Wind Turbine Blade Market Size, Share & Industry Analysis By Blade Length (Upto 50 Meters and Above 50 Meters), By Capacity (Upto 10 MW and Greater than 10 MW), By Deployment (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

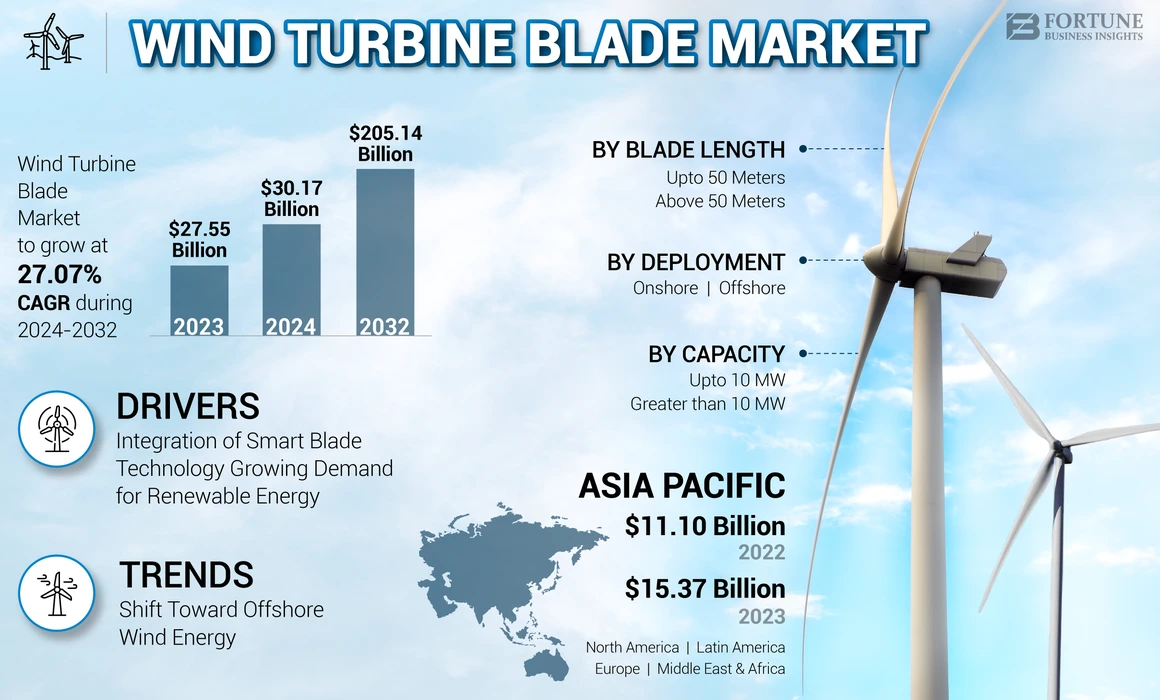

The global wind turbine blade market was valued at USD 42.58 billion in 2025. It is projected to be worth USD 58.15 billion in 2026 and reach USD 205.14 billion by 2034, exhibiting a CAGR of 27.07% during the forecast period. Asia Pacific dominated the global market with a share of 55.79% in 2025.

Wind turbine blades are the parts of a wind turbine that convert wind's kinetic energy into electricity. As countries seek to achieve their sustainability goals, the demand for wind energy is expected to grow, consequently driving the demand. Several governments globally are supporting the wind energy sector through tax incentives to encourage the adoption of wind energy. These policies create a favorable environment for the growth of the market.

Wind Turbine Blade Market Overview

Market Size:

- 2023 Value: USD 27.55 billion

- 2024 Value: USD 30.17 billion

- 2032 Forecast Value: USD 205.14 billion

- Forecast CAGR (2024–2032): 27.07%

Market Share:

- Regional Leader: Asia Pacific dominates the market, driven by large-scale wind energy projects and supportive policies.

- Fastest‑Growing Region: Asia Pacific is expected to maintain its position as the fastest-growing region due to rapid deployment of wind energy infrastructure.

- End‑User Leader: The onshore segment leads the market, driven by high demand for wind turbine blades in onshore wind farms, though offshore is expanding significantly.

Industry Trends:

- Rising Blade Length & Capacity: Increasing demand for blades over 50 meters in length and turbines with capacities exceeding 10 MW.

