 30% reported complete pain relief within 12 months of the intracept procedure. Thus, growing adoption of alternative treatment options by the patient population will hamper the adoption rate of these therapeutics over the forecast period.

Chronic Lower Back Pain Treatment Market Segmentation Analysis

By Drug Class Analysis

Non-steroidal Anti-inflammatory Drugs Segment Leads as they are Mostly Preferred Medications

Based on drug class, the market is segmented into non-steroidal anti-inflammatory drugs, antidepressants, analgesic, opioids, and others.

The Non-steroidal Anti-Inflammatory Drugs (NSAIDs) segment dominated the market 25.77% in 2026. These drugs are mostly preferred medication among the general population as they are easily available over the counter, and provide long term relief from pain, making them one of the most prescribed drugs by practitioners. According to an article by Harvard Health Publishing in May 2022, non-steroidal anti-inflammatory drugs are the first choice for treatment of back pain, owing to certain benefits such as over the counter availability, lower cost, and other clinical benefits.

The opioids segment held the second-largest market share in 2024. For management, and treatment of the condition, healthcare professionals are prescribing opioids for chronic lower back pain treatment to provide instant relief from severe back pain, which is driving the segment’s growth.

The antidepressants segment generated notable revenue in 2024. The effectiveness of these drugs in chronic lower back pain treatment mainly contributes to the segment’s growth. Analgesics such as acetaminophen are widely prescribed for pain relief, and an OTC drug makes it easily available. These are some of the factors leading the segment’s growth.

The others segment includes muscle relaxants and anticonvulsants, which will exhibit steady growth over 2024-2032. This growth is attributed to the large number of products available in the market at affordable prices.

To know how our report can help streamline your business, Speak to Analyst

By Route of Administration Analysis

Oral Segment Dominated the Market Due to its Benefits

By route of administration, the market is classified into oral, topical, and others.

The oral segment dominated the chronic lower back pain treatment market share 44.38% in 2026. The factors contributing to the growth of the segment is its patient compliance, bioavailability, safety, low production cost, and higher quality, making it one of the best oral routes of administration amongst the end users and manufacturers’ point of view.

The topical segment held the second-largest market share during the forecast period. The temporary and effective pain relief given by topical medications such as ointments and gels made them one of the preferred choice of treatment among adults and professional athletes are contributing to the growth of the segment.

The others segment held a comparatively lower share and is expected to grow at lower CAGR during the forecast period. Other routes of administration include intravenous, intramuscular, and subcutaneous, which are the least preferred routes among the patient population for the treatment of this disease. Hence, all these factors cumulatively will drive the global market growth.

By Distribution Channel Analysis

Higher Procurement of Therapeutics through Retail & Online Pharmacies Led to Segment’s Dominance in 2024

The market is classified by distribution channel into retail & online pharmacies and hospital pharmacies.

The retail & online pharmacies segment dominated the global market 91.83% in 2026 by generating the highest revenue. The increasing focus of retailers on the expansion of their business through both retail and online channels, increased accessibility, and ensure timely availability of drugs are majorly contributing to the segment's growth.

The hospital pharmacies segment generated notable revenue in 2024. The severity of this condition increases due to patients' lack of awareness and reluctance to seek treatment options. Moreover, lack of adherence to complete the treatment regime is delaying the treatment outcomes. This is increasing hospital admission rates and subsequently driving the segment's growth. Hence, all these factors cumulatively will drive the global market growth.

REGIONAL INSIGHTS

By region, the global market is analyzed across North America, Europe, Latin America, Asia Pacific, and the Middle East & Africa.

North America Chronic Lower Back Pain Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market was valued at USD 1.36 billion in 2025 and is likely to dominate the market throughout the forecast period. The growing need for progressive therapy has enforced established pharmaceutical companies to focus on R&D of advanced drugs, driving the expansion of the market in North America. In October 2021, ClinicalTrials.org published that Braeburn Pharmaceuticals, an U.S. based pharmaceutical company is developing a study on safety and efficacy of buprenorphine, which is under phase III clinical trial.The U.S. market is projected to reach USD 1.44 billion by 2026.

