Psoriasis Treatment Market Size, Share & Industry Analysis, By Drug Class (TNF Inhibitors, Interleukins Inhibitors, and Others), By Type (Plaque Psoriasis, Psoriatic Arthritis, and Others), By Product Type (Biologics and Non-Biologics), By Route of Administration (Oral, Parenteral/Systemic, and Topical), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

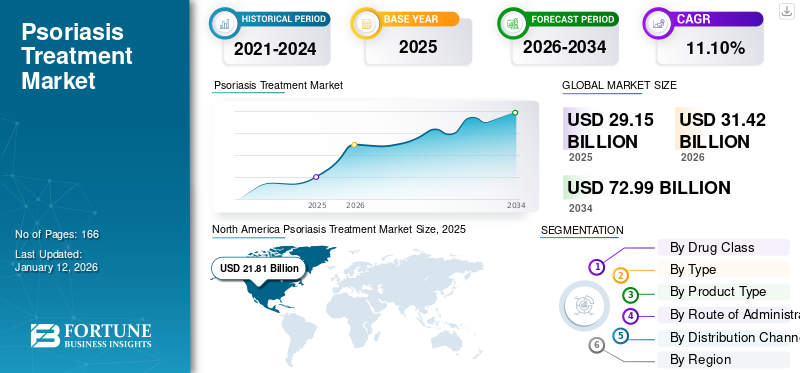

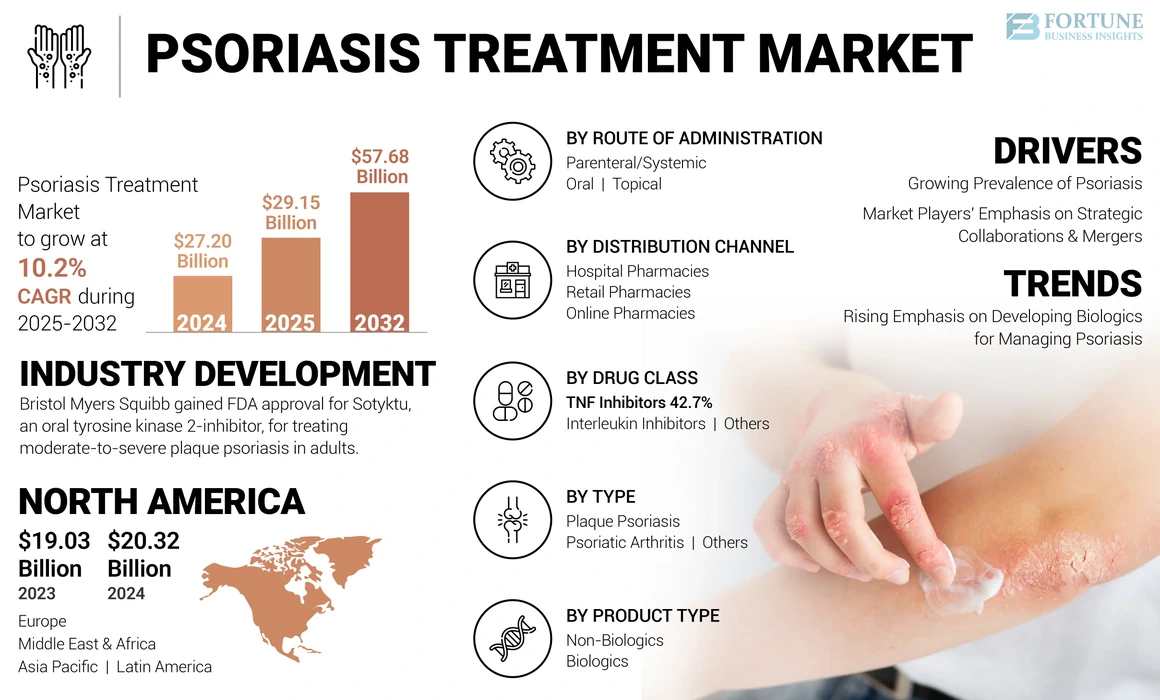

The global psoriasis treatment market size was valued at USD 29.15 billion in 2025. The market is projected to grow from USD 31.42 billion in 2026 to USD 72.99 billion by 2034, exhibiting a CAGR of 11.10% during the forecast period. North America dominated the psoriasis treatment market with a market share of 74.83% in 2025.

Psoriasis is an autoimmune inflammatory disorder resulting from the overproduction of skin cells, resulting in an itchy and painful skin condition characterized by inflammation, red lesions, and plaque formation. The disease is categorized into two major types - plaque psoriasis and Psoriatic Arthritis (PsA). According to a study published by Scotland’s National Health Information Service (NHS inform), between 30%-40% of patients suffering from psoriasis develop an inflammation of the joints, known as psoriatic arthritis.

The rising prevalence of plaque psoriasis, such as mild to moderate plaque psoriasis and moderate plaque psoriasis, along with other types of psoriasis across the globe, is one of the major factors raising the demand for psoriasis treatment. According to the National Psoriasis Foundation (NPF) 2023 statistics, an estimated 2%-3% (125 million) of the total population worldwide are suffering from psoriasis. Moreover, in order to cater to the target population, such as treating adults with active psoriatic arthritis, manufacturers are continuously investing in developing various biologics and non-biologic drugs. Additionally, favorable reimbursement policies for treating patients with psoriasis, launches of biosimilars, and others are some of the factors contributing to the global psoriasis treatment market growth.

The COVID-19 pandemic positively impacted the market, leading to a higher growth rate in 2020. This significant growth was due to increased revenues of key players, higher demand for psoriasis treatment, increasing investments in research & development of new drugs, and other factors.

Additionally, several medical research studies demonstrated a link between COVID-19 and this disorder, as many patients were experiencing symptoms indicative of psoriasis. During the COVID-19 pandemic, telemedicine services significantly increased the demand for psoriasis treatments, even when hospital visits were restricted. These services facilitated the management of psoriasis, showing higher success rates than regular care. The forecast period anticipates cutting-edge innovations in various types of psoriasis therapies, including biologics, which are anticipated to drive strong and steady growth in the market.

Global Psoriasis Treatment Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 29.15 billion

- 2026 Market Size: USD 31.42 billion

- 2034 Forecast Market Size: USD 72.99 billion

- CAGR: 11.10% from 2026–2034

Market Share:

- Region: North America dominated the market with a 74.83% share in 2025. This leadership is driven by the rising burden of psoriasis, increasing awareness initiatives, higher adoption of advanced biologic therapies, significant R&D spending by key players, and supportive government actions.

- By Type: Plaque Psoriasis held the largest market share as it is the most common form of the disease, accounting for 80-90% of all cases. This high prevalence has led to a strong focus on developing effective medications and awareness programs specifically for this patient population.

Key Country Highlights:

- Japan: The market is propelled by regulatory approvals for novel biologic drugs. For instance, the Japanese Ministry of Health, Labor, and Welfare (MHLW) granted market authorization to UCB S.A.'s drug Bimzelx for treating plaque psoriasis, psoriatic erythroderma, and pustular psoriasis.

- United States: Growth is fueled by a large patient base, with over eight million people living with psoriasis. The market is also supported by a steady stream of U.S. FDA approvals for new biologics, such as UCB's BIMZELX, and government initiatives like the Inflation Reduction Act, which includes psoriasis management drugs in Medicare price negotiations.

- China: As a key country in the fastest-growing Asia Pacific market, growth in China is driven by increasing government initiatives to raise awareness about the complications of psoriasis and a growing focus by manufacturers on conducting clinical trials to develop and launch new drugs for the large patient population.

- Europe: The market is advanced by a high prevalence of the disorder, affecting approximately 1.3% to 2.2% of the general population in the U.K. Growth is further stimulated by major regulatory approvals, such as the European Commission's authorization for Bristol Myers Squibb's Sotyktu to treat moderate-to-severe plaque psoriasis.

Psoriasis Treatment Market Trends

Rising Emphasis on Developing Biologics for Managing Psoriasis

Patients suffering from psoriasis are seeking effective ways to manage the condition. Earlier topicals and systemic drugs were the standard treatment for the condition. However, the introduction of biologics for the treatment of psoriasis has revolutionized the management of this disease. Biologics target specific checkpoints in the inflammatory pathways and provide high efficiency with minimal side effects. Due to the benefits associated with biologics, many manufacturers have shifted their focus toward the development of biologics. Additionally, government and regulatory bodies are providing a conducive environment for developing and launching new biologics for treating psoriasis.

- For instance, in October 2023, UCB S.A. received approval from the U.S. Food and Drug Administration (U.S. FDA) for its drug, BIMZELX, an IL-17A and IL-17F inhibitor for treating adult patients suffering from moderate-to-severe plaque psoriasis.

Download Free sample to learn more about this report.

Psoriasis Treatment Market Growth Factors

Growing Prevalence of Psoriasis to Boost Treatment Demand

The growing prevalence of psoriasis across the globe is one of the predominant factors creating a massive demand for safe and effective treatments for the disease. According to the National Psoriasis Foundation data published in 2023, more than eight million individuals living in the U.S. have psoriasis. Furthermore, the government, along with companies operating in the market, are launching various awareness programs in order to educate patients about the improvement of psoriasis management. In addition, the launches of new drugs in the market to accelerate psoriasis treatment are anticipated to bolster the market growth in the upcoming years.

- In June 2023, the American Academy of Dermatology, in collaboration with Boehringer Ingelheim International GmbH, launched a project to develop educational resources with an aim to improve the evaluation, diagnosis, and treatment of patients suffering from Generalized Pustular Psoriasis (GPP).

Market Players' Emphasis on Strategic Collaborations and Mergers to Augment Market Expansion

Biologics or biological therapy is one of the most sought-after psoriasis treatment options. Several large-scale companies have identified the introduction of new products as an ideal opportunity for market growth. Additionally, market players are focusing on entering strategic collaborations and mergers, which have yielded several innovative products. For instance, in September 2022, Boehringer Ingelheim International GmbH received U.S. FDA clearance for its drug, SPEVIGO, an interleukin-36 receptor inhibitor. The drug was developed to treat adult patients suffering from Generalized Pustular Psoriasis (GPP).

RESTRAINING FACTORS

High Medication Costs to Restrict Market Growth in Emerging Countries

Psoriasis is a lifelong disease and can incur considerable expenses. According to the economic analysis of psoriasis treatment, the proportion of medication costs for this ailment accounts for approximately 20% of the total costs. According to the NPF, it was estimated that one in three people with the condition had trouble paying for the cost of treatment, and a tube of topical medications would cost between USD 500 to USD 600. Additionally, as per a 2021 article published in the National Center for Biotechnology Information (NCBI), the out-of-pocket cost of biologics could range from around USD 4,423 to USD 6,950 per year. Thus, despite the growing prevalence of psoriasis and other related disorders, high medication costs and the lack of favorable reimbursement policies in developing nations are a few factors restricting the market growth during the forecast period.

Psoriasis Treatment Market Segmentation Analysis

By Drug Class Analysis

Interleukin Inhibitors to Gain Traction Due to Increasing Number of Clinical Trials

Based on drug class, the market is segmented into TNF inhibitors, interleukin inhibitors, and others. The interleukin inhibitors segment is expected to register the highest CAGR due to the growing prevalence of research trials conducted worldwide, aiming to assess the effectiveness of these drugs in treating a particular disease.

- In November 2022, ACELYRIN, INC. commenced a phase 2/3 clinical trial to study the safety and efficacy of Izokibep, an IL17A protein inhibitor, in patients suffering from psoriatic arthritis. The study is expected to be completed by 2024.

The TNF inhibitors segment dominated the market share with a share of 41.31% in 2026. However, the segment is expected to lose market share to some extent in the upcoming years owing to the decline in the prices of branded products due to the loss of exclusivity of these products and the entry of biosimilar versions, along with the growing prescription volume for interleukin inhibitors drugs.

- For instance, in December 2021, Coherus BioSciences, Inc. received U.S. FDA approval for YUSIMRY, a biosimilar of Humira developed for the treatment of plaque psoriasis, psoriatic arthritis, and other types.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Plaque Psoriasis Segment Dominated Driven by Increased Awareness Programs

Based on type, the market is categorized into plaque psoriasis, psoriatic arthritis, and others. The plaque psoriasis segment held the lion’s share of 41.31% in 2026. Plaque psoriasis is the most common type of psoriasis, accounting for 80%-90% of all psoriasis cases. To cater to the rising target population, key players, in collaboration with governments, are raising awareness programs to improve the adoption of these drugs. Furthermore, the market players are raising funds to develop and launch effective medications for plaque psoriasis in the market.

- For instance, in September 2022, Nimbus Therapeutics raised USD 125.0 million for its lead drug candidate, TYK2, indicated for treating plaque psoriasis. The company aimed to advance its lead drug into late-phase clinical testing.

On the other hand, psoriatic arthritis is anticipated to witness the highest CAGR during the forecast period. Rising focus toward research and development initiatives aiming for launching new drugs for treating psoriatic arthritis. Additionally, the rising burden of the target population along with government funding grants promoting the discovery of new and effective treatments for the condition, are a few factors contributing to the segment growth.

- In March 2022, the National Institutes of Health (NIH) granted USD 58.5 million for five years to various institutions under the Autoimmune and Immune-Mediated Diseases (AMP AIM) program. The program is divided into four disease teams: psoriatic arthritis, rheumatoid arthritis, and others.

