Cryogenic Equipment Market Size, Share & Industry Analysis, By Product (Tank, Valve, Vaporizer, Pump, Actuator, Bayonet Connection, and Others), By Cryogen Type (Nitrogen, Oxygen, Argon, Liquefied Natural Gas, Hydrogen, Helium, and Others), By End-User (Oil and Gas, Metallurgy, Power Generation, Chemical and Petrochemical, Marine, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

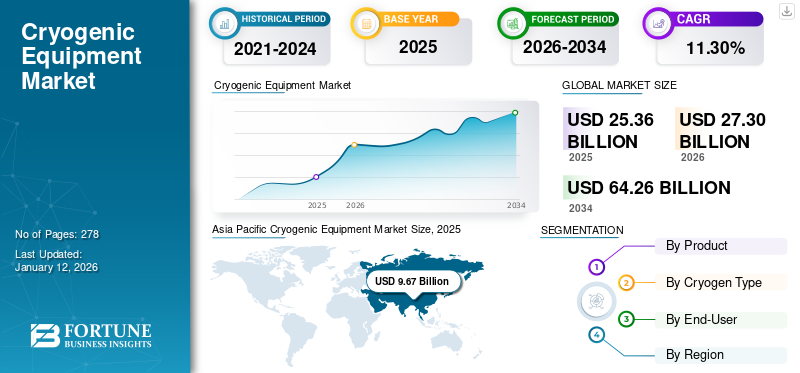

The global cryogenic equipment market size was valued at USD 25.36 billion in 2025. The global market is projected to grow from USD 27.3 billion in 2026 to USD 64.26 billion by 2034, exhibiting a CAGR of 11.30% during the forecast period. AsAsia Pacific dominated the cryogenic equipment market with an industry share of 38.15% in 2025.

The rising interest in liquefied natural gas (LNG) as a cleaner energy source has driven demand for cryogenic equipment. LNG facilities require specialized cryogenic systems for storage and transportation, leading to increased investments in this sector. Innovations in cryogenic technology have improved efficiency and reliability. Enhanced designs and materials improve performance in extremely low-temperature environments, making cryogenic equipment more appealing to various industries.

The aerospace industry, which utilizes cryogenic technology for rocket propulsion and satellite cooling systems, is experiencing growth. This increasing activity requires advanced cryogenic solutions, contributing to market growth.

Chart Industries specializes in designing and manufacturing equipment used in the storage, distribution, and processing of cryogenic gases, including liquefied natural gas (LNG), hydrogen, and biogas. Their products include cryogenic tanks, vaporizers, and related systems.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Liquefied Natural Gas (LNG) Acting as a Catalyst to Drive Market Growth

The demand for LNG is increasing, as LNG is a crucial transition fuel that bridges the gap between conventional fossil fuels and renewable energy sources. According to Shell's LNG Outlook 2024, the global LNG trade is anticipated to expand significantly over the next several years. This growth is due to the increasing demand in Asia, especially in China and India, and the need for energy security in Europe.

The expansion of facilities for floating LNG (FLNG) is another factor driving the cryogenic equipment market growth. These offshore installations require specific cryogenic equipment to withstand severe sea conditions. For instance, in November 2021, Technip Energies declared that the Coral Sul floating liquefied natural gas (FLNG) unit had sailed to Mozambique. Nearly 3.4 Mtpa of liquefied natural gas might be produced by the floating liquefied natural gas (FLNG) facility. It was anchored in Area 4, off the coast of Mozambique, at a depth of 2,000 meters. The project was granted to TechnipFMC in 2017, along with Samsung Heavy Industries and JGC Corporation. It addressed the installation of the umbilical and subsea equipment, and the Engineering, Procurement, Construction, Installation, Commissioning, and Start-up (EPCIC) of the Coral South FLNG facility and the risers and subsea flowlines system that are connected to it.

