Botulinum Toxin Market Size, Share & Industry Analysis, By Application (Therapeutic {Chronic Migraine, Spasticity, Overactive Bladder, Cervical Dystonia, Blepharospasm, and Others} and Aesthetics {Forehead Wrinkles, Glabellar Lines, Crow's Feet, and Others}), By Type (Botulinum Toxin Type A and Botulinum Toxin Type B), By End-user (Specialty & Dermatology Clinics, Hospitals & Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

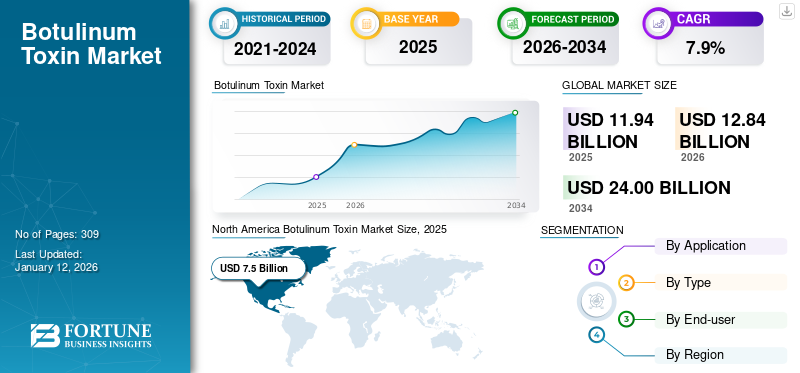

The global botulinum toxin market size was valued at USD 11.94 billion in 2025. The market is projected to grow from USD 12.84 billion in 2026 to USD 24.0 billion by 2034, exhibiting a CAGR of 7.91% during the forecast period. North america dominated the botulinum toxin market with a market share of 62.79% in 2025.

A gram-positive anaerobic bacterium named Clostridium botulinum produces the botulinum toxin. This toxin is divided into seven different types of neurotoxins with distinct antigenic and serological characteristics, but they have similar structures. For the therapeutic and aesthetic procedures, the market utilizes the Type A and Type B forms of the toxin.

In recent years, the demand for these non-invasive cosmetic procedures has increased due to the advanced product launches, favorable reimbursement policies, and rising disposable incomes. The major players in the global market are also focused on developing and launching innovative products for diverse indications to expand their neurotoxin portfolios and improve patient outcomes in the therapeutic and aesthetic settings.

- For instance, in February 2025, Galderma, introduced RelabotulinumtoxinA (Relfydess), a ready-to-use liquid toxin in the European markets. This type of innovative product launches by the key market players drives the market growth.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Demand for Botulinum Toxin Procedures to Boosts Market Expansion

The rise in the demand for minimally invasive and non-invasive procedures globally drives the market growth during the forecast period. These procedures are increasing due to several factors, such as the rise in the look-related concerns of individuals of various ages and demographics, and people seeking painless and simple ways to look healthy and young.

- For instance, according to the International Society of Aesthetic and Plastic Surgery (ISAPS) report for 2023, the total number of BoT procedures globally was 8.9 million in the year 2023.

Additionally, the demand for these procedures further rises due to the major players focusing on launching advanced products into the market by either filing for key regulatory approvals or concentrating on the research and development activities.

- For instance, in January 2025, Galderma announced the positive results of its phase IIIb RELAX clinical trial. It further demonstrated the rapid onset and long-lasting duration of aesthetic efficacy using a single dose of RelabotulinumtoxinA (Relfydess) to treat glabellar lines.

MARKET RESTRAINTS

High Cost of Treatment May Hinder Market Growth

The high cost of this treatment may limit the botulinum toxin market growth during the forecast period.

The comparatively higher costs may lead the customers to find other alternative non-invasive procedures, which provide the same results at a lower cost. Also, the procedures involving neurotoxins for cosmetic purposes may require further repetitions after a certain time duration. This also substantially increases the costs for the customers. Hence, these negative factors may eventually lead to the hampering of the market growth across the forecast period.

- For instance, in October 2023, according to the NICE guideline NG236 Economic analysis report, 2023, the cost of botulinum toxin A treatment is high. In the probabilistic scenario analysis (SA11), a 1-year treatment with Xeomin 250U costs approximately USD 2,448.1, while Dysport 500U costs around USD 1,768.7.

Furthermore, the lack of adequate reimbursement policies for botox treatment for therapeutic purposes in the lower-economic countries also decreases the adoption and the growth of the market.

MARKET OPPORTUNITIES

Heavy Investment in R&D for Therapeutic Applications of Botulinum Toxin Expected to Boost Market Growth

The rise in the use of botulinum toxin for therapeutic indications, such as cervical dystonia, chronic migraine, spasticity, blepharospasm, hyperhidrosis, and achalasia etc., is expected to boost the market growth in the future. Additionally, with the increasing number of regulatory approvals for therapeutic applications, key market players are investing heavily in their research and development for product launches. The rise in product launches provides a wide range of options to consumers, which increases the product adoption rate. This is anticipated to offer wide opportunities for global market growth in the future.

- For instance, in May 2024, Hesperos, received a USD 2.0 million research grant from the National Center for Advancing Translational Sciences (NCATS) in partnership with the U.S. Food and Drug Administration (FDA). This project aimed to create an advanced testing platform that can evaluate the potency of Botulinum Toxin (BoT) without relying on animal testing.

MARKET CHALLENGES

Availability of Counterfeit Products May Limit Market Growth

The demand for botox products increases the availability of counterfeit products to cater to the high demand at a comparatively lower cost. With the increasing popularity of genuine products, the counterfeit products have also entered the market. Customers who are in search of lower-priced products tend to buy these products online from illegal providers. This has inflicted harm on several consumers and their trust, and it also hampers the market growth.

- For instance, in April 2024, the U.S. FDA alerted healthcare professionals and consumers that unsafe counterfeit versions of Botox (botulinum toxin) have been found in multiple states of the U.S. and administered to consumers for cosmetic purposes.

- Also, for instance, the World Health Organization (WHO) issued an alert in August 2022 regarding falsified versions of Ipsen's Dysport being discovered in multiple countries.

BOTULINUM TOXIN MARKET TRENDS

Increasing Awareness through Promotional Activities by Key Players

The major players in the market are continuously improving and implementing new marketing plans to increase the global awareness of these products among consumers. As its a prescription-only medicine (POM), it is illegal to advertise these treatments. However, players such as AbbVie Inc. and Merz Pharma are adopting several advanced marketing techniques to increase customer awareness.

- For instance, in May 2025, AbbVie Inc., granted USD 20,000 to each woman entrepreneur to support the BOTOX Cosmetic business and fill the bridge of Confidence Gap through “The Confidence Project: Empowering Women Entrepreneurs”.

Key market players use social media platforms such as Instagram and Facebook are becoming essential modes for the growth of aesthetic treatment. The patients around the world have been asking cosmetic surgeons to perform procedures that make them look better, such as software-filtered versions of themselves. To address such concerns, major brands are taking steps to engage consumers by casting celebrities to promote their products and launching campaigns. This may contribute to the growth of the market in the coming years.

Rising Adoption by the Male Demographic is a Key Trend

Another prominent trend witnessed in the global market is the increased adoption of these products by males. An expanding group of men are adopting these products, also popularly known as “brotox”, when these treatments are specifically designed for the male demographic. Crow’s feet and wrinkles on the forehead are the common areas that are treated with neurotoxins for males.

- According to the data published by the ISAPS for the year 2023, an estimated 1.35 million botulinum toxin procedures for males were undertaken in 2023.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Multiple Product Launches and Regulatory Approvals Drive Therapeutics Segment’s Dominance

Based on application, the market is bifurcated into aesthetics and therapeutics. The therapeutics segment is further sub-segmented into spasticity, chronic migraine, blepharospasm, cervical dystonia, overactive bladder, and others.

The therapeutics segment dominated the market share in 2024. This dominance is due to several factors, such as the rise in R&D initiatives to launch products and focus on getting regulatory approvals to treat diverse diseases by key market players.

- For instance, in August 2023, Revance Therapeutics, Inc. received approval for DAXXIFY (DaxibotulinumtoxinA-lanm), a botulinum toxin injection for the treatment of cervical dystonia in adults from the U.S. FDA.

In terms of the therapeutics segment, the indication of spasticity has the highest global market share 53.42% due to the growth in the prevalence of related diseases, such as multiple sclerosis. Additionally, the rising awareness of the importance of treating these medical conditions with neurotoxins, coupled with the increase in understanding of their mechanisms of action, supports the segmental growth.

The aesthetics segment can also be further divided into forehead wrinkles, glabellar lines, crow’s feet, and others. The aesthetics segment accounted for a considerable share of the market in 2024. The market growth of this segment is driven by the overwhelming demand for minimally invasive treatments and the increasing awareness of using these products for cosmetic purposes.

- For instance, according to the ISAPS in 2022, 9,221,419 minimally invasive cosmetic botulinum toxin procedures were performed worldwide. A rising number of procedures further contributed to the expanding segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Type

Large Number of Product Approvals to Type A Segment’s Market Dominance

On the basis of type, the market is segmented into botulinum toxin type A and botulinum toxin type B.

The botulinum toxin type A segment dominated the global market share of USD 12.67 billion in 2026. The segment is projected to grow with the highest CAGR 98.67% during the upcoming years. The botulinum toxin type A injection is the most common cosmetic procedure used globally. Surveys from core aesthetic specialty organizations consistently rank it first on the lists of member-reported, nonsurgical aesthetic procedures. The dominance of the segment is due to the large number of product introductions. Ongoing research by major market players to launch new, promising clinical trial results and innovative type A products also plays a positive role in segmental growth.

- For instance, in February 2025, Daewoong Pharmaceutical launched its high-purity, high-quality botulinum toxin type A product, NABOTA, in Saudi Arabia.

The botulinum toxin type B segment held comparatively lower share in the market due to limited product approvals. However, the expansion of the therapeutic indication of chronic sialorrhea and the possible approval of the product in emerging regions promise prospects of future segmental growth. Additionally, the growing strategic activities to boost the commercialization of these products may further propel the segment’s growth.

By End-User

Strong Preference for Specialty & Dermatology Clinics Drives Segmental Growth

On the basis of end-user, the market is segmented into specialty & dermatology clinics, hospitals & clinics, and others.

The specialty & dermatology clinics segment held the largest market share 48.52% in 2026. This growth is due to a rise in the number of botulinum toxin procedures, which are conducted in specialty and dermatological clinics. Additionally, the rise in the prevalence of chronic diseases and aesthetic concerns, such as glabellar lines, crow’s feet, and frown lines, is expected to support the growth of this segment.

- For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), 2023, approximately 47.7% of total cosmetic procedures were performed in free-standing surgery centers, and 27.8% were performed in office facilities. This is expected to fuel the growth of the segment.

The hospitals & clinics segment held the second-largest share in 2024. This dominance is driven by the rise in the number of aesthetic and therapeutic procedures performed in hospitals & clinics.

- For instance, according to the data published by the American Society for Aesthetic Plastic Surgery in 2023, approximately 16.0% of total cosmetic procedures were conducted in hospitals.

Botulinum Toxin Market Regional Outlook

On the basis of region, the global market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Botulinum Toxin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market and generated a revenue of USD 8.09 billion in 2026. This is due to the rise in the number of botox procedures in this region with a high acceptance rate for these products.

U.S.

U.S. market dominated the North America region in 2024. This is due to the increase in the number of product launches and the strong presence of key market players in this region. Additionally, a rise in the acceptance rate for these procedures among the people in the country also supports the market growth. Furthermore, increasing regulatory approvals and favorable government policies drive market growth. The U.S. market is poised to hold USD 7.83 billion in 2026.

- For instance, according to the data published by the International Society of Aesthetic Plastic Surgery, in 2023, in the U.S., approximately 2.5 million botox procedures were performed.

Europe

Europe is the third largest market set to reach USD 1.65 billion in 2026. Europe is the second-dominated region in the market, with a significant share due to the increasing number of people undergoing Botox surgeries in key European markets. The U.K. market continues to expand, projected to reach a valuation of USD 0.22 billion in 2025. Additionally, the high investment in the research and development sector to introduce new products also supports the market growth during the forecast period. Germany is forecasted to gain USD 0.44 billion in 2025, while France is anticipated to be valued at USD 0.29 billion in the same year.

- For instance, in February 2023, Evolus, Inc. announced the commercial launch of Nuceiva (botulinum toxin type A) in the countries of Germany and Austria.

Asia Pacific

Asia Pacific is the second leading region expected to grow with a faster CAGR of 20.82% during the forecast period (2026-2034) and is set to be valued at USD 2.68 billion in 2026. This growth is attributed to the rise in the prevalence of chronic diseases and the rise in concerns about physical appearance. The Chinese market is predicted to hold USD 1.22 billion in 2026. These procedures are becoming more popular in Asia, and the majority of these procedures are performed in specialist and dermatological clinics. Furthermore, increasing research and development activities improve patient outcomes and support market growth in this region. Also, the presence of domestic players in the region, such as in the South Korea and China markets, further augments the regional growth. India is expected to hit USD 0.13 billion in 2026, while Japan is estimated to reach USD 0.73 billion in the same year.

- For instance, in February 2022, Evolus, Inc. announced the acceptance of its submission for the regulatory approval of Nuceiva (parabotulinumtoxinA) to the Australian Therapeutics Good Administration (TGA)

Latin America

Latin America is the fourth largest market foreseen to be worth USD 0.27 billion in 2026. This is augmented by the increasing adoption rate of botox products for cosmetic procedures in this region. Additionally, the growing awareness among people also supports the development of this market.

- For instance, according to the ISAPS, in Brazil, in 2022, 44.6% of all nonsurgical cosmetic injectable procedures were performed with these products.

Middle East & Africa

In the Middle East & Africa region, the number of cosmetic injectable procedures is expected to continue to grow. The increasing per capita healthcare spending and rising health and beauty norms have driven the market’s growth. Saudi Arabia is estimated to hit USD 0.03 billion in 2025.

- For instance, in April 2025, Shanghai Fosun Pharmaceutical (Group) Co., Ltd signed a strategic partnership with the Fakeeh Care Group to accelerate healthcare and innovation in Saudi Arabia.

COMPETITIVE LANDSCAPE

Key Industry Players

Robust Product Offerings and Global Reach to Enable AbbVie Inc. and Ipsen Pharma to Reach Market Dominance

The global botulinum toxin market share demonstrates a concentrated competitive structure, with the presence of companies such as AbbVie Inc., Ipsen Pharma, and Galderma. These companies dominate the global market, accounting for a significant market revenue share.

Abbvie Inc. (Allergan Aesthetics) held the largest share in the market, owing to its strong product portfolio, which includes the market-leading products of BOTOX Cosmetic and BOTOX Therapeutic. The company’s product of Botox has been in the market since 1989 and has continued to perform well even after the introduction of new products with differentiating features. The company's consistent efforts to participate in clinical trials to expand Botox’s application areas are also contributing to the company's growth in this market.

- For instance, in October 2023, AbbVie Inc. announced positive topline results from two pivotal Phase 3 clinical studies evaluating trenibotulinumtoxinE (BoNT/E). It treats moderate to severe glabellar lines (M21-500 and M21-508).

Ipsen Pharma also held significant shares in the market in 2024. The company’s product of Dysport, has continued to perform well in the therapeutics and aesthetics segments of the market. The company is also focusing on getting regulatory approvals for new indications of existing products to contribute toward the company’s market growth.

- For instance, in June 2022, Ipsen Pharma received a positive opinion announced for Dysport in Europe for the management of urinary incontinence in adults with neurogenic detrusor overactivity, which can be caused due to a spinal cord injury or due to multiple sclerosis.

LIST OF KEY BOTULINUM TOXIN COMPANIES PROFILED

- AbbVie Inc. (U.S.)

- Ipsen Pharma (France)

- Merz Pharma (Germany)

- Medytox (South Korea)

- GALDERMA (Switzerland)

- HUGEL, Inc. (South Korea)

- Evolus, Inc. (U.S.)

- REVANCE (U.S.)

- Supernus Pharmaceuticals, Inc. (U.S.)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (China)

- DAEWOONG PHARMACEUTICAL CO., LTD. (South Korea)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Merz Therapeutics, received approval for XEOMIN (incobotulinumtoxinA) from Health Canada for the treatment of post-stroke lower limb spasticity involving the ankle and foot in adults.

- October 2024: Allergen Aesthetics, (AbbVie) received the U.S. FDA approval for BOTOX Cosmetics for the temporary improvement in the appearance of moderate to severe vertical bands connecting the jaw and neck (platysma bands).

- September 2024: AbbVie Inc. received approval in China for the treatment of masseter muscle prominence (MMP) from the China National Medical Product Administration (NMPA)

- March 2024: Hugel Inc. received marketing approval for its botulinum toxin Letybo, used in the treatment of moderate-to-severe glabellar lines (frown lines) in adults from the U.S. FDA

- September 2023: AbbVie Inc. announced the results of the second trial from the phase 3 study. Significant improvement was observed by using onabotulinumtoxinA (BOTOX Cosmetic) to treat moderate to severe platysma.

REPORT COVERAGE

The global botulinum toxin market report provides market size & forecast by all the segments included in the report. The market outlook also details the market dynamics and trends expected to drive the market in the forecast period. It offers information on the prevalence of chronic diseases in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions in key countries. The market outlook covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.9% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global botulinum toxin market size was valued at USD 11.94 billion in 2025. The market is projected to grow from USD 12.84 billion in 2026 to USD 24.0 billion by 2034, exhibiting a CAGR of 7.91% during the forecast period.

In 2026, the market in North America stood at USD 8.09 billion.

Growing at a CAGR of 7.91%, the market will exhibit steady growth during the forecast period.

The therapeutics segment is the leading segment in this market.

The rise in demand for Botox procedures and increasing R&D initiatives to gain regulatory approvals for newer products are the key factors that drive the market.

AbbVie Inc., Ipsen Pharma, and Merz Pharma are the top players in the market.

North America dominated the market in 2026.

High demand for the botulinum toxin procedures and significant research activities proving the safety and efficacy of these products contribute to the product adoption across the globe.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us