Turboexpander Market Size, Share & Industry Analysis, By Loading Device (Compressor, Generator, and Others), By End-Use Industry (Oil & Gas, Industrial Gases, Energy Recovery, and Others), and Regional Forecast, 2025-2034

KEY MARKET INSIGHTS

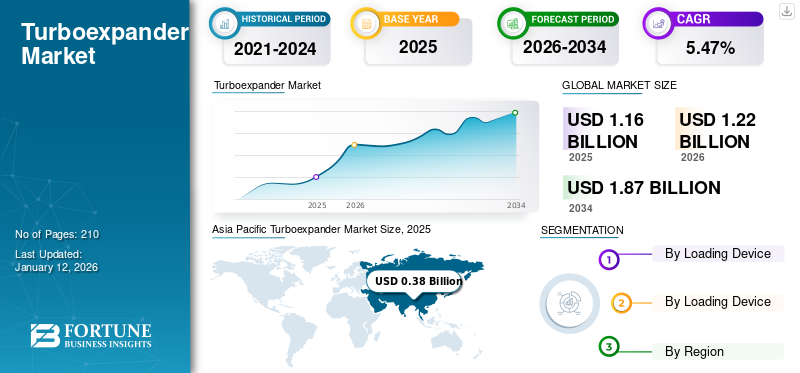

The global turboexpander market size was valued at USD 1.16 billion in 2025 and is projected to grow from USD 1.22 billion in 2026 to USD 1.87 billion by 2034, exhibiting a CAGR of 5.47% during the forecast period. The Asia Pacific dominated the turboexpander market with a share of 32.83% in 2025.

A turboexpander is a mechanical device used to expand high-pressure gas, typically in cryogenic applications, and convert the energy from the expanding gas into useful mechanical power. It operates by allowing the gas to expand rapidly, which drives a turbine connected to a generator or compressor. It is commonly used in natural gas processing, Liquefied Natural Gas (LNG) production, and industrial refrigeration. As industries focus on reducing energy consumption and emissions, turboexpanders are seen as critical components for sustainable energy generation and cryogenic cooling processes. The market is driven by increasing demand for natural gas, hydrogen liquefaction, and technological advancements in bearing technology.

The market features a diverse and competitive landscape, with several prominent global players driving innovation and market growth. Atlas Copco and Cryostar are the major players in the market. Atlas Copco, a Swedish multinational, holds a leading share of the global market with the largest installed bases of turboexpander and a diversified industrial portfolio. This has enabled wider applications of these devices across multiple sectors.

MARKET DYNAMICS

MARKET DRIVERS

Growth of the LNG Industry to Boost Market Development

Turboexpanders are integral to LNG production, where they are used in cryogenic cooling processes to liquefy natural gas. With LNG becoming a preferred energy source due to its lower carbon emissions compared to coal and oil, the need for energy-efficient devices, such as turboexpanders, is growing. These devices are essential in optimizing energy recovery during the LNG liquefaction process as they convert excess pressure energy into mechanical power, reducing overall energy consumption in LNG plants.

The International Energy Agency (IEA) projects that the global demand for LNG will grow by approximately 3.5% annually through 2025 as several countries are transitioning from coal to cleaner energy sources. This creates a robust demand for more energy-efficient LNG plants, where turboexpanders play a critical role in minimizing energy waste during the liquefaction process.

For instance, in 2022, QatarEnergy announced its plan to increase its LNG production capacity to 126 million tons per year by 2027, up from the current 77 million tons per year. This expansion was part of a broader trend to meet the global energy demand, and turboexpanders will be key components in improving energy efficiency in these new plants.

Rising Emphasis on Energy Efficiency and Sustainability to Propel Market Expansion

The growing emphasis on energy efficiency and sustainability is driving the demand for turboexpanders in various industrial applications. As industries strive to reduce their carbon footprint and operational costs, the need for technologies that optimize energy use has never been more pronounced. These devices enable the conversion of excess pressure energy into mechanical power, which can be used for electricity generation or other processes, contributing to reducing waste energy and enhancing system efficiency.

According to the International Energy Agency (IEA), improvements in industrial energy efficiency could account for nearly 40% of the total emission reductions required to meet global climate goals by 2050. Turbo expanders are crucial in these efforts as they are commonly used in processes, such as natural gas liquefaction and petrochemical production, which consume a lot of energy and produce significant emissions. The recovery of excess pressure energy in these systems directly contributes to lowering energy consumption and emissions.

