Cryogenic Pump Market Size, Share & Industry Analysis, By Type (Positive Displacement Pump and Centrifugal Pump), By Cryogen Type (Nitrogen, Oxygen, Argon, Liquefied Natural Gas, and Other), By End-User (Oil & Gas, Metallurgy, Power Generation, Chemical & Petrochemical, Marine, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

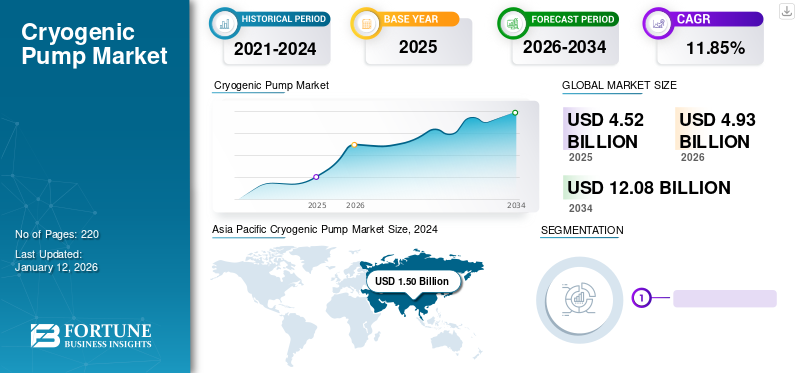

The global cryogenic pump market size was valued at USD 4.19 billion in 2025. The market is projected to grow from USD 4.53 billion in 2026 to USD 7.50 billion by 2034, exhibiting a CAGR of 11.85% during the forecast period. Asia Pacific dominated the global market with a share of 36.94% in 2025. The cryogenic pump market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.47 billion by 2032, driven by the growth in LNG industry and rising demand from healthcare sector.

Cryogenic pumps create, can withstand, and operate in temperatures of -1200 C. They are also used for refrigeration purposes. The major factors driving this market include growing demand for LNG, including power generation, domestic & commercial fuel sectors, growing demand for medical gases in healthcare facilities, and electricity generation from renewable resources.

The remarkable development in the exploration and production of natural gas globally has led to the growth in the demand for liquefied natural gas. Revolution in various fields such as automobile, pharmaceutical, power generation, and manufacturing has led to huge industrialization and urbanization, making liquefied natural gas a vital development element. The pumps help transport the gas to liquid materials at low temperature and high pressures.

The global health crisis caused by the sudden spread of the novel coronavirus damaged every industry. Industries suffered significant losses in operational time due to the imposition of strict rules, such as nationwide lockdowns to limit the spread of the COVID-19 virus. Accordingly, the virus outbreak altered the demand for such pumps. As the market is majorly dependent on the natural gas industry, the industry faced the biggest collapse in a long time, impacting the product's investments. The excess supply and low demand for natural gas forced leading gas companies to temporarily reduce production activities, which ultimately led to a fluctuation in natural gas prices.

Cryogenic Pump Market Trends

Increasing Demand for Liquefied Natural Gas to Augment the Market Growth

Liquefied natural gas is considered as a fuel for the future due to its efficiency in transport and safety. The rapid development in pipeline infrastructures, favorable government policies, and growing demand for LNG from natural gas are key factors that will drive the adoption of liquefied natural gases. These gases can be stored in liquid form and then used accordingly when there is a rise in demand. Recent times have seen massive growth in liquefied natural gas production, further pushing its demand.

With the rising demand for liquefied natural gas, the demand to control, transport, and handle liquefied natural gas has seen a surge in the demand for equipment. According to the World LNG Report 2020, published by the International Gas Union, the global trade of LNG increased by 13% in 2019 to 354.7 million tons, compared to the previous year. The increasing trade of LNG across various industries propels the growth for the market.

Augmented Utilization of Liquefied Natural Gas in Power Generation is a Vital Trend

LNG -Liquefied Natural Gas is heated from -160°C to 0°C by seawater or other LNG terminal. The exchanged energy is denoted as cold energy. LNG cryogenic in power generation makes use of this cold energy of LNG. This process helps power generation to work smoothly via improvement in the minimum energy of separation, which also includes cryogenic equipment such as pumps. This factor is boosting the demand for cryogenic pumps in several emerging countries. This is due to the growing industrialization and advancement in the several regions.

In addition, increasing power and fuel demand, new rules & regulations, and the modernization of existing supply chains are also a few factors driving the LNG. On the other hand, the appearance of technology such as advanced industrial pumps, which can considerably lower financial risks of projects and mobilize rapidly on demand, is another reason why small-scale LNG projects, in particular, hold great future potential.

For Instance, February 20, 2024, Shell’s latest LNG outlook underestimates barriers to demand growth in Asia. Serious barriers to LNG value chain backing are likely to oblige demand growth in Southeast Asian markets. Moreover, LNG is unlikely to provide base load power production in emerging Asia due to its high costs likened to other energy sources.

