Coronary Stents Market Size, Share & Industry Analysis, By Stent Type (Drug Eluting Stent, Covered Stent, Bare Metal Stent, Bioresorbable Stent, and Others), By Material Type (Metal and Polymer), By Deployment (Self-expandable and Balloon-expandable), By Application (Acute Coronary Syndrome (ACS) and Chronic Coronary Syndrome (CCS)), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

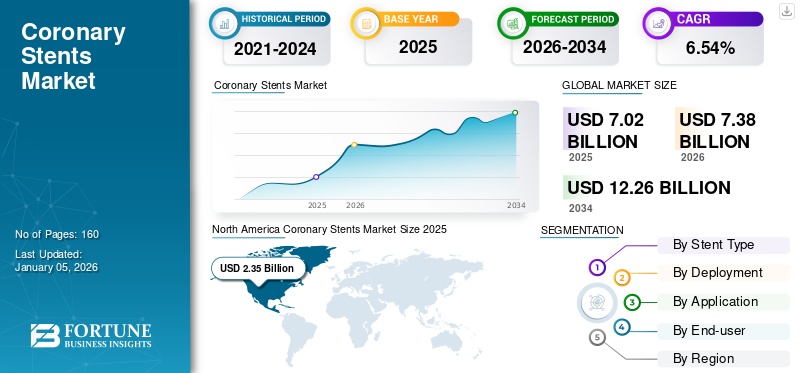

The global coronary stent market size was valued at USD 7.02 billion in 2025 and is projected to grow from USD 7.38 billion in 2026 to USD 12.26 billion by 2034, exhibiting a CAGR of 6.54% during the forecast period. North America dominated the coronary stent market with a market share of 33.55% in 2025.

Coronary stents are small, tube-shaped devices inserted into coronary arteries to keep them open, ensuring adequate blood flow to the heart. They are primarily used in Percutaneous Coronary Interventions (PCI) to treat Coronary Artery Diseases (CAD), such as atherosclerosis.

Millions of people across the globe suffer from cardiovascular diseases, including coronary artery diseases. Due to this, angioplasty has gained immense popularity in the past few years among individuals experiencing atherosclerosis and heart attacks.

Technological advancements in stenting procedures have reduced manual errors during operations. This is anticipated to enhance the adoption of these products among cardiologists in both emerging and developed nations.

Furthermore, the market is highly fragmented with the presence of key players, such as Medtronic, Stentys S.A., Boston Scientific Corporation, BIOTRONIK SE & Co. KG, and Abbott, among others. The growing focus of these players on receiving regulatory approvals for the launch of new products in the global market will enhance their dominance.

Coronary Stents Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 7.02 billion

- 2026 Market Size: USD 7.38 billion

- 2034 Forecast Market Size: USD 12.26 billion

- CAGR: 6.54% from 2026–2034

Market Share:

- North America dominated the coronary stents market with a 33.55% share in 2025, driven by a robust healthcare infrastructure, high CAD prevalence, and frequent product launches backed by regulatory approvals in the U.S.

- By stent type, drug-eluting stents (DES) are projected to maintain the largest market share in 2025, due to growing clinical demand, increasing launches, and regulatory approvals. Their ability to reduce restenosis rates contributes to widespread clinical preference.

Key Country Highlights:

- Japan: Growth is supported by an aging population susceptible to CAD, growing hospital infrastructure, and regulatory support for advanced coronary devices. The presence of local players like Terumo fosters product accessibility.

- United States: High disease burden, advanced cardiac care centers, and product innovations by key players (e.g., Abbott, Medtronic) contribute to increased adoption. Regulatory approvals, like the FDA clearance of new DES systems, also accelerate market growth.

- China: Rising CAD prevalence, increasing awareness, and the expansion of specialty hospitals and catheterization labs are key growth drivers. Domestic manufacturers like MicroPort are expanding rapidly with government approvals, including NMPA authorization for bioresorbable stents.

