Military Drone Market Size, Share & Russia-Ukraine War Impact Analysis, By Product Type (Fixed Wing, Hybrid & Rotary Wing), By Range (Visual Line of Sight, Extended Visual Line of Sight,& Beyond Line of Sight), By Technology (Remotely Operated Drones, Semi-Autonomous Drones, Autonomous Drones), By System (Airframe, Avionics, Propulsion, Payload, Software), By Application (Intelligence, Surveillance Reconnaissance,& Targeting, Combat Operations, Battle Damage Management), & Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

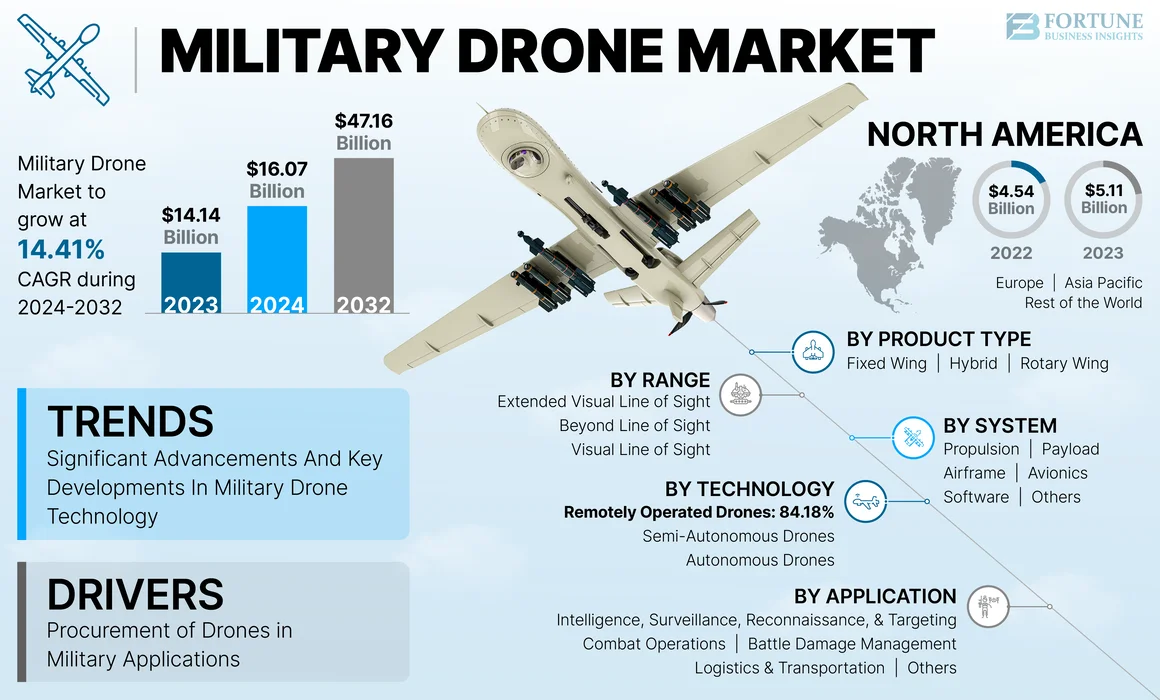

The military drone market size was valued at USD 14.14 billion in 2023 and is projected to grow from USD 16.07 billion in 2024 to USD 47.16 billion by 2032, exhibiting a CAGR of 14.41% during the forecast period. North America dominated the military drone market with a market share of 36.1% in 2023. Moreover, the military drone market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 10.71 billion by 2030, driven by an increasing R&D investment by industry players such as Sikorsky, Boeing, among other regional players.

A military drone, also known as an unmanned aerial vehicle (UAV), is a remotely piloted aircraft system used in military operations. These drones are equipped with advanced sensors and cameras that provide real-time situational awareness, aiding decision-making and improving the effectiveness of military operations. The military drone market is expected to grow significantly in the coming years, driven by increasing military spending and the growing procurement of military drones by defense forces.

