Distributed Energy Resource Management System Market Size, Share & COVID-19 Impact Analysis, By Software (Virtual Power Plant, Management & Control, Analytics), By Application (Solar, Energy Storage, Wind, EV Charging Stations, Others), By End-user (Residential, Commercial, Industrial & Utilities), and Regional Forecasts, 2025-2032

Distributed Energy Resource Management System Market Size

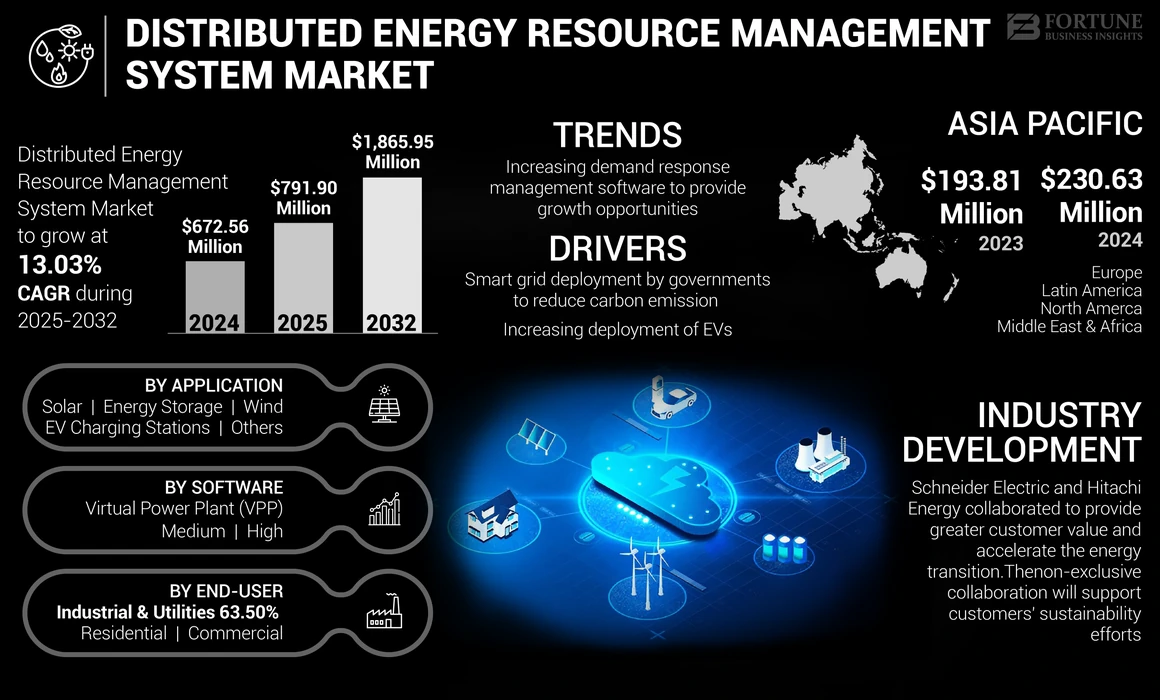

The global distributed energy resource management system market size was valued at USD 672.56 million in 2024 and is projected to grow from USD 791.90 million in 2025 to USD 1,865.95 million by 2032, exhibiting a CAGR of 13.03% during the forecast period. Asia Pacific dominated the global market with a share of 34.29% in 2024. The U.S. market is projected to grow significantly, reaching an estimated value of USD 441.69 million by 2032.

Distributed Energy Resource Management Systems or DERMS are software solutions that control and coordinate various Distributed Energy Resources (DERs). These DERs are of different energy types such as solar, wind, and battery storage. Distributed energy resource management includes the maintenance, control, analysis, demand control, and remote management of energy resources using software and networks.

Distributed Energy Resource Management System (DERMS) Market Overview

Market Size:

- 2024 Value: USD 672.56 million

- 2025 Value: USD 791.90 million

- 2032 Forecast Value: USD 1,865.95 million

- CAGR: 13.03% (2025–2032)

Market Share:

- Regional Leader: Asia Pacific holds 34.29% market share in 2024, driven by rapid adoption of solar, wind, and storage systems.

- Fastest-Growing Region: Asia Pacific is projected to maintain the highest growth rate during the forecast period.