- Growth in Offshore Wind Projects: Offshore wind installations are fueling the demand for larger, high-performance turbine blades.

- Material Innovation in Blade Manufacturing: Adoption of carbon-glass hybrid composites for enhanced durability, reduced weight, and longer operational life.

- Policy & Investment Support: Government renewable energy targets and financial incentives are accelerating wind turbine installations globally.

Driving Factors:

- Rapid expansion of wind power capacity across key regions.

- Large-scale onshore and offshore wind energy deployments requiring advanced blade technologies.

- Technological advancements in materials and aerodynamic designs enhancing blade efficiency.

- Supportive government policies, subsidies, and renewable energy mandates.

- Rising global demand for clean energy sources and decarbonization initiatives.

Rapid industrial development and urban growth in areas like Asia Pacific are leading to an increasing market. Nations including China and India are making significant investments in renewable energy initiatives, which enhances the need for cutting-edge blade technologies, these factor to drive the market growth.

LM Wind Power is one of the leading companies in the market. In October 2022, Vestas entered into a partnership with LM Wind Power, a prominent producer of wind turbine blades, to enhance the wind energy supply chain and effectively increase renewable energy production for the global transition. This partnership involves the design and production of blades for the V172-7.2 MW wind turbines from the EnVentus platform.

MARKET DYNAMICS

MARKET DRIVERS

Integration of Smart Blade Technology to Drive Market Growth

The integration of smart blade technology is significantly driving demand within the market. These advanced blades incorporate sensors, actuators, and data analytics to optimize performance, reduce maintenance costs, and improve overall efficiency. Smart blades adjust their pitch or shape in real time to optimize energy production based on wind conditions, maximizing power output. Embedded sensors can monitor blade health and detect potential issues early, enabling proactive maintenance and reducing downtime. Smart blades optimize their operation to reduce energy losses and improve overall efficiency. By predicting and addressing maintenance needs proactively, smart blades help reduce long-term maintenance costs. Screens are made from composite materials such as fiber-reinforced polymer composites, which include carbon, glass, or natural fibers. These materials can account for up to 50% of the cost of a manufactured air circulation surface. An onshore turbine with 60-meter blades and an average weight of 20 tons (20,000 kg, 2,205 lb) costs between USD 150,000 and USD 250,000. Ongoing research focused on blades is in the process of finding the best material that can maintain low density and high stiffness to improve blade performance and control while reducing friction.

Growing Demand for Renewable Energy to Drive Market Growth

With growing concerns about climate change and environmental degradation, the world is turning to clean energy solutions. Wind energy is recognized as one of the most sustainable alternatives to fossil fuels, increasing investments and installations of wind energy systems worldwide. This change supports the growing demand for market, which are an integral part of these systems.

Many governments are implementing supportive policies and incentives to promote the adoption of renewable energy. These include setting ambitious targets for renewable energy, providing financial incentives for wind power projects, and creating laws that favor clean energy sources. These activities will encourage the development of wind farms and increase the demand for turbine blades. To expand energy efficiency and bring the next generation of American-made clean energy technology to market, the size of the electric grid has increased significantly. This may be linked to the domestic wind power forecast to increase to 12.7 gigawatts (GW) in 2019, which is higher than the annual capacity increase of the past six years. Changes to the production tax deduction over the past few years have increased this amount.

MARKET RESTRAINTS

High Manufacturing and Installation Costs to Hinder Market Growth

Large-scale production of wind turbine blades requires significant investment in materials and advanced technology. Costs associated with manufacturing processes, such as vacuum-assisted resin coating (VARTM), contribute to increased capital costs for gas projects. This financial burden can prevent developers, especially in emerging markets with limited funds, from adopting wind power solutions more effectively.

Blades are made of composite materials and can be expensive. Although carbon fiber blades are used more often because of their lower cost, they perform better but are more expensive. Fluctuations in the prices of raw materials, such as steel and copper, disrupt cost control and affect the overall cost of turbine manufacturing.

MARKET OPPORTUNITIES

Technological Advancement in Blade Design to Create New Growth Opportunities for Market

The trend toward larger rotor blades is a major advance in wind turbine technology. Today's blades can be up to 140 meters (460 ft) long, well double the size of blades made a decade ago. Larger blades allow turbines to absorb wind energy and increase torque and power generation capacity. This change allows the turbines to operate efficiently at low wind speeds, thus increasing the total power output and reducing the number of turbines required for the same level of power generation.

