Diabetes Drugs Market Size, Share & Industry Analysis, By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), By Diabetes Type (Type 1 and Type 2), By Route of Administration (Oral, Subcutaneous, and Intravenous), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

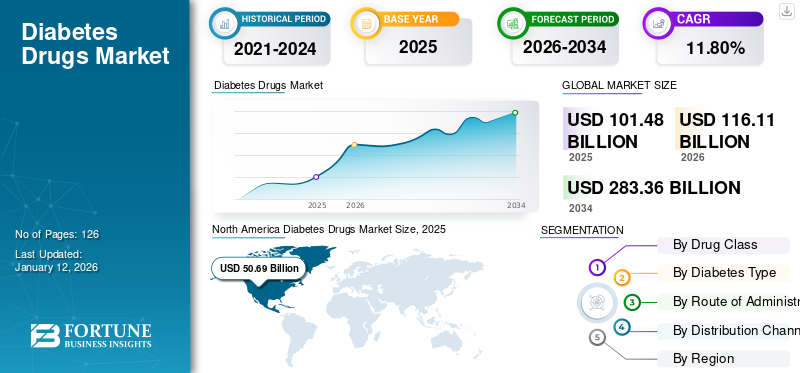

The global diabetes drugs market size was valued at USD 101.48 billion in 2025 and is projected to grow from USD 116.11 billion in 2026 to USD 283.36 billion by 2034, registering a CAGR of 11.80% over the forecast period. North America dominated the diabetes drugs market with a market share of 49.95% in 2025. Some of the key players in the market include Novo Nordisk A/S, Eli Lilly & Company, and Sanofi. These companies hold a major portion of the global diabetes drugs market.

Diabetes is a chronic health condition which affects a substantial proportion across the world. There are two types of diabetes, namely Type 1 and Type 2. According to the latest data provided by the International Diabetes Federation (IDF), in 2021, 537 million adults aged 20-79 years were diagnosed with diabetes. This number is estimated to reach 643 million by 2030 and 783 million by 2045. Diabetes is considered a major public health concern and poses the greatest public health and health system challenge. It impacts the quality of life and lifespan and is associated with several complications. The economic burden of diabetes treatment is quite high across the world. Thus, the market plays an important role in the global healthcare system. Additionally, factors, such as increasing diabetes cases, aging population, and technological advancements in drug delivery have also propelled the market growth.

Currently, several medications are used to treat diabetes mellitus type 1 and type 2 by lowering the blood glucose levels of the body. There are different classes of drugs involved in the treatment of diabetes, which are administered via the oral, intravenous, or subcutaneous route. These drugs are classified into different drug classes, such as insulin therapies, GLP-1 agonists, SGLT2 Inhibitors, and others.

Global Diabetes Drugs Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 101.46 billion

- 2026 Market Size: USD 116.11 billion

- 2034 Forecast Market Size: USD 283.36 billion

- CAGR: 11.80% from 2026–2034

Market Share:

- North America dominated the diabetes drugs market with a 49.95% share in 2025, driven by high diabetes prevalence, strong healthcare infrastructure, growing insurance penetration, and continuous R&D investments by key players.

- By drug class, GLP-1 receptor agonists are expected to retain their largest market share owing to rising demand for novel, effective therapeutics, increasing clinical trial activities, and a shift towards dual-action glucose-lowering medications.

Key Country Highlights:

- United States: Market growth is propelled by new anti-diabetic drug launches, favorable reimbursement policies, expansion of manufacturing facilities, and strategic collaborations among leading pharmaceutical companies.

- Europe: The region benefits from increasing drug launches, penetration of key market players, and licensing agreements for innovative diabetes treatments.

- China: The market is driven by a rising diabetes burden, growing patient awareness, and increasing initiatives to enhance access to affordable treatment options.

- Japan: Market expansion is supported by growing demand for advanced therapeutics, a strong focus on personalized diabetes care, and the adoption of innovative drug delivery technologies.

MARKET DYNAMICS

DRIVING FACTORS

Rising Prevalence of Diabetes to Boost Market Growth

Rise in obesity, growing adoption of sedentary lifestyle, and increase in uptake of unhealthy diets among the population are anticipated to increase the prevalence of diabetes. This is expected to boost the global diabetes drugs market growth during the forecast period.

- For instance, according to the data published by the American Heart Association in February 2021, annually around 30-53% of new diabetes cases are associated with obesity in the U.S.

- Similarly, as per the Diabetic Statistics report published by the U.S. Centers for Disease Control and Prevention (CDC) in 2022, the number of individuals suffering from diabetes or prediabetes in the U.S. is more than 130 million.

In addition to the high prevalence of diabetes in developed countries, in low- and middle-income countries, over 3 in 4 adults live with diabetes. This number suggests that a huge percentage of the population in these countries is suffering from diabetes.

- For instance, according to an article published in June 2021 in The Lancet, around 80% of the world’s total diabetic population lives in low- and middle-income countries (LMICs).

Other Drivers:

Technological Innovations to Bolster Market Growth

Innovations in drug administration technologies have also played an important role in shaping the market. Introduction of advanced devices, such as insulin pumps, smart pens, and autoinjectors have boosted the market’s growth. In addition, development of new drug classes with improved efficacy have further supported the market’s growth.

- For instance, in July 2020, Xeris Pharmaceuticals, Inc., a pioneer in ready-to-use injectable and infusible drug formulations, announced that Gvoke HypoPen (glucagon injection) was available by prescription in the U.S. The injection will be used for the treatment of severe hypoglycemia in adults and children aged two years and above suffering from diabetes.

Government Initiatives & Funding:

As the global burden of diabetes is increasing rapidly, several governments and organizations are actively involved in undertaking initiatives and offering funding and research grants for the development of diabetes drugs. This will support the market’s growth.

- For instance, in October 2024, the Ministry of Health and Family Welfare (MoHFW), in collaboration with the World Health Organization (WHO) Country Office in India, introduced a national project to ensure timely access to care for 75 million people with diabetes and hypertension by 2025.

Growing Awareness and Early Diagnosis:

Rising awareness about diabetes prevention and management, coupled with increase in early detection and diagnosis driving the demand for treatment, is one of the major factors driving the market’s growth.

RESTRAINING FACTORS

Large Undiagnosed Patient Population in Emerging Countries to Limit Market Growth

There is a large proportion of undiagnosed diabetes patients globally. Emerging countries, including India, China, and others, have the largest share of undiagnosed diabetes population. The major factors for this include lack of symptoms, insufficient access to healthcare, and sociocultural factors, such as taboo among people.

The prevalence of undiagnosed diabetes remains high owing to the above-mentioned factors. According to the International Diabetes Federation, in 2021, an estimated 239.7 million i.e. almost one in two adults aged 20-79 years were suffering from undiagnosed diabetes across the globe.

These proportions were the highest in Africa (53.6%), Western Pacific (52.8%), and South-East Asia regions (51.3%). This shows that emerging countries in these regions have a major public health concern due to the high percentage of undiagnosed diabetic population.

MARKET OPPORTUNITIES

Unmet Needs and Underpenetrated Market in Developing Countries to Create Lucrative Growth Opportunities

There is a high percentage of undiagnosed diabetic population in emerging countries. This is due to the lack of awareness about disease diagnosis in the region, poor healthcare systems, and slow onset of the symptoms or progression of type 2 diabetes.

High number of undiagnosed diabetics poses a major public health challenge in emerging countries. This, coupled with the lack of availability of low-cost drugs in these nations, is a key factor hampering the market’s growth.

However, these challenges are being overcome through rising government initiatives to promote the entry of market players with novel drugs for the management of diabetes and growing number of awareness programs in emerging countries. These factors are projected to increase the number of people diagnosed with diabetes, further augmenting the opportunities for players operating in the global diabetes drugs market.

MARKET CHALLENGES

High Treatment Cost of Diabetes May Limit Market Growth

The growing prevalence of diabetes has been increasing the demand for drugs to manage the disease. However, there are certain limitations associated with the treatment process. High treatment cost is one of the key factors that negatively affects the market’s growth. Despite the presence of several approved drugs to treat this chronic disease, the economic burden of the disease is still high in various countries across the world. In addition, high cost of advanced diabetes therapeutics further creates a hurdle to the market’s growth.

- For instance, in November 2023, the American Diabetes Association published data which stated that in the U.S., the cost of diagnosed diabetes was USD 412.9 billion in 2022. It included USD 306.6 billion direct medical costs along with USD 106.3 billion indirect costs.

Additionally, easy availability of OTC medical supplies that are used to regulate blood sugar levels also increases the treatment cost. The high cost of innovative drugs and insurance concerns also limit the growth of the diabetes drugs market size.

Other Challenges:

Side Effects and Adverse Reactions

Safety concerns associated with the long-term use of diabetes drugs and regulatory scrutiny on new drugs are anticipated to challenge the market’s growth to a certain extent. Some of the side effects of long-term use of diabetes drugs include weight gain, nausea, gastrointestinal disturbance, and others.

Launch of Generic Drugs:

The costs of conventional diabetes treatment options are comparatively higher. This has resulted in consumer preference shifting toward cost-effective treatment options, such as biosimilars and generic equivalents.

- For instance, in January 2024, Lupin’s Dapagliflozin and Saxagliptin tablets were approved by the U.S. FDA for the treatment of type 2 diabetes. These tablets are generic version of Qtern tablets manufactured by AstraZeneca plc.

Regulatory Challenges:

Differences in approval processes across countries and the lengthy process time required to meet the U.S. FDA and other global regulatory standards further creates a challenge for manufacturers to easily launch new drugs in the market.

Barriers to Access in Emerging Markets:

The high cost of diabetes treatment and drugs among the uninsured population in low- and middle-income countries is expected to hamper the adoption of diabetes drugs, further restraining the market’s growth. Along with this, lack of a well-established healthcare infrastructure in rural areas will also impede the market’s growth.

MARKET TRENDS

Development of Innovative Drugs for Treatment of Diabetes

In recent years, the interest in therapeutics has shifted to glucose-lowering medications, such as GLP-1 analogs, SGLT-2 inhibitors, and dual-action drugs among healthcare professionals, which are being widely prescribed for diabetic patients. These factors further aid the adoption of these drugs among patients suffering from diabetes. Moreover, advancements in diabetes treatments and increased drug adherence are further increasing the adoption of diabetes drugs, thereby bolstering the market’s growth.

- According to a report published in April 2023 by the Providence Veterans Affairs Medical Center, the adoption of SGLT2Is (GLP-1 analogs) by prescribers is increasing over time, compared with sulfonylureas and other diabetes drugs.

- According to an article published by Komodo Health, Inc., in February 2023, more than 5 million prescriptions were filled in 2022 for diabetes drugs, such as for Ozempic, Mounjaro, Rybelsus, or Wegovy in the U.S.

Other Trends:

Technological Advancements:

Technological advancements, such as innovation in Continuous Glucose Monitoring (CGM) and insulin delivery devices, advances in drug formulation (smart insulins, inhalable insulin), and integration of digital technologies, such as mobile apps, diabetes management software, and others, have been witnessing a larger adoption. This, in turn, is driving the market’s growth.

Personalized Medicines:

Personalized medicine to treat diabetes involves the use of genetic information to tailor strategies for the prevention, detection, treatment, and monitoring of diabetic individuals. The use of tailored drug regimens based on genetic profiles to treat diabetes is one of the recent global diabetes drugs market trends.

Rise of Biosimilars:

As the demand for diabetic treatment drugs is rapidly increasing, the market players are now focusing on the development of cost-effective alternatives, such as biosimilars.

- For instance, in January 2024, in India, Lirafit - a biosimilar of the anti-diabetic drug, Liraglutide, was launched by Glenmark Pharmaceuticals Ltd. The drug costs around INR 100 daily for a standard dose of 1.2 mg.

Telemedicine and Digital Health Solutions:

In recent years, telemedicine has been playing an important role in diabetes management. This is majorly due to the increased adoption of digital health platforms for diabetes care.

- For instance, according to a study conducted among patients with type 2 diabetes in India and published in November 2021, during the lockdown period, 30.6% of the patients who tried to consult a doctor, utilized the telemedicine facility.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic substantially impacted the sales of the product globally. The country-wise lockdown measures imposed by government authorities across the globe limited the number of patient visits to healthcare settings, such as hospitals and pathology labs for disease diagnosis and treatment. However, the COVID-19 recovery in 2021 led to increased hospital visits by patients and a rise in the number of diabetes diagnoses among them, further propelling the demand for these drugs among the population. Thus, the increase in hospital visits post-pandemic and rising focus of major players on the introduction of advanced drugs for diabetes treatment led to the growth of the market in 2021. The market is further expected to witness strong growth in the coming years.

Segmentation Analysis

By Drug Class

Growing Demand for Novel Drugs Proliferated GLP-1 Receptor Agonists Segment Growth

Based on drug class, the market is segmented into DPP-4 inhibitors, insulin, GLP-1 receptor agonists, SGLT2 inhibitors, and others.

The GLP-1 receptor agonists segment dominated the market share by 57.48% in 2026. This can be attributed to factors, such as high demand for innovative, novel drugs to treat diabetes and advantages of this type of therapeutics. In addition, rising R&D investments by market players for the launch of novel drugs is further expected to propel the segment’s growth.

- For instance, as per the Cleveland Clinic Journal of Medicine, in August 2022, the REWIND trial indicated a relative risk reduction of 12% for cardiovascular events among patients treated with dulaglutide (a GLP-1 receptor agonist) compared to placebo.

The insulin segment is poised to grow at a considerable rate during the forecast period. The segment dominated the market share by 22.7% in 2024. The growth can be credited to the increasing launch of generic versions of insulin across the globe.

- For instance, in October 2022, Gulf Pharmaceutical Industries Company (Julphar) and PureHealth signed a partnership for the production of insulin glargine through the establishment of its first factory in the Middle East.

To know how our report can help streamline your business, Speak to Analyst

By Diabetes Type

High Prevalence of Type 2 Diabetes among Individuals Augmented Product Demand

On the basis of diabetes type, the global market is bifurcated into type 1 and type 2.

The Type 2 diabetes segment dominated the market with a 95.62% share in 2026. The rapidly increasing prevalence of type 2 diabetes has prominently driven the product’s demand. In addition, the rising number of clinical trials for type 2 diabetes drugs by the market players is anticipated to boost the market’s growth. The type 1 diabetes to record a considerable CAGR of 12.69% during the forecast period.

- For instance, in 2021, the World Health Organization (WHO) published statistical data which stated that, in India, an estimated 77 million people above the age of 18 suffered from type 2 diabetes.

The type 1 segment is likely to hold 4.4% of the market share in 2025 and to record a considerable CAGR during the forecast period. The increasing diagnosis and prevalence of type 1 diabetes among children and young adults in developing countries has boosted the segment’s growth.

By Route of Administration

Rising Presence of Generic Equivalents to Insulin Impelled Subcutaneous Segment Growth

Based on route of administration, the global market is divided into subcutaneous, oral, and intravenous.

The subcutaneous segment held a dominant position in the market in 2026. This is majorly due to factors, such as high availability of diabetes drugs that are administered subcutaneously and rising consumption of insulin injections across the globe. The increasing availability of generic equivalents and biosimilars of insulin in emerging countries is anticipated to further propel the segment’s growth. The subcutaneous segment is likely to hold a dominant position in the market share by 54.42% in 2026.

- For instance, as per statistics published by the American Diabetes Association, in August 2022, the number of diabetic patients in the U.S. that use insulin to treat diabetes was around 8.4 million.

The oral segment is projected to grow at a noteworthy CAGR of 12.95% in the coming years. The growth is attributed to the high demand for oral tablets due to ease of administration and high availability of various branded and generic drugs in the region.

By Distribution Channel

Availability of Drugs at Affordable Costs Boosted Retail Pharmacies Segment Growth

Based on distribution channel, the global market is categorized into online pharmacies, hospital pharmacies, and retail pharmacies.

In 2026, the retail pharmacies segment is likely to capture the highest share of the market by 46.28%. This dominance can be credited to the increasing availability of different diabetes drugs at affordable prices across retail pharmacies. The segment’s growth is further supported by the growing number of retail pharmacies around the world to fulfill the high diabetes drug demand.

- For instance, according to the news published by the Times of India in January 2023, Reliance Retail planned to open over 2,000 standalone pharmacy stores in a year.

The online pharmacy segment is also anticipated to witness the highest growth rate during the forecast period. The segment’s rapid growth can be ascribed to the rising focus of pharmacies on expanding their product offerings through e-commerce sites globally.

The hospital pharmacies segment is expected to show a CAGR of 11.96% during the forecast period.

PIPELINE ANALYSIS

With the rapidly growing demand for drugs for the management of diabetes, companies, such as Novo Nordisk A/S, Eli Lilly & Company, Sanofi, and others are actively involved in the development of new drugs.

- For instance, in August 2024, Eli Lilly & Company announced positive topline results from the SURMOUNT-1 three-year study. The study evaluates the efficacy and safety of tirzepatide in delaying the progression to diabetes in adults with pre-diabetes and the drug’s effectiveness in managing weight in obese or overweight patients.

Diabetes Drugs Market REGIONAL OUTLOOK

Geographically, the market covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America Diabetes Drugs Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Dominated Market Due to Growing Investments in R&D and Increasing Prevalence of Diabetes

North America dominated the market with a valuation of USD 50.69 billion in 2025 and USD 57.91 billion in 2026. The region is estimated to maintain its dominant position in the coming years. This can be attributed to factors, such as high prevalence of diabetes in the U.S., strong commercial & research base across the region, presence of advanced healthcare infrastructure, and increased insurance penetration among the population.

The U.S. dominated the regional market with highest share in 2024. The growing awareness about novel anti-diabetic drugs, new launches of anti-diabetic drugs, and favorable reimbursement policies are anticipated to boost the market’s growth in the country. Along with that, expansion of manufacturing facilities, and strategic collaborations between the market players further supported the country’s dominance. The U.S. market size is estimated to hit USD 53.45 billion in 2026.

- For instance, in November 2022, TZIELD (teplizumab-mzwv), a CD3-directed monoclonal antibody, received the U.S. FDA approval to delay the onset of stage 3 type 1 diabetes in adults and children 8 years and older who were previously diagnosed with stage 2 T1D.

- In January 2023, Eli Lilly and Company announced plans to invest an additional USD 450 million in the expansion of its manufacturing facility in North Carolina. The expansion includes additional parenteral filling and expanded device assembly & packaging capacity to support an increased demand for Lilly's incretin products that treat diabetes.

Europe:

Europe is anticipated to account for the second-highest market size of USD 24.86 billion in 2025, exhibiting the second-fastest growing CAGR of 24.49% during the forecast period. The region captured the second-largest market share in 2024. Major factors, such as increasing diabetes drug launches, rising penetration of key players, and increasing awareness regarding the available treatment options, among others, have supplemented the regional market’s growth. The UK market is expected to reach USD 3.08 billion, while Germany is projected to reach USD 11.45 billion by 2026.

- For instance, in November 2023, AstraZeneca signed an exclusive license agreement with Eccogene for ECC5004, an investigational oral once-daily glucagon-like peptide 1 receptor agonist (GLP-1RA). This medicine will be used for the treatment of type-2 diabetes, obesity, and other cardiometabolic conditions.

- Similarly, in September 2021, Sanofi started supplying its next-generation basal insulin Toujeo Solostar to the European Union countries.

Asia Pacific:

Asia Pacific region is to be anticipated the third-largest market with USD 18.25 billion in 2025 and USD 21.10 billion in 2026. It is an emerging market and its growth can be attributed to the growing incidence of diabetes in the region and increasing demand for diabetes care owing to the high disease burden. China and India are crucial in driving the regional market due to the high prevalence of diabetes in these countries. The market in China is estimated to be USD 9.12 billion in 2026.

Japan’s market size is estimated to be valued at USD 6.35 billion and India is likely to stand at USD 1.54 billion in 2026.

- For instance, in 2021, the data provided by the International Diabetes Federation stated that the number of South-East Asian individuals between the ages of 20-79 years suffering from diabetes was 90 million. By 2030, this number is projected to reach 113 million and 151 million by 2045.

Middle East & Africa:

On the other hand, the Middle East & Africa market is likely to witness moderate growth in the future. The growing patient pool suffering from type 2 diabetes is one of the prominent factors driving the market’s growth. The GCC market is expected to reach USD 2.01 billion in 2025.

Latin America:

Latin America region is to be anticipated the fourth-largest market with USD 5.41 billion in 2026. Contrastingly, the Latin American market is poised to grow at a comparatively slower rate during the forecast period. The market is expected to be driven by the large unmet needs of patients in Latin American countries, such as Brazil, Mexico, and others.

COMPETITIVE LANDSCAPE

Key Industry Players

Novo Nordisk A/S, Eli Lilly and Company, and Sanofi Dominate Market With Their Broad Product Portfolios

Novo Nordisk A/S is a prominent player with the highest share in the global market in 2024. The company is anticipated to maintain its dominance throughout the forecast period. Factors contributing to this dominance include broad product portfolio, significant investments in research & development of new drugs, and strong partnerships leading to technological innovations, among others. Novo Nordisk A/S, along with Eli Lilly & Company and Sanofi, currently leads the diabetes drugs market by capturing more than half of the market share in terms of revenue.

- For instance, in March 2024, Novo Nordisk A/S announced that the EMA’s Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion, recommending marketing authorization for Awiqli for the treatment of diabetes in adults.

Apart from the above-mentioned entities, the market also encompasses Bayer AG, Novartis AG, AstraZeneca, Merck & Co. Inc., and other players. The active involvement of these companies in undertaking initiatives, such as regulatory approvals, collaborations & partnerships, distribution agreements, and others, have strengthened their current positions in the market.

LIST OF KEY PLAYERS PROFILED:

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Merck & Co., Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Bayer AG (Germany)

FUTURE OUTLOOK

Market Forecasts and Trends for the Next Decade:

The diabetes drugs market is projected to witness notable growth during the forecast period of 2025-2032. This is majorly driven by factors, such as growing prevalence of diabetes, increasing awareness & diagnosis, new & innovative product launches, and advancements in drug delivery technologies. Additionally, the development of innovative therapies, such as gene therapy, nanomedicine will also shape the future market landscape, thereby improving treatment regimen for patients.

Emerging Markets:

The market for diabetes drugs has lucrative growth opportunities in underserved markets in low- and middle-income countries. The market players are expected to focus on undertaking various initiatives to capture the untapped avenues of the market. India, China, and Africa are some of the countries that are projected to witness strong market growth in the coming years.

Challenges and Opportunities Ahead:

The high cost of diabetes treatments is one of the critical issues that needs to be addressed in the future to support the market’s growth. This can be achieved by advancements in technology, resulting in affordable drug prices and cost-effective treatment options.

Thus, innovation plays an important role in shaping the diabetes drugs market. Development of new drug classes leading to launch of new products is likely to increase the adoption of these drugs, thereby boosting the market’s growth.

KEY INDUSTRY DEVELOPMENTS:

- July 2024 - Novo Nordisk A/S received the Complete Response Letter (CRL) covering the Biologics License Application for once-weekly basal insulin icodec for the treatment of diabetes mellitus in the U.S.

- March 2024 – Eli Lilly and Company partnered with Amazon Pharmacy to deliver its GLP-1 drugs through Amazon or Truepill. This increased the global penetration of Mounjaro and Zepbound, the company’s injectable GLP-1 medications.

- January 2024 – Glenmark Pharmaceuticals Ltd. introduced Lirafit - a biosimilar of the anti-diabetic drug, Liraglutide, in India. The per-day price of this drug is around USD 1.21 for a standard dose of 1.2 mg.

- June 2023 – Pfizer Inc. announced that the company continued the clinical development of its oral GLP-1-RA candidate for the treatment of adults suffering from type 2 diabetes and obesity.

- March 2023 - Sanofi (India) received marketing authorization for its diabetes drug Soliqua (in a pre-filled pen) from the Central Drugs Standard Control Organization (CDSCO) in India.

- February 2023: Akums Drugs and Pharmaceutical Limited, a contract drug manufacturing company, announced the launch of the ‘Lobeglitazone’ drug for the treatment of type 2 diabetes in India.

- December 2022 - Glenmark Pharmaceuticals Ltd. launched a new drug under the brand Zita-PioMet for type-2 diabetes treatment in India. The company introduced it in the first triple Fixed-Dose Combination (FDC) Teneligliptin, with a combination of Pioglitazone and Metformin.

- October 2022 - Glenmark Pharmaceuticals Ltd. launched the Lobeglitazone medicine in India for the treatment of type-2 diabetes in adults.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market. It focuses on key aspects, such as an overview of the prevalence of diabetes globally, drug class, product launches, and key industry developments such as partnerships, mergers and acquisitions. Besides this, it also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

|||

|

Study Period |

2021-2034 |

||

|

Base Year |

2025 |

||

|

Forecast Period |

2026-2034 |

||

|

Historical Period |

2021-2024 |

||

|

Growth Rate |

CAGR of 11.80% from 2026-2034 |

||

|

Unit |

Value (USD Billion) |

||

|

Segmentation |

By Drug Class, Diabetes Type, Route of Administration, Distribution Channel, and Region |

||

|

By Drug Class |

|

||

|

By Diabetes Type |

|

||

|

By Route of Administration |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

Frequently Asked Questions

The global diabetes drugs market size was valued at USD 101.46 billion in 2025. The market is projected to grow from USD 116.11 billion in 2026 to USD 283.36 billion by 2034, exhibiting a CAGR of 11.80% during the forecast period.

The market is projected to record a CAGR of 11.80% during the forecast period.

Based on drug class, the GLP-1 receptor agonists segment led the market.

The increasing adoption of the product for the treatment of diabetes is the key factor driving the market’s growth.

Novo Nordisk A/S, Eli Lilly and Company, and Sanofi are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us