Growing Healthcare and Pharmaceutical Sectors to Expand Applications of Cryogenic Technology

To preserve biological samples, such as blood, tissues, and cells, at extremely low temperatures for long-term preservation, clinical trials, and research, cryogenic freezers and storage systems are essential. Cryogenic storage of patient-specific samples is becoming more and more crucial as customized medicine and regenerative therapies gain traction.

Furthermore, the COVID-19 pandemic highlighted the importance of cryogenic freezers for storing vaccines at extremely low temperatures. Pfizer-BioNTech and Moderna developed mRNA vaccines that required storage at -70°C and -20°C, respectively, which led to a rise in demand for cryogenic freezers and related equipment. It is projected that even after the pandemic, the infrastructure established for vaccine storage will continue to support the growth of the market in the healthcare sector. The development of new vaccines and biopharmaceuticals that require cryogenic storage will continue to drive the need for advanced cryogenic solutions.

MARKET RESTRAINTS

High Initial Investment and Operating Costs Expected to Hamper Market Expansion

Cryogenic equipment manufacturing is complex and requires specific engineering, materials, and production techniques, making it overall costly. Additionally, maintaining ultra-low temperatures and cooling requires a lot of energy, raising the running costs for cryogenic equipment.

Liquid nitrogen, liquid helium, and LNG are examples of cryogenic fluids that can be expensive, particularly when prices fluctuate globally. For example, due to supply shortages and rising demand, especially in the MRI industry, liquid helium prices have fluctuated in recent years. Due to this pricing volatility, companies find it challenging to budget for cryogenic operations, which may also deter them from investing in new cryogenic equipment.

Moreover, the stringent safety regulations and standards for cryogenic facilities increase the overall cost of investment. Projects become more complex as a result of the particular knowledge and tools required to comply with these rules.

Due to the high maintenance costs, many end users are reluctant to purchase certain pieces of equipment. In addition, finding the right specialists to manage complex operations is also challenging.

MARKET OPPORTUNITIES

Advancements in Cryogenic Technologies Paving the Way for New Applications and Efficiencies

The development and construction of more effective and economical cryogenic systems is made possible by advancements in materials science, such as the creation of lightweight, high-strength alloys and composite materials. These cutting-edge materials can tolerate high pressures and temperatures, which lightens the weight of cryogenic equipment and saves money on transportation. Cryogenic storage and transportation systems also use less energy and decrease heat losses thanks to advancements in insulation technologies, including vacuum insulation panels (VIPs) and multilayer insulation (MLI). For example, cryogenic fluids may now be transported over great distances with minimal loss thanks to new, creative vacuum-insulated pipelines.

Furthermore, the performance and dependability of cryogenic equipment are being improved using digital technologies, including artificial intelligence (AI) and the Internet of Things (IoT). Predictive maintenance and equipment failure prevention are made possible by IoT sensors' real-time monitoring of temperature, pressure, and other vital data.

MARKET CHALLENGES

Supply Chain Disruptions to Restrain Market Growth

Disruptions in the supply chain can lead to longer lead times for obtaining raw materials and components for manufacturing cryogenic equipment. This can delay production schedules and hinder timely delivery to customers. Supply chain issues often result in increased costs for materials and logistics. Manufacturers face higher prices for essential components, which can squeeze profit margins or force them to pass these costs on to customers.

The market relies on specialized materials often sourced from limited suppliers. Disruptions lead to shortages of critical materials, impacting production capabilities and potentially leading to project cancellations or delays.

CRYOGENIC EQUIPMENT MARKET TRENDS

Increased Investment in Research and Development to Drive Market Expansion

R&D efforts focused on discovering and engineering new materials are one of the cryogenic equipment market trends. The R&D effort is on thermal insulation properties, durability, and other factors. These advancements can lead to more efficient cryogenic systems that require less energy to maintain low temperatures.