The integration of artificial intelligence and machine learning algorithms into military drones is improving autonomous flight capabilities, target recognition, and mission planning, leading to more effective and efficient operations. For instance, in December 2023, General Atomics Aeronautical Systems, a business unit of General Atomics, was awarded a USD 389 million contract to deliver MQ-1C-25M Gray Eagle Modernized Extended Range systems to the U.S. Army.

The growing use of Unmanned Aerial Vehicles (UAVs) in the defense and security industry for several applications, such as surveying, mapping, transportation, combat operations, and monitoring, will fuel the demand for military UAVs in the coming years. The rise in defense expenditure of various countries to procure modernized & technologically advanced military drones/UAVs for intensified combat capability is expected to support the global market growth. The adoption of Artificial Intelligence (AI) is modernizing military drone technologies from picking targets autonomously with precision. Furthermore, increasing investment in AI and autonomous systems for advanced technologies is boosting the market expansion.

Military Drone Market Key Takeaways

Market Size & Forecast:

- 2023 Market Size: USD 14.14 billion

- 2024 Market Size: USD 16.07 billion

- 2032 Forecast Market Size: USD 47.16 billion

- CAGR: 13.15% from 2024–2032

Market Share:

- North America led the military drone market in 2023 with a 36.1% share, driven by high defense spending, R&D, and key OEMs. The U.S. market is set to hit USD 10.71 billion by 2030, boosted by ISR and combat modernization.

- Fixed-wing drones dominated in 2023 due to long endurance, high payloads, and suitability for surveillance and strategic missions.

Key Country Highlights:

- United States: Awarded a USD 389 million contract to General Atomics in 2023 for MQ-1C Gray Eagle drones. The U.S. continues to lead military drone exports, particularly in HALE and MALE categories, and is heavily investing in autonomous drone systems.

- Ukraine: Deployed over 700 kamikaze drones, including DJI Mavic 3T and Switchblade drones, for ISR and tactical strikes. Drone use has been pivotal in Russia-Ukraine conflict dynamics.

- Russia: Acquired and deployed Shahed-136 drones (rebranded Geranium-2) for attacks in Kyiv, Mykolaiv, and Odesa. Recently signed a USD 12 million drone procurement contract with China.

- China: Supplied over 48 GJ-2 MALE drones to Pakistan. The GJ-2 is capable of carrying 12 missiles or attack bombs, with speeds up to 380 km/h.

- United Kingdom: Investing in tactical and small drones for ISR capabilities enhancement, as part of its broader military modernization strategy.

RUSSIA-UKRAINE WAR IMPACT

High Adoption Rate of Military Drones in Russia-Ukraine War to Bolster the Market Growth

In the Russia-Ukraine war, which began in February 2022 where Russia and Ukraine have utilized drones for various military operations, such as Intelligence, Surveillance, and Reconnaissance (ISR) operations, target acquisition support, and other operations.

- Russia recently acquired Iranian loitering munitions Shahed-136 called Geranium-2 by Russian Ground Forces. Its first use was mentioned in September 2022 for military operations in the Kharkiv region in Eastern Ukraine. Furthermore, it has been utilized to target Kyiv, Odesa, and Mykolaiv.

- Ukraine has been supplied with more than 700 Switchblade kamikaze drones to target Western Crimea, an airbase and ship harbor near Sevastopol, and airbases at Ryazan and Saratov.

In addition, Russia signed a contract worth USD 12 million with China to provide military drones for the Russian Armed Forces amid the ongoing Russia-Ukraine war. These factors are expected to propel the market growth over the forecast period.

Military Drone Market Trends

Significant Advancements and key Developments in Military Drone Technology Drive the Market Growth

Military drone technology has undergone significant advancements in recent years, with key developments in stealth technology, artificial intelligence (AI) and autonomous flight, and swarming technology. Stealth drones are designed to evade enemy radar detection, making them virtually invisible during reconnaissance and combat missions. These drones are constructed with special materials and shapes that reduce their radar cross-section, rendering them difficult to detect even by advanced radar systems. North America witnessed military drone market growth from USD 4.54 Billion in 2022 to USD 5.11 Billion in 2022.

AI has revolutionized military drone technology by enabling autonomous decision-making. Drones equipped with AI algorithms can process vast amounts of data in real time, making split-second decisions without human intervention. Swarming technology allows multiple drones to operate collaboratively as a coordinated unit. This innovation has significant implications for military tactics and strategies.

Military drones are equipped with an array of advanced sensors and payloads that enhance their capabilities. These include high-resolution cameras, thermal imaging, LiDAR (Light Detection and Ranging), electronic warfare systems, and signal intelligence (SIGINT).

Download Free sample to learn more about this report.

Military Drone Market Growth Factors

Growing Procurement of Drones in Military Applications Boost the Market Growth of Military Drone

Military warfare today is shifting from the conventional notion that better firepower provides an edge on the battlefield, to which side has the better intelligence, surveillance, and reconnaissance (ISR) capabilities. This phase of electronic warfare has created a huge demand for the use of Military Drones (UAVs) in the military sector. UAVs do not need a crew on-board for flight, and can be autonomous or remotely-controlled by human personnel from a safe distance.

Aside from ISR, UAVs are also employed for offenses. UAVs as big as a small aircraft have the capacity to carry missiles into the battlefield, while autonomous UAVs, also called drones, which can be the size of a wingspan of a bird, are used for kamikaze warfare. Such capabilities make drones a must-have for any military, allowing for major push-back to the enemy from the safety of the ground stations. For instance, in April 2023, Ukraine announced that it had procured over 300 DJI Mavic 3T UAVs and send on the front lines. The thermal and zoom capabilities of these UAVs make them ideal to gather intelligence on ground zero.

RESTRAINING FACTORS

Government Rules and Regulations in the Missile Technology Control Regime (MTCR) to Hinder Market Growth

Growing geo-political tensions across the world also contribute to the deceleration of military drone market growth. The vast majority of commercial drones and unmanned aerial vehicles are equipped with cameras, making them prone to online assaults. National security is further hampered by the suspicion of snooping through the network. Market growth is slowing down because countries have started imposing restrictions on products from a specific manufacturer.

For instance, in May 2023, the use of Chinese drones for any kind of activity was banned in two states. In suspicion of suspected data leaks through the network of drones, the U.S. Department of Defense and other agencies have already blacklisted the company.

Military Drone Market Segmentation Analysis

By Product Type Analysis

Fixed Wing Segment to Hold Major Share Owing to its Increasing Use for Long Distance Operations

By product type, the market is classified into rotary wing, fixed wing, and hybrid wing.

The fixed wing segment held the highest share of the military drone market in 2023 and is expected to continue its dominance during the projected period. Compared to VTOL UAVs, fixed-wing aircraft are able to carry heavier loads for longer flight times while using less power. This implies they are best suited for missions, including mapping, strategic defense, defense, and surveillance, which require high durability. Various military authorities globally use it to great effect in the defense industry. All these factors drive the segment growth during the projected period.

The rotary wing segment is anticipated to showcase significant growth during the forecast period, owing to the increasing development of rotary wings. Rotary wings, extensively used for road and logistics applications in all parts of the world, carry heavy loads. Due to vertical takeoff and landing, a rotary-wing drone is also used for tactical operations, such as surveillance, intelligence, and reconnaissance missions.

By Range Analysis

Extended Visual Line of Sight Segment to Grow at the Fastest CAGR Impelled by Rising Adoption in Electronic Warfare and Battle Management

Based on range, the market is segmented into Extended Visual Line Of Sight (EVLOS), Visual Line Of Sight (VLOS), and Beyond Line Of Sight (BLOS).