Download Free sample to learn more about this report.

Cryogenic Pump Market Growth Factors

Growing Investment from the Industrial Sector to Aid Market Dynamics

Growing investments from the industrial sector, such as metallurgy, healthcare, food & beverage, and electronics in developing economies, would accelerate the demand for cryogenic type of pumps. The transportation, storage, and regasification applications of cryogenic gases, such as nitrogen, argon, oxygen, and LNG, hold a strong potential for market growth. According to the World Investment Report 2020, published by the U.N. Publications, Asia holds the largest share of FDI inflow, decreasing by 4.95% to USD 473.8 billion in 2019.

Moreover, China is the largest developing economy, with USD 141 billion in FDI investment in Asia. Additionally, Africa holds 3% of FDI investment worth USD 45 billion. Hence, increasing investment from the industrial sector raises the need for deploying the pumps in various end-use industries, propelling the market growth during the projected period.

Increasing Demand for Oxygen in Medical Sector in the Wake of COVID-19 to Drive the Demand

The rising cases in the global COVID-19 pandemic gave rise to the demand for oxygen cylinders in hospitals and homes for patients severely suffering from the disease. This rise in demand for oxygen boosted the oxygen production and transportation market. In order to support this demand, oxygen production increased manifold, leading to a growth in the demand for pumps for cryogen-type oxygen. The second wave of the COVID-19 pandemic witnessed a greater demand for oxygen cylinders and positively impacted the global market.

RESTRAINING FACTORS

Increase in Raw Material Prices to Restrain Market Growth

The cryogenic pump has parts such as a drive shaft, an outer pressure containment tube, and an intermediate static support tube made of stainless steel. However, the need for improvement in the productivity of the pump is increased by modifying and replacing the material of the components with glass/epoxy composite. Reduction in steel production and volatility in steel price due to the stringent regulations for greenhouse gases from the steel industry and crude oil supply fluctuations would increase the production costs of the pump. Hence, increased raw material prices restrain the market growth during the forecast period.

Cryogenic liquids or refrigerants are expensive; usually, only high-speed pump systems can be justified economically, which are costlier. This economic factor is considered to be adversely affecting the market growth rate. In addition, the declining production of steel owing to an economic slowdown in China and fluctuation in oil and gas prices have led to declining investment in the steel industry, which has hindered the investment in new steel plants is also hindering the market as these pumps are utilized for transporting cryogenic gases.

Cryogenic Pump Market Segmentation Analysis

By Type Analysis

Centrifugal Cryogenic Pumps to Dominate the Market Owing to Maximum Technical Advantages

The market is segmented into positive displacement and centrifugal pumps based on the type analysis.

The centrifugal pump segment led the market accounting for 75.86% market share in 2026. A centrifugal pump transports fluid by converting rotational energy driven by an external motor or engine into energy moving the fluid. The centrifugal pump can operate with only two-phase (gas-liquid) fluid during pump priming. Centrifugal pumps held the maximum share in 2023, due to technical advantages, resulting in low maintenance costs and longer life. They have a simple design that produces the same output levels as a positive displacement pump. It has a high capacity and relatively low head and can be designed as per the needs, and it can be made out of several different materials, including plastic, cast iron, and stainless steel. These advantages have led to an increasing application of centrifugal pumps in oil & gas, food & beverage, steel industry, and metal & mining.

A positive displacement pump carries fluid by catching a permanent amount of the liquid and compelling it inside the discharge pipe. These pumps are specifically used to move the cryogenic liquid from one place to another. They are used to pump high-viscosity fluids and are preferred in any application requiring accurate dosing or high-pressure output.

By Cryogen Type Analysis

Rising Gas-To-Liquid Activities Leads the Liquefied Natural Gas Segment Growth

Based on cryogen type analysis, the market can be primarily split into nitrogen, oxygen, argon, liquefied natural gas, and others.

The maximum portion of the market is currently employed to the liquefied natural gas sector due to the massive usage of liquefied natural gas in various end-user applications.

Rising energy demand for argon by industries such as refractory and welding, the argon segment is anticipated to grow.

The Liquified Natural Gas segment dominated the market accounting for 42.60% market share in 2026. The demand for nitrogen is also growing as these gases are used in several industries, such as plastics, food & beverage, and others; nitrogen is also used to produce liquefied natural gases. With the rising gas-to-liquid activities all over the globe, the other cryogen-type segments are indirectly expected to grow at a very high rate.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Growing GTL Activities to Dominate the Oil & Gas Segment

Based on the end-user analysis, the market is divided into oil & gas, metallurgy, power generation, chemical & petrochemical, marine, and other segments.

The Oil & Gas segment led the market accounting for 43.41% market share in 2026. The oil & gas segment, which involves pumps for oil and gas activities involving cryogenic liquefied natural gas, accounts for the maximum share of the market due to the maximum utilization of these pumps in the gas-to-liquid activities across the oil & gas sector.