- End-User Leader: The Industrial & Utilities segment leads the market due to large-scale DER installations and grid management needs.

Industry Trends:

- Virtual Power Plants (VPP) dominate the software segment, offering efficient aggregation of distributed assets like solar, wind, and storage.

- Solar applications account for the largest share, fueled by expanding rooftop solar installations and optimization needs.

- Demand Response software adoption is rising to support utilities in real-time grid balancing and economic dispatch.

Driving Factors:

- Accelerated adoption of clean energy resources such as solar, wind, storage, and EV charging.

- Government initiatives and smart grid policies promoting DERMS deployment for energy efficiency and emissions reduction.

- Rising electricity demand across emerging economies, requiring advanced grid management solutions.

- Integration of ICT, IoT, and real-time analytics into DERMS enhances operational efficiency and system intelligence.

- Growing need for grid flexibility, scalability, and reliability to manage increasing volumes of distributed energy resources.

The remarkable development of industrialization and urbanization worldwide has resulted in energy demand. The growing demand for energy to support the world's livelihood has led to increasing investments in renewable energy resources. Developing the renewable energy sector and managing distributed generation have surged the demand for the distributed energy resource management system.

COVID-19 IMPACT

Decline in Demand for Distributed Energy Resource Management Systems Amid the Pandemic Slowed Down the Market Growth

COVID-19 continues to spread rapidly around the world. The global impact of COVID-19 on the distributed energy resource management system market growth is moderate, as it hampered the growth rate of the DERMS market. Factors such as reduced capital investments in solar and others, radical change in the energy demand patterns due to shutdowns of industries, businesses, and schools, and necessitating the home office mode during the COVID-19 crisis have impacted the market of distributed energy resource management system.

Furthermore, lockdown measures deteriorated power demand due lack of industrial activities, reducing efforts to set up new DERs. However, the rising reliance on renewable energy drives the market growth.

Distributed Energy Resource Management System Market Trends

Download Free sample to learn more about this report.

Increasing Demand Response Management Software to Provide Growth Opportunities

With a rapidly expanding population and an expansion in production activity across many industries, there is a huge demand for products. This is due to the rapidly evolving industrial landscape and rapid urbanization. Massive consumption and growing digitization have also accelerated industry and increased demand for materials, manufacturing capacity, and production. To fulfill power demands, the industrial landscape around the world occasionally experiences significant peak load circumstances. There is a sizable need for demand response management software and systems, which is anticipated to drive the market due to increasing development of intelligent infrastructures and higher power consumption.

According to the International Energy Agency (IEA), quick progress is required in demand-response management, which will require 500 GW of response capacity by 2030 as a result of the continuous expansion of renewable energy projects to meet net-zero emissions goals. The agency went on to add that both the supply and demand sides of the system must be flexible. The need for decentralized energy resource management is anticipated to rise significantly over the next 10 years as a result of numerous nations, including Canada, Singapore, the European Union, and China, announcing renewable energy targets and infrastructure development programs for EV charging stations.

Distributed Energy Resource Management System Market Growth Factors

Smart Grid Deployments by Governments to Reduce Carbon Emission to Promote Market Growth

Several governments have directed the installation of smart grids, making them a critical factor in national energy policies. These countries' energy policies focus on improving efficiency and reducing CO2 emissions. Government entities are increasingly investing in the smart grid sector to fast-track the replacement of old grid structures.

One recent development in this context occurred in July 2022, when the U.S. Trade and Development Agency awarded the Régie Autonome de Distribution d'Eau et d'Electricité de Marrakech (RADEEMA), the electricity and water utility of Marrakech to study the transformation of power infrastructure of Marrakech into smart grid and will serve as a model for other Moroccan cities.

Additionally, in November 2021, the U.S. government passed a new Infrastructure Investment and Jobs Act, wherein the country invests heavily in developing smart and distribution grids. The law provides a USD 3 million investment in the Smart Grid Investment Matching Grant Program.

Increased Deployment of EVs to Augment Product Demand

The growing responsibility for protecting the environment through sustainable development has increased the demand for electric vehicles worldwide. Sales of Electric Vehicles (EVs) in 2021 doubled from 2020 to a record nearly 6.6 million, according to the International Energy Agency (IEA). Almost 10% of global automotive sales were EVs in 2021, which stood at 4% of the market share in 2019. The sales of electric cars are likely to grow strongly in 2022, with 2 million units sold in Q1, up 75% from the same period in 2021.

