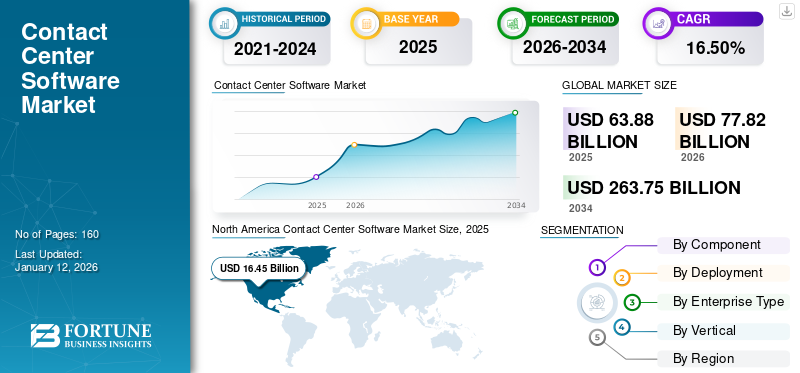

Contact Center Software Market Size, Share & Industry Analysis, By Component (Solution and Services), By Deployment (Cloud and On-Premise), By Enterprise Type (Small & Medium Enterprises and Large Enterprises), By Vertical (BFSI, ITES, IT and Telecom, Government, Healthcare, Consumer Goods & Retail, Travel & Hospitality, Media & Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global contact center software market size was valued at USD 63.88 billion in 2025. The market is projected to grow from USD 77.82 billion in 2026 to USD 263.75 billion by 2034, exhibiting a CAGR of 16.50% during the forecast period. North America dominated the global market with a share of 25.70% in 2025.

Emerging technologies, such as artificial intelligence, cloud, predictive analysis, and machine learning, are projected to enhance contact center software capabilities. The increasing awareness of consumer rights has resulted in the growth of customer queries across industries. The customer service-oriented sectors, such as consumer goods and retail, healthcare, BFSI, and others, are increasingly investing in contact centers to improve the customer experience and ensure service satisfaction. In the scope of the market report, we have included component solutions and services offered by companies including NICE CXone, Genesys Cloud CX, 3CX, and Five9 Inc., among others.

Advancements in technologies assisted customers to contact companies via all accessible platforms, including phone conversations, video chats, emails, and social media. Omni-channel solutions are provided by the contact center solution to reach customers across several channels. For instance, to create a seamless and intelligent customer experience, Capital One installed the Amazon Connect cloud-based contact center technology. As a result, the market for contact center software is driven by the increased rivalry to retain loyal consumers through seamless services.

Additionally, the impact of COVID-19 was significant and to deal with it, businesses globally began adopting work-from-home policies in large numbers. This strategy had a significant impact on the demand for contact center services in a range of sectors. In addition, owing to the pandemic, businesses observed unexpected behavioral changes among their clientele bases. As customers expected immediate solutions to their queries, most businesses moved their customer support to the cloud. For instance,

- According to a report published by Cisco System, Inc. on the global contact center market in 2020, around 62% of industries aim to develop cloud-based contact center software in the next 18 months.

- In the same year, Avaya Holdings Corp. launched remote contact center solutions for workforces working from home.

Contact Center Software Market Trends

Artificial Intelligence Integrated Software to Drive Market Growth

Artificial intelligence is being integrated by the developer to improve the software's efficiency. At every stage of service, AI-based software aids in analyzing customer behavior. It gives customers real-time customer insights and forecasts their future behavior. This analysis assists the agents in handling and guiding clients through the call with the appropriate solutions. By engaging and filtering the conversations, AI-enabled chatbots assist in minimizing customers' waiting time. The data gathered throughout the interaction is transferred to an analytics engine that assists in contact center process optimization.

Similarly, in conjunction with predictive analysis, sentimental analysis searches for a keyword to anticipate the tone of a customer's expression. NLP and machine learning assist agents in making judgments that improve customer service and caller’s experience. According to Kearney, a worldwide management consulting organization, implementing AI and robotic process automation can reduce agent support time by 25% by 2022.

Download Free sample to learn more about this report.

Contact Center Software Market Growth Factors

Increased Implementation of Omnichannel Services to Ensure Customer Satisfaction

Customers communicate with the organization via digital communication channels, including emails, social media, SMS, phone calls, video, live chats, and more with the help of an omnichannel solution. It provides personalized communication with customers, which increases customer satisfaction. The contact center solution reduces customer service costs while increasing the improved number of customer complaints. The presence of service providers across all available channels assists developing client trust. It also provides real-time insights into customers across channels to the agents who deal with them. This enables the agent to develop stronger customer relationships and provide enhanced customer experience. This is anticipated to accelerate the contact center software market growth. For instance,

- In April 2023, Enghouse Interactive Inc. launched a new CX suite that combines unified communications, omnichannel contact center, and IoT capabilities. The suite integrates AI to enhance customer interactions and IoT to meet specific demands.

Increased Demand for Cloud-based Contact Centers to Support Market Growth

The escalating demand for cloud-based contact centers is catalyzing the market. Organizations are increasingly adopting cloud-based solutions to modernize their contact center operations, leveraging cloud infrastructure to deliver scalable, flexible, and cost-effective customer support and engagement services. Examples of cloud-based contact center software include Amazon Connect, Twilio Flex, and Genesys Cloud, which offer features such as omnichannel communication, AI-driven analytics, and remote agent management. The imperative drives businesses to adapt to remote work environments, optimize operational efficiency, and enhance customer experiences through seamless communication across multiple channels, resulting in a surge in the adoption of cloud-based contact center solutions worldwide.

- In April 2023, Teckinfo Solutions Pvt. Ltd., a software company specializing in Call/Contact Center solutions for ITES/BPO, Enterprises, and MSMEs, unveiled its newest product, ID Cloud, a premium contact center software. This platform aims to simplify customer engagement for businesses of all sizes, offering executives tech-savvy solutions. ID Cloud provides the same capabilities as on-premise software but with the added convenience of cloud deployment.

RESTRAINING FACTORS

High-cost Investment to Inhibit the Market Growth

End-use enterprises face challenges as the cost of contact center solutions increases. The on-premise contact center solutions need in-house hardware that requires regular maintenance and services. The requirement for service maintenance and dedicated staff results in massive company expenses. Similarly, in the case of cloud-based software, extended downtime can be extremely costly to the business. Due to the rising number of cloud attacks, companies enabling cloud systems are required to provide dedicated cybersecurity solutions. This is expected to hamper market growth during the forecast period.

Contact Center Software Market Segmentation Analysis

By Component Analysis

Rising Customer Experience Demand to Drive the Solution Segment Growth

Based on component, the market is categorized into solution and services.

The solution segment is subdivided into Interactive Voice Response (IVR), automatic call distribution, Computer Telephony Integration (CTI), call recording, reporting and analytics, dialer, workforce optimization, customer collaboration, and others.

The solution segment is projected to dominate the market with a share of 69.77% in 2026. Integrating advanced technologies, such as AI, predictive analytics, robotic process automation, and others, with contact center solutions is accelerating market growth. IVR solutions are expected to capture a significant market share. The intelligent IVR understands the needs of the customers through speech recognition and notifies the operatives about updates. Similarly, workforce optimization is expected to grow rapidly as it improves agent’s efficiency and performance. The solution analyzes customer communication and provides agents with insights.

The services segment is further bifurcated into professional services and managed services. The services segment is expected to witness high growth during the forecast period owing to rising software adoption. Contact center services assist businesses in deploying and implementing solutions without disrupting the existing network. Similarly, implementing technical support and maintenance services reduces the likelihood of communication disruption.

By Deployment Analysis

Cloud's Flexibility and Scalability to Lead to Cloud to Grow Significantly

Based on deployment, the market is categorized into cloud and on-premise.

The on-premise deployment segment is expected to lead the market, accounting for 53.55% of the total market share in 2026. However, due to high investment costs, it is likely to experience declining growth over the forecast period. Cloud is anticipated to grow significantly during the forecast period owing to its capabilities such as ease of implementation, deployment, enhancements, and others. The adoption of cloud-based technology also aids in the reduction of enterprise operational costs. This is expected to drive the cloud segment.

By Enterprise Type Analysis

Growing Competition in Small and Medium-Sized Businesses to Enhance Market Size

Based on enterprise type, the market is segmented into large enterprises and small & medium enterprises.

The large enterprises segment is anticipated to hold a significant market share of 57.75% in 2026. The integration of cloud services and AI with contact centers is accelerating software adoption across large enterprises.

The small & medium enterprises segment is expected to witness high growth as competition to increase customer base grows. The software provides agents with analytical skills to ensure customer satisfaction during communication. Furthermore, cloud-based software provides a better experience at a lower cost.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Online Trade Demand to Boost BFSI Market Share Significantly

Based on vertical, the market is segmented into BFSI, IT and telecom, government, media and entertainment, ITES, healthcare, travel and hospitality, consumer goods and retail, and others.

During the forecast period, the BFSI segment is expected to lead the market with majority of the market share. The increasing cross-selling and up-selling of the financial portfolio is driving the BFSI industry's adoption of contact center software. Other industry verticals, including ITES, IT and telecom, government, travel and hospitality, media and entertainment are expected to grow steadily.

The healthcare segment is expected to grow rapidly due to increased customer inquiries across the industry. The industry's growing emphasis on patient-centric services is expected to drive market growth. The pandemic crisis has increased the demand for contact center software solutions in healthcare to provide 24-hour hotline services.

Software is also in high demand in the consumer goods & retail segment. The growing popularity of online shopping drives the demand for continuous customer service facilities. The software improves the customer experience by providing retailers with omnichannel services. The growing number of customer inquiries in the consumer goods and retail sectors is expected to surge the demand for contact center solutions.