In the metallurgy industry, cryogenic gases such as nitrogen and other gases are used in huge quantities during the manufacturing of metals. Nitrogen is considered the most consumed cryogenic gas in the industry as this gas is used as a high-pressure gas for laser cutting of steel and metals.

The marine industry is primarily used for the transportation & storage of cryogenic liquid from one location to another. Hence, the growing LNG demand from various regional parts drives the demand for cryogenic liquid storage tanks & vessels in the maritime industry.

REGIONAL INSIGHTS

The market has been analyzed across major regions, including North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Asia Pacific Cryogenic Pump Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominates the global cryogenic pump market share. The demand for these pumps is rising from gas-based power plants owing to depleting energy resources and stringent regulations for emissions. Furthermore, the growing awareness and increasing government policies to develop clean power generation from gas-based power plants and the increasing investment from industries such as healthcare, food & beverage, and steel will propel regional growth.

The Japan market is projected to reach USD 0.39 billion by 2026, the China market is projected to reach USD 0.66 billion by 2026, and the India market is projected to reach USD 0.35 billion by 2026.

North America also contributes a significant share in the global market due to the increasing investment in the oil & gas industry, and growing industrial infrastructure sectors will propel the demand. Furthermore, in the region, the U.S. & Canada hold a potential market for LNG exports, as the depleting coal resource propels the need for LNG-based power plants, driving the market growth. The U.S. market is projected to reach USD 0.99 billion by 2026.

In Europe, the increasing focus on developing a clean energy source, which increases demand for LNG and decreases the number of reloading cargoes at European import terminals, drives the demand for the market. The UK market is projected to reach USD 0.21 billion by 2026, and the Germany market is projected to reach USD 0.36 billion by 2026.

The Middle East & Africa is the prominent region indulged in the business of oil & gas as it is indulging more in natural gas dealings and production. Gulf countries in the Middle East are the fastest-growing in energy demand due to increasing power consumption, seasonal volatility, and rapid industrial growth. Hence, it drives the application of cryogenic pumps in the region.

Latin America holds potential growth opportunities for LNG demand owing to new investment schemes and innovations, governments, and corporations to implement investment assignments on construction, development, and transformation of LNG regasification and LNG production factories.

List of Key Companies in Cryogenic Pump Market:

Ebara Corporation, Nikkiso Co., Ltd, and Fives Are the Players Expected to Lead with Investments in R&D Activities and Wide Customer Reach

Very few companies in the market have developed viable products for all segments. Much of the equipment is undergoing testing to be ready for the market with the required capabilities. The fragmented market has seen numerous new technological advancements coming up to keep pace with the top-performing manufacturers. Considering all the scenarios, Ebara Corporation, Nikkiso Co., Ltd, and Fives are the leading manufacturers and extensively invest in the research and development of pumps. They are expected to lead the market in the upcoming years.

List of Key Companies Profiled:

- Nikkiso Co., Ltd (Japan)

- SHI Cryogenics Group (Japan)

- Ebara Corporation (Japan)

- The Weir Group PLC (Scotland)

- Fives (France)

- Sulzer (Switzerland)

- Flowserve Corporation (U.S.))

- INOXCVA (India)

- Cryostar (France)

- Phpk Technologies (U.S.))

- Vanzetti Engineering (Italy)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 – Atlas Copco announced that it had acquired Trillium US Inc., a vacuum pump services provider. Additionally, it also manufactures piston and cryogenic pumps.

- January 2023 - IceCure announced that it had received an Allowance Notice for the title 'Cryogen Pump' from the Japan Patent Office for its novel cryogenic pump for cryoablation systems.

- January 2023 - Cryomotive and Fives announced they had signed an agreement to develop and validate a cryogenic pump for generating CRYOGAS hydrogen based on Fives’ cryogenic reciprocating pump technology.

- December 2022 - Vanzetti Engineering announced the launch of its submerged cryogenic pumps for LNG (ARTIKA series). The models also include the new single-stage ARTIKA 400 pump prototype.

- January 2022 – The cryogenic solution specialist Cryostar has announced that it has received orders from NeoVP vertical pumps for the Chinese market; these pumps will be installed in air separation units. NeoVP vertical pumps are designed for easy installation and maintenance, and they also possess hydraulic efficiency, reducing the unit’s carbon footprint and energy costs.

REPORT COVERAGE

The global cryogenic pump market research report highlights leading regions worldwide to offer a better understanding of the user. Furthermore, the market research report provides insights into the latest industry trends and analyzes technologies deployed at a rapid pace at a global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the industry.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.85% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Cryogen Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.52 billion in 2025.

In 2025, the market value stood at USD 1.67 billion.

The market will likely grow at a CAGR of 11.85%, exhibiting substantial growth during the forecast period (2026-2034).

The centrifugal pump segment was dominating segment in the year 2025.

Ebara Corporation, Nikkiso Co., Ltd., and Fives are key participants in this market.

The Asia Pacific dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us