Cardiovascular Stents Market Size, Share and Industry Analysis By Product Type (Coronary Stenting, Peripheral Stenting), Stent Type (Drug Eluting Stents (DES), Bioresorbable Stents, Bare Metal Stents & Others), Disease Indication (Venous Disease, Arterial Disease), End User and Regional Forecast, 2026- 2034

Cardiovascular Stents Market Size and Industry Outlook

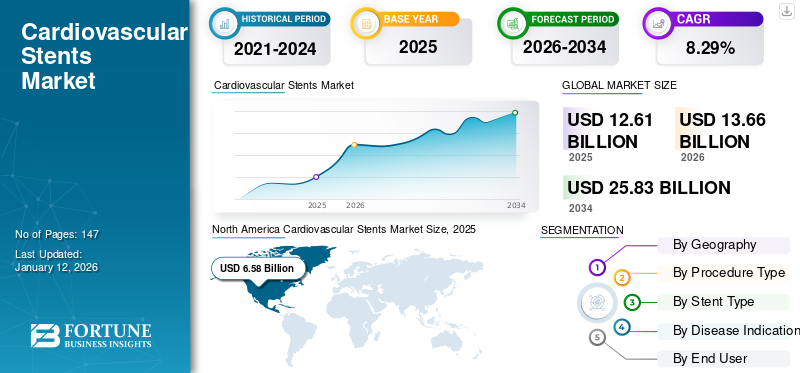

The cardiovascular stents market size was valued at USD 12.61 billion in 2025 The market is projected to grow from USD 13.66 billion in 2026 to USD 25.83 billion by 2034, exhibiting a CAGR of 8.29% during 2026-2034. North America dominated the global market with a share of 52.16% in 2025.

Cardiovascular diseases are becoming increasingly common across the globe. Lifestyle-related heart diseases such as obesity and atherosclerosis are the key factors associated with the rising patient pool for invasive & minimally invasive procedures such as angioplasty.

Angioplasty or percutaneous coronary intervention is a procedure that involves permanent placement of a tiny mesh tube, called a stent, to wide open the clogged artery or vein. The stent keeps the coronary & peripheral vasculature (arteries & veins) wide open, compressing the plaques, and reduces the chances of a heart attack. A consistent rise in the incidence of coronary artery diseases owing to the rapid adaption of a sedentary lifestyle by people around the world is a key factor associated with the rising procedures of percutaneous coronary intervention. Moreover, the introduction of technologically advanced stents by key manufacturers across the globe is projected to boost the cardiovascular stents market share between 2025 and 2032.

Download Free sample to learn more about this report.

Cardiovascular Stents Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 12.61 billion

- 2026 Market Size: USD 13.66 billion

- 2034 Forecast Market Size: USD 25.83 billion

- CAGR: 8.29% from 2026–2034

Market Share:

- North America dominated the cardiovascular stents market with a 52.16% share in 2025, driven by a high prevalence of coronary artery disease, availability of skilled interventional cardiologists, and the continued rollout of advanced stents approved by regulatory bodies like the FDA.

- By type, drug-eluting stents (DES) are expected to retain the largest market share throughout the forecast period, supported by the introduction of next-generation drug-eluting platforms and enhanced clinical outcomes in comparison to bare-metal and bioresorbable stents.

Key Country Highlights:

- Japan: Technological advancements and the presence of leading medical device companies are boosting innovation and adoption of minimally invasive cardiovascular interventions.

- United States: Ongoing clinical trials and regulatory approvals (e.g., Medtronic’s Resolute Onyx and Abbott’s Absorb GT1) support market growth; increasing procedural volumes due to sedentary lifestyle-related conditions like obesity and diabetes also drive demand.

- China: Improving healthcare infrastructure and widespread access to interventional cardiology procedures are contributing to robust market expansion; local manufacturing is also increasing accessibility.

- Europe: Favorable reimbursement policies and CE approvals for advanced stents such as XIENCE Sierra are supporting growth; arterial disease burden and aging population further fuel adoption.

Market Segmentation

"Coronary Stenting Procedure Type to Account for Highest Market Share by 2025"

Increasing investment by emerging players in the research and development (R&D) of coronary stents to introduce novel & advanced coronary stents such as bioresorbable stents, bioengineered stents, etc. is a key factor associated with the rising uptake of coronary stents in the global market. The coronary stents market segment is expected to lead the market, contributing 64.23% globally in 2026.

To know how our report can help streamline your business, Speak to Analyst

In terms of stent type, the market is categorized into drug-eluting stents (DES), bare-metal stents, bioresorbable stents, and others. Of these, drug-eluting stents are expected to dominate the market throughout the forecast period owing to the introduction of next-generation drugs for DES by key companies.The Drug Eluting Stents (DES) segment is expected to lead the market, contributing 68.55% globally in 2026. Various disease indications in the cardiovascular stents market are venous diseases and arterial diseases. The arterial diseases segment is projected to dominate the market with a share of 78.53% in 2026. The venous disease segment is anticipated to grow with a maximum CAGR during 2025-2032. On the basis of end-user, the market is segmented into hospitals, ambulatory surgery centers, specialty clinics, and catheterization labs. The Hospitals segment is anticipated to hold a dominant market share of 42.15% in 2026.

Regional Analysis

North America

North America Cardiovascular Stents Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

"Government Participation in Price Capping of Cardiovascular Stents Augmenting the Market in the Asia Pacific at Highest CAGR"

North America generated USD 6.58 billion in revenue in 2025 and is expected to remain dominant throughout the forecast period. Market leadership is supported by ongoing clinical trials for novel stent technologies and timely regulatory approvals, which accelerate commercialization and adoption. A high burden of cardiovascular diseases and strong reimbursement frameworks further sustain demand. The U.S. market is projected to reach USD 3.2 billion by 2026.