The Extended Visual Line of Sight (EVLOS) segment is anticipated to witness the highest CAGR during the forecast period owing to the high acceptance of EVLOS UAVs in long-range missions to collect important information, manage battle properly, and electronic warfare. For instance, in February 2022, General Atomics tested advanced datalink and avionics enhancements for the MQ-1C Gray Eagle Extended Range (GE-ER) drone.

The VLOS segment estimated to be the second-fastest growing during the forecast period. The Visual Line of Sight (VLOS) range of drones is generally used in applications, including fire emergencies, disaster management and relief, and border patrol.

The Beyond Line of Sight (BLOS) segment is projected to grow substantially during the projected period owing to the growing awareness of the technology progressing towards commercialization and advancement. These UAVs can transport weapons, ammunition, and cargo to the targeted locations.

By Technology Analysis

Growing Adoption of Remotely Operated UAVs for Military Operation to Drive Segment Growth

Based on technology analysis, the market is segmented into semi-autonomous drones, remotely operated drones, and autonomous drones.

The remotely operated drones segment is expected to hold a 84.18% share in 2023. Due to strict government requirements for autonomous flight systems for high-altitude military drones, many contracted Unmanned Aircraft Vehicles fly remotely globally. This technology has been used on UAVs in Command & Control (C&C), telemetry systems, and radio communications.

The autonomous segment will likely grow at the fastest CAGR during the forecast period. Growing economies are focused on designing and developing autonomous unmanned aerial vehicles to offer tactical and strategic services.

The semi-autonomous segment is expected to grow significantly during 2024-2032 due to the rising preference for fixed-range flight operations to gather vital information.

To know how our report can help streamline your business, Speak to Analyst

By System Analysis

Airframe Segment to Dominate Due to Increasing Adoption of UAVs in Military

Based on system, the market is classified into avionics, airframe, payload, propulsion, software, and others.

The airframe segment held the highest market share in 2023. During the forecast period, this segment will continue to lead. This segment results from an increasing adoption of Unmanned Aerial Vehicles for a wide range of defense operations, including surveillance, observation, reconnaissance, and combat.

The propulsion segment is projected to grow at a higher CAGR during the study period owing to the increasing demand for turboprop engines in military UAVs due to their high durability.

The avionics segment is projected to grow significantly due to integrating modern electronics, automated flight management, and path control.

The payload segment is expected to grow throughout the projection period. The segmental growth is attributed to the growing incorporation of payloads such as cameras, radar, sensors, weapons, and others into the UAVs.

By Application Analysis

ISRT Segment to Lead the Market Due to Rising Awareness to Strengthen the Defense System

By application, the market is segmented into intelligence, surveillance, reconnaissance, and targeting (ISRT), logistics & transportation, combat operations battle damage management, and others.

The ISRT segment is projected to lead during the forecast period. The segmental growth is due to the role of UAVs in the defense industry rather than combat operations. These flying machines are designed to provide crucial information and collect data on the targeted territory or terrorist area.

The logistic operation anticipated to be the second fastest growing during the forecast period. For applications, such as transportation and logistics, over the last several years, unmanned aircraft have been employed by the U.S. Air Force, Navy, Army, and other security agencies. Market growth is projected to increase over the coming years due to the growing demand for logistics and transport.

REGIONAL INSIGHTS

The market is subdivided into North America, Europe, Asia Pacific, and the rest of the world.

North America Military Drone Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is a dominant region with the highest military drone market share in 2023 and was valued at USD 5.11 billion. This large share is attributed to several OEMs in the U.S., such as Northrop Grumman Corporation, General Atomics Aeronautical Systems, Inc., and others. Advances have been made in drone technology, which brought major fixed-wing segments and key regional players increased investment, boosting market growth. The U.S. is one of the world's largest exporters of unmanned aerial vehicles, and this is expected to drive regional growth. Historically, Lockheed Martin Corporation and General Atomic Aeronautics received contracts for military HALE and MALE drones from NATO and major defense partners such as India. These companies are anticipated to receive more military drone contracts for various operation-specific military drones for ISR or target acquisition or MUM-T (Manned-Unmanned Teaming Platforms).

