Subdural Electrodes Market Size, Share & Industry Analysis, By Material (Platinum and Stainless Steel), By Type (Strip, Grid, Depth, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

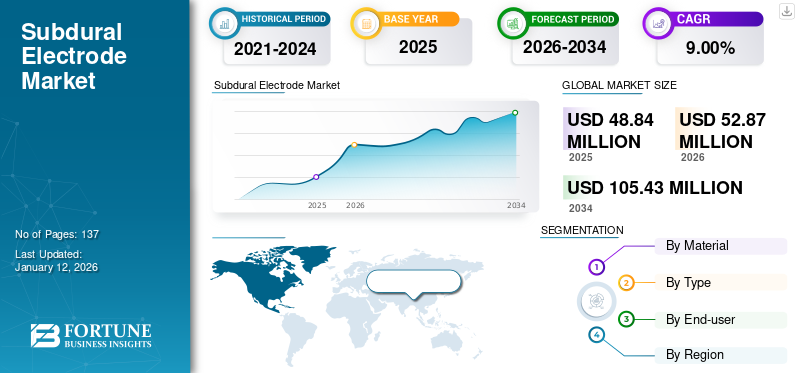

The global subdural electrodes market size was valued at USD 48.84 million in 2025 and is projected to grow from USD 52.87 million in 2026 to USD 105.43 million by 2034, exhibiting a CAGR of 9.00% during the forecast period. The United States dominated the subdural electrode market with a market share of 39.96% in 2025.

Subdural electrodes are devices that are primarily used for intracranial monitoring, carried out in patients experiencing seizures and epileptic episodes in the pre-surgical phase of epilepsy. These procedures are carried out in patients who fail to respond to medications and require surgery. It facilitates locating the lobe of origin of seizures, which will help guide the surgical procedure. Based on seizure location, a particular type of electrode is recommended. For instance, if the focus of a seizure is believed to be in the brain, then a depth electrode is recommended for intracranial monitoring.

An increasing number of epilepsy surgeries, the rising adoption of intracranial monitoring, and the prevalence of epilepsy are anticipated to boost the subdural electrodes market growth rate during the forecast period. For instance, as per statistics published in 2022 by the World Health Organization (WHO), about 50.0 million people worldwide have epilepsy, and it is one of the most common neurological diseases globally. Around 80.0% of people with epilepsy live in low- and middle-income countries. This prevalence represents higher growth for intracranial monitoring, which signifies a higher demand for these products during the forecast period.

The COVID-19 pandemic negatively influenced market growth. It led to a reduction in in-person visits to healthcare professionals, cancellation of elective intracranial monitoring procedures, closure of specialized epilepsy care centers, and diversion of resources toward pandemic-centric procedures. Moreover, after the lifting of the COVID-19 restrictions, such as the reopening of EMUs, there was a resurgence in the market’s growth prospects, which was expected to return to its pre-pandemic level at a steady rate from 2023.

Global Subdural Electrodes Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 48.84 million

- 2026 Market Size: USD 52.87 million

- 2034 Forecast Market Size: USD 105.43 million

- CAGR: 9.00% from 2026–2034

Market Share:

- This is driven by a high adoption rate of these devices for intracranial monitoring, an increasing number of specialized epilepsy centers, and a rising prevalence of drug-resistant epilepsy among the patient population.

- By Type: The Depth Electrode segment held the largest market share. The segment's dominance is attributed to significant benefits such as the ability to comprehensively record deep brain structures, minimal procedural invasion, improved patient comfort, and superior quality of brain mapping.

Key Country Highlights:

- Japan: The market is propelled by a higher prevalence of epilepsy, significant research and development activities, and supportive government initiatives, such as the approval of insurance reimbursement for robot-assisted placement of depth electrodes.

- United States: Growth is fueled by the high adoption rate of intracranial monitoring procedures, driven by an increasing number of Level 3 and 4 specialized epilepsy centers and a growing patient population that is resistant to anti-epileptic drugs.

- China: The market is characterized by remarkable improvements in epilepsy surgeries and pre-surgical planning, indicating a modernizing healthcare landscape and a growing capacity for advanced neurological procedures.

- Europe: The market is driven by improved healthcare facilities for epilepsy, higher adoption rates for advanced depth electrodes, and strong awareness of the benefits of intracranial monitoring among both patients and healthcare providers. The region sees a high volume of relevant procedures, with an estimated 18,000 craniotomies for epilepsy performed annually.

