Dermal Fillers Market Size, Share & Industry Analysis, By Material (Hyaluronic Acid, Calcium Hydroxylapatite, Poly-L-lactic Acid, PMMA (Poly (Methyl Methacrylate)), Fat Fillers, Collagen, and Others), By Product (Biodegradable and Non-Biodegradable), By Application (Scar Treatment, Wrinkle Correction Treatment, Lip Enhancement, Restoration of Volume/Fullness, and Others), By End-user (Specialty & Dermatology Clinics, Hospitals & Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

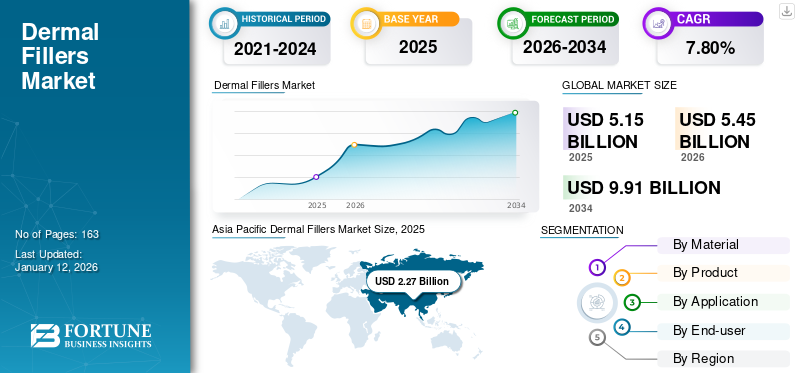

The global dermal fillers market size was valued at USD 5.15 billion in 2025 and is projected to grow from USD 5.45 billion in 2026 to USD 9.91 billion by 2034, exhibiting a CAGR of 7.8% during the forecast period. Asia Pacific dominated the dermal fillers market with a market share of 36.29% in 2025.

The dermal fillers industry is driven by increasing demand for non-invasive aesthetic treatments and aging populations. A growing preference for non-invasive procedures such as dermal fillers, which offer minimal downtime and visible results, is also fueling market expansion. Additionally, a desire for global beauty standards is contributing to the widespread adoption of dermal fillers across various cultures and regions.

Furthermore, taboos linked to cosmetic procedures have witnessed a substantial decrease with increasing awareness about dermal filler procedures. Such changes in attitudes are escalating the adoption of these products.

In response to these favorable growth trends, numerous facial injectable manufacturing companies have invested substantially in R&D initiatives. This has resulted in the development of many products that exhibit notably enhanced aesthetic results. Furthermore, in addition, the number of dermal filler procedures over the years is also increasing. As per the data published by the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) Survey, the top procedures performed in 2024 included neurotoxins, fillers, and topical treatments, including micro-needling and chemical peels.

Some of the prominent players in the market include AbbVie Inc. (Allergan Aesthetics), Galderma, and Merz Pharma. These companies are actively involved in various strategic initiatives including new product launches, collaborations for regional expansions, and others.

Global Dermal Fillers Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.15 billion

- 2026 Market Size: USD 5.45 billion

- 2034 Forecast Market Size: USD 9.91 billion

- CAGR: 7.8% from 2026–2034

Market Share:

- Region: Asia Pacific dominated the market with the highest share. The region is expected to maintain its dominance and grow at the fastest CAGR, driven by improving healthcare infrastructure, a growing aging population, and increasing consciousness about physical appearance.

- By Material: Hyaluronic Acid held the dominant market position. The segment's growth is fueled by the high demand for hyaluronic acid-based fillers due to their safety and comparative longevity, along with the presence of key companies offering a wide range of these products.

Key Country Highlights:

- Japan: As a key country in the dominant Asia Pacific region, Japan's market is driven by a growing aging population and an increasing focus on aesthetic treatments. New product launches by both domestic and international players are also a significant growth factor.

- United States: The market is propelled by a very high number of cosmetic procedures, with approximately 5.3 million hyaluronic acid-based dermal filler procedures performed in 2023. The market is also supported by consistent new product approvals from the U.S. FDA, such as Allergan's SKINVIVE by JUVÉDERM.

- China: Growth is supported by the launch of innovative products from international companies. For instance, Galderma launched Sculptra, a regenerative biostimulator, in China to meet the growing demand for advanced aesthetic treatments in the Asia Pacific region.