The European market is anticipated to grow substantially due to the rising awareness of improving the air force, navy, and military capabilities. European countries, such as the U.K., Germany, and France, are competing to procure tactical and small drones to enhance ISR capability in the foreseeable future.

Asia Pacific is estimated to be the fastest-growing region, growing at a higher CAGR, owing to the burgeoning procurement of military drones by most countries in the region. The ongoing Russia-Ukraine war has shifted the procurement priority of regional armed forces toward UAVs, driving the regional market growth during the forecast period.

- According to official sources, Pakistan purchased over 48 GJ-2 drones from China. GJ-2 is a MALE drone that can carry around 12 missiles or attack bombs and has a top speed of 380 km/hour.

In addition, the key players in Asia Pacific are investing heavily in drone development, which will fuel the product demand.

The rest of the world accounted for a lower market share as it is underpenetrated in the region. Furthermore, key players, such as Elbit Systems Ltd and Israel Aerospace Industries Ltd., are focused on developing surveillance, public safety, and infrastructure technologies to boost regional market growth.

KEY INDUSTRY PLAYERS

Growing Key Companies’ Focus on Strong Product Portfolio to Drive Market Expansion

The market is consolidated due to the strong product portfolio of UAV manufacturers in developed and emerging countries. Thales Group, Lockheed Martin Corporation, and Northrop Grumman Corporation are anticipated to lead the market. However, a low entry barrier is expected to increase the number of domestic UAV companies entering into the global market. The growing number of new entrants in the drone industry is expected to lead to a highly fragmented market in the coming years.

LIST OF TOP MILITARY DRONE COMPANIES:

- General Atomics Aeronautical Systems, Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- Israel Aerospace Industries Ltd. (Israel)

- AeroVironment, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- Thales Group (France)

- Boeing (U.S.)

- BAE Systems (U.K.)

- SAAB Group (Sweden)

- Textron Systems (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023 – The Indian Army announced that it is seeking 850 nano drones for special military operations, which should be indigenous nano drones for surveillance and counter-terrorism operations.

- February 2023 – The U.S. Air Force completed the development of face recognition technology in UAVs. Autonomous drones could identify the target and could be killed by themselves. Further, the drones will be working by special operations forces to gather intelligence and mission pieces of information.

- February 2023 – The Indian Coast Guard (ICG) awarded a contract to drone startup Sagar Defense Engineering Pvt. to supply 10 multicopter (VTOL) drones. ICG had issued an RFP for procuring the contract under Make in India to increase the capabilities and boost marine surveillance of the ICG.

- January 2023 - The U.S. Department of Defense awarded State-owned Israel Aerospace Industries a contract to develop and supply new attack drones. These drones, called Point Blank, can easily be carried in soldiers' backpacks and launched from anywhere.

- June 2023- Northrop Grumman Corporation delivered the fourth multi-intelligence MQ-4C Triton to the U.S. Navy ahead of initial operational capability (IOC) this year. The delivery completes the aircraft set for Unmanned Patrol Squadron (VUP) 19’s establishment of the first operational orbit, while a second orbit is preparing for delivery this summer.

REPORT COVERAGE

The research report provides a detailed military drone market analysis and focuses on key aspects such as product types, leading companies, technology, and applications. It also offers insights into market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to market growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 14.41% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Range

|

|

|

By System

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

According to a study by Fortune Business Insights, the military drone market size was valued at USD 14.14 billion in 2023 and is projected to grow from USD 16.07 billion in 2024 to USD 47.16 billion by 2032

Growing at a CAGR of 14.41%, the market will exhibit exponential growth during the forecast period.

The fixed wing segment is expected to lead the market during 2024-2032.

Lockheed Martin, Thales Group, and Northrop Grumman are the major companies in the global military drone market.

North America dominated the market share in 2023.

Growing procurement of drones in military applications boost the market growth of military drone.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us