Subdural Electrodes Market Trends

Increased Expansion of Pipeline Studies into Newer Application Areas to Determine Market Growth

The subdural electrodes market trends can be determined by the steadily increasing demand for these products across the globe, which has significantly increased the market growth in the forecast period. As the demand for these technologies is expected to grow over the next few decades, the need for the launch of novel products across diverse clinical indications, apart from the primary indication of epilepsy has led to the engagement of several established and emerging companies and institutions to increase R&D initiatives for the development.

For instance, in October 2020, Hospices Civils de Lyon in France initiated clinical trials to implant cortical electrodes in patients with head trauma, subarachnoid hemorrhage, and brain lesions. This study is considered to be an essential step in studying the clinical benefit of individualized management on the basis of such monitoring. The rising number of clinical trials in technologies is expected to strongly move forward the commercialization process of these critical medical devices. In addition, the large number of patients who need these technologies and are ineligible for traditional treatments is expected to drive a significant demand for these upcoming products.

Download Free sample to learn more about this report.

Subdural Electrodes Market Growth Factors

Increasing Demand for Intracranial Monitoring as Surgical Planning for Epilepsy to Drive Market Growth

The prevalence of epilepsy is growing across the globe, leading to an increasing number of surgeries, such as intracranial monitoring, which is a pre-surgical planning process for epilepsy surgery. This factor is also driven by the substantial boost in the number of level 3 and level 4 dedicated specialized epilepsy centers, which exclusively provide intracranial monitoring procedures, including the implantation of these products. For instance, according to an article published by the World Health Organization (WHO) in February 2023, around 5.0 million people worldwide are diagnosed with epilepsy annually. In high-income countries, 49 per 100,000 people are diagnosed with epilepsy yearly. Whereas in low- and middle-income countries, 139 per 100,000 people are diagnosed with epilepsy yearly.

Furthermore, there is a gradual shift in the preference of epileptic patients from Anti-Epileptic Drugs (AEDs) to epilepsy surgery. According to the World Health Organization, in 2022, around 30.0% of patients on anti-epileptic medications across the globe will fail to get the desired treatment outcomes for epilepsy seizure control. The failure of AEDs for seizure control is leading to an increasing number of epilepsy surgeries, which is expected to result in increased intracranial monitoring procedures for epilepsy.

Superior Procedural Outcomes of Subdural Electrodes for Locating Seizure Focus in Epilepsy to Drive Product Adoption

Intracranial monitoring is recommended for patients failing to get seizure control by anti-epileptic medications. To locate seizure focus and perform brain mapping, subdural electrodes are implanted in the patient's brain. It enables visual mapping of seizure patterns, which surgeons analyze. Moreover, they allow detailed mapping of several areas in the brain to accomplish superior procedural outcomes, eventually leading to greater adoption of intracranial monitoring and driving market growth.

There is a gradual shift in preference for depth electrodes from strip & grid electrodes. Certain benefits offered by depth electrodes, such as minimal invasion, superior visualizations, and lower postoperative complications, are expected to fuel the growth of depth electrodes, which is expected to boost the growth of the global market during the forecast period. For instance, according to an article published by the National Institutes of Health (NIH) in 2022, a pilot study was conducted to investigate the feasibility of ECoG monitoring via a less invasive burrhole approach. This was done using a Spencer-type electrode array, which was implanted subdurally rather than in the depth of the parenchyma. The study found that no adverse events related to electrode implantation were noted. The product efficacy and safety will result in strong product adoption and positively impact the market growth.

RESTRAINING FACTORS

Lack of Product Awareness in Emerging Countries to Impede Market Growth Prospects

Despite the higher prevalence of epilepsy in emerging nations, there is a huge treatment gap due to the lack of infrastructure and product availability in emerging nations. Moreover, certain factors, such as lack of awareness about surgical planning of epilepsy, social stigma about epilepsy, widespread misconceptions, and the reluctance of government authorities to promote treatment programs in emerging nations, are expected to restrain the market growth during the forecast period.

For instance, according to an article published by the World Health Organization (WHO) in 2023, in low-income countries, around three-quarters of people with epilepsy don’t get access to any epilepsy treatment. Also, in many parts of the world, epileptic patients and their families suffer from stigma and discrimination. These factors are reducing the number of intracranial monitoring procedures in emerging countries, which will eventually reduce product usage. Such limiting factors are anticipated to restrict the market growth in the forecast period.

Subdural Electrodes Market Segmentation Analysis

By Material Analysis

Higher Bio-Compatibility to Boost the Adoption of Platinum Electrode

By material, the global market can be bifurcated into platinum and stainless steel.

The platinum segment is projected to dominate the market, accounting for 76.83% of the total market share in 2026 due to its various benefits, such as better compatibility with the organic environment, low risk of infection among patients, and better electrical conductivity over stainless steel. Positive results of clinical cases performed through newly launched products of key market players augment the market growth. For instance, in August 2021, Natus Medical Incorporated completed its first clinical case using the newly launched XactTrode family of platinum subdural electrodes.