Companies are investing in R&D to improve the overall performance of cryogenic systems, including refrigeration cycles and energy efficiency. Innovations in compressor technology, heat exchangers, and control systems can lead to reduced operational costs and improved reliability. Research is being directed toward integrating smart technologies into cryogenic equipment. This includes the use of sensors, IoT devices, and data analytics to enable real-time monitoring and optimization of system performance, predictive maintenance, and enhanced safety protocols.

For instance, the TACOMA project explores the development, production validation, and testing of cryogenic hydrogen tanks in composite design for passenger aircraft, specifically focusing on the inner tank shells. TACOMA is a joint collaboration of the aviation research program led by Airbus Operations GmbH and LuFo VI (3rd call), with an R&D duration from 2023 to 2026. In addition to the DLR Institutes of Structures and Design, Lightweight Systems, Maintenance, Repair and Overhaul, and Space Systems, INVENT GmbH, Lufthansa Technik AG, Ostseestaal GmbH & Co. KG, and Broetje-Automation GmbH are also part of this program.

Download Free sample to learn more about this report.

IMPACT OF TARIFF

The Trump Administration has placed tariffs on both foreign industrial and agricultural goods to help boost domestic production. The main targets of these tariffs are steel and aluminum, with considerable tariffs on all imports of these metals, including any products made from them.

While President Donald Trump's unpredictable tariff strategy and some retaliatory actions from key trading partners are not expected to cause immediate chaos in global gas markets, they will directly affect the future capacity for U.S. liquefaction.

Starting March 12, 2025, Trump's 25% tariffs on foreign steel and aluminum will raise infrastructure expenses in the U.S. upstream and midstream sectors. This creates a pressing challenge for U.S. LNG developers, especially for the five projects currently under construction and the six more that are set to make final investment decisions this year.

This situation could have a major impact on the natural gas supply. It might pose challenges for cryogenic equipment, especially since LNG is one of the primary cryogenic types available in the market.

SEGMENTATION ANALYSIS

By Product

Need for Ultra-low Temperature Storage Propels Tank Segment Growth

By product, the market covers tank, valve, vaporizer, pump, actuator, bayonet connection, and others.

The tank segment dominates the market with a share of 32.67% in 2026. It serves as the primary storage unit for liquefied gases such as LNG, liquid nitrogen, oxygen, argon, and hydrogen. These tanks are essential for safe, insulated, and long-term storage at ultra-low temperatures.

Cryogenic valves are the second dominating segment in the market and are used in liquefied natural gas and gas processing. They are mainly used to control the flow of LNG and other cryogenic fluids in processing plants, pipelines, and storage tanks. They must operate under low temperatures and high-pressure differences in cryogenic applications. Cryogenic valves must offer a tight shutoff to avoid leakage and ensure that LNG can be safely transported.

By Cryogen Type

Rising Liquefaction Capacity of Liquefied Natural Gas Drives Segment Growth

Based on cryogen type, the market is segmented into nitrogen, oxygen, argon, liquefied natural gas, hydrogen, helium, and others.

LNG is the major cryogen type segment accounting for 34.69% market share in 2026. The liquefaction capacity of natural gas is increasing, which is consequently increasing the demand for cryogenic equipment. According to the LNG outlook report of the Institute of Energy Economics and Financial Analysis, by 2028, global total nameplate liquefaction capacity may reach as high as 666.5 MTPA. To put this in perspective, the International Energy Agency (IEA) estimates total LNG trade in 2050 to be 482 MTPA under its stated scenario. LNG liquefaction capacity will arrive online between 2028 and surpass the IEA’s long-term demand projections.

Oxygen is one of the fastest-growing segments in the market and plays a vital role in many industries, such as aerospace, pharmaceutical, medical, and metallurgy. Oxygen is used in the aerospace sector for rocket engine propellant combustion and cryogenic cooling systems. It is also utilized in advanced manufacturing techniques that involve ultra-low temperatures and highly specific atmospheric conditions.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Rising Global LNG Demand Drives Oil and Gas Segment Growth

Based on the end-user segment, the global market covers oil and gas, metallurgy, power generation, chemical and petrochemical, marine, and others.

