Network Attached Storage Market Size, Share & Industry Analysis, By Enterprise Type (SoHo: <10 FTEs, Mid-Size: <1,000 FTEs, and Large Enterprise: >1,000 FTEs), By Storage Solution (Scale-up NAS and Scale-out NAS), By Industry (BFSI, IT & Telecommunications, Consumer Goods & Retail, Healthcare, Energy & Utilities, Government, Media & Entertainment, Education, and Others), and Regional Forecast, 2026 – 2034

NETWORK ATTACHED STORAGE MARKET SIZE AND FUTURE OUTLOOK

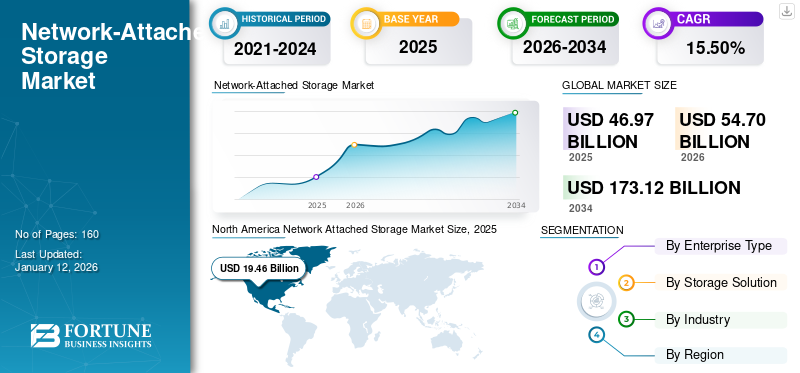

The global network-attached storage market size was valued at USD 46.97 billion in 2025. The market is projected to grow from USD 54.7 billion in 2026 to USD 173.12 billion by 2034, exhibiting a CAGR of 15.50% during the forecast period. North America dominated the market with a share of 41.40% in 2025.

The network attached storage (NAS) market focuses on developing, producing, and installing NAS solutions, which provide centralized and file-level data storage accessible over a network. NAS devices enable seamless data sharing, backup, and storage management across multiple users and systems, making them critical for individual users, small and medium-sized enterprises, and large enterprises.

The market is driven by the increasing demand for scalable and cost-effective storage solutions, the growing need for data backup, disaster recovery, the rising adoption of cloud-based NAS, and high-speed file sharing. Key players in the market include IBM Corporation, Hitachi Vantara LLC (Hitachi Ltd.), Western Digital Corporation, Seagate Technology Holdings plc, QNAP Systems, Inc., NetApp, Inc., NetGear, Inc., Synology Inc., and Buffalo Americas, Inc. These companies focus on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market presence.

IMPACT OF GENERATIVE AI

Rapid Integration of Generative AI in NAS to Accelerate Automation

Generative AI is expected to drive higher automation within NAS environments. Future developments may include predictive analytics for capacity planning, automated data tiering, and intelligent caching solutions that enhance operational efficiency while reducing costs. These innovations will help organizations manage their data more effectively, allowing IT teams to focus on strategic initiatives rather than routine maintenance tasks. This integration can potentially drive advancements in AI and NAS, shaping the future of both fields.

For instance,

- In May 2024, Huawei unveiled the OceanStor A800, a network-attached storage solution capable of scaling to exabyte levels, specifically designed to meet the demands of AI workloads. This system aims to provide high performance and resilience, which are essential for managing large datasets required by Gen AI applications.

NETWORK ATTACHED STORAGE MARKET TRENDS

Evolution of AI-driven NAS to Support Enterprise and Cloud-Based Workloads has Emerged as a Market Trend

The evolution of AI-driven NAS has significantly transformed how enterprises manage and store data. Traditional NAS solutions faced scalability, performance, and integration limitations. However, with the increasing demand for high-speed data processing, enhanced security, and seamless cloud integration, AL NAS has evolved to meet the growing needs of modern enterprises. For instance,

- According to Gartner, by 2025, more than 95% of all new digital data workloads will be shifted to cloud-based platforms, up from 30% in 2021. This strategy is driving the growth of the network-attached storage market.

Moreover, the integration of AI in NAS systems has further enhanced automation, predictive analytics, and intelligent data management, making them more efficient and reliable for large-scale workloads. For instance,

- Synology’s AI-powered NAS solutions, such as the Synology DS series, incorporate machine learning to optimize storage management and improve data indexing, ensuring faster access to frequently used files.

MARKET DYNAMICS

Market Drivers

Increasing Product Launches and Investments in Network Technologies, such as 5G, Drive the Market Growth

The integration of advanced internet technologies with high-speed data transfer and storage has provided an ideal platform for network attached storage devices. With rapid globalization and high-volume electronic data generation, organizations are investing and launching new products to enhance data storage and security. For instance,

- In May 2024, StarHub and Global Switch joined forces to establish Low Latency Data Centre Connect. This partnership enables them to utilize both the consumer NAS ecosystem and the operational ecosystem to overcome security challenges.

The increase in the use of this technology is majorly due to the backup targets and the store of file copies of data rapidly. Adequate storage is necessary to stock data efficiently, which, in the case of advanced internet technologies, has increased demand for high-capacity solid-state drives and internal memory. Therefore, the rapid deployment of 5G and a rebound in data usage will likely fuel network attached storage market share.

- According to industry specialists, by 2040, the economic impact of 5G is estimated to be between USD 450.0 billion and USD 500.0 billion due to a combination of cross-sector contributions for productivity gains and efficiency gains.

Market Restraints

Concerns Related to Data Theft and Breaches on Servers and an Increase in Traffic Over the LAN Hinders the Market Growth

According to the Cujo AI cybersecurity report, in 2023, network attached storage devices were targeted by 100 times more threats than an average device. Along with this, the migration cost of the software also hinders market growth. Moreover, data backup should be quick, and the solution should enable businesses to save their unstructured data at a low cost and quickly deploy it on the cloud.

High traffic over Local Area Networks (LANs) can slow NAS performance, especially when multiple users access the system simultaneously. This is primarily due to its reliance on dedicated protocols, including Server Message Block (SMB) and Network File System (NFS), which may not handle high-performance applications efficiently due to their inherent latency and throughput limitations.

Market Opportunities

Enhanced Multimedia Capabilities and Increasing Demand for Data Storage are Creating Lucrative Opportunities for the Market

Effective and reliable storage technologies are becoming increasingly important as the digital landscape evolves and people and businesses create vast amounts of data. The NAS devices are given an environment for growth due to the growing data storage solutions. The proliferation of digital content creation primarily drives the increasing demand for data storage.

Businesses realize the importance of data storage and redundancy and protect themselves from loss as digital information grows in value. NAS devices have built-in backup functions such as RAID configuration and automated backups that ensure data integrity and protection from possible data loss. For instance,

- According to a report by market experts, in 2023, there were 209 data center transactions in the U.S. with a combined value of over USD 48.0 billion 2021, up 40% from 2020, when it was worth USD 34.0 billion. There were 87 transactions with an overall value of USD 24.2 billion in the 1st half of 2022.

Moreover, the enhanced multimedia capabilities of NAS devices create an opportunity for the market. Multimedia consumption has increased sharply in the past few years, and individuals, as well as households, are relying more on service providers such as Internet Streams, Online Games, or HD content for entertainment purposes.

- According to Gitnux, 1.79 billion paid video-on-demand subscriptions will be globally available by the end of 2023.

Thus, increasing demand for data storage and enhanced multimedia capabilities is expected to create lucrative opportunities for the key vendors in this market.

SEGMENTATION ANALYSIS

By Enterprise Type

Escalating Data Security Fuels Mid-Size: <1,000 FTEs Segment Growth

By enterprise type, the market is divided into SoHo: <10 FTEs, Mid-Size: <1,000 FTEs, and Large Enterprise: >1,000 FTEs.

The mid-size: <1,000 FTEs segment held the highest market share of 55.37% in 2026. It is expected to grow at the highest CAGR due to the increasing need for cost-effective, scalable, and high-performance storage solutions to manage expanding volumes of data from these enterprises. These rapidly adopt NAS solutions to enhance data security, enable remote access, and support hybrid cloud environments without the high costs associated with large-scale data centers.

SoHo: <10 FTEs holds the second-largest share of the NAS market. Small office or home office users require affordable, easy-to-deploy, and efficient storage solutions for data backup, file sharing, and remote collaboration. The growing adoption of digital tools, cloud applications, and remote work models has further driven NAS adoption among small businesses and individual professionals.

By Storage Solution

Growing Demand for Vertically Scalable Storage Solutions Drives the Scale-up NAS Segment Growth

By storage solution, the market is distributed into Scale-up NAS and Scale-out NAS.

The scale-up NAS leads the market share with anticipated 50.18% share over 2026-2034, due to its widespread adoption among enterprises requiring vertically scalable storage solutions with centralized management and cost-efficient capacity expansion. Its ability to provide high-performance storage for structured and unstructured data makes it a preferred choice for industries with moderate to high storage demands.

The scale-out NAS is expected to grow at the highest CAGR of 17.50% over 2025-2032 as businesses increasingly require horizontally scalable storage solutions to handle massive data growth and distributed workloads. Its capability to expand storage capacity seamlessly by adding nodes without disrupting operations makes it ideal for industries leveraging big data, Artificial Intelligence (AI), and cloud computation.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Increase in Data Traffic Propels IT & Telecommunication Segment Growth

The market is segmented by industry into BFSI, IT & telecommunications, consumer goods & retail, healthcare, energy & utilities, government, media & entertainment, education, and others.

The IT & telecommunications will hold the highest market share of 25.48% in 2026. It is expected to grow at the highest CAGR of 19.10% during 2025-2032, due to the exponential rise in data traffic, cloud adoption, and the need for efficient data management solutions. The increasing deployment of NAS for data storage, backup, disaster recovery, and data backup solutions across telecom networks and IT infrastructure further drives market growth.

The consumer goods & retail segment holds the second-largest share as retailers increasingly adopt NAS solutions to manage vast amounts of transactional, inventory, and customer data. The growing shift toward e-commerce, digital marketing, and omnichannel retailing has further accelerated network attached storage market growth.

North America Network Attached Storage Market Size, 2025(USD Billion)

To get more information on the regional analysis of this market, Download Free sample

NETWORK ATTACHED STORAGE MARKET REGIONAL OUTLOOK

The global market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America dominates the market of value USD 19.46 billion in 2025 due to high digital transformation rates, strong cloud adoption, and significant investments in enterprise storage solutions. The presence of key market players and the demand for scalable and secure data storage further strengthen its market leadership. Moreover, the U.S. dominates the North American market due to its advanced IT infrastructure, high adoption of cloud computing, and strong presence of leading technology companies offering innovative storage solutions. The U.S. will account for USD 17.53 billion market size in 2026.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific holds the second-largest market share of USD 18.19 billion in 2026 and is expected to grow at the highest CAGR of 19.50% due to rapid industrialization, increasing cloud adoption, and the expansion of data centers across emerging economies such as China, Japan, and India. The region's growing digital ecosystem and government initiatives supporting data storage infrastructure drive substantial market growth. The market size in China will be valued at USD 6.73 billion in 2026, along with Indian market at USD 2.58 billion, and Japan at USD 3.26 billion in 2026.

Europe

Europe holds a significant market share of USD 9.15 billion in 2026 due to the strong adoption of NAS in industries such as BFSI, healthcare, discrete manufacturing, and transportation, where data security and compliance are critical. Furthermore, the region's emphasis on data protection regulations, such as GDPR, further fuels the demand for secure and scalable NAS solutions. The U.K. market size will be valued at USD 2.4 billion, Germany market at USD 1.83 billion, and France at USD 1.36 billion in 2025.

Middle East & Africa and South America

The Middle East & Africa, and South America are expected to grow at an average rate due to increasing enterprise digitization and rising data storage needs, with limited infrastructure investments compared to other regions. Although cloud adoption and IT modernization initiatives are gaining traction, economic challenges and slower technological adoption rates are thus impacting overall market growth. The fourth largest market which is South America will be valued at USD 2.50 billion in 2025, along with GCC market value at USD 0.79 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Alliances and Investments Pave the Way for Growing Business Trajectories to Sustain the Competition

Different market players are updating their existing products and developing new products to meet the changing customer requirements. Innovations, advancing present portfolios, and new integrations help businesses increase their product expertise, deliver better user experience, and determine measurable evaluations and analyses for marketers.

In addition, strategic agreements, partnerships & collaborations, and mergers & acquisitions are some prominent business strategies every market player adopts to expand their business operations and geographical presence. The strategy aids the overall development and expansion of the market.

Major Players in the Network Attached Storage Market

The key players hold the highest share of the NAS market due to their strong product portfolios, extensive global presence, and continuous innovation in storage solutions. Their strategic investments in R&D, partnerships, and acquisitions enable them to maintain a competitive edge, catering to diverse enterprise storage needs across various industries. For instance,

- In March 2023, IBM partnered with Cohesity, a data security and backup provider, to incorporate Cohesity’s data protection functionality into the company’s storage product suite. This new launch, Storage Defender, has been developed to better protect customers' organizations’ critical information.

List of Key Network Attached Storage Companies Profiled:

- Dell Technologies Inc. (U.S.)

- IBM Corporation (U.S.)

- Hitachi Vantara LLC (Hitachi Ltd.) (Japan)

- Western Digital Corporation (U.S.)

- Seagate Technology Holdings plc (Ireland)

- QNAP Systems, Inc. (Taiwan)

- NetApp, Inc. (U.S.)

- NetGear, Inc. (U.S.)

- Synology Inc. (Taiwan)

- Buffalo Americas, Inc. (U.S.)

- Nasuni (U.S.)

- ASUSTOR Inc. (Taiwan)

- Acronis International GmbH (Switzerland)

- Qumulo (U.S.)

- TerraMaster Technology Co., Ltd. (China)

- iXsystems, Inc. (U.S.)

- Cloudian (U.S.)

- LaCie (France)

- Ciphertex (U.S.)

- Pure Storage, Inc. (U.S.)

..and more

KEY INDUSTRY DEVELOPMENTS:

- June 2024: IBM Corporation collaborated with Telefónica Tech to drive the development of AI and data management solutions for enterprises.

- June 2024: Hitachi Vantara partnered with AMD to develop energy-efficient and high-performance hybrid cloud and database solutions supported by AMD EPYC processors.

- June 2024: Western Digital Corporation launched a novel AI Data Cycle Storage Framework. Through this product launch, the company will support customers in planning and developing advanced storage infrastructures to improve efficiency and increase their AI investment.

- March 2024: IBM Corporation partnered with Komprise to launch a user-friendly, secure service that provides a complete view across data storage silos.

- February 2024: Dell Technologies collaborated with Subaru Corporation to develop a powerful grouping of AI and high-performance storage solutions to improve safety for drivers, passengers, and pedestrians.

- January 2024: QNAP, ASUSTOR, and Terramaster introduced new NAS units and refreshed their Arm-powered NAS devices for home and personal use.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The substantial capital allocation toward product innovation, infrastructure expansion, and strategic collaborations in cloud-based and AI-powered storage solutions creates significant opportunities for the market. Increasing investments in data security, scalability, and energy-efficient NAS systems present lucrative opportunities for market players seeking to enhance their competitive position. For instance,

- In June 2022, Nasuni Corporation purchased Storage Made Easy, which provides remote work solutions and compliance regarding cloud file storage by replacing traditional NAS. This acquisition marks Nasuni's second transaction in the past two months, following a USD 60 million investment in 2022.

REPORT COVERAGE

The global market report covers an overview of the market and centers on central characteristics such as prominent players, their products/services, Enterprise Types, and their use cases in the market. Besides, the report offers insights into the market trends and highlights current market-related improvements. In addition, the report covers the competitive landscape of the overall market. Further, the report comprises several factors that backed the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.50% from 2026 to 2034 |

|

Segmentation |

By Enterprise Type, By Storage Solution, By Industry, and by Region |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Enterprise Type

By Storage Solution

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 173.12 billion by 2034.

In 2025, the global market was valued at USD 46.97 billion.

The market is projected to grow at a CAGR of 15.50% during the forecast period.

By Industry, IT & telecommunication leads the market.

Increasing product launches and investments in network technologies fuel market growth.

Dell Technologies Inc., IBM Corporation, Hitachi Vantara LLC (Hitachi Ltd.), and Western Digital Corporation are the top players in the market.

North America held the highest market share in 2025.

By enterprise type, the Mid-size: <1,000 FTEs are expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us