- Europe: Market growth is supported by CE-mark approvals and increasing preference for PCI procedures. Countries like Germany and the U.K. are expanding their interventional cardiology services, and major players are launching advanced DES platforms in the region.

MARKET DYNAMICS

Market Drivers:

Rising Prevalence of Coronary Heart Diseases Globally Will Facilitate Market Growth

The growing prevalence of coronary heart disorders across the globe is one of the primary factors that will drive the market’s growth during the forecast period. Increasing habit of binge-eating, coupled with sedentary lifestyles and growing stress levels, is responsible for the rise in the prevalence of heart disorders.

- For instance, as per the data provided by the U.S. Centers for Disease Control and Prevention (CDC) in October 2024, around 1 in 20 adults aged 20 and older had Coronary Artery Disease (CAD) in 2023. This was equivalent to 5% of the total U.S. population.

Coronary heart disorder is the most common form of cardiovascular disease, affecting millions of people worldwide. Therefore, the rising patient pool and growing prevalence of heart diseases are projected to accelerate the market’s growth throughout the forecast period.

Furthermore, increase in the global elderly population, who are more susceptible to CAD, will also drive the demand for coronary stents, leading to the market’s growth.

Technological Advancements in Coronary Stents Will Bolster Market Growth

Coronary stents have been widely used in cardiac procedures to close the perforation in the blood vessels for several years. Currently, the field of Percutaneous Coronary Intervention (PCI) is witnessing many innovations to make it safe and effective for treatment during complex CAD surgeries. Several medical device companies are largely involved in receiving regulatory approvals to launch these devices in the global market. This is one of the main factors that will drive the market’s growth throughout the forecast period.

- For instance, in May 2022, Medtronic announced that it had received the U.S. Food and Drug Administration (FDA) approval for its Onyx Frontier Drug-Eluting Stent (DES). As the newest advancement in the Resolute DES range, the Onyx Frontier DES utilizes the same top-tier stent platform as the Resolute Onyx DES. It features an improved delivery system to enhance deliverability and boost performance in the most difficult cases.

Moreover, rapid advancements in devices and a growing preference for minimally invasive procedures like Percutaneous Coronary Intervention (PCI) over traditional open-heart surgeries have led to an increase in the adoption of stenting devices, boosting the market’s growth.

Market Restraints:

Side Effects Associated With Coronary Stents to Hinder Market Growth

Despite the growing demand for treatment solutions, the side effects associated with the use of coronary stents might hinder the market’s growth to a certain extent.

- For example, as per the data provided by the National Health Service (NHS) in October 2022, stent insertion in coronary angioplasty carries the risk of serious complications, such as damage to the arteries while inserting stents and allergic reaction to the contrast agent used during the procedure.

Moreover, strict government regulations pertaining to product approval will further restrict market growth.

Market Opportunities:

Rising Healthcare Infrastructure and Growing Awareness about Cardiovascular Diseases in Emerging Regions

The increasing awareness about coronary artery disease and its treatment in emerging countries can create a growth opportunity for the market.

- For example, in September 2023, on the occasion of World Heart Day, the Indian Ministry of Health rolled out a public campaign on heart health. This campaign placed special emphasis on raising awareness of hypertension risk factors that can lead to premature death and morbidity due to cardiovascular disease.

In addition, the expansion of cardiology services by opening new multispecialty hospitals and catheterization laboratories in emerging nations will create an opportunity for the market to grow substantially throughout the forecast period.

- For instance, in August 2024, Canberra Hospital expanded its cardiology services by launching its critical services building in Garran, Australia. The hospital's heart care services moved to the new facility, featuring a new acute cardiac care unit, a cardiac day unit, and three cardiac catheterization laboratories.

- Similarly, in July 2024, during the celebration of World Doctors Day, Sanjeevan Hospital inaugurated its state-of-the-art cathlab and Cardiothoracic and Vascular Surgery (CTVS) services in New Delhi, India.

