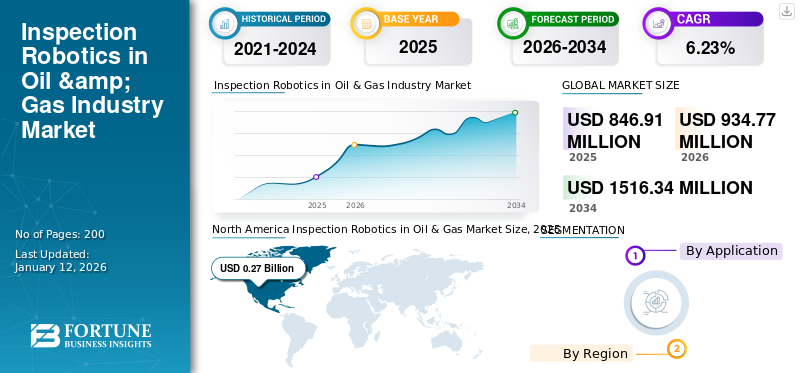

Inspection Robotics in Oil & Gas Market Size, Share & Industry Analysis, By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

Inspection Robotics in Oil & Gas Market Size and Future Outlook

The global Inspection Robotics in Oil & Gas Market size was valued at USD 0.84 billion in 2025. The market is projected to grow from USD 0.93 billion in 2026 to USD 1.51 billion by 2034, exhibiting a CAGR of 6.23% during the forecast period. North America dominated the Inspection Robotics in Oil & Gas market with a market share of 32.20% in 2025.

An inspection robot is a multifunctional device equipped with software, sensors, vision systems, and advanced technologies designed to engage with its environment, collect data, and carry out regular or essential inspection activities.

The market is expected to grow in the coming years owing to the rising investments in oil and gas exploration and production, the need for improved safety and efficiency in inspection operations, and the growing need for automated solutions for unsafe and inaccessible environments.

Baker Hughes is one of the major players in the market, operating through its business unit, Waygate Technologies, which offers versatile crawler robots equipped with various non-destructive testing (NDT) payload options, advanced point-tilt-zoom (PTZ) camera systems, and 3DLOC software, which geotags inspection data to a digital twin.

MARKET DYNAMICS

MARKET DRIVERS

Growing Need for Remote Inspection to Support Market Growth

The increasing need for remote inspection and monitoring solutions is a key driver of growth in the Inspection Robotics in Oil & Gas Market. Remote inspection robots are utilized to assess assets and infrastructure in hazardous, isolated, or hard-to-access locations without requiring human involvement. In the oil and gas sector, routine inspections are crucial for ensuring both safety and the upkeep of assets. These robots are created to navigate challenging locations, gather data, and transmit it wirelessly to operators for timely decision-making. Thus, the adoption of remote inspection technologies is expected to increase as companies increasingly look for economical and efficient solutions for asset maintenance and inspection.

Need for Workforce Safety to Drive Market Growth

Owing to the operational nature and environment of the oil & gas industry, inspection tasks are often hazardous or hard for people to access. These tasks require work outside regular hours and under harsh conditions. In these scenarios, inspection robots have become essential partners in enhancing worker safety due to their capacity to function for long periods and effectively in difficult environments. Besides ensuring safety, these robots can handle mechanical and repetitive tasks, enabling operators to concentrate on more valuable and engaging activities.

MARKET RESTRAINTS

Extensive Capital and Maintenance Requirements to Limit Market Growth

Significant upfront investment is required for inspection robotics, which can pose a challenge for widespread adoption. Oil & gas rig operators in emerging economies could struggle to allocate the required resources, impeding the broad acceptance of the technology. Additionally, deploying and operating inspection robots requires a trained workforce with adequate knowledge. Since inspection activities produce a large volume of intricate technical data, experienced professionals are required to analyze them. Consequently, the shortage of skilled professionals with experience in managing robots and analyzing data also presents a challenge for inspection robotics in the oil & gas industry market growth.

MARKET OPPORTUNITIES

Increasing Need for Data for Better Decision-Making to Drive Market Growth

Inspection robots produce large quantities of data throughout the inspection process, such as images, sensor data, and additional diagnostic details. By utilizing this information, organizations can obtain important insights regarding the status and functionality of their assets. Additionally, inspection robots enhance precision and uniformity in data, removing the possibility of human mistakes and delivering dependable insights for informed decision-making.