With technology development, the cost of EVs is reducing, further surging their demand. Governments of different nations have endorsed electric vehicles and set appropriate policies to accelerate the transition to zero-emission vehicles. Environmental regulations and fuel consumption standards determine the EV market.

- In October 2022, the Uttar Pradesh Cabinet approved the new UP EV Policy – Uttar Pradesh Electric Vehicle Manufacturing and Mobility Policy 2022. The electric two-wheelers receive 15% discount on the ex-factory costs. The new policy will support 50,000 electric tricycles and provide a 15% subsidy on the ex-factory cost of up to a certain limit.

With the rise of electric vehicles and a further rise of electric vehicle charging stations, the demand for energy management systems is expected to grow and propel the market.

RESTRAINING FACTORS

Cyber Security Risks Associated with IoT to Hinder Market Growth

A distributed energy resource management system uses Information & Communication Technology (ICT), the Internet of Things (IoT), automated control, energy storage, and demand management. The data from the systems is collected for analysis. The data poses a threat of getting hacked by cyber-attacks and data breaches. For example, in February 2021, Npower, a gas and electricity company, permanently withdrew its mobile app after threat actors used it to access their customers’ personal information. The attackers accessed the customer accounts using login data from another website, leaving customers open to fraud.

The heavy investment in data breach prevention and cybersecurity increases the cost of management systems. This financial disadvantage affects the adoption of distributed energy resource management and is expected to hamper market growth.

Distributed Energy Resource Management System Market Segmentation Analysis

By Software Analysis

Virtual Power Plant Software to Dominate Owing to its Aggregation Capacity with Different Energy Sources

Based on software, the market is trifurcated into Virtual Power Plant (VPP), analytics, and management & control.

The Virtual Power Plants (VPP) segment is anticipated to hold the biggest market share. The wide range of features of a VPP, together with elements such as using cloud-based real-time operational control to cluster capacities of diverse Distributed Energy Resources (DERs) to boost efficiency and trading power, make it an appealing option for end-users.

The management & control software assists in remotely managing the distributed energy resource to regulate operations, quickly identify faults, and take the appropriate corrective action. To boost productivity and take advantage of visual datasets, analysis tools and software also assist planners in determining various parameters by integrating massive datasets.

By Application Analysis

Solar Application to Dominate Due to Functional Optimization and Growing Solar Installation

Based on application, the market is segmented into solar, energy storage, wind, EV charging stations, and others.

Use of DERMS in solar is utilized to control and optimize the functionalities of solar energy generation. The wide perforation rate of DERMS in the solar industry and the massive utilization of rooftop solar lead to the dominance of solar applications in the distributed energy resource management system market share.

Moreover, DERMS is also utilized for controlling wind power generation and for controlling & maintaining the EV charging station. The growing installation of wind farms and development of EV charging infrastructure across major regions resulted in market growth during the forecast period. The others segment accounts for Combined Heat & Power (CHP) applications and demand response management.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Industries & Utilities to Dominate Due to the Use of Distributed Energy Resource Management Systems in their Operations

Based on end-user, the market is subdivided into commercial, residential, and industrial & utilities.

Due to the significant penetration of DERMS, the industrial & utilities segment dominates the DERMS market. In addition, the industrial & utilities segment creates a significant amount of distributed energy, which contributes to the market's supremacy.

Additionally, the use of distributed energy resource management on a smaller scale than in the industrial & utilities segment is referred to as residential and commercial segments. The significant increase in rooftop PV system installations among commercial and residential end-users, including home and business owners who typically use management, control, and analytic software for efficient operation and optimization, is the segment's primary driver.

REGIONAL INSIGHTS

Asia Pacific Distributed Energy Resource Management System Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific to Dominate the Market Owing to Growing Solar & Wind Power Installation

The global market is analyzed across major regions, Europe, Asia Pacific, Latin America, North America, and the Middle East & Africa.

Asia Pacific dominates the distributed energy resource management system market share. The massive growth in solar & wind renewable energy installation coupled with excessive energy demand propels the demand for DERMS across the region. One recent development in this context occurred in August 2022, when Horizon Power launched a new DERMS in Western Australia's regional microgrids, which enables rooftop solar, battery and electric vehicle customers to securely join with utility energy resources.