MARKET RESTRAINTS

High Initial Capital Cost Associated with Turboexpander Technology to Hinder Market Growth

The high initial capital cost associated with the turboexpander technology is one of the major restraining factors, as turboexpanders are complex, specialized systems that require a significant upfront investment for design, installation, and integration into industrial operations.

For instance, the cost of a turboexpander unit can range from USD 1 million to over USD 10 million, depending on its size and application. Additionally, the installation of these units often involves substantial engineering work, specialized equipment, and skilled labor. This high capital cost, coupled with ongoing maintenance expenses, makes turboexpanders a considerable investment, especially for smaller companies or industries with tight profit margins. While these devices can improve energy efficiency and provide long-term savings, the initial financial burden can deter many potential adopters.

MARKET OPPORTUNITIES

Rising Application of Turboexpanders in Carbon Capture, Utilization, and Storage (CCUS) Technologies

As global efforts to mitigate climate change and reduce carbon emissions intensify, industries, such as power and oil & gas, are increasingly adopting CCUS systems. Turboexpanders are essential in these systems to enhance energy recovery during CO2 compression and liquefaction processes. This is expected to drive the turboexpander market growth during the forecast period.

With governments and private companies investing billions in CCUS projects, the demand for these devices is set to rise. For instance, Saudi Arabia is investing heavily in CCUS, with its ambitious plans to capture up to 10 million tons of CO2 annually by 2030. This includes large-scale CCUS facilities where turboexpanders will play a key role in reducing energy consumption during CO2 liquefaction. These developments underline the increasing role of these devices in the global CCUS infrastructure.

MARKET CHALLENGES

Complexity of Integrating New Turboexpanders into Existing Infrastructure Creates a Challenge

Many industries, particularly in natural gas processing, petrochemicals, and industrial sectors, often have legacy systems that are not designed to accommodate modern turboexpander technology. Retrofitting these systems with new turboexpanders involves significant engineering efforts, potential downtime, and high costs for installation and calibration.

For instance, in the oil & gas sector, many refineries and natural gas plants were built decades ago and are primarily designed around older, less energy-efficient equipment. In 2022, the International Energy Agency (IEA) noted that around 75% of the world's oil and gas infrastructure is more than 20 years old, which poses a significant challenge to integrating newer, more energy-efficient technologies.

TURBOEXPANDER MARKET TRENDS

Integration of Digital Technologies and IoT for Enhanced Performance and Monitoring

The turboexpander market is witnessing a growing trend towards integrating digital technologies and the Internet of Things (IoT) for real-time performance monitoring, predictive maintenance, and overall operational optimization. Operators can detect possible problems early, maximize energy economy, and enhance overall system reliability by collecting and analyzing data from turboexpanders using sensors, data analytics platforms, and cloud-based solutions. The growing need for remote monitoring capabilities, decreased downtime, and greater operating efficiency across a range of applications is propelling this trend towards smart turboexpanders, which will result in significant cost savings and improved environmental performance.

For instance, in February 2024, Veritone, an AI business, and Baker Hughes announced a cooperation to incorporate Veritone's AI platform, which includes their carbon management app into their equipment to help clients monitor equipment performance and minimize emissions.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic temporarily disrupted the market, leading to delays in project timelines, supply chain challenges, and reduced demand from industries, such as oil & gas and LNG during the peak of the pandemic. However, as global economies recover, there is an increasing focus on energy efficiency and sustainability, driving a rebound in product demand, particularly in natural gas processing and renewable energy sectors.

SEGMENTATION ANALYSIS

By Loading Device

Compressor Segment Dominates Market Due to Its High Application in Energy Recovery

Based on loading device, the global market can be segmented into compressor, generator, and others.

The compressor segment is the leading segment primarily due to its critical role in energy recovery and efficiency optimization in industries, such as natural gas, LNG, and petrochemical. Compressors are integral to systems where turboexpanders are used to recover excess energy from high-pressure gas flows, often in processes that involve gas compression or refrigeration cycles. The segment is expected to gain 67.54% of the market share in 2026.

The generator segment holds the second-leading market position, driven by the growing need for power generation and energy recovery in various industrial applications. Turboexpanders connected to generators convert the kinetic energy from expanding gases into electrical power, making them a key component in systems where waste heat or excess pressure needs to be transformed into usable energy. The segment is likely to register a considerable CAGR of 4.75% during the forecast period (2025-2032).

By End-User Industry

Oil & Gas Sector Dominates Market Due to Increasing Demand for LNG in Various Applications

Based on application, the market is classified into oil & gas, industrial gases, energy recovery, and others.