MARKET CHALLENGES

Volatile nature of Oil & Gas Industry to Hinder Market Growth

The oil and gas sector faces uncertainties owing to regulatory changes, fluctuating oil & gas prices, and the need to comply with environmental and safety standards, making it challenging to implement new technologies. Fluctuating revenues could impact decision-making and resource allocation, prompting businesses to prioritize daily operations over investing in inspection robotics. As an advanced technology that requires adequate funding for operations and maintenance, its adoption may be delayed under such circumstances.

MARKET TRENDS

Technological Advancements to Fuel Market Growth

The integration of cutting-edge technologies such as Artificial Intelligence (AI) and IoT into inspection robots offers substantial growth prospects. These advancements enable swift data analysis, enhanced decision-making, and remote monitoring. Current developments in the inspection robot sector show a rising preference for autonomous and semi-autonomous robots capable of conducting inspections independently. Furthermore, the utilization of drones for aerial assessments is becoming increasingly popular, offering economical and effective options for extensive inspections. The incorporation of 5G technology is further improving the functionalities and performance of inspection robots.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The outbreak of the COVID-19 pandemic presented several challenges for the Inspection Robotics in Oil & Gas Market. The oil and gas sector faced significant challenges due to decreased demand, resulting in financial setbacks, delayed project development, and hindered market growth. Moreover, COVID-19 negatively impacted the Inspection Robotics in Oil & Gas Market growth, as oil and gas companies delayed or halted funding for non-essential technologies such as inspection robots to save capital amid economic uncertainty.

SEGMENTATION ANALYSIS

By Application

Growing Need For Safety & Inspection Of Onshore And Offshore Fields To Propel The Market

By application, the Inspection Robotics in Oil & Gas Market is bifurcated into onshore and offshore.

Onshore application is anticipated to dominate the inspection robotics in the oil & gas industry market share during the forecast period. Onshore inspections are crucial for maintaining the safety and integrity of facilities and equipment in the oil and gas industry. Inspections assist in detecting problems such as corrosion, mechanical wear, and structural failures before they escalate into significant issues. The onshore segment dominated the market share by 88.86% in 2026.

Offshore inspections are essential for the oil and gas sector to guarantee asset safety and reliability and to avoid expensive downtime. However, offshore locations can pose significant difficulties owing to the isolated sites, dangerous situations, and intricate nature of offshore structures.

To know how our report can help streamline your business, Speak to Analyst

INSPECTION ROBOTICS IN OIL & GAS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Inspection Robotics in Oil & Gas Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Growing Adoption of Robotics to Foster Market Growth

North America region is anticipated to dominate the Inspection Robotics in Oil & Gas Market share over the forecast period. The regional market value in 2026 was USD 0.27 billion, and in 2025, the market value led the region by USD 0.28 billion. In North America, the inspection robotics in the oil & gas industry is driven by the growing adoption of robotics and technological advancements, pushing industry players to leverage advanced solutions for inspections. The region is also home to some of the leading industry players, which further drives the research and development efforts for robotics in the oil & gas sector.

U.S.

Growing Oil & Gas Industry to Propel Market Growth

The U.S. market size is estimated to reach USD 0.06 billion in 2026. The shale revolution has turned the U.S. into the world's leading oil and gas producer and a major exporter of these fuels. This has spurred the growth of the oil & gas industry and developed a robust value chain. As the industry continues to expand, it is anticipated to propel the demand for advanced solutions such as robotics, to ensure the inspection of critical assets.

Europe

Growing Emphasis On Advance Solutions to Support Market Growth

Europe is anticipated to account for the second-highest market size of USD 0.28 billion in 2026, exhibiting the second-fastest growing CAGR of 5.54% during the forecast period. The market for inspection robotics in oil & gas industry in Europe is expected to expand due to the region’s emphasis on adopting new technologies and solutions for inspecting and maintaining aging infrastructure. Companies in the region are focusing their efforts and investments on advanced robotics technologies to minimize accidental risks and damages that might occur within the oil and gas infrastructure. The U.K. market size is estimated to be USD 3.51 million in 2026. Russia is projected to lead the market size with USD 203.97 million in 2025, whereas Norway is likely to hit USD 5.38 million in 2025.

Asia Pacific

Expanding Oil And Gas Exploration Reserves to Facilitate Region's Development

Asia Pacific region is to be anticipated as the third-largest market with USD 0.19 billion in 2026.

The Asia Pacific region is experiencing significant growth driven by the growing focus on exploring new oil & gas reserves, which has led to increasing activities in offshore locations. Additionally, rising investments in new technologies for the oil & gas sector is anticipated to incresase demand for inspection robotics solutions. India is likely to hit USD 33.10 million in 2026 and Indonesia’s market size is estimated to hit USD 20.00 million in 2025.

China

Growing Offshore projects to Support Market growth

The market in China is expected to hit USD 0.11 billion in 2026. In China, rapid urbanization and industrialization are driving an ever-increasing demand for energy. To meet this demand, offshore projects are being developed to increase operational productivity. This growing focus on offshore projects is anticipated to fuel demand for inspection robotics to efficiently assess critical offshore infrastructure.

Latin America

Expansion of Oil Production To Aid Market Expansion

Latin America’s oil & gas industry is in the growing stage, particularly in countries such as Brazil and Mexico, with Brazil being the top oil producer in the region. The U.S. Energy Information Administration (EIA) indicates that over 95% of Brazil's oil output is sourced from deep-water oil fields located offshore. The growth of the industry creates investment opportunities, which are anticipated to support the deployment of new technologies, such as inspection robotics for infrastructure development.

Middle East & Africa

Efficiency and Accuracy in Inspections to Influence Market Growth

The Middle East & Africa region is to be anticipated as the fourth-largest market with USD 0.11 billion in 2026. The Middle East is the top oil-producing region in the world, with major oil-producing countries such as Saudi Arabia, UAE, and Iraq. The region’s dependency on the oil & gas sector is anticipated to propel the growth of inspection robotics in the market. Utilization of inspection robotics could help maintain the region’s position by improving the efficiency of inspecting oil rigs and platforms, reducing human intervention, and providing more accurate insights. Saudi Arabia is likely to reach market size of USD 28.56 million in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Advanced Solutions By Market Players To Support Market Growth

Globally, Schlumberger Limited (SLB), Eddyfi Technologies, and Baker Hughes are some of the key players in the market. Eddyfi Technologies provides a varied range of NDT tools, sensors, software, and robotic solutions designed to inspect vital components and assets in sectors such as aerospace, oil & gas, and others. The company offers VersaTrax™, a range of flexible, track-mounted inspection crawlers (robots) created for confined areas where human reach is challenging or unsafe.

List of the Key Inspection Robotics in Oil & Gas Industry Companies Profiled:

- SLB (U.S.)

- Baker Hughes (U.S.)

- Anybotics (Switzerland)

- Cyberhawk (U.S.)

- Eddyfi Technologies (Canada)

- Autel Robotics (China)

- Boston Dynamics (U.S.)

- Petrobot (India)

- Energy Robotics (Germany)

- SMP Robotics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

October 2024 - Rockwell Automation, Inc. entered into a contract with Taurob to deliver a comprehensive robotic solution allowing industrial companies to progress toward autonomous operations. Taurob designs and produces ground robots for inspection, maintenance, and data gathering to improve and increase efficiency across various industrial locations, including the oil and gas sector.

October 2024 - ANYbotics, a global player in autonomous mobile robotics, formed a partnership with international energy technology firm SLB to deliver cutting-edge solutions for the oil and gas sector. This partnership would provide comprehensive robotics solutions, revolutionizing how oil and gas operators handle inspections, predictive maintenance, and global safety.

September 2024 - Avestec Technologies Inc., a supplier of aerial drones for asset evaluations in multiple sectors, is launching its flying robot, SKYRON, for commercial use. Avestec SKYRON is an aerial robot equipped with sophisticated technology capable of conducting ultrasonic thickness assessments and visual inspections.

July 2024 - Australian-based SRJ Technologies agreed to acquire UK-based Air Control Entech (ACE), a step intended to enhance its fleet with sophisticated drones and robots for remote inspections of offshore energy facilities. ACE offers in providing remote inspection solutions for the oil & gas sector utilizing cutting-edge robotics and tailored UAV technology.

June 2024 - ANYbotics, a provider of comprehensive autonomous robotics solutions, partnered with Energy Robotics, a developer of sophisticated data platforms for robotic applications. This strategic alliance aims to revolutionize asset monitoring by providing end-to-end inspection solutions and data integration for the energy sector.

REPORT COVERAGE

The global Inspection Robotics in Oil & Gas Market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies in the Inspection Robotics in Oil & Gas Industry. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.23% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued USD 0.84 billion in 2025.

The Inspection Robotics in Oil & Gas Market is likely to grow at a CAGR of 6.23% over the forecast period.

The onshore segment is expected to dominate the Inspection Robotics in Oil & Gas Market in the forecast period.

The market size of North America stood at USD 0.27 billion in 2025.

Rising demand for remote inspection solutions and enhanced workforce safety in hazardous environments.

Some of the top players in the Inspection Robotics in Oil & Gas Market are SLB, Baker Hughes, Eddyfi Technologies, and others.

The global market size is expected to reach USD 1.51 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us