Followed by Asia Pacific, the North America market is largely driven by the growing sanctioning of various virtual power plants and distributed resource management projects across the region. For example, in November 2022, Swell Energy raised USD 120 million to expand the categorization of virtual power plants.

Subsequently, Europe has significant projects in DERMS-based software across renewable energy and energy storage-based systems, resulting in demand for distributed energy resource management systems. For example, Statkraft's virtual power plant in Germany produces 10,000 MW+ of electricity to cater to the energy demand. In parallel, the significant investment in renewable energy projects in Latin America and the Middle East & Africa will drive the market's growth.

KEY INDUSTRY PLAYERS

Key Participants are Concentrating on Enhancing their Business Capacities to Deliver Efficient Products

Most players operating in the market are focusing on the development of virtual power plants with the rise in deployment of the renewable energy industry, which increases the need for managing the energy demand more sustainably.

Consequently, other players are present across the industry, catering to different project requirements. These establishments focus more on delivering newer technological developments for distributed energy generation, forming a significant portion of the global competitive landscape. For example, in May 2022, Oracle partnered with POWER Engineers to help the utilities implement & integrate more reliable and innovative grid modernization solutions. As a part of the partnership, Oracle offered a wide range of suitable Advanced Distribution Management System (ADMS) solutions, including Network Management System (NMS), DERMS, and Outage Management System (OMS) solutions.

List of Top Distributed Energy Resource Management System Companies:

- Itron (U.S.)

- Oracle (U.S.)

- Energy Hub (U.S.)

- AutoGrid Systems (U.S.)

- Opus One Solutions (Canada)

- Blue Pillar (U.S.)

- Kitu Systems (U.S.)

- Enel (Italy)

- Open Access Technology International, Ltd. (U.S.)

- Sunverge Energy Inc. (U.S.)

- Hitachi ABB (Switzerland)

- Schneider Electric (France)

- Siemens (Germany)

- General Electric (U.S.)

- Engie (France)

- Generac (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Doosan Heavy Industries & Construction (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 - Oracle offered Advanced Distribution Management System for FirstEnergy, an Ohio-based company, to manage the response to power outages across its six-state electric system. Oracle has helped the company implement its Utilities Network Management System (NMS), which helped FirstEnergy to manage & control centers across its 10 electric utilities actively.

- November 2022 - Awesense Wireless Inc. announced its partnership with Kitu Systems Inc. to accelerate the deployment of Distributed Energy Resource Management Systems (DERMS). The partnership focuses on helping electric utility companies deploy the DERMS and help overcome inaccuracy in data models, lack of real-time visibility, and others.

- October 2022 – Generac’s DERMS was selected by Dominion Energy Virginia to control and manage the grid reliability. The platform can manage the planned distribution of energy resources, including smaller, behind-the-meter consumer devices such as home solar panels, smart thermostats, battery storage, electric vehicles, and other capacity resources.

- September 2022 – Itron linked its IoT with Samsung’s smart platform link to enable utility with an improved DERMS. The solution provides participating consumers with real-time consumption data from their meters, behind-the-meter systems and devices within the SmartThings Energy service to provide a comprehensive picture of energy consumption.

- May 2022 - GE Digital and Opus One Solutions came together to help utilities on their DERs journey with a modular DERMS platform. The software is designed to provide information, operations, profitability, and markets in a modular solution. In this way, network operators can connect, view, control, and optimize the DERs from a technical and economic point of view.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several methodologies and approaches are adopted to make meaningful assumptions and views to formulate the report.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.03% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Software, Application, End-user, and Region |

|

Segmentation |

By Software

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the global market was USD 672.56 million in 2024.

The global market is projected to grow at a CAGR of 13.03% in the forecast period.

The market size of Asia Pacific stood at USD 230.63 billion in 2023.

Based on software type, the virtual power plant segment holds the dominating share in the global market.

The global market size is expected to reach USD 1865.95 million by 2032.

The key market drivers are the adoption of clean energy and the growing smart grid infrastructure.

The top players in the market are General Electric, Oracle, Siemens, Enel, and Blue Pillar.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us