The oil & gas segment holds the largest global turboexpander market share and is expected to remain dominant over the forecast period. The oil & gas industry majorly includes on-shore and offshore LNG applications, and there is an increasing demand for LNG in various applications, such as industrial, commercial, and residential. This segment acquired 44.32% of the market share in 2024.

Industrial gases hold a second-leading position in the market as they widely utilize turboexpanders for varied applications. In the industrial gas sector, turboexpanders are widely used as sources of refrigeration in industrial processes, such as the extraction of ethane & natural gas liquids from natural gas, liquefaction of gases, which includes argon, helium, oxygen, and nitrogen, and other low-temperature processes.

To know how our report can help streamline your business, Speak to Analyst

TURBOEXPANDER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Turboexpander Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Growing Need for Energy-Efficient Technologies Fuels Market Growth in Asia Pacific

Asia Pacific dominated the market with a revenue share of USD 0.38 billion in 2025 and USD 0.41 billion in 2026. The region dominates the global market, owing to rapid industrialization, growing demand for energy-efficient technologies, and increased investments in natural gas infrastructure. For instance, India is investing in infrastructure to expand its natural gas capacity. Moreover, the Indian government's focus on improving industrial energy efficiency under initiatives such as Perform, Achieve, and Trade (PAT) is expected to drive product demand. Japan and India are set to be worth USD 0.04 billion in 2026.

China

Increased Investments to Diversify Energy Sources is Driving Product Demand in China

China, as one of the world's largest energy consumers, has been making substantial investments in its natural gas infrastructure to diversify its energy sources and reduce pollution. According to the China National Petroleum Corporation (CNPC), the country's LNG imports increased by 18.3% year-on-year in 2021, with turboexpander technology playing a key role in optimizing energy recovery during the liquefaction process. China is predicted to hit USD 0.16 billion in 2026.

North America

North America to Witness Growth Due to Expanding Natural Gas Industry

North America is the second largest market anticipated to hold USD 0.29 billion in 2026, registering a CAGR of 4.13% during the forecast period (2025-2032). In North America, the market is experiencing significant growth, particularly due to the demand for natural gas processing and the increasing focus on sustainable energy practices. In the region, LNG terminals are increasingly relying on turboexpander technology to optimize energy efficiency in liquefaction processes. For instance, the Cove Point LNG terminal in Maryland, one of the largest in the U.S., uses turboexpanders to recover energy during the liquefaction process.

U.S.

Expanding Processing of Natural Gas and Its Increased Consumption to Drive Product Demand in the U.S.

The U.S. is a global leader in LNG exports, and the U.S. Energy Information Administration (EIA) reported in 2023 that the country’s LNG exports reached about 13.5 billion cubic feet per day (Bcf/d) in 2022, marking a substantial increase over the past decade. Moreover, the country is also a major consumer and producer of natural gas. According to the U.S. Energy Information Administration (EIA), the U.S. consumed 32.50 Trillion Cubic Feet (TCF) of natural gas in 2023, which is equivalent to about 36% of the country’s total primary energy consumption in 2023. These factors are the driving demand for turboexpanders in natural gas processing and other industries in the U.S. The U.S. market is expanding, anticipated to reach USD 0.24 billion in 2026.

Europe

Sustainable Fuel Adoption Initiatives and Growing Energy Security Concerns to Drive Product Demand in Europe

Europe is the third largest market foreseen to gain USD 0.27 billion in 2026. Europe's upstream oil and gas power generation with offshore opportunities is gaining prominence amid growing energy security concerns and ambitious climate pledges. The regional market’s outlook remains robust as operators strive to balance the demand for reliable energy supplies with the urgent need for sustainable practices. The U.K. market is set to grow, projected to reach a market value of USD 0.03 billion. According to the International Energy Association (IEA), Europe witnessed growth in oil and gas investments, which reached over USD 30 billion in 2023. Moreover, the investment in LNG reached over 7 billion, while Europe added more than 50 bcm/year of extra LNG import capacity, mainly via Floating Storage Regasification Units (FSRUs). Germany is poised to reach USD 0.04 billion in 2026, while France is anticipated to grow with a value of USD 0.02 billion in 2025.

Latin America

Increased Focus on Improving Share of Natural Gas in Energy Consumption to Drive Regional Market

With large oil and gas resources, Latin America can diversify its oil and gas supply in the near term. It is also making investments to develop and export advanced biofuels and low-emission hydrogen and ramping up the production of critical minerals that are essential to clean energy technologies.