Innovations in materials science are leading to the use of lighter and stronger composites, such as carbon fiber and hybrid composites that combine synthetic and natural fibers. These materials improve the mechanical properties of the blades and offer long life without excessive weight. For example, studies show that a 10% increase in blade length can increase energy production by 9.3% and reduce costs by 6.7%. The move to recycled materials also addresses environmental concerns related to the disposal of blades at the end of their life cycle.

MARKET CHALLENGES

Transportation Complexity to Create Challenges for Market Growth

Wind turbine blades are very large, often over 100 meters long, and weigh up to 12 tons each. The nacelle and tower components add more weight, making them a challenge to transport. These sizes exceed the limits of existing infrastructure and disrupt transportation routes and methods. As the blades get longer (up to 200 feet), secondary roads and local infrastructure become more difficult to navigate. This requires careful route planning to avoid obstacles, such as small bridges and narrow roads.

Download Free sample to learn more about this report.

WIND TURBINE BLADE MARKET TRENDS

Shift Toward Offshore Wind Energy to Drive Market Trends

Innovations in turbine technology allow the development of higher and more efficient turbines capable of producing higher power. Turbines of more than 15 megawatts (MW) are expected to be available soon, compared to an average size of 8 MW in 2020. These advances will increase power output, reduce the cost of electricity (LCOE), and help with onshore wind. The advent of floating wind farms represents a major development in offshore wind technology. These platforms allow turbines to be installed in deep waters where permanent foundations are not possible. This potential opens up great opportunities for development, especially in areas with strong winds but challenging sea conditions. Floating wind technology will play an important role in global energy integration as it addresses environmental concerns and increases the potential for offshore wind development and further assisting in wind turbine blade market growth.

IMPACT OF COVID-19

The COVID-19 pandemic slowed production of these blades in the market. However, it had little effect on other aspects. Production facilities were temporarily shut down, and work stoppages delayed production plans. Despite these challenges, many manufacturers adapted by implementing hygiene measures and optimizing operations to keep things running smoothly. The pandemic delayed the installation of various wind power developments due to supply chain disruptions and movement restrictions. This affected the manufacturing of the blades and the work involved in transporting and installing them at the project sites. Delayed project timelines led to increased costs and fines for developers.

SEGMENTATION ANALYSIS

By Blade Length

Demand for Blades Longer than 50 meters is Due to Need for Greater Energy Absorption and Efficiency

The market is divided by blade length into upto 50 meters and above 50 meters.

The above 50 meters segment is the dominant segment in the market. The demand for blades longer than 50 meters is due to the need for greater energy absorption and efficiency. Longer blades sweep a larger area, and turbines can generate more wind power, which is ideal in low-wind areas. This process is necessary to increase energy production and improve the economics of wind power projects. In October 2024, RWE unveiled the first 108m wind turbine built at the Siemens Gamesa facility in Hull, which will be among the 100 wind turbines to be installed at the 1.4GW Sofia offshore wind farm in the U.K.

Each of the 100 14MW wind turbines fitted with 108m long blades will operate at the heart of the Sofia Offshore Wind Project.

The upto 50 meters is also the major segment in the market. For instance, the surface area of for instance 38-50 meters meets the critical range for wind turbines, especially those used in offshore installations. This unit is popular among standard wind farms where the balance between capacity, cost, and installation is important. With the expansion of the wind power sector, this segment is expected to grow during the forecast period.

By Capacity

Above 10 MW Segment Dominates Wind Turbine Market Primarily Due to Combination of High Efficiency and Output

The market is divided by capacity into upto 10 MW and greater than 10 MW.

Wind turbines with a capacity above 10 MW generate more electricity compared to smaller turbines. This makes them appropriate for utility-scale projects and wind farms that seek to enhance power generation while reducing operational expenditure. However, the initial capital investment for large-scale turbines is considerable, and their cost per unit of energy produced is likely to be lower.

The upto 10 MW segment holds strategic significance in the market due to its capability to cater to particular market requirements, offer confined energy solutions, and cater to diverse consumer bases. Smaller to moderate capacity wind turbines, characteristically upto 10 MW, are compatible with distributed energy applications. This segment plays a vital role in offering power at a confined level, reducing the strain on centralized grids, and improving energy resilience, especially in remote or off-grid regions.

In several rural and underