Optical Satellite Communication Market Size, Share & Industry Analysis, By Laser Type (YAG Laser, Silex Laser, CO2 Laser, VCSEL laser, FP-LD, DFB-LD, and Others), By Application (Telecommunication, Tracking & Monitoring, Surveillance & Security, Space Exploration, Earth Observation, and Others), By Component (Transmitter, Receiver, Antenna, Modular, and Others), and Regional Forecast, 2025-2032

Optical Satellite Communication Market Size

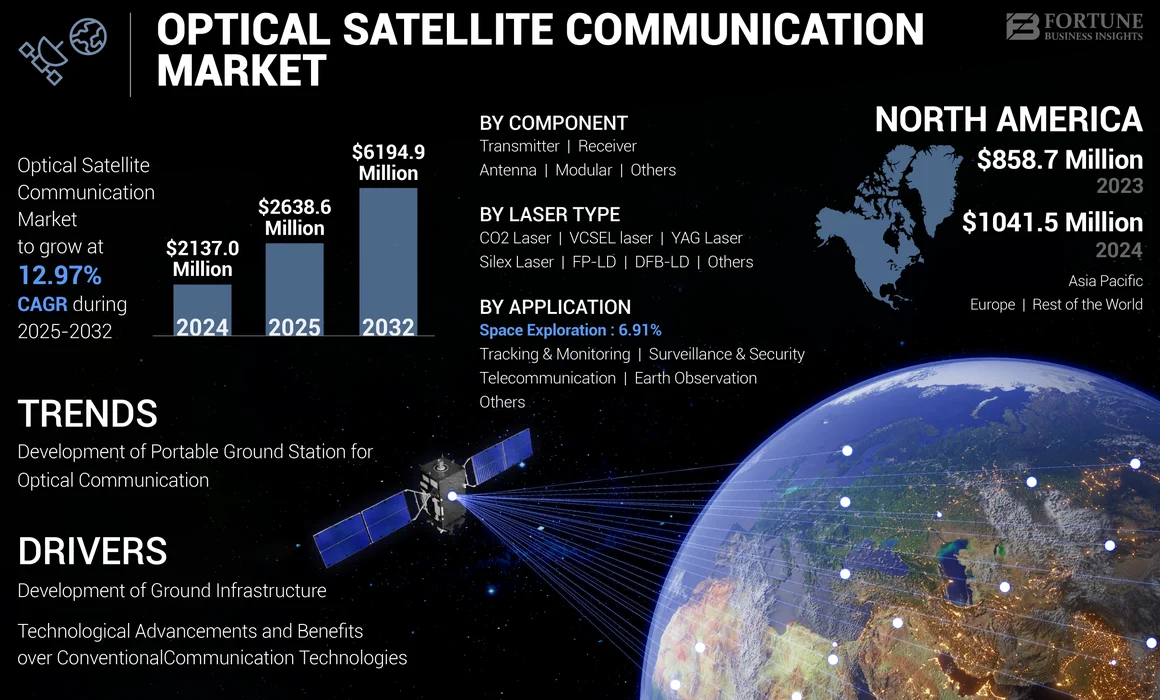

The global optical satellite communication market size was valued at USD 2137.0 million in 2024. The market is projected to grow from USD 2638.6 million in 2025 to USD 6194.9 million by 2032, exhibiting a CAGR of 12.97% during the forecast period. North America dominated the optical satellite communication market with a market share of 48.74% in 2024.

Optical communication refers to the transmission of data from space to the ground using lasers. Laser-based communication allows higher data transmission rates and more secure systems. Over the years, prominent space agencies have created such systems and effectively shown inter-satellite and satellite-to-ground communication links.

The use of optical communication in data relay satellites is also a significant application in this sector. Nations including the U.S., Japan, China, and Russia have showcased inter-satellite communication for transmitting earth observation, remote sensing, and various other types of data. Additionally, laser communication is employed for real-time tracking of satellites or objects in orbit. For instance, the Indian Space Research Organization (ISRO) intends to launch data relay satellites to monitor Gaganyaan missions. These advancements are expected to drive market growth throughout the forecast period.

The market is led by major players such as Mitsubishi Electric Corporation, Honeywell International Inc., NEC Corporation, Thales Group, SpaceX (Starlink), Ball Aerospace, Maxar Technologies, Tesat-Spacecom, Mynaric AG, Analytical Space Inc., and BridgeSat Inc. These companies are at the forefront of technological innovation, driving advancements in high-speed, secure, and efficient optical data transmission for applications in defense, telecommunications, and space exploration.

The outbreak of COVID-19 pandemic caused significant loss in the space sector due to decrease in overall budget of public space agencies across the globe and delays in several satellite programs and communication related projects. Moreover, lockdown in major countries, such as the U.S., France, Germany, China, India, and Japan, had a huge impact on the space industry, leading to suspension or postponement of satellite launches.

Global Optical Satellite Communication Market Overview

Market Size & Forecast

- 2024 Market Size: USD 2,137.0 million

- 2025 Market Size: USD 2,638.6 million

- 2032 Forecast Market Size: USD 6,194.9 million

- CAGR: 12.97% from 2025–2032

Market Share

- North America dominated the optical satellite communication market with a 48.74% share in 2024, supported by strong leadership in space technology, significant satellite deployment programs, and the presence of major industry players like SpaceX, Lockheed Martin, and Honeywell International. The region benefits from rapid adoption of optical links for high-speed, secure data transmission, particularly for defense, telecommunications, and research applications.

- By laser type, the CO2 Laser segment accounted for the largest share in 2024 due to its efficiency and reliability for high-speed data transmission. However, the YAG Laser segment is projected to register the fastest growth through 2032, driven by its versatility and suitability for high-precision, short-pulse communication systems.

Key Country Highlights

- United States: Leading adoption of optical satellite communications driven by LEO satellite constellations, 5G backhaul demand, and defense-grade secure data transfer programs. SpaceX’s Starlink and government R&D initiatives contribute heavily to market expansion.

- China: Rapid progress in optical inter-satellite links under initiatives like the “Space Information Corridor,” boosting communication capabilities for remote sensing and Earth observation.

- India: Advancements by ISRO in optical data relay satellites, particularly for human spaceflight missions like Gaganyaan, are expected to elevate demand for optical ground infrastructure and laser communication payloads.

- Europe: Growth fueled by the European Space Agency’s (ESA) free-space optical communication projects and applications in scientific missions and military-grade secure links.

OPTICAL SATELLITE COMMUNICATION MARKET TRENDS

Development of Portable Ground Station for Optical Communication is Latest Market Trend

Portable ground stations are an emerging trend in optical satellite communication. These stations are designed to be compact, lightweight, and easily transportable, making them ideal for field operations and disaster response. They can be quickly developed in remote locations, providing a reliable communication link with satellites.

Portable optical ground stations offer several advantages over traditional systems. They provide high-bandwidth communication with enhanced security due to the low-interference nature of optical signals. Optical communication uses laser beams, which have significantly lower beam divergence compared to radio frequencies, allowing for longer-distance transmission with minimal interference. This characteristic makes optical communication inherently more secure than radio-frequency (RF) systems. Additionally, portable stations can be used to support satellite constellations for global internet coverage, Earth observation, and navigation services.

- North America witnessed optical satellite communication market growth from USD 858.7 Million in 2023 to USD 1,041.5 Million in 2024.

Technological advancements are driving the development of portable ground stations. For instance, the use of commercial off-the-shelf (COTS) telescopes has made these stations more affordable and transportable. Innovations in pointing and tracking algorithms enable rapid deployment and accurate satellite tracking, even with low-cost hardware. Furthermore, transportable optical ground stations (TOGS) are being developed to mitigate the effects of atmospheric conditions by allowing deployment at optimal locations. These stations can be transported by vehicles and set up quickly to establish communication links in emergency situations.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Technological Advancements and Benefits over Conventional Communication Technologies Boosts Market Growth

Optical communication is experiencing rapid technological advancements, driven by the need for higher data rates, lower latency, and increased security compared to traditional radio frequency (RF) systems. These advancements are significantly boosting optical satellite communication market growth by offering several benefits over conventional communication technologies.

Optical communication relies on laser beams, which operate at a much higher frequency than RF signals, enabling significantly higher data transmission rates. For example, SpaceX's Starlink system can achieve data transfer speeds to 100 Gbps per link, far exceeding the capabilities of RF systems.

Optical signals are less susceptible to interference, ensuring more reliable data transmission. The inherent security of optical communication further reduces the risk of data breaches and unauthorized access, as the narrow beam width of laser signals makes interception more difficult to intercept compared to RF signals. Furthermore, while initial setup costs may be higher, optical systems can reduce operational costs by minimizing the need for frequency licenses and offering higher data throughput.

Development of Ground Infrastructure to Drive Market Growth

Ground stations are a crucial component of the optical satellite communication system. As optical communication technology continues to advance, the development of ground stations has become increasingly important to ensure efficient and effective system operation. Various agencies globally are implementing ground stations in locations with less atmospheric interference to enhance system operation.

The development of ground infrastructure is crucial for supporting optical communication, as it enables efficient transmission and reception between satellites and Earth. Optical ground stations (OGS) play a key component of this infrastructure, providing high-bandwidth communication links with satellites using laser technology. These stations are designed to mitigate the effects of atmospheric turbulence, which can impact signal quality, through advanced technologies such as adaptive optics and atmospheric turbulence management systems. The European Space Agency (ESA) and other organizations are actively involved in establishing networks of optical ground stations to facilitate seamless communication between satellites and ground-based systems. In March 2024, Safran announced its efforts in developing technical solutions for high-speed optical communications between optical ground stations (OGS) and geostationary orbit satellites. This project aims to revolutionize space communications by providing faster and more secure data transfer.

MARKET RESTRAINTS

Issue of Cloud Coverage in Optical Communication to Hamper Market Growth

Cloud coverage poses a significant challenge for optical communications system. Cloud coverage can hamper the communication system as clouds can scatter and absorb the laser beam, causing signal attenuation. This attenuation can result in a decrease in signal strength, which can reduce the data rate and increase the error rate of the communication link.

Moreover, clouds coverage can degrade by scattering laser beams in different directions, further impacting communication reliability. Cloud coverage can impact the availability of optical communication. The amount of cloud coverage can vary depending on the location and time of the day, which can further impact the communication link. Due to cloud-induced attenuation in satellite-to-ground communication, inter-satellite links are often preferred for optical communication. Although several techniques exist to calculate cloud attenuation, such as measuring attenuation through cloud water content, further developments are required to develop all-weather communication systems.

MARKET OPPORTUNITIES

Rapid Expansion of 5G and Internet of Things (IoT) is a Rising Opportunities for Optical Communication Market Growth

The rapid expansion of 5G and the Internet of Things (IoT) is creating significant opportunities for the satellite optical communication market. As 5G networks roll out globally, it brings a surge in connected devices and data traffic, especially from IoT applications in smart cities, manufacturing, healthcare, and transportation. These applications require ultra-fast, reliable, and low-latency connections-capabilities that optical communication technologies are uniquely equipped to deliver.

Optical communication systems are critical for supporting the backbone of 5G infrastructure. They enable high-capacity data transfer between cellular base stations, data centers, and cloud services, which is essential for the real-time processing and analytics that 5G and IoT require. The proliferation of IoT sensors in industries such as automotive, manufacturing, and smart infrastructure drives the need for advanced optical networking equipment capable of supporting large-scale, low-latency data transmission.

SEGMENTATION ANALYSIS

By Laser Type

CO2 Laser Segment Held the Dominant Market Share Owing to Robust Data Transmission

By laser type, the market is segmented into YAG laser, Silex laser, CO2 laser, VCSEL laser, FP-LD, DFB-LD, and others.

The CO2 laser segment dominated the market share by 26% in 2024. CO2 lasers are highly efficient in providing a platform for data transmission in satellite communications. They offer a robust and reliable means of transmitting data, which is crucial for applications requiring high-speed and secure communication.

The YAG laser segment is projected to be the fastest growing during the study period. The growth in the segment is owing to due to its versatility and potential for future technological improvements. YAG lasers offer high precision and are suitable for applications requiring high- peak power, high-speed data transmission, and short pulse durations.

By Application

Telecommunication Segment to Dominate the Market Owing to Increased Demand for Broadcasting Services

The market by application is segmented into telecommunication, tracking & monitoring, surveillance & security, space exploration, earth observation, and others.

The telecommunication segment is anticipated to dominate the market during the forecast period owing to increased demand for broadcasting services using inter satellite links. These inter-satellite optical links enable high-speed, secure, and reliable data transmission between satellites without relying heavily on ground stations, facilitating near-real-time data dissemination and global coverage. The segment is expected to dominate the market share by 59% in 2025.

The space exploration segment will witness the highest CAGR of 15.27% during the study period due to increase in satellite launches. Optical satellite communication offers high-speed data transmission, which is crucial for complex and data-intensive, enhancing communication between spacecraft and Earth increases.

- The space exploration segment is expected to hold a 6.91% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Component

Transmitter Segment Dominates the Market Owing to the Significance of Optical Transmitters in Satellite Communication System

By component, the market is segmented into transmitter, receiver, antenna, modular, and others.

The transmitter segment is projected to dominate the market share by 27% in 2024 and register the highest growth rate during the study period, driven by its critical role in electronics devices such as broadcasting stations, communication satellites, and others. Optical transmitters, which use laser technology, provide significant advantages including higher bandwidth, low latency, and minimal interference compared to traditional radio frequency systems. These features are essential for applications like 5G backhaul, defense communications, and space exploration, where data integrity and rapid transmission are crucial.

The receiver segment is projected to witness significant growth during the study period, supported by advancements in receiver technology, such as improved sensitivity and noise reduction. These innovations enhance the ability to accurately process optical signals, ensuring high data transmission rates and reliability, essential for applications such as Earth observation and inter-satellite communication.

The modular segment is likely to witness highest CAGR of 14.75% during the forecast period.

OPTICAL SATELLITE COMMUNICATION MARKET REGIONAL OUTLOOK

In terms of geography, the market is divided into North America, Europe, Asia Pacific, and Rest of the World.

North America

North America Optical Satellite Communication Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 1,041.5 million in 2024, and in 2023, the market size was USD 858.7 million. North America held the largest optical satellite communication market share in 2024, driven by its leadership in space technology and satellite development. Companies such as SpaceX, Boeing, and Lockheed Martin are key innovators advancing optical communication in the region.

The U.S. optical satellite communication market is experiencing robust growth, driven by high demand for high-speed data transmission across sectors like telecommunications, defense, and research. The adoption of optical satellite communication is accelerating due to the deployment of low earth orbit (LEO) satellites, increasing need for secure and reliable connectivity, and the expansion of commercial applications such as 5G backhaul and high speed data transmission services in remote areas. The U.S. market size is estimated to hit USD 1,186 million in 2025.

Europe

Europe is estimated to hold the second-largest market size with USD 855.6 million in 2025, exhibiting a CAGR of 13.02% during the forecast period, owing to specialized applications in free-space optical communication technologies for military or scientific purposes, where long-range and high power lasers are required. The market value in U.K. is expected to be USD 174.5 million in 2025.

On the other hand, Germany is projecting to hit USD 218.7 million and France is likely to hold USD 113.4 million in 2025.

Asia Pacific

The market in Asia Pacific is projected to witness significant growth during the forecast period, fueled by rapid technical advancements in the region. The region is projected to be the third-largest market with a value of USD 535.9 million in 2025. China, India, Japan, and Southeast Asian countries are major contributors to the region's growth, with initiatives such as China's "Space Information Corridor" and India's international space agencies collaborations. For instance, in March 2023, Axelspace Corporation was selected by the New Energy and Industrial Technology Development Organization (NEDO) for a development and demonstration project for an optical inter-satellite communication network system. This initiative is part of a cross-community collaboration program for the research & development of key and advanced technologies. The market for China is likely to hit USD 205.1 million in 2025. On the other hand, the market for India is projected to hit USD 135.6 million and Japan is poised to stand at USD 61.3 million in 2025.

Rest of the World

Rest of the World is anticipated to witness moderate growth opportunities for the optical satellite during the forecast period owing to increase in investments related to enhanced space capabilities and increased focus of research & space exploration activities in Saudi Arabia, the UAE, and others. The rest of the world region is likely to be the fourth-largest market with a value of USD 56.1 million in 2025. Latin America is increasingly adopting optical communication to bridge the digital divide in remote areas. High-speed satellite communication is critical for providing internet access in underserved regions.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Focusing on Developing Payload to Enhance Laser Communication System

The competitive environment of the market is somewhat consolidated in nature due to the presence of major players such as Ball Corporation (U.S.), BridgeComm, Inc. (U.S.), Honeywell International Inc. (U.S.), Laser Light Communications (U.S.), and Mynaric (Germany). These players are focusing on developing payload for cubesats and smallsats to enhance laser communication system. In May 2022, Laser Light Communications announced that it selected Nokia as its exclusive lead supplier for the first phase of the beta deployment of its global optical software-defined network. This first beta phase would focus on 16 locations in Australia, Africa, Europe, and the U.S.

LIST OF KEY COMPANIES PROFILED

- Ball Corporation (U.S.)

- BridgeComm, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Laser Light Communications (U.S.)

- Mynaric (Germany)

- NEC Corporation (Japan)

- Surrey Satellite Technology (U.K.)

- Starlink (U.S.)

- Thales Group (France)

- Tesat-Space GmbH & Co. KG (Germany)

KEY INDUSTRY DEVELOPMENTS

- September 2024 - Advanced Space received a contract from General Atomics Electromagnetic Systems (GA-EMS) to support Phase 1 of the Enterprise Space Terminal (EST) for the U. S. Space Force’s (USSF) Space Systems Command (SSC). The EST initiative aimed to enhance the operational effectiveness of Department of Defense (DoD) platforms by establishing a mesh laser communication network that offers robust, high-capacity communication pathways for spacecraft operating in beyond Low Earth Orbit (bLEO) environments at crosslink distances of up to 80,000 km.

- September 2024 – Xenesis received a Phase 2 contract from the Space Development Agency (SDA) for optical communications terminals. The project aimed to develop the Xen-Hub terminal with a high bandwidth of 10 Gbps, compatible with SDA standards.

- January 2024 - General Atomics Electromagnetic Systems (GA-EMS) received a contract from the Space Development Agency (SDA) to showcase its Optical Communication Terminals (OCTs) mounted on GA-EMS’ GA-75 (75 kilogram class) spacecraft in Low Earth Orbit (LEO).

- June 2024 - Kepler rolled out Space Development Agency (SDA) compatible data relay networks to enhance government network resilience, driving demand for optical communication terminals.

- March 2023 – The European Space Agency (ESA) extended a contract with Surrey Satellite Technology Ltd (SSTL) to provide additional communications services from Lunar Pathfinder, scheduled for launch in 2025. The agreement extends ESA and SSTL's existing commercial lunar service agreement signed in September 2021 and creates new opportunities for low-cost lunar exploration, technology demonstration, and reconnaissance missions.

REPORT COVERAGE

The market research report provides a detailed optical satellite communication market analysis, covering key aspects, such as R&D capabilities, competitive landscape, and the optimization of manufacturing capabilities and operating services. The research offers insights into the market trends, market share, market dynamics, segmentation, and growth opportunities in the optical satellite communication systems sector. It also highlights key industry developments and focuses on primary drivers contributing to market growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 12.97% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Laser Type

|

|

By Application

|

|

|

By Component

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued USD 2137.0 million in 2024.

The market is anticipated to grow at a CAGR of 12.97% during the forecast period.

Telecommunication segment leads the market.

The market size in North America stood at USD 1,041.5 million in 2024.

Some of the top players in the market are Ball Corporation (U.S.), BridgeComm, Inc. (U.S.), Honeywell International Inc. (U.S.), Laser Light Communications (U.S.), Atlas Space Operations Inc. (U.S.), and others.

The issue of cloud coverage in optical satellite communication is anticipated to restrain market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us