- Europe: The market is advanced by strategic collaborations and new product launches. For example, Evolus, Inc. signed an exclusive licensing agreement to distribute a new line of next-generation dermal fillers in the U.K. and Europe, expanding the product offerings in the region.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Demand for Minimally Invasive Cosmetic Procedures Drive Market Expansion

One of the prominent factors driving the dermal fillers market growth includes substantial growing demand for facial aesthetics. The shift from surgical to non-surgical cosmetic treatments has resulted in an increasing number of minimally invasive cosmetic procedures among consumers. The easier and painless procedures have been opted for by individuals for a youthful appearance and radiant face. As there are risks associated with invasive surgeries that require additional time for recovery, the shift of patients toward minimally invasive cosmetic procedures is taking place.

- For instance, according to the American Society of Plastic Surgeons (ASPS), the number of minimally invasive cosmetic procedures has grown nearly 200.0% since 2000, with no indication or trends of slowing down.

- Similarly, according to the American Society of Plastic Surgeons (ASPS), in 2023, approximately 5,294,603 hyaluronic acid-based dermal procedures, including Juvéderm Ultra, Ultra, Plus, Voluma, Volbella, Vollure, Volbella, Restylane Lyft, and others were performed in 2023.

Other Drivers

Aging Population and Social Media Influence to Boost Market Growth

Growing demand for anti-aging treatments to reduce wrinkles and restore volume, coupled with increasing beauty consciousness among teens, young adults, and the aging population globally, significantly drives the growth of the market. This rising demand for younger-looking and perfect skin through noninvasive dermatology methods is expected to increase the minimally-invasive procedures.

MARKET RESTRAINTS

High Costs and Side Effects Associated with Product to Hamper Market Growth

Even though the awareness and acceptance of dermal fillers are rapidly growing across the countries, there are certain factors that are restraining the market growth. The high cost is one of the major restraints contributing to the decline of the market growth. The cost of the dermal filler may vary based on the expertise and qualifications of the person performing the treatment, the type of procedure used, and the time and effort the procedure or treatment requires.

In addition, the adverse effects after administration of filler injections significantly contribute toward reducing the market growth. Risks such as bruising, swelling, and rare complications such as vascular occlusion can deter adoption, in turn hampering the market growth.

MARKET OPPORTUNITIES

Wide Range of Applicability of Hyaluronic Acid Fillers Expected to Offer Lucrative Opportunities

In recent years, with the growing demand for hyaluronic acid filler procedures is constantly increasing. This has resulted in shifting the focus of the operating players on expanding the applications of hyaluronic acid dermal fillers. In view of the increasing applications and acceptance, key market players are heavily investing in their research and development activities to launch innovative HA-based dermal fillers.

- In June 2023, Merz Pharma announced positive results from a pivotal study that demonstrated the safety & efficacy of Belotero Balance (+) for infraorbital hollows. The hollows occur under the eye, causing a sunken eye appearance.

MARKET CHALLENGES

Stringent Regulatory Barriers and Presence of Counterfeit Products to Hinder Market Growth

Stringent regulations surrounding cosmetic procedures and product approval can create delays and obstacles for new entrants. These regulations, while ensuring safety, can slow down market expansion. For instance, in the European Union (EU), Medical Device Regulation (MDR) classifies fillers as Class III devices, thereby increasing approval costs and timelines.

Additionally, the rise in unregulated fillers that are sold online, especially in emerging markets, threatens both safety and brand credibility. Such factors have created challenges for market expansion.

DERMAL FILLERS MARKET TRENDS

Rising Male Participation Identified as One of the Prominent Market Trends

In recent years, aesthetic treatments among men have surged, especially for jawline contouring, under-eye rejuvenation, and chin definition. This is one of the most prevalent trends witnessed in the market. An increasing preference for wrinkle correction treatment among the younger male population is supporting the growing patient population base. Increasing the patient population base for these procedures is likely to increase the demand for advanced dermal filler launches in the market.

Other Trends

Technological Innovation in Filler Composition Innovates New Market Trends

Development of advanced, longer-lasting, and natural-looking fillers is another trend witnessed in the market. Advanced cross-linked hyaluronic acid fillers and bio-stimulatory fillers such as poly-L-lactic acid are trending for natural and long-term results. These advanced fillers offer increased durability, enhanced viscoelasticity, and improved stability. Additionally, clinicians are offering tailored facial aesthetic plans, enhancing consumer satisfaction and retention.

Download Free sample to learn more about this report.

Segmentation Analysis

By Material

Hyaluronic Acid Segment Dominates Due to Its Strong Product Base and Increasing Number of HA Based Cosmetic Procedures

In terms of material, the market is divided into calcium hydroxylapatite, hyaluronic acid, PMMA (poly (Methyl Methacrylate), Poly-L-lactic acid, fat fillers, collagen, and others.

In 2024, the hyaluronic acid segment held the dominating position in the market throughout the forecast period. Increasing demand for hyaluronic acid-based dermal fillers owing to its safety and comparative longevity along with the presence of key companies offering the product. The segment captured 76.19% of the market share in 2024.

- For instance, in October 2024, Evolus, Inc. received the EU certification for new dermal filler products - Estyme line of injectable Hyaluronic Acid (HA) gels.

Moreover, the launch of new products in the hyaluronic acid category in prominent countries, such as the U.S. and U.K., is expected to boost the growth of this segment between 2025 and 2032.

- In February 2021, Merz Aesthetics introduced an injectable hyaluronic acid filler with Lidocaine called BELOTERO BALANCE (+) in the U.S. market.

On the other hand, the calcium hydroxylapatite segment is also growing during the forecast period. The segmental growth is due to an increasing number of key players focusing on launching products with calcium hydroxylapatite among patients, along with an increasing number of procedures for facial lines improvement procedures, supporting the growing adoption of calcium hydroxylapatite among patients.

- For instance, in April 2023, Allergan Aesthetics introduced HArmonyCa, an injectable dermal filler with Lidocaine that utilizes calcium hydroxylapatite (CaHA) for sustained collagen stimulation and hyaluronic acid for immediate lift.

Similarly, the fat fillers segment is anticipated to witness considerable growth in the near future. This is majorly driven by an increase in procedures involving fat fillers in regions such as North America.

The PMMA (Poly (Methyl Methacrylate)) segment has a limited market share due to the lack of biodegradability of its products. However, the relaunch of products containing Poly-L-lactic Acid is expected to drive growth in the Poly-L-lactic Acid segment.

To know how our report can help streamline your business, Speak to Analyst

By Product

Robust Usage of Biodegradable Products to Propel Segment Growth

Based on product, the market is classified into biodegradable and non-biodegradable.

Among the products, the biodegradable segment dominated the global market in 2024. The key factors contributing to the segmental growth include the increasing preference of consumers toward the usage of biodegradable products owing to their several benefits. Furthermore, the growth of the biodegradable segment is fueled by the introduction of new, safer products and stringent regulations, as well as increased research and development efforts by both established and emerging players. The segment is expected to capture 92.16% of the market share in 2026.

- For instance, in April 2021, Merz Aesthetics U.K. and Ireland announced the launch of BELOTERO BALANCE (+), a biodegradable dermal filler containing the lidocaine formulation of BELOTERO BALANCE in the U.K. and Ireland.

On the other hand, the non-biodegradable segment captured a comparatively lower share of the market in 2024. The adoption rates for non-biodegradable products are relatively lower due to their non-temporary nature. The decline in this segment's market growth is attributed to the non-decomposable nature of these products. This segment is likely to record a considerable CAGR of 3.91% during the forecast period (2025-2032).

By Application

Wrinkle Correction Treatment Segment Leads due to Increasing Number of Patient Seeking this Treatment

In terms of application, the market is segmented into scar treatment, lip enhancement, wrinkle correction treatment, restoration of volume/fullness, and others.

In 2024, the wrinkle correction treatment segment dominated the market with the largest share. The dominance can be attributed to an increasing number of patient pool with skin issues such as wrinkles, resulting in a growing demand for wrinkle correction treatment procedures. Furthermore, the segment's growth is projected to be driven by the introduction of new products in this category. This segment is foreseen to document a substantial CAGR of 7.50% during the forecast period (2025-2032).

- For instance, according to data from the American Society of Plastic Surgeons, in the U.S., the use of fillers soared from 1.8 million procedures in 2010 to 2.7 million in 2019 and most of them were for wrinkle correction.

On the other hand, the lip enhancement segment is also growing during the forecast period. The rising awareness amongst women about lip aesthetics and the growing expenditure on cosmetic procedures are some factors contributing to the growth of the segment during the forecast period.

- In December 2023, Evolus, Inc. entered into an exclusive licensing agreement with Symatese to distribute their next-generation fillers, including Estyme facial fillers for lip indications, in the U.K. and Europe.

The restoration of volume/fullness segment ranked as the third-largest segment. This can be attributed to the launch of new products by key players, such as Allergan's (AbbVie, Inc.) JUVEDERM VOLUX focuses on providing restoration effects. However, the scar treatment segment is projected to have a relatively lower market share during the forecast period.

The scar treatment segment is predicted to gain 11.8% of the market share in 2025.

By End-user

Emergence of Specialty & Dermatology Clinics Coupled with Increasing Collaborations Between Clinics and Stores to Boost Segment Growth

On the basis of end-user, the market is categorized into hospitals & clinics, specialty & dermatology clinics, and others.

In 2024, the specialty & dermatology clinics segment captured the dominating share of the global market. The rising prevalence of skin disorders such as wrinkles, skin depressions, and scars, among others, resulting in a large number of dermal filler procedures performed in specialty and dermatological clinics, is likely to support the growth of the segment in the market.

- For instance, according to the data published by the International Society of Aesthetic Plastic Surgery in 2023, worldwide, approximately 31.4% of cosmetic procedures were carried out in specialty clinics.

The hospitals & clinics segment accounted for the second-largest market share in 2024. This is primarily due to the significant number of facial injectable procedures carried out in these healthcare facilities.

DERMAL FILLERS MARKET REGIONAL OUTLOOK

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Dermal Fillers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, geographically, Asia Pacific dominated the global market with the highest share with a valuation of USD 1.87 billion. The region is anticipated to maintain its dominance throughout the forecast period and is expected to grow at the fastest CAGR in the coming years. The Chinese market is anticipated to gain USD 0.97 billion in 2026. This can be attributed to factors such as increasing improvement in healthcare infrastructure in Asian countries, the growing aging population, and the consciousness of individuals regarding their physical appearance. In addition, new product launches by domestic players in the region also support the regional market growth. India is poised to be worth USD 0.20 billion in 2026, while Japan is set to hold USD 0.33 billion in the same year.

- For instance, in April 2024, VONBIO Co., Ltd. launched the new Glinity Aesthetic Derma Filler Line in South Korea.

North America

North America is expected to hold USD 1.17 billion in 2026. The North American market held a substantial share of the market in 2024. The strong market demand is driven by disposable income, early adoption, and aesthetic culture. Additionally, a significant number of cosmetic procedures in the region also supplement the market growth.

- For instance, according to the American Society of Plastic Surgeons (ASPS), in 2023, about 25.4 million cosmetic minimally-invasive procedures were performed in U.S.

U.S.

The U.S. dominated the North American market share in 2024. Growing demand for these dermal fillers among patients is resulting in the growing focus of key players on receiving approvals for their products. Additionally, growing awareness about the importance of beauty treatments amongst the U.S. population, along with their penetration in the country is likely to foster the growth of the market in the U.S. The U.S. market is likely to be worth USD 1.10 billion in 2026.

Europe

Europe held the largest market share in 2025 valued at USD 1.77 billion. The factors contributing to the region's growth include a rising number of dermal filler procedures among individuals in key European countries and greater expenditure on research and development (R&D). The U.K. market continues to expand, projected to reach a market value of USD 0.31 billion in 2026. Furthermore, the consistent increase in the number of new product launches and strategic collaborations between major players also boosted the market growth. the region is expected to hold the second largest market share in 2025 with a valuation of USD 1.87 billion, registering a significant CAGR of 5.83% during the forecast period (2025-2032). Germany is set to be valued at USD 0.47 billion in 2026, while France is expected to hold USD 0.31 billion in 2025.

- For instance, in December 2023, Evolus, Inc. signed a distribution agreement with Symatese for the distribution of next-generation dermal fillers in the U.K. and Europe.

Latin America and the Middle East & Africa

Latin America is anticipated to be valued at USD 0.26 billion in 2026. Latin America and the Middle East & Africa have a relatively low dermal fillers market share. However, the market's growth in these regions can be driven by increasing healthcare expenditure on infrastructure and the entry of new players with innovative products. Also, an increasing interest in non-surgical aesthetics in Brazil, Mexico, and UAE is further propelling regional growth. Saudi Arabia is likely to stand at USD 0.03 billion in 2025.

- For instance, according to International Society of Aesthetic Plastic Surgery (ISAPS), in 2023, about 553,122 total surgical procedures and 648,018 on-surgical procedures were performed in Turkey.

COMPETITIVE LANDSCAPE

Key Market Players

Widespread Product Portfolio and Strong Brand Presence to Boost Market Presence of Leading Companies

The global market space for dermal fillers represents a diverse competitive landscape, comprising both well–established as well as emerging players.

Currently, the leading players in the market include Abbvie Inc. (Allergan Aesthetics) and Galderma. Their dominance can be attributed to the strong portfolio of products, and wider adoption of their brands across the world. Additionally, a growing focus on receiving approvals for their dermal fillers is also likely to contribute to these companies' market share.

- For instance, in May 2023, Allergan Aesthetics, an AbbVie company, announced the U.S. FDA approval of SKINVIVE by JUVÉDERM to improve the smoothness of the cheeks in adults above the age of 21.

Some other prominent players operating in the market include Merz Pharma and Revance

These companies are actively engaged in strategic initiatives, such as launching new products and fostering collaborations to enhance their market presence. Similarly, Sinclair Pharma and Galderma, prominent players in the industry, are focusing on introducing new products in key regions to augment their revenue share in the global market.

LIST OF KEY DERMAL FILLERS COMPANIES PROFILED

- ALLERGAN (AbbVie, Inc.) (U.S.)

- Merz Pharma (Germany)

- Galderma (Switzerland)

- Sinclair (U.K.)

- BIOPLUS CO., LTD. (South Korea)

- Bioxis Pharmaceuticals (France)

- Korman (Israel)

- Prollenium Medical Technologies (Canada)

- Medytox (South Korea)

- Teoxane (Switzerland)

- HUGEL, Inc. (South Korea)

- Revance (U.S.)

- Tiger Aesthetics Medical, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Medytox launched two new premium hyaluronic acid (HA) filler products in the Neuramis series, Neuramis Heart and Neuramis Skin Enhancer.

- April 2025: Galderma launched Sculptra, a first proven regenerative biostimulator with a unique poly-L-lactic acid formulation, in China.

- October 2023: Prollenium Medical Technologies announced its acquisition of SoftFil medical devices with the aim of innovating potent tools that deliver optimal results for practitioners and patients.

- February 2023: Galderma launched Radiesse (+) Lidocaine injectable implants, specifically designed for deep injection (subdermal and supraperiosteal) to enhance the contour of the jawline and address moderate to severe loss in adults aged 21 and above.

- January 2023: AbbVie Inc.'s subsidiary Allergan introduced JUVÉDERM VOLUX XC, a treatment for adults over 21 years old experiencing moderate to severe loss of jawline definition.

REPORT COVERAGE

The global dermal fillers market report provides a detailed analysis of the industry. It focuses on key facts such as the overview of the product types, regulatory scenarios by key countries, reimbursement scenarios by key countries, overview of new product launches/approvals, and pipeline analysis. In addition, it includes detailed insights into market dynamics, new product & service launches, and key industry developments such as mergers, partnerships, & acquisitions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 7.80% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Product

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 5.15 billion in 2026 and is projected to reach USD 9.91 billion by 2034.

In 2026, the market in Asia Pacific stood at USD 1.87 billion.

Growing at a CAGR of 7.80%, the market will exhibit steady growth during the forecast period (2026-2034).

In terms of material, the hyaluronic acid segment led the market during the forecast period.

Surge in the demand of minimally invasive cosmetic procedures coupled increasing number of dermal filler procedures and increasing R&D initiatives to launch innovative products are the major factors driving the market's growth.

AbbVie Inc. (Allergan Aesthetics), Galderma, and Merz Pharma are some of the prominent operating players in the global market.

Asia Pacific dominated the dermal fillers market with a market share of 36.29% in 2025.

The significantly increasing demand for dermal fillers, growing awareness regarding aesthetic beauty and frequent regulatory approvals & new product introductions are driving the adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us