The oil and gas industry is the dominating segment in the market with a share of 44.84% in 2026. It is used for storing, transporting, and processing liquefied natural gas. LNG demand is expected to increase in the coming years due to its rising use in various sectors such as marine, power generation, manufacturing, and others. In addition, the growing city gas distribution sector in emerging economies is also propelling the demand for natural gas.

The chemical and petrochemical industry is also one of the leading segments in the market. Cryogenic equipment finds applications in chemical and petrochemical plants to regulate the flow of cryogenic gases, including nitrogen, oxygen, and helium. These gases are used to clean, feed, and cool, and their low-pressure and high-temperature demand requires special cryogenic equipment. The chemical industry has long been revolutionized by the potential of employing cryogenic systems.

The power generation segment in the cryogenic equipment is growing rapidly due to its expanding role in energy storage, fuel handling, and efficiency optimization.

CRYOGENIC EQUIPMENT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Cryogenic Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Emergence of Hydrogen Economy and Rapid Industrialization to Drive Market Growth

Asia Pacific is the dominating and fastest-growing region in the market. Asia Pacific is a developing economy, and as per the World Economic Forum, it is expected to hold the largest GDP (Gross Domestic Product), owing to rapidly changing consumer behavior, policies to achieve sustainable development, and investment in industrial infrastructure. Increasing investment from FDI (Foreign Direct Investment) also contributes to the growth of the market over the forecast period. The power generation industry is expected to grow in the Asia Pacific region due to favorable macroeconomic factors. This increasing demand for energy is leading to the construction of transportation and storage infrastructure. The Japan market is projected to reach USD 2.18 billion by 2026.

India

Rising Industrial Demand Drives Expansion of India’s Gas Delivery Systems

India is one of the major markets, with some players demonstrating extraordinary potential. For instance, in 2024, Ellenbarrie Industrial Gases Ltd (EIGL) is among the few companies to have separate plants for every mode of gas delivery system - pipeline, merchant liquid, and cylinder filling. It has a strong distribution network with India's third-largest number of transport tankers, cylinders, and customer installations. In terms of bulk distribution capacity, EIGL's fleet of cryogenic transport tankers in service is one of the largest in India. India market is projected to reach USD 1.83 billion by 2026.

China

China’s Established Consumer Base is Driving Market Growth

China holds a considerable share of the market, owing to an established consumer base, including chemicals and petrochemicals, oil and gas, metallurgy, and others. In addition, China not only leads in the hydrogen sector but also in the LNG sector. It has considerable gas-based power generation capacity. According to Hydrogen Review 2024 (IEA, Clean Energy Ministerial), China is one of the largest hydrogen users, accounting for most global demand. China market is projected to reach USD 3.85 billion by 2026.

North America

Fast Growth in AI-Fueled Data Centers Is Surging Electricity Demand Across Region

The fast growth in artificial intelligence (AI)-fueled data centers and the industrial reshoring wave are driving a spike in electricity demand worldwide, with power markets racing to ensure a secure supply. The U.S. is playing a key role in the AI revolution and is expected to boost the demand for energy infrastructure, including LNG.

In addition, according to EIA, in 2025, the increase in natural gas demand, including domestic consumption and exports, will surpass the increase in supply, including domestic production and imports. According to their projections, consumption and exports rise by nearly 3%, or 3.2 billion cubic feet per day (Bcf/d).

Furthermore, the chemical sector is also driving the North America cryogenic equipment market share. As the U.S. has intense product identification and quality, availability of cheap natural gas, an educated workforce, world-class research facilities, intellectual property protection, and a sound regulatory framework, it renders the country a competitive base for chemical companies worldwide.

U.S.

Increased Focus on LNG to Drive Market Growth

The U.S. has become a major player in liquefied natural gas (LNG), driven by both domestic consumption and export opportunities. The need for efficient cryogenic storage and transportation systems to handle growing LNG usage is fueling cryogenic equipment demand. As the country shifts toward cleaner energy sources, it might experience slower growth due to changes in government policy. In addition, hydrogen is also gaining traction as a viable alternative. Developing hydrogen production, storage, and distribution infrastructure requires specialized cryogenic solutions, leading to increased investments in cryogenic technologies. The U.S. market is projected to reach USD 4.97 billion by 2026.

Europe

Investment in Hydrogen Infrastructure to Drive Market Growth

According to the Global Hydrogen Review, hydrogen trucks carry storage tanks with a total capacity of approximately 8 to 12 times that of light-duty vehicle tanks. Thus, by using the latest technology, the fill time is similarly longer for trucks. Government and industry stakeholders are collaborating to create technologies and procedures for high-throughput, heavy-duty hydrogen refueling.

As part of the joint European H2Haul project, in September 2022, Air Liquide will commission a 1-ton-per-day dual-pressure hydrogen refueling station capable of refueling cars and trucks. Although, as of now, flow rates are restricted to approximately 60 grams per second (g/s), similar to refueling stations for light-duty vehicles. Once new nozzles become available in 2023-24, the station will be upgraded to deliver flow rates two to three times greater. The UK market is projected to reach USD 1.14 billion by 2026, while the Germany market is projected to reach USD 2.03 billion by 2026.

Latin America

Increasing Energy Sector Development to Drive Market Growth

According to the IEA, Brazil's natural gas demand grew by an estimated 23% year-over-year during the first nine months of 2021. Demand growth from the power generation sector, which soared by over 93%, was supplemented by a 15% year-over-year increase in industrial sector consumption. This is also a factor driving the demand for more drilling of offshore wells across the region.

As per the IEA, Brazil's gas consumption for power generation remained the region's main growth driver throughout the southern hemisphere due to deficient hydro reservoir levels. It further increased the demand for well drilling to meet Brazil's power generation needs.

Brazil has taken a significant step forward by launching the Brazilian Hydrogen Certification Scheme (SBCH2). They have enacted legislation that establishes a greenhouse gas (GHG) threshold of 7 kg CO2-eq/kg H2 for low-carbon hydrogen.

Middle East & Africa

Diversification of Energy Sources to Drive Market Growth

The Middle East & Africa is the prominent region involved in the business of oil and gas, as it holds 50% of the world's proven conventional natural gas reserves.

Gulf countries in the Middle East are primarily involved in transporting and storing cryogenic liquid and natural gas. Hence, it drives the application of cryogenic equipment in the Middle East & Africa markets. Many countries in the Middle East & Africa region are seeking to diversify their energy portfolios to include cleaner energy sources. This includes investments in renewable energy and hydrogen production, which require advanced cryogenic technologies for storage and transportation.

As per the International Gas Union (IGU) LNG report, the Middle East was the second-largest exporting region, with a total of 94.69 million tons in 2023. This marks a decrease of 1.84 million tons from the 96.53 million tons recorded in 2022.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Market Players are Adopting Expansion Strategies to Increase Market Share and Global Presence

The global market is mostly fragmented, with key players operating across the industry. Companies in the cryogenic equipment industry remain active through various developments such as product launches and business expansions. For instance, Chart Industries Inc., one of the dominating players in the market, acquired CSC Cryogenic Service Center AB, a Swedish business, for USD 4 million in May 2022. After Chart is able to expand its service and repair presence geographically due to CSC's robust service network in the Nordic Region and numerous overlapping clients, this localized assistance will be beneficial. It will support its robust installed base of original equipment (OE) and its ongoing OE expected growth in the Nordic region.

List of Key Cryogenic Equipment Companies Profiled

- Chart Industries, Inc. (U.S.)

- Cryofab, Inc. (U.S.)

- Linde PLC (U.K.)

- Nikkiso Co., Ltd (Japan)

- Air Liquide (France)

- SHI Cryogenics Group (Japan)

- HEROSE (Germany)

- Wessington Cryogenics (U.K.)

- Air Products and Chemicals Inc. (U.S.)

- INOX India Ltd (INOXCVA) (India)

- Parker-Hannifin Corporation (U.S.)

- SLB (U.S.)

- Flowserve Corporation (U.S.)

- FIVES (France)

- Emerson Electric Co. (U.S.)

- PHPK Technologies (U.S.)

- Marshall Excelsior Co. (U.S.)

- HABONIM (Denmark)

- Acme Cryogenics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Linde signed an agreement to design and construct one of the biggest cryogenic cooling facilities in the world to support a utility-scale quantum computer run by PsiQuantum, a computing startup in Brisbane, Australia. After the project's completion, tens of thousands of photonic chips will be cooled to -269°C, or near absolute zero, by the plant, allowing PsiQuantum's system to sustain the quantum states required for scalable quantum computation.

- April 2025: Nikkiso Co., Ltd. announced that Kawasaki Heavy Industries, Ltd. (Kawasaki) placed an order with Nikkiso for a pump unit for hydrogen-fueled ships. The pump unit will be created by fusing hydrogen stations' technologies with LNG-fueled marine items. Delivery of this is planned for 2026.

- February 2025: Air Liquide reached a new milestone in 2024 when nearly 70 pieces of its Turbo-Brayton cryogenic equipment were ordered during the year. This demonstrates the Group's ability to provide creative and effective technology solutions that lead to complete industrialization in order to satisfy pressing market requirements.

- December 2024: Cryofab announced the purchase of Cryocomp Inc., a California-based cryogenic valve producer with a focus on vacuum valve assemblies. As a fully-owned subsidiary of Cryofab, the new business will continue to operate under the name Cryocomp Inc. Apart from being one of the leading providers of cryogenic valves, Cryocomp also offers experience in vacuum valves, vacuum relief valves, bayonet assembly in pipe and tube sizes, vapor vents and heaters, and helium control valves.

- January 2024: SHI Cryogenics Group introduced the RJT-100 4K GM-JT Cryocooler, adding a unique product option to its cryocooler range. With a maximum capacity of 9.0 W at 4.2 K (50/60 Hz), the RJT-100 Gifford-McMahon/Joule-Thomson (GM-JT) Cryocooler is SHI's newest and largest 4 K cryocooler. The RJT-100 stands out from conventional 4 K Gifford-McMahon and Pulse Tube Cryocoolers due to its exceptional efficiency at 4.2 K.

INVESTMENT ANALYSIS AND OPPORTUNITIES

- In March 2024, the purchase of Marshall Excelsior Company ("MEC") for USD 395 million in cash was announced by Dover. Within Dover's Clean Energy & Fueling sector ("DCEF"), MEC will be integrated into the OPW Global ("OPW") business unit. MEC offers extremely complex flow control equipment for transporting, storing, and utilizing liquefied petroleum gas and other industrial gases. With a full line of fittings, adapters, valves, regulators, pigtails, gauges, and other accessories, MEC delivers distinct performance that satisfies its clients' mission-critical applications with stringent safety, quality, and reliability criteria. In 2023, the company brought in around USD 120 million in sales.

REPORT COVERAGE

The global cryogenic equipment market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations, offering cryogenic equipment services. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 11.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Cryogen Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 27.3 billion in 2026.

The market is likely to grow at a CAGR of 11.30% over the forecast period.

By product, the tank segment leads the market.

The market size of Asia Pacific stood at USD 9.67 billion in 2025.

Rising demand for Liquefied Natural Gas (LNG) is a key factor driving market growth.

Chart Industries Inc., Cryofab, Inc., Linde PLC, and Nikkiso Co., Ltd, among others, are some of the market's top players.

The global market size is expected to reach USD 64.26 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us