The stainless steel segment is expected to lose market share from 2025-2032 due to the changing preference of healthcare professionals from stainless steel to platinum. Some factors of stainless steel material, such as oxidation properties and high infection rate is expected to impact the segment's growth during the forecast period. Hence, healthcare professionals' preference for subdural electrodes is shifting from stainless steel to platinum.

By Type Analysis

Better Safety and Patient Comfort Offered by Depth Electrode to Drive Segment Growth

Based on type, the global market can be segmented into strip, grid, depth, and others.

The depth segment is expected to lead by type, contributing 63.39% of the market share in 2026. Certain factors, such as comprehensive recording of deep brain structures, minimal invasion, improved patient comfort, and superior quality of brain mapping, are attributable to the segment’s growth during the forecast period.

The grid and strip segments are anticipated to witness a decline in their market share during the forecast period. Their current market share is attributable to the strong adoption of grid and strip electrodes due to their lower costs and robust usage in low and middle-income countries, where a large patient populace resides.

The others segment is estimated to grow at a lower CAGR due to a comparatively limited number of product offerings in this segment.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Growing Demand for Advanced Healthcare Facilities is Projected to Drive Growth for Hospitals & ASCs

By end-user, the global market can be classified into hospitals & ASCs, specialty clinics, and others.

Hospitals and ambulatory surgical centers (ASCs) are anticipated to remain the primary end users, representing 71.74% of the total market share in 2026, as the majority of the implant procedures are carried out in these settings. Furthermore, the increased utilization of healthcare facilities, such as hospitals for epilepsy care in emerging nations, and the rising awareness about intracranial monitoring are anticipated to drive the market growth with the highest CAGR during the forecast period. Similarly, the rising clinical research initiatives in the association of hospitals and key players propel the segment’s expansion. In November 2022, Panaxium announced that Dr. Gilles Huberfeld would lead the first human-patient investigations of its next-generation iontronic brain-computer interface in 2023. The project is under the coordination of Inserm with Dr Michel LE VAN QUYEN and in collaboration with Hôpital Sainte Anne and Pitié-Salpêtrière Hospital in Paris, France. Such factors are contributing to segment growth.

The specialty clinics segment accounted for a substantial market share in 2024 and is estimated to grow with a considerable CAGR during the forecast period due to the increasing number of epilepsy centers across the globe. According to the American Academy of Neurology article published in 2022, data was analyzed during 2012, 2016, and 2019 from all level 3 and level 4 National Association of Epilepsy Centers (NAEC) accredited epilepsy centers. It was found that the availability of specialty epilepsy care in the U.S. improved as the NAEC implemented its accreditation program. The others segment is anticipated to witness a decline in its market share from 2025-2032.

REGIONAL INSIGHTS

On the basis of region, the global market can be segmented into the U.S., Europe, Japan, and the Rest of the World.

The U.S. market was valued at USD 18.1 million in 2024 and is likely to remain dominant throughout the forecast period. There is a high adoption rate of these devices for intracranial monitoring in the U.S. as the number of epilepsy centers is increasing, coupled with the rising prevalence of drug resistance amongst the epileptic patient population. These factors are boosting the market growth during the forecast period. The U.S. market is projected to reach USD 21.07 billion by 2026.

Europe is anticipated to be the second leading region in revenue, which is attributable to improved healthcare facilities for epilepsy, higher adoption of depth electrodes, and higher awareness of intracranial monitoring and its benefits among epileptic patients and healthcare resources. For instance, according to the NeuroOne Medical Technologies Corporation FY 2021 report, it is estimated that there are 18,000 craniotomies performed for epilepsy cases each year in Europe. Such instances are expected to lead to comparatively higher market growth in the region.

Japan is projected to witness strong growth during the forecast period, with the second-highest CAGR in the global market. Japan has witnessed a higher prevalence of epilepsy, coupled with a significant number of research and development activities carried out by the major market players. Furthermore, there is a higher probability of the penetration of the Japanese market by the U.S. and Europe-based players, along with certain government initiatives, which are expected to boost the adoption of these products in the Japanese market. For instance, in early 2020, the Japan Ministry of Health, Labor and Welfare approved reimbursement as insurance coverage for robot-assisted placement of depth electrodes for SEEG. The Japan market is projected to reach USD 5.94 billion by 2026.

The Rest of the World, including India, China, Australia, South Africa, Brazil, and others, made remarkable improvements in epilepsy surgeries and pre-surgical planning for epilepsy. The unmet requirement in South Africa and Brazil could provide lucrative opportunities for leading market players to capture a higher subdural electrodes market share in these regions.

Key Industry Players

Ad-Tech Medical Instrument Corporation, CorTec GmbH, and Integra LifeSciences Corporation to Lead by Providing Unique Technology

Introducing new products and focusing on mergers and acquisitions have been the key driving factors for the major industry players to capture higher market revenue. Combined with this, the companies are reinforcing their strategic position in the global market owing to their hold on unique technology, a wide range of product offerings, a robust distribution network, key industry developments, mergers, and strong brand presence. The growth strategies adopted by the dominating companies have facilitated leading the competition in the market. For instance, in October 2021, Ad-Tech Medical Instrument Corporation received investment from ArchiMed, intending to scale up its business operations in North America and Europe.

CorTec GmbH is considered a second leading player in the global market due to its strong presence in the European market and growing focus on expanding its presence globally. In June 2021, CorTec GmbH entered into a transatlantic strategic partnership with Blackrock Neurotech, LLC, to provide a more comprehensive portfolio of solutions to address various neurological disorders, including peripheral nerve application, and enter the U.S. market. Other key players, such as Natus Medical Incorporated, PMT Corporation, Unique Medical Ltd, and inomed Medizintechnik GmbH, are focusing on collaborations with healthcare institutions and strengthening their supply chain network to maintain their position in the market.

LIST OF TOP SUBDURAL ELECTRODES COMPANIES:

- Integra LifeSciences Corporation (U.S.)

- Natus Medical Incorporated (U.S.)

- Ad-Tech Medical Instrument Corporation (U.S.)

- DIXI Medical (Dixi) (France)

- PMT Corporation (U.S.)

- inomed Medizintechnik GmbH (Germany)

- CorTech GmbH (Germany)

- NIHON KOHDEN CORPORATION (Japan)

- NeuroOne (U.S.)

- Alliance Biomedica (India)

KEY INDUSTRY DEVELOPMENTS:

- October 2022: Synaptive Medical Inc. and Panaxium had a joint-development partnership to incorporate Panaxium’s ultra-flexible iontronic electrocorticography (ECoG) platform into Synaptive’s Modus V robotic exoscope technology.

- August 2022: NeuroPace, Inc. entered into a commercialization agreement with DIXI Medical USA. NeuroPace will become the exclusive U.S. distributor of DIXI’s product line.

- July 2022: Natus Medical Incorporated was acquired by ArchiMed for USD 1.2 billion in total equity value.

- May 2022: NeuroOne Medical Technologies Corporation received the U.S. FDA clearance for its Evo sEEG Electrode for less than 30-day use.

- April 2022: Neurosoft Bioelectronics received USD 3.0 million from the SERI-Funded European Innovation Council Accelerator Grant and a share of the USD 165,000.0 through the European Research Council Proof-of-Concept Grant. In addition, it has secured a USD 100,000.0 convertible note from the Fongit Innovation Fund. Such funding will be used to develop the company’s soft, flexible electrodes to be marketed as SOFT ECoG.

- October 2021: Ad-Tech Medical Instrument Corporation received investment from ArchiMed with an aim to scale up its business operations in the North American and European markets.

REPORT COVERAGE

The report provides qualitative and quantitative insights into the global market and a detailed analysis of the global market size & growth rate for all possible segments in the market. The report also provides an elaborative analysis of the global market dynamics and competitive landscape. Various key insights presented in the report are the prevalence of epilepsy in key countries, key recent industry developments – mergers, acquisitions, and partnerships; key industry developments – new product launches, approvals, recalls; regulatory scenario, overview of product applications in cranial nerves & others, trends of usage of these products and intracranial monitoring in epilepsy surgeries, the impact of COVID-19 on the market, and market volume data.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.00% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 48.84 million in 2025 to USD 105.43 million by 2034.

In 2025, the U.S. market stood at USD 18.1 million.

Growing at a CAGR of 9.00%, the market will exhibit steady growth during the forecast period.

The depth segment is expected to be the leading segment in this market.

The increasing demand for intracranial monitoring as surgical planning for epilepsy is the key driving factor of the global market.

AD Tech Medical Instrument Corporation, CorTech GmbH, and Integra LifeSciences Corporation are the leading players in the global market.

The U.S. dominated the market in 2025.

The increasing prevalence of epilepsy and the rising adoption of epileptic surgeries are the factors expected to drive product adoption.

The substantial increase in the number of dedicated epilepsy centers in the U.S. and the increase in expansion of pipeline studies into newer application areas to determine market growth are a few of the trends in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us