Market Challenges:

Increasing Product Recalls is Considered a Significant Challenge Affecting Market Expansion

The expensive nature of stent procedures, especially in developing regions, can limit their accessibility and adoption. In addition, the increasing cases of product recalls due to safety concerns is considered a significant challenge for the market’s growth as the safety issues with coronary stents affect patient trust and limit their adoption.

- For example, in June 2022, Atrium Medical Corporation announced the recall of its iCast-covered stents due to safety issues.

Furthermore, the availability of other treatments for coronary artery diseases will also pose a challenge to the growth of the market.

MARKET TRENDS

Continuous Innovations and Enhancements in Coronary Stenting Devices to Become Significant Market Trend

The market players are focused on the development of innovative stenting devices. They strongly emphasize minor refinements, such as reducing the stent strut thickness, making stents more deliverable in tortuous vessels, and introducing smaller diameters of these stents. The enhancements resulted in improved flexibility, smaller diameters, and longer lengths to address critical Percutaneous Coronary Interventions (PCIs). Therefore, such modifications to improve patient experience and eliminate procedural complexities will aid market growth.

Moreover, continuous innovations, such as developing bioresorbable and drug-eluting stents with biodegradable polymers, enhance the stent’s performance and patient outcomes.

- For example, in October 2023, Medinol announced that its EluNIR-PERL Drug-Eluting Stent (DES) received approval from the U.S. Food and Drug Administration (FDA). This device will be used in the treatment of coronary heart disease.

Download Free sample to learn more about this report.

Impact of COVID-19 on the Market

The COVID-19 pandemic had a negative impact on the market in 2020. During the early phases of the outbreak, the healthcare systems prioritized treating COVID-19-infected patients, leading to delays or cancellations of elective surgeries, including coronary stent placements.

- For example, as per the data provided by the National Center for Biotechnology Information (NCBI) in June 2022, during the control period (March 2019 and February 2020), the total number of cardiac surgeries was 1,778. Compared with the COVID-19 pandemic period (March 2020 to February 2021), the total number of these surgeries was 1,127 (a decrease of 37%).

However, in 2021, the market players experienced significant growth in their revenues from cardiovascular businesses.

- For instance, as per the 2020 annual report of Integer Holdings Corporation, the company generated a revenue of USD 593.1 million in 2021 and witnessed a growth of 4.7% compared to USD 569.9 million generated in 2020. Furthermore, the company generated a revenue of USD 699.5 million in 2022 and experienced a growth rate of 17.9% compared to FY 2021.

This market is anticipated to witness faster growth in 2024 and the coming years due to the increasing number of coronary interventions globally.

SEGMENTATION ANALYSIS

By Stent Type

Increasing Product Launches Will Stimulate Demand for Drug-Eluting Stents

Based on stent type, the market is segmented into drug eluting stent, covered stent, bare metal stent, bioresorbable stent, and others. The drug-eluting stents segment accounting for 76.51% of the market share in 2026 owing to the increasing demand for these stents. Moreover, increasing regulatory approvals and product launches for these stents are some of the major factors contributing to the segment’s growth throughout the forecast period.

- For instance, in May 2024, Abbott announced the launch of XIENCE Sierra Everolimus (drug) eluting coronary stent in the Indian market.

The bare metal stent segment is anticipated to record a moderate CAGR during the forecast period. In patients with high bleeding risks, where prolonged dual antiplatelet therapy is not advisable, bare metal stents are preferred in such cases to minimize complications. This is one of the important factors responsible for the segment’s growth during the forecast period.

The bioresorbable stent segment is anticipated to grow throughout the forecast period. The higher burden of cardiovascular disorders across the globe is one of the most prominent factors propelling the demand for bioresorbable stents. The rising geriatric population is another significant factor boosting the market’s growth since people over 60 years of age are more prone to chronic ailments, such as cardiovascular diseases. Hence, the abovementioned factors are anticipated to boost the segment’s growth during the forecast period.