By Product Type Analysis

Biologics Segment Dominated due to Strong Presence and Adoption of Biologic Drugs

On the basis of product type, the market is segmented into biologics and non-biologics. The biologics segment dominated the global psoriasis treatment market share with a share of 90.73% in 2026 and is projected to continue its market dominance during the forecast period. The dominance of the biologics segment is due to the presence of a number of products within this category and their robust adoption trends. Furthermore, biologics offer key benefits attributed to the treatment of psoriasis, including improved patient outcomes, shorter treatment times, greater effectiveness, and the premise of a more targeted treatment. Some of the examples of biologics for psoriasis include secukinumab, etanercept, tildrakizumab, golimumab, and others.

The non-biologics segment is anticipated to grow at a significant CAGR during the forecast period. Some of the examples of non-biologic drugs include corticosteroids, methotrexate, and others.

By Route of Administration Analysis

Parenteral/Systemic Segment to Gain Traction Due to Rising Adoption of Biologics

On the basis of the route of administration, the market is segmented into oral, parenteral/systemic, and topical. The parenteral/systematic segment held the lion’s share of 83.48% in 2026. The dominance of the segment is attributed to the increasing adoption of biologics, which are primarily delivered through the parenteral route of administration. Furthermore, the launch of parenteral biologics for treating psoriatic arthritis, the high effectiveness of parenteral administration compared to other methods, and others are some factors supporting the market growth.

- For instance, in October 2023, Novartis AG received the U.S. FDA approval for the intravenous formulation of the interleukin-17A antagonist Cosentyx for treating adults suffering from psoriatic arthritis, and other rheumatic diseases.

However, the oral segment is anticipated to witness lucrative growth in the forthcoming years. The rising approval of oral drugs and various advantages associated with the oral route of administration, such as safety, pain avoidance, good patient compliance, and ease of ingestion, are increasing the uptake of oral drugs among patients.

By Distribution Channel Analysis

Retail Pharmacies Dominated the Market Due to Increasing Number of Retail Pharmacies

Based on distribution channel, the market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment dominated the global market in 2024. The dominance of the segment is attributed to the increasing number of independent retail pharmacies with easy access to patients, especially in emerging nations. For instance, according to a press release published in January 2023, Reliance Retail announced the opening of 2,000 standalone pharmacies in India to expand its network.

On the other hand, the online pharmacies segment is anticipated to witness the fastest CAGR during the forecast period. The benefits offered by online pharmacies, such as patient convenience and the availability of attractive discounts & coupons on online sales, are a few factors shifting patient preference toward e-commerce platforms. Moreover, drug manufacturers collaborating with online pharmacies to improve access to psoriasis treatment drugs is augmenting the growth of the segment in the upcoming years.

- For instance, in June 2023, Mark Cuban Cost Plus Drug Company, which launched its online pharmacy in 2022, collaborated with Coherus BioSciences, Inc. to offer its customers YUSIMRY (adalimumab-aqvh), a HUMIRA biosimilar.

REGIONAL INSIGHTS

In terms of geography, the market for psoriasis treatment is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Psoriasis Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America market size was valued at USD 21.81 billion in 2025. The region is projected to witness significant growth prospects in the forecast period. The rising burden of psoriasis in the region and increasing initiatives to raise awareness among the general population are anticipated to boost the demand for effective treatment options for managing the condition. Furthermore, the higher adoption of advanced treatment therapies, increasing research & development spending by key players in the region on clinical trials for psoriasis treatment, and increasing long-term & preventive healthcare facilities are also contributing to the regional growth. Rising initiatives by the government to reform healthcare facilities in order to offer greater accessibility to medical care among the population are fueling market growth during the forecast period. The U.S. market is valued at USD 21.75 billion by 2026.

- For instance, in August 2023, the Centers for Medicare and Medicaid Services (CMS) announced the list of the first ten drugs for inclusion into Medicare price negotiation under the act known as the Inflation Reduction Act. The list includes some psoriasis management drugs such as Enbrel and Stelara.

Europe

Europe was the second-largest market and is expected to register a significant CAGR during the forecast period. The increasing prevalence of the disorder across European countries has strongly surged the demand for therapeutic drugs, thereby propelling the regional market growth. For instance, data released by the National Institute for Health and Care Excellence (NICE) indicated that the prevalence of the condition was approximately 1.3% to 2.2% within the general population in the U.K. The UK market is valued at USD 0.63 billion by 2026, while the Germany market is valued at USD 1.05 billion by 2026.

Asia Pacific

Asia Pacific psoriasis treatment market is anticipated to record the highest growth rate due to the rising number of government initiatives to raise awareness among the population regarding the complications of prolonged psoriasis. Furthermore, the governments promoting the manufacturers for clinical research & studies to develop and launch new drugs for psoriasis is expected to bolster the market growth. The Japan market is valued at USD 0.61 billion by 2026, the China market is valued at USD 0.74 billion by 2026, and the India market is valued at USD 0.27 billion by 2026.

- In May 2023, Sareum Holdings PLC received approval from the Therapeutic Goods Administration, Australia, to commence phase I clinical trial of its drug SDC-1801 intended for treating patients suffering from psoriasis.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa are expected to register a significant CAGR owing to the shifting focus of market players toward expanding their operating network in untapped regions. For instance, the World Health Organization (WHO) data stated that the estimated age-standardized prevalence of psoriasis in Latin American countries ranged from 1.27% to 1.56%.

Key Industry Players

Diverse Product Portfolio by Johnson & Johnson Services, Inc. and Abbvie Inc. to Contribute to their Leading Positions

The market’s competitive landscape is highly consolidated, with key industry players holding a major share of the global market. Dominant players include Johnson & Johnson Services, Inc. and AbbVie Inc., among others. The dominance of these players is primarily attributed to their strong distribution networks across the globe. Moreover, the manufacturers' initiatives to develop drugs targeting all types of psoriasis also contributed to the dominance of the key players. For instance, in January 2024, Johnson & Johnson Services, Inc. announced the results from its phase III clinical trial, VISIBLE, where Tremfya significantly cleared scalp psoriasis and improved scalp itch among patients.

Key players such as Novartis AG and Eli Lilly and Company have also entered the market competition with innovative biologic products. The introduction of novel psoriasis treatment products and substantial investments in developing new biologics are major strategies adopted by manufacturers in the market. For instance, in December 2021, Novartis AG announced that it had obtained U.S. FDA approval for Cosentyx to treat psoriatic arthritis in children and adolescents. Other significant market players include Pfizer Inc., Merck & Co., Inc., LEO Pharma A/S, Sun Pharmaceutical Industries Ltd., Evelo Biosciences, Inc., and Eli Lilly & Company.

LIST OF TOP PSORIASIS TREATMENT COMPANIES:

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- Johnson & Johnson Services, Inc.(U.S.)

- Pfizer Inc. (U.S.)

- LEO Pharma A/S (Denmark)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Evelo Biosciences, Inc. (U.S.)

- UCB S.A. (Belgium)

- Sun Pharmaceutical Industries Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Arcutis Biotherapeutics, Inc., a biopharmaceutical company received the U.S. FDA approval for the Supplemental New Drug Application (sNDA) to expand indication of Zoryve cream for tropically treating plaque psoriasis, comprising intertriginous areas, to children ages 6 to 11 years.

- March 2023 – Bristol Myers Squibb received approval from the European Commission for Sotyktu to treat adult patients suffering from moderate-to-severe plaque psoriasis.

- September 2022 – Bristol Myers Squibb received the FDA approval for Sotyktu, an oral, allosteric tyrosine kinase 2-inhibitor for treating adults suffering from moderate-to-severe plaque psoriasis.

- July 2022 – Health Canada accepted the New Drug Submission review for Roflumilast cream developed by Arcutis Biotherapeutics, Inc. to treat plaque psoriasis in adults and adolescents.

- January 2022 – UCB S.A. received market authorization for its drug Bimzelx from the Japanese Ministry of Health, Labor, and Welfare (MHLW) to treat plaque psoriasis, psoriatic erythroderma, and pustular psoriasis.

REPORT COVERAGE

The psoriasis treatment market research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, drug class, type, and route of administration. Besides, market analysis it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Class

|

|

By Type

|

|

|

By Product Type

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 29.15 billion in 2025 and is projected to reach USD 72.99 billion by 2034.

In 2025, the market value is estimated to reach USD 29.15 billion.

The market will record a CAGR of 11.10% during the forecast period of 2026-2034.

The rise in the number of moderate-to-severe plaque psoriasis in adults around the globe, growing strategic collaborations and mergers among key players, and high demand for safe and effective therapies for treatment are some of the factors expected to drive the market during the forecast period.

By drug class, the TNF inhibitors segment led the market.

North America is anticipated to hold the largest share of the market during the forecast period.

AbbVie Inc., Novartis AG, Johnson & Johnson Services, Inc., and Pfizer Inc. are the leading players in the global market.

By type, the plaque psoriasis segment dominated segment in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us