REGIONAL INSIGHTS

The market has been analyzed across five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Contact Center Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America is predicted to hold the largest contact center software market share during the forecast period. The U.S. is expected to witness high growth due to increased integration and innovation in technologies such as cloud computing, Big Data analytics, and AI. These emerging technologies are providing real-time analytics capabilities to contact center software. The BFSI, healthcare, retail, and government sectors are more concerned with providing excellent customer service. The U.S. market is projected to reach USD 14.15 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Similarly, Europe is expected to grow steadily during the forecast period, owing to the region's expanding service-based industries. Germany and the U.K. are expected to lead the regional market. The UK market is projected to reach USD 3.64 billion by 2026, while the Germany market is projected to reach USD 4.54 billion by 2026.

Asia Pacific

Asia Pacific is likely to grow rapidly during the forecast period owing to the presence of a significant number of IT and ITES companies in the region. Healthcare, BFSI, consumer goods, and retail, among other businesses, are all experiencing rapid expansion in the region. The need for contact center software is likely to rise as a result of this. The Japan market is projected to reach USD 6.14 billion by 2026, the China market is projected to reach USD 7.65 billion by 2026, and the India market is projected to reach USD 5.86 billion by 2026.

During the forecast period, the Middle East & Africa as well as Latin America are expected to increase steadily. The demand for contact center solutions is driven by increased competition among local and multinational businesses.

Key Industry Players

Key Players to Diversify their Product Portfolios through Strategic Acquisitions and Collaborations

Cisco Systems, Inc. integrated AI and automation tools to deliver advanced software solutions and is strategically broadening its services by acquiring small and medium vendors. Other key market players, such as NEC Corporation, Genesis Corporation, NICE Corporation, Microsoft Corporation, and Mitel Networks Corporation, are concentrating on expanding their operations by providing creative and advanced solutions. These key players are investing in developing cloud-based contact center software solutions.

- October 2023: 8x8, Inc., a provider of integrated cloud contact center and unified communications platforms, unveiled innovations in its BxB XCaaS platform. These advancements aim to enhance customer and employee experiences, featuring AI-driven voice conversational self-service, expanded video capabilities for contact center interactions, deeper integrations with Microsoft Teams, and enhancements to 8x8 video meetings.

- April 2023: Teckinfo Solutions Pvt. Ltd. launched ID Cloud - Premium Contact Centre Software platform to provide a complete set of customer engagement platforms that streamlines and simplifies customer engagement for businesses of all sizes and types.

- July 2021: 3CLogic. Inc. formed a strategic partnership with ScreenMeet. The partnership will augment ServiceNow's existing digital channels and self-service by combining their respective communication offerings across SMS, voice, video, screen-sharing, and co-browsing to extend ServiceNow's omnichannel customer support capabilities.

- May 2021: Mitel Networks Corporation announced a strategic partnership with Five9, Inc. The partnership aims to deliver customers and partners around the world to access the Contact Center as a Service (CCaaS) solution, which works in conjunction with Mitel's communications solutions.

List of Top Contact Center Software Companies:

- Alcatel Lucent Enterprise (France)

- NEC Corporation (Japan)

- Mitel Networks Corporation (Canada)

- Bright Pattern, Inc. (U.S.)

- Enghouse Interactive Inc. (U.S.)

- Genesys Telecommunications Laboratories, Inc. (U.S.)

- Five9 (U.S.)

- 8x8, Inc. (U.S.)

- NICE Ltd. (Israel)

- 3CLogic (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Bharti Airtel, a telecommunications service provider in India, introduced Airtel CCaaS, marking the debut of an omni-channel cloud platform. This innovative offering provides enterprises with a unified solution for their contact center needs.

- April 2023: Bright Pattern launched an omni-enterprise contact center platform. This platform enhances customer experiences and drives greater enterprise productivity.

- March 2023: Five9 and Qualtrics collaborated to improve the contact center experience for customers and agents. The partnership aided integrating between Qualtrics’ XM Platform and Five9 Event Subscription Services to respond to customers more efficiently.

- March 2023: 8x8, Inc. launched AI-driven features to its Contact Center solution. The new additions include an 8x8 Supervisor Workspace, 8x8 Intelligent Customer Assistant, and platform integration with OpenAI. It transforms contact center performance through improved customer experiences.

- March 2023: 3CLogic debuted its CTI and Contact Center solution on SAP Store. The solution integrates with SAP CRM Service Manager and SAP CRM Sales to enable SMS experiences and intelligent voice. This helps in optimizing live customer engagements while decreasing operational costs.

- June 2021: Genesys Telecommunications Laboratories, Inc. introduced new AI-driven Customer Experiences capabilities to assist rapid innovation. The objective is to make it simple for businesses to create and manage their own bot experiences as well as to integrate third-party messaging apps and provide technical training to their workforces. In addition, this flexible consumption model allows businesses access to Genesys solutions, allowing them to grow or deploy new capabilities as needed to meet changing consumer and business requirements.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader to gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 16.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Vertical

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 263.75 billion by 2034.

In 2025, the market was valued at USD 63.88 billion.

The market is projected to grow at a CAGR of 16.50% over the forecast period.

The solution segment is predicted to lead the market based on components.

The increased implementation of omnichannel services is expected to drive the market growth.

Cisco Systems, Inc., NEC Corporation, Genesis Corporation, NICE Corporation, Microsoft Corporation, Mitel Networks Corporation, and Bright Pattern, Inc. are some of the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow with a significant growth rate.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us