In the region's energy consumption, natural gas will continue to generate about a quarter of electricity by 2030, while coal and oil will decline rapidly.

Middle East & Africa

High Oil and Gas Production and Processing to Boost Market Progress in the Region

The Middle East & Africa is the fourth leading region set to be valued USD 0.15 billion in 2026. The market in the Middle East & Africa is driven by the region's distinctive energy landscape, dominated by oil and gas production, growing renewable energy initiatives, and increasing industrialization. In the Gulf Cooperation Council (GCC) countries, such as Saudi Arabia, the U.A.E., and Qatar, turboexpanders are primarily used in natural gas processing, LNG production, and industrial gas separation.

For example, Qatar is expanding its North Field LNG project, which will require advanced turboexpander systems to enhance energy efficiency in the liquefaction process. Saudi Arabia, as part of its Vision 2030 goals, is investing heavily in its energy infrastructure and technologies that promote energy recovery and efficiency. This is fueling demand for turboexpander solutions. The GCC market is poised to reach a valuation of USD 0.08 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Technological Advancements to Create Competitive Market Landscape to Meet Efficient Equipment Demand in Industries

The global market is highly competitive and fragmented. Key market players are competing with a broad spectrum of companies that manufacture, distribute, and market similar products. They are focusing on expanding their presence to gain higher market shares.

Elliot Group has been among the major players in the market due to its long-standing expertise in designing and supplying turboexpanders for critical applications in natural gas processing, LNG plants, and air separation units. With a strong global presence, Elliott's innovative and highly efficient turboexpander technologies are being widely recognized for their reliability, energy efficiency, and ability to increase power recovery in industrial processes.

List of Key Turboexpander Companies Profiled:

- Atlas Copco (Sweden)

- Air Products (U.S.)

- Nikkiso (Japan)

- PBS Group, a. s. (Norway)

- L.A. Turbine (U.S.)

- Ebara Elliott Energy (Japan)

- Blair Engineering (Canada)

- Cryostar (France)

- Howden (U.K.)

- Mitsubishi Heavy Industries (Japan)

- Honeywell (U.S.)

- Turbogaz (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2024- Air Liquide completed the acquisition of Nikkiso Cryogenic Industries' turboexpander division. This strategic move aims to expand Air Liquide's capabilities in cryogenic technologies, especially in natural gas and industrial gas processing.

- October 2024- L.A. Turbine launched the ARES Active Magnetic Bearing (AMB) turboexpander-compressor, which is optimized for natural gas liquid processing and LNG applications. This launch will further expand the company's turboexpander portfolio, which serves the major industrial sector.

- October 2024- Rotoflow announced the expansion of its business in Asia and the Middle East by establishing new service centers to support turboexpander maintenance and operations. These centers aim to reduce the downtime for clients in LNG and petrochemical applications, which is a significant step in strengthening their global presence.

- November 2023- Elliott Group secured a major contract to supply turboexpanders for a new LNG plant in Qatar. The contract involved the provision of turboexpander systems for the plant's liquefaction units, which are designed to improve energy recovery efficiency significantly.

- April 2022- Atlas Copco and Process secured an order from Plug Power to supply compressors and turboexpanders for 15 tons-per-day (TDP) hydrogen liquefaction plants in Texas. These plants aimed to advance the green hydrogen economy.

Investment Analysis and Opportunities

Indonesia is expanding its oil and gas exploration by investing in 60 new oil and gas blocks with a total potential of 48 billion barrels of oil equivalent. The blocks are strategically located across different regions, including Air Komering, Serpang, Kojo, Binaiya, Gaea, and Gaea II, which are spread across onshore and offshore territories. This initiative is part of the government's broader strategy to address the declining domestic hydrocarbon production and enhance energy security. Indonesia's focus on energy efficiency and operational cost reduction will likely increase the adoption of turboexpanders.

REPORT COVERAGE

The report provides a detailed market analysis. It focuses on key aspects, such as major players, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.47% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Loading Device, By End-Use Industry, and By Region |

|

Segmentation |

By Loading Device

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 1.16 billion in 2025.

The market is likely to record a CAGR of 5.47% over the forecast period of 2026-2034.

By end-use industry, the oil & gas segment leads the market.

The market size was valued at USD 0.38 billion in 2025.

Rapid expansion of the LNG industry is driving the market growth.

Some of the top players in the market are Elliot Group, Cryostar SAS, Atlas Copco, and others.

The global market size is expected to reach a valuation of USD 1.87 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us