The covered stents segment is anticipated to grow throughout the forecast period owing to the high prevalence of coronary artery diseases and increasing product launches in the global market.

- For example, in April 2019, BIOTRONIK SE & Co. KG announced the commercial launch of its PK Papyrus-covered coronary stent system in the U.S. market. This product is used in the emergency treatment of acute coronary perforations.

The others segment is expected to grow during the forecast period owing to the increasing usage of dual therapy stents for the treatment of coronary diseases.

To know how our report can help streamline your business, Speak to Analyst

By Material Type

Adoption Rate of Metal-based Coronary Stents Increased Due to Their High Efficiency

Based on material type, the market is divided into metal and polymer. The metal segment dominated the global market in 2024. This segment is also expected to record the highest CAGR during the forecast period. The segment’s dominance was mainly due to the increasing launch of coronary stents made from stainless steel, cobalt-chromium, and platinum-chromium alloys and the high efficiency of these stents.

- For example, in August 2022, Medtronic announced the launch of the Onyx Frontier Drug-Eluting Stent (DES) for the treatment of coronary artery disease in the global market.

The polymer segment is anticipated to grow throughout the forecast period. This is mainly due to the fact that bioresorbable stents are completely made up of polymers that provide clinical benefits, such as their ability to degrade over time.

By Deployment

Higher Clinical Efficiency of Self-Expandable Stents is Responsible for its Dominance in Market

Based on deployment, the market is segmented into self-expandable and balloon-expandable. The higher efficiency of self-expandable stents and emerging local & regional manufacturers of these stents across the world are some of the major factors responsible for the dominance of this segment in the global market.

Moreover, the launch of novel self-expandable stents demonstrates their ability to treat acute myocardial infarction and follow the enlargement of the artery with near-perfect precision. Hence, such high clinical efficacy of these stents will substantially drive the segment’s growth during the forecast period. The self-expandable stents segment accounted for 69.11% of the market share in 2026.

The balloon-expandable segment is anticipated to witness stable growth during the forecast period. The high burden of cardiovascular disorders and growing research on the development of technologically advanced medical stents are some of the factors expected to fuel the segment’s growth throughout the forecast period.

- For instance, according to Heart and Circulatory Disease Statistics 2023, published by the British Heart Foundation (BHF) in August 2023, the prevalence of coronary heart disease and atrial fibrillation was 3.1% and 1.9%, respectively in the U.K. in 2022.

By Application

Rising Prevalence of Coronary Artery Diseases (CADs) Globally Boosted Product Use in CCS

Based on application, the market is categorized into Acute Coronary Syndrome (ACS) and Chronic Coronary Syndrome (CCS).

The Chronic Coronary Syndrome (CCS) segment held the largest market share in 2026 with 89.21% owing to the rising cases of cardiovascular diseases, including Coronary Artery Diseases (CADs). The growing initiatives by market players to launch coronary stents are an additional factor that will drive the segment’s growth throughout the forecast period.

- For instance, as per the data provided by the Journal of the American College of Cardiology in April 2024, there were 315 million cases of Coronary Artery Disease (CAD) globally in 2022.

The Acute Coronary Syndrome (ACS) segment is expected to grow throughout the forecast period. The increasing number of Percutaneous Coronary Intervention (PCI) procedures for the treatment of acute coronary syndrome is one of the main factors that will drive the segment’s growth in the future.

- For instance, according to data provided by Elsevier B.V. in October 2024, from 2006 to 2021, around 743,149 PCI procedures were carried out among patients aged between 18 and 100 years for Acute Coronary Syndrome (ACS) in England and Wales.

By End-user

Growing Number of Healthcare Facilities for Providing Efficient Treatment Increased Product Use in Hospitals & ASCs

Based on end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment dominated the global coronary stents market in 2024. The segment is projected to hold a significant market share due to the growing number of critical cardiovascular surgeries, such as angioplasty, which are predominantly performed in hospitals & ASCs. Moreover, the opening of new hospitals and ambulatory surgical centers providing advanced treatment for cardiovascular diseases is one of the additional factors that will drive the segment’s growth during the forecast period.

- For instance, in October 2024, Compass Surgical Partners, Bon Secours Mercy Health, and AlignedCardio announced their plans to open a cardiovascular ambulatory surgery center in late 2025 in the Short Pump area of Henrico, Virginia. This facility will offer a range of procedures, including diagnostic heart catheterization, coronary interventions, peripheral interventions, pacemakers, and Automatic Implantable Cardioverter Defibrillator (AICD) implantations.

The specialty clinics segment held a moderate market share in 2024 and is expected to record a moderate CAGR during the forecast period. The segment’s moderate growth is attributed to factors, such as the increasing number of specialty clinics and cardiologists across the world. Additionally, increasing awareness among individuals regarding the various advantages of coronary stents is another key factor drawing the patient population toward these facilities, thus augmenting the segment’s growth during the forecast period.

The others segment is also expected to grow throughout the forecast period. The increasing number of catheterization laboratories across the globe for the treatment of coronary artery diseases is one the main factors that will drive the segment’s growth throughout the forecast period.

COROONARY STENTS MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America Coronary Stents Market Size 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market in 2025, accounting for USD 2.35 billion of the global market value. This was due to the presence of an advanced healthcare infrastructure in this region. Moreover, the market in North America is expected to register the highest CAGR during the forecast period owing to the increasing regulatory approvals and product launches.

In addition, the rising prevalence of Coronary Artery Disease (CAD) has led to the increasing demand for coronary stenting procedures, which is an additional factor expected to drive the market’s growth in the U.S.

- For example, as per the data provided by Elsevier B.V. in August 2024, the overall prevalence of CAD among U.S. adults increased from 4.6% in 2019 to 4.9% in 2022.

Europe:

Europe held a moderate market share in 2024 and is expected to grow moderately throughout the forecast period. This is due to the growing emphasis of market players on receiving regulatory approvals for the launch of coronary stents in the regional market. The UK market is valued at USD 0.51 billion by 2026, while the Germany market is valued at USD 0.64 billion by 2026.

- For instance, in August 2022, Medtronic announced the European CE Mark approval and launch of its Onyx Frontier Drug-Eluting Stent (DES) for the treatment of patients with coronary artery disease.

Asia Pacific:

The coronary stent market in Asia Pacific is expected to grow throughout the forecast period owing to a large patient pool suffering from coronary artery diseases and improvement in the region’s healthcare facilities. Moreover, the opening of new hospitals, catheterization laboratories, and specialty clinics in the region are some of the factors boosting the market’s growth. The Japan market is valued at USD 0.25 billion by 2026, the China market is valued at USD 0.39 billion by 2026, and the India market is valued at USD 0.33 billion by 2026.

Additionally, the growing strategic initiatives by manufacturers for the launch of these devices in the Asia Pacific market is an additional factor driving the market’s growth in this region.

- For example, in December 2023, Terumo Corporation announced the launch of Ultimaster Nagomi, a drug-eluting stent in the Indian market. This device is intended to treat coronary artery disease.

Latin America:

The market is projected to grow at a steady rate in Latin America. The market’s growth in this region is attributed to the rising cases of coronary artery diseases.

Middle East & Africa:

The coronary stent market in the Middle East & Africa is expected to grow during the forecast period owing to the rising number of angioplasty surgeries.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing Focus of Market Players on Strategic Acquisitions to Enhance their Product Offerings Will Boost Companies' Revenue Growth

Abbott, Medtronic, Boston Scientific Corporation, and BIOTRONIK SE & Co. KG are among the major players accounting for a significant portion of the global coronary stents market share in 2024. The significant presence of these companies in the market is attributed to their focus on expanding their product offerings for the treatment of coronary artery disease.

- For instance, in February 2023, Abbott announced the acquisition of Cardiovascular Systems, Inc. (CSI), a company that provides medical devices used to treat peripheral and coronary artery diseases.

Moreover, other players, such as Terumo Corporation, MicroPort Scientific Corporation, and B. Braun SE have been focusing on conducting clinical trials to develop novel cardiac stents, an important factor driving the market’s growth. Also, the growing focus of market players on receiving regulatory approvals for the launch of coronary stents is one of the additional factors driving the market’s progress.

- For instance, in July 2024, MicroPort Scientific Corporation announced that its wholly-owned subsidiary, Shanghai MicroPort Medical (Group) Co., Ltd., received official market approval from the National Medical Products Administration (NMPA) for Firesorb, the world's first next-generation fully bioresorbable cardiac stent.

LIST OF KEY CORONARY STENTS COMPANIES PROFILED:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- BIOTRONIK SE & Co. KG (Germany)

- Terumo Corporation (Japan)

- Abbott (U.S.)

- Relisys Medical Devices Limited. (India)

- Braun SE (Germany)

- MicroPort Scientific Corporation (China)

- Stentys S.A. (France)

- Meril Life Sciences Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 - Terumo Corporation announced the start of a new prospective clinical study on Ultimaster Nagomi sirolimus-eluting coronary stent system in complex Percutaneous Coronary Intervention (PCI) patients.

- November 2022 - Terumo Corporation announced that it had received the CE mark approval for its Ultimaster Nagomi sirolimus-eluting coronary stent system.

- December 2021 - Shanghai MicroPort Medical (Group) Co., Ltd. received regulatory approval from the Australian Therapeutic Goods Administration (TGA) for its Firehawk Rapamycin target eluting coronary stent system. With this approval, the company started offering its coronary stent product in the Australian market.

- April 2019 - BIOTRONIK SE & Co. KG announced the commercial launch of the PK Papyrus-covered coronary stent system in the U.S. market. This product is used in the emergency treatment of acute coronary perforations.

- February 2019 - BIOTRONIK SE & Co. KG received the U.S. Food and Drug Administration (FDA) approval for its Orsiro Drug-Eluting Stent (DES) system.

REPORT COVERAGE

The global coronary stents market research report provides a detailed competitive landscape and market insights. The report focuses on key aspects, such as competitive landscape, stent type, material type, deployment, application, end-user, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the market size, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.54% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Stent Type, Material Type, Deployment, Application, End-user, and Region |

|

By Stent Type |

· Drug Eluting Stent · Covered Stent · Bare Metal Stent · Bioresorbable Stent · Others (Dual Therapy Stents) |

|

By Material Type |

· Metal · Polymer |

|

By Deployment |

· Self-expandable · Balloon-expandable |

|

By Application |

· Acute Coronary Syndrome (ACS) · Chronic Coronary Syndrome (CCS) |

|

By End-user |

· Hospitals & ASCs · Specialty Clinics · Others |

|

By Region |

· North America (By Stent Type, Material Type, Deployment, Application, End-user, and Country) o U.S. o Canada · Europe (By Stent Type, Material Type, Deployment, Application, End-user, Country/Sub-Region) o Germany o U.K. o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Stent Type, Material Type, Deployment, Application, End-user, Country/Sub-Region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Stent Type, Material Type, Deployment, Application, End-user, Country/Sub-Region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Stent Type, Material Type, Deployment, Application, End-user, Country/Sub-Region) o GCC o South Africa o Rest of Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 7.38 billion in 2026 and is projected to reach USD 12.26 billion by 2034, exhibiting a CAGR of 6.54% during the forecast period.

In 2025, the market value in North America stood at USD 2.35 billion.

The market will exhibit steady growth at a CAGR of 6.54% during the forecast period of 2026-2034.

By stent type, the drug eluting stent segment led the market.

Growing healthcare infrastructure, increasing medical workforce, entry of new market players, and launch of new products are the key drivers of the market.

Medtronic, Terumo Corporation, Boston Scientific Corporation, and Abbott are the major players in the market.

North America dominated the market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us