The Asia Pacific market is projected to grow with the highest CAGR during the forecast period. The growth in this region is primarily attributed to the cost benefits offered by generic drugs, which have high demand among the patient population. For instance, Pfizer Inc. launched a generic celecoxib in 2020 that is used as pain relief in Japan. Moreover, the daily price of branded celecoxib was 138 JPY (1.31 USD) for 200mg dose whereas the daily price of generic version at the same dose was 39.2 JPY (0.38 USD). Such cost benefits potentially are expected to drive the demand for these drugs for chronic lower back pain treatment.The Japan market is projected to reach USD 0.31 billion by 2026, the China market is projected to reach USD 0.13 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

The Europe market is expected to grow with second-highest CAGR during forecast period. The growing number of people following a sedentary lifestyle is making this condition more prevalent across the region. The increasing geriatric population suffering from musculoskeletal disorders is increasing the hospital admission rate for effective therapeutic measures, which is likely propelling the market growth across the region. According to the statistics published by Versus Arthritis in 2021, over 20 million people in the United Kingdom i.e. around one third of the population is living with musculoskeletal condition such as arthritis and low back pain, among which 2.8 million people are aged under 35 years of age and 10.2 million people are aged between 35 to 65 years. To meet the growing patient population need, market players are focusing on introducing novel drugs, which is anticipated to drive the chronic lower back pain treatment market growth during the forecast period.The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.26 billion by 2026.

The Middle East & Africa and Latin America are expected to grow at a slower rate during the forecast period. However, rising expenditure on chronic conditions and the availability of drugs at cheaper rates are anticipated to drive the market growth. For instance, tramadol, a potent opioid analgesic, costs around USD 27 (500 Mexican pesos) for 60 tablets of 100mg, which is similar to the U.S., but without the high cost of the U.S. prescription. Moreover, it is also available for those without health insurance.

KEY INDUSTRY PLAYERS

Johnson & Johnson Services, Inc., Bayer AG, and GSK plc, held a Significant Market Share in 2024 due to Strong Product Portfolio

In the competitive scenario, the global market is fragmented as there are many prominent players offering a wide range of products for chronic lower back pain treatment. Some prominent players in Tier 1 are Johnson & Johnson Services, Inc., Bayer AG, and Sanofi-Aventis. These companies are dominating due to various factors such as a strong distribution network, offering a diverse product portfolio, a strong focus on R&D initiatives, and an emphasis on getting regulatory approvals.

Tier 2 includes companies such as Sanofi, Dr. Reddy’s Laboratories, Lilly, Endo International Inc., and others that are making strategic decisions to accelerate their R&D activities with an aim to introduce novel products for this condition. Some other emerging market players include Pfizer, Inc., Novartis AG, Merck & Co., Inc., Atherna Biosciences, LLC, Wyeth Pharmaceuticals Company, and others. These companies are expanding their market shares by diversifying their product ranges and focusing on increasing the sales of their products by increasing their product availability in key countries.

List of Top Chronic Lower Back Pain Treatment Companies:

- Pfizer Inc. (U.S.)

- Lilly (U.S.)

- GSK plc (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co, Inc. (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Dr. Reddy's Laboratories Ltd. (India)

- Bayer AG (Germany)

- Endo International plc. (Ireland)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Lilly and Confo Therapeutics signed an agreement for the clinical development of CFTX-1554, a novel angiotensin II type 2 receptor inhibitor with an approach to treat neuropathic pain, and additional peripheral pain indications.

- July 2022: Sanofi sold 17 drugs to Neuraxpharm, including Tramadol drug used as pain management medication.

- June 2021: Bayer AG relaunched its key product Saridon with new packaging focusing on growing OTC drugs in India used for old age pain relief.

- March 2020: The U.S. Food and Drug Administration (FDA) approved the use of GSK plc’s Advil Dual Action in combination with Acetaminophen for pain relief in the U.S.

- February 2020: GSK plc received the U.S. Food and Drug Administration (FDA) approval for Voltaren, an arthritis pain reliever, as an Over-the-Counter (OTC) product.

REPORT COVERAGE

The global market research report provides qualitative and quantitative insights on the global market and a detailed analysis of global market size & growth rate for all possible segments in the market. The report also provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are the prevalence of the chronic lower back pain, pipeline analysis, key industry developments, key players, and the impact of COVID-19 on the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.63% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Class

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

The global chronic lower back pain treatment market size is projected to grow from $3.10 billion in 2026 to $6.95 billion by 2034, at a CAGR of 10.63%

In 2025, the North America market stood at USD 1.36 billion.

The market will grow at a CAGR of 10.63% in the forecast period (2026-2034).

The non-steroidal anti-inflammatory drugs segment is expected to be the leading segment in this market during the forecast period.

The rising prevalence of this condition and the emphasis of market players on introducing novel drugs are some of the major factors driving the global market.

Johnson & Johnson Services, Inc. Bayer AG, and GSK plc are the some of the prominent market players in the global market.

North America dominated the market in 2025.

Increasing prevalence of underlying causes such as osteoarthritis, degenerative disk disease, and accident-related trauma is expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us