Asia Pacific

Asia Pacific is likely to grow at a significant CAGR during the forecast period. Improved distribution networks by manufacturers and distributors in China and Australia are propelling market growth. Additionally, price capping of stents in India to enhance accessibility is boosting uptake, positioning India as a key growth contributor during 2025–2032. The Japan market is projected to reach USD 0.45 billion by 2026, the China market is projected to reach USD 0.72 billion by 2026, and the India market is projected to reach USD 0.62 billion by 2026.

Europe

Europe’s cardiovascular stents market growth is driven by high procedure volumes for coronary interventions and steady adoption of advanced drug-eluting and bioresorbable stents. Strong clinical guidelines and public healthcare coverage support consistent utilization across major markets. The UK market is projected to reach USD 0.99 billion by 2026, while the Germany market is projected to reach USD 1.34 billion by 2026.

Latin America

Latin America growth is supported by expanding access to interventional cardiology procedures and gradual modernization of hospital infrastructure. Increasing penetration of cost-effective stents is improving adoption.

Middle East & Africa

The Middle East & Africa market to grow with rising cardiovascular disease prevalence and increasing investments in tertiary healthcare facilities. Government initiatives to strengthen cardiac care services are improving procedural volumes.

Key Market Drivers

"Abbott, Medtronic, and Boston Scientific Corporation leading the global market"

The current vendor landscape in the market is consolidated owing to the remarkable distribution network of major companies in emerging economies. However, ongoing clinical studies being funded by public & private players is expected to increase the number of companies in the global market during the forecast period. Currently, Abbott, Medtronic, and Boston Scientific Corporation lead the market together constituting maximum market share. The scenario is likely to change owing to the market fluctuations in India. In 2025, Abbott withdrew its leading XIENCE Alpine stent from the Indian market, which is expected to affect its leading position in the global market during 2025-2032. Other players operating in the global cardiovascular stents industry are Biotronik SE & Co. KG, Cardinal Health, Cook, C. R. Bard, Inc., MicroPort Scientific Corporation, Terumo Corporation, B. Braun Melsungen AG, and others.

KEY COMPANIES MENTIONED IN REPORT

- Biotronik SE & Co. KG

- Cardinal Health

- Cook

- C. R. Bard, Inc.

- MicroPort Scientific Corporation

- Terumo Corporation

- B. Braun Melsungen AG

- Abbott

- Boston Scientific Corporation

- Medtronic

- Other players

REPORT OVERVIEW

Recent advancements in cardiac care are increasing awareness about cardiovascular diseases across the globe. The advancements in the percutaneous coronary interventions are improving the operational capabilities and reducing errors. The efficiency of stent placements is being enhanced owing to the availability of well-qualified interventional cardiologists across the globe.

The report provides qualitative and quantitative insights on the cardiovascular stents industry and detailed analysis of market size & growth rate for all possible segments in the market. The market is segmented on the basis of procedure type, stent type, disease indication, and end-user. On the basis of procedure type, the cardiovascular stents market is categorized into coronary stenting & peripheral stenting. Various stent types covered in the report are drug-eluting stents (DES), bioresorbable stents, bare-metal stents, and others. In terms of disease indication, the market is categorized into venous diseases & arterial diseases, while various end-users in the report are hospitals, ambulatory surgery centers, specialty clinics, and catheterization labs. Geographically, the market is segmented into five major regions, which are North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The regions are further categorized into countries.

Along with this, the report provides an elaborative analysis of the cardiovascular stents market value dynamics and competitive landscape. Various key insights provided in the report are the prevalence of key cardiovascular diseases (Peripheral Artery Diseases & Coronary Artery Diseases) by major countries, pricing analysis, recent industry developments such as partnerships, mergers & acquisitions, a regulatory scenario for key countries, and health reimbursement scenario for key countries.

Request for Customization to gain extensive market insights.

Key Industry Developments

- In February 2018, Medtronic announced the FDA approval and launch of Resolute Onyx 2.0 mm Drug-Eluting Stent (DES), which the smallest size Drug-Eluting Stent (DES) available in the market.

- In October 2017, Abbott received CE approval for XIENCE Sierra, an everolimus-eluting coronary stent system for sale in all the CE mark countries

- In July 2016, Abbott received FDA approval for Absorb GT1 BVS, an absorbable stent for the treatment of coronary artery disease.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 8.29% from 2026 to 2034 |

|

By Product Type |

|

|

By Stent Type |

|

|

By Disease Indication |

|

|

By End User |

|

|

By Geography |

|

Frequently Asked Questions

Based on the detailed study conducted by Fortune Business Insights, the cardiovascular stents market was valued at USD 12.61 Billion in 2025.

Fortune Business Insights has estimated the value of the cardiovascular stents market at USD 25.83 Billion in 2034.

The cardiovascular stents market is projected to grow at a CAGR of 8.29% during the forecast period (2026-2034).

Cardiovascular stents market in North America generated a revenue of USD 6.58 Billion in 2025.

Increasing investment in research and development of advanced cardiovascular stents is driving the growth of global cardiovascular stents market.

Medtronic, Abbott, B. Braun Melsungen AG and Terumo Corporation are the companies that dominated the market in 2024.

Based on the analysis done by Fortune Business Insights, the cardiovascular stents market is expected to witness diverse opportunities due to the increasing prevalence of cardiovascular diseases and improving reimbursement policies in emerging countries.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us