Colorectal Cancer Screening Market Size, Share & Industry Analysis, By Type (Stool-based (Fecal Immunochemical Test (FIT), Fecal Occult Blood Test (FOBT), and Stool-DNA Test), Colonoscopy, and Others), By End-user (Hospitals & Clinics, Clinical Laboratories, Diagnostics Imaging Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

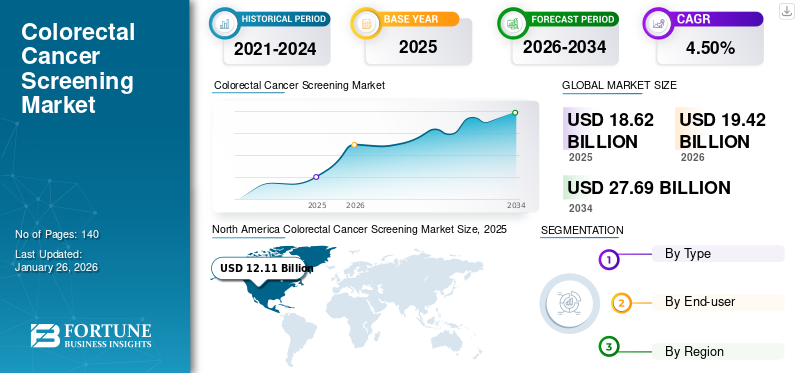

The global colorectal cancer screening market size was valued at USD 18.62 billion in 2025 and is projected to grow from USD 19.42 billion in 2026 to USD 27.69 billion by 2034, exhibiting a CAGR of 4.50% during the forecast period. North America dominated the cosmeceuticals market with a market share of 65.04% in 2025.

Colorectal Cancer (CRC) occurs when the cancerous cells begin to grow and spread in the colon or rectum part of the digestive tract, and adults aged 45 and above are more prone to it. If this cancer is detected at early stages, effective treatments can be provided. Colorectal cancer screening helps in detecting the cancer in asymptomatic and high-risk patients, aged 45 and above. Therefore, the increasing prevalence of colorectal cancer and rising government initiatives to create awareness have been fueling the demand for these screening tests.

- For instance, according to data published by the World Health Organization (WHO) in 2025, approximately 1.9 million new cases of colorectal cancer occurred globally in 2022. Moreover, in the same year, around 900,000 deaths occurred due to colorectal cancer.

The market is dominated by several key players, with Exact Sciences, Olympus, and Fujifilm being at the forefront. Increasing investment in R&D, along with numerous novel product launches for screening and a strong geographic presence, are supporting the growth of these companies.

COLORECTAL CANCER SCREENING MARKET TRENDS

Shifting Preference Toward Less Invasive and Patient-Friendly Screening Pathways

A key trend shaping the market is the shift toward less invasive, patient-friendly screening pathways. Many healthcare systems are increasingly favoring stool-based tests as the first-line screening option, reserving colonoscopy for confirmatory diagnosis. This trend is particularly evident in national screening programs across Europe and parts of the Asia Pacific, where FIT has become the standard entry test due to its balance of accuracy, cost, and patient compliance.

Another notable trend is the technological innovation within colonoscopy which is also gaining momentum. High-definition imaging, enhanced visualization techniques, and AI-powered polyp detection systems are increasingly adopted to improve diagnostic yield. At the same time, there is a growing interest in single-use endoscopy devices to address infection control and reprocessing challenges.

Such new technologies for the detection of CRC are increasing the adoption of tests, thereby fueling the overall market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Incidence of Colorectal Cancer to Boost the Market Growth

One of the major drivers that is positively impacting the growth of the market is the significant increase in the incidence of colorectal cancer globally. The incidence is higher in developed countries, and it is increasing in middle- and low-income countries due to unhealthy lifestyle choices and a surge in the aging population in these countries.

- For instance, in 2025, the American Cancer Society, Inc. estimated that rectal cancer and colon cancer cases diagnosed in the U.S. were 46,950 and 107,320, respectively.

- Similarly, as per data published by the Centers for Disease Control and Prevention (CDC) in 2025, 147,931 new colorectal cancers were reported in the U.S. in 2022, and 53,779 people in the U.S. died from colorectal cancer in 2023.

The increasing incidence of CRC and its rising mortality rate have heightened the demand for CRC detection, which is expected to propel the global colorectal cancer screening market growth in the coming years.

MARKET RESTRAINTS

Low Screening Participation and Significantly Higher Per-Test Costs to Restrict Market Growth

Despite a strong clinical rationale, the market faces notable restraints that limit full adoption across regions. One of the most persistent barriers is low participation in screening, particularly in low- and middle-income countries. Even in developed markets, a sizable proportion of eligible individuals remain unscreened due to fear, discomfort, or lack of awareness. Colonoscopy, while clinically effective, is invasive, requires bowel preparation, and often involves sedation, factors that discourage participation and contribute to delayed uptake.

Additionally, cost remains another critical restraint. Colonoscopy is a resource-intensive procedure that requires specialized infrastructure, trained gastroenterologists, and anesthesia support in many settings. These requirements strain healthcare systems and restrict scalability, especially in regions with limited endoscopy capacity. Similarly, newer screening modalities, such as stool-DNA and blood-based tests, have significantly higher per-test costs than FIT, which limits their inclusion in publicly funded screening programs. Additionally, reimbursement variability across regions leads to uneven access, particularly in fragmented healthcare systems where preventive services are not uniformly covered. Such a scenario is expected to hinder the market growth in the upcoming years.

Market Opportunities

Rising Adoption of Non-Invasive and At-Home Screening Tests to Expand Screening Uptake

In recent years, there has been a growing adoption of non-invasive and at-home colorectal cancer (CRC) screening tests, which are expected to represent a significant market opportunity, as these solutions address key barriers associated with traditional colonoscopy-based screening.

The convenience, ease of use, absence of bowel preparation, and elimination of procedural risks are driving higher acceptance among average-risk and screening-averse populations, particularly in asymptomatic individuals.

Stool-based tests, such as fecal immunochemical tests (FIT), fecal occult blood tests (FOBT), and multi-target stool DNA tests, have gained significant traction due to their clinical validation and suitability for population-scale screening programs. As a result, several tests are receiving approvals to support the demand.

- For instance, in July 2024, Guardant Health received U.S. FDA approval for its Shield blood test as the first primary screening option for colorectal cancer in adults aged 45 and above, paving the way for Medicare reimbursement. This blood-based test, supported by the ECLIPSE study, provides a convenient alternative to enhance screening rates and early detection.

Additionally, collaborations amongst diagnostics companies, healthcare providers, and public health agencies are accelerating market penetration. Several national screening programs in Europe and the Asia Pacific have expanded FIT-based home testing through centralized mail distribution and digital result reporting. Private-sector partnerships with telehealth platforms and pharmacy chains are also enabling direct-to-consumer access to at-home CRC screening kits, improving compliance and repeat testing rates.

Moreover, as healthcare systems increasingly emphasize preventive care, early detection, and cost containment, non-invasive and at-home CRC screening solutions are expected to complement or replace first-line invasive screening in many settings, creating sustained growth opportunities for test developers, diagnostic laboratories, and digital health providers globally.

Market Challenges

Adverse Effects and Procedural Risks Associated with Colonoscopy to Limit Market Growth

Despite being the gold standard for colorectal cancer (CRC) screening due to its high diagnostic accuracy and therapeutic capability, colonoscopy is associated with several procedural risks that act as a restraint on the global market. The invasive nature of the procedure, requirement for bowel preparation, sedation-related discomfort, and fear of complications discourage a significant proportion of the eligible population from opting for colonoscopy-based screening.

Additionally, device-related infection risks persist, especially with reusable colonoscopes, due to challenges in complete reprocessing and sterilization, even with adherence to high-level disinfection protocols. Several studies have indicated that colonoscopy is associated with measurable risks of bleeding, perforation, and post-procedure infections, particularly among elderly patients.

- For instance, in January 2025, a study published by the National Center for Biotechnology Information (NCBI) found that among older adults over 65 years, colonoscopy-related perforation and bleeding occurred at rates of 0.078% and 0.235%, respectively. The risk of both complications was significantly elevated in the very elderly subgroup (over 80 years) relative to the young-elderly group (65-80 years).

Post-colonoscopy complications such as abdominal pain, cramping, dizziness, fever, persistent rectal bleeding, and delayed bleeding further contribute to patient apprehension and lower repeat screening compliance. These risks have not declined substantially over the past decade, underscoring the need for patient and physician caution.

Moreover, as awareness of these adverse effects increases, healthcare systems and patients are increasingly favoring non-invasive stool-based tests and molecular screening alternatives, thereby limiting the growth potential of colonoscopy within themarket.

Segmentation Analysis

By Type

High Positivity Rate Associated with Screening through Colonoscopies to Boost the Segment’s Growth

Based on type, the market is segregated into stool-based, colonoscopy, and others. The stool-based segment is further sub-segmented into fecal occult blood tests (gFOBT), fecal immunochemical tests (FIT/iFOBT), and stool-DNA tests.

The colonoscopy segment dominated the global market share with 71.27% in 2026 and is expected to expand at a substantial CAGR during the forecast period. The growth of the segment is attributed to the high accuracy of the procedure and the increasing incidence of colorectal cancer, which drives demand for colonoscopy procedures for screening and influences product advancements.

- For instance, according to the data from the International Agency for Research on Cancer, more than 1.9 million colorectal cancer cases were reported in 2022, which was the third most common cancer type globally.

The stool-based segment is anticipated to rise with a CAGR of 10.7% over the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user

High Patient Volume to Boost Hospitals & Clinics Segment Growth

Based on end-user, the market is categorized into hospitals & clinics, clinical laboratories, diagnostic imaging centers, and others.

The hospitals & clinics segment dominated the global market share with 53.04% in 2026 and is expected to expand at a considerable CAGR during the forecast period. The growth is attributed to the high patient volume diagnosed in hospitals, which drives demand for stool-based and colonoscopy procedures, thereby influencing key players to expand the availability of their products.

- For instance, according to the data published by the National Center for Biotechnology Information (NCBI) in April 2023, over 15.0 million colonoscopies are performed in the U.S. each year.

In addition, clinical laboratories are projected to grow at a CAGR of 6.4% during the study period.

Colorectal Cancer Screening Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Colorectal Cancer Screening Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025, valuing at USD 12.11 billion, and also maintained the leading share in 2026, with USD 12.64 billion. Growth in the North American market is driven primarily by strong guideline support, high awareness for the disease, and favorable reimbursement structures. The lowering age of the recommended screening age to 45 years has significantly expanded the pool of eligible population, particularly in the U.S., where rising CRC incidence among younger adults has become a major clinical concern.

U.S Colorectal Cancer Screening Market

Based on North America’s strong contribution and the U.S. dominance within the region, the U.S. market can be approximated at around USD 12.44 billion in 2026, accounting for roughly 64.0% of global sales.

Europe

Europe is projected to record a growth rate of 8.3% in the coming years, which is the second highest among all regions, and reached a valuation of USD 0.90 billion by 2025. The market in Europe is expected to grow at a significant CAGR during the forecast period. Increasing demand for screening procedures such as stool-based testing in European countries, the presence of government programs, and rising awareness about the disease in key European countries are some of the major factors expected to boost market growth in Europe.

- For instance, United European Gastroenterology (UEG), with the European Code against Cancer, regulates CRC screening across Europe with organized, population-based screening programs and proactively promotes screening.

U.K Colorectal Cancer Screening Market

The U.K. market in 2026 was estimated at around USD 0.17 billion, representing roughly 0.9% of global market revenues.

Germany Colorectal Cancer Screening Market

Germany’s market is reached approximately USD 0.4 billion in 2026, equivalent to around 2.0% of global market sales.

Asia Pacific

Asia Pacific is estimated to reach USD 4.86 billion in 2025 and secure the position of the second-largest region in the market. The enhancement and improvement of healthcare facilities in Asian countries, increasing CRC incidence in the countries across the region, and the increasing consciousness of individuals in terms of better treatment outcomes are driving the regional market growth.

- For instance, as per a research article published by the National Center for Biotechnology Information (NCBI), in 2023, the incidence rate of colorectal cancer in Japan per 100,000 individuals was around 26.7 men and 22.7 women aged between 40 and 44.

Japan Colorectal Cancer Screening Market

The Japan market in 2026 was around USD 0.57 billion, accounting for roughly 3.1% of global market revenues.

China Colorectal Cancer Screening Market

China’s market is projected to be one of the largest, with 2026 revenues around USD 1.96 billion, representing roughly 10.5% of global sales.

India Colorectal Cancer Screening Market

The India market in 2026 was about USD 1.71 billion, accounting for roughly 9.2% of global market revenues.

Latin America and Middle East & Africa

The markets in Middle East & Africa and Latin America are also expected to expand at a significant CAGR during the forecast period. The increasing burden of the condition, rising government initiatives to create awareness about the disease along with easy availability of screening tests such as FIT and FOBT are responsible for the growth of the market in these regions.

Saudi Arabia Colorectal Cancer Screening Market

The Saudi Arabia market is projected to reach around USD 0.10 billion in 2025, representing roughly 0.6% of global market revenues.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies with Strong Focus on Expansion of Screening Portfolio Leads to Their Key Market Share

Olympus Corporation, Exact Sciences Corporation, and Quest Diagnostics are the prominent players in the market and captured a considerable global colorectal cancer screening market share in 2025.

Olympus Corporation and Exact Sciences Corporation accounted for significant shares of the market in 2025. This was due to the their product portfolio for colonoscopy and cancer screening test, which consists of efficient and technologically advanced products.

- For instance, October 2024, Exact Sciences Corp announced the U.S. Food and Drug Administration (FDA) approved the Cologuard Plus test, the company’s next generation multitarget stool DNA test. The Cologuard Plus test is now approved for adults ages 45 and older who are at the average risk for colorectal cancer.

Other significant players, including FUJIFILM Holdings Corporation, Laboratory Corporation of America Holdings, and Clinical Genomics Technologies Pty Ltd are emphasizing research and development activities for the launch of new and technologically advanced products in order to strengthen their market positions.

LIST OF KEY COLORECTAL CANCER SCREENING COMPANIES

- NOVIGENIX SA (Switzerland)

- EIKEN CHEMICAL CO., LTD. (Japan)

- Clinical Genomics Technologies Pty Ltd. (U.S.)

- Exact Sciences Corporation (U.S.)

- Epigenomics AG (Germany)

- bioMérieux, Inc. (France)

- Olympus Corporation (Japan)

- KARL STORZ SE & Co. KG (Germany)

- FUJIFILM Holdings America Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2025 - NHS England announced rollout of home FIT screening to age 50, expanding the eligible population and boosting stool-test volumes.

- August 2024 - Guardant Health, Inc. a leading precision oncology company, announced that its Shield blood test, recently approved by the U.S. Food and Drug Administration (FDA), is now covered by Medicare and is commercially available in the U.S. as the first FDA-approved blood test for primary colorectal cancer (CRC) screening.

- February 2024 – Reese Pharmaceutical launched ColoTest, a home-based FIT colorectal cancer screening test.

- November 2023 – Guardant Health and Samsung Medical Center launched Shield, a blood-based CRC test, in South Korea.

- September 2021 - Exact Sciences Corp. announced that the U.S. Food and Drug Administration (FDA) approved its noninvasive colorectal cancer screening test, Cologuard, eligible for average-risk individuals ageed 45 and older, expanding on its previous indication for ages 50 and older.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.5% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type, End-user, and Region |

|

By Type |

· Stool-based o Fecal Immunochemical Test (FIT) o Fecal Occult Blood Test (FOBT) o Stool-DNA Test · Colonoscopy · Others |

|

By End-user

|

· Hospitals & Clinics · Clinical Laboratories · Diagnostic Imaging Centers · Others |

|

By Region |

· North America (By Type, End-user, and Country) o U.S. o Canada · Europe (By Type, End-user, and Country/Sub-region) o U.K. o Germany o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Type, End-user, and Country/Sub-region) o Japan o China o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Type, End-user, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, End-user, and Country/Sub-region) o GCC o South Africa o Rest of Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 19.42 billion in 2026 to USD 27.69 billion by 2034.

The market is expected to exhibit a CAGR of 4.5% during the forecast period (2026-2034).

The colonoscopy segment is the leading type in the market.

The key factors driving the market are favorable government policies, high incidence of colorectal cancer, and increasing initiatives by market players for the development of technologically advanced products.

Olympus Corporation, Exact Sciences Corporation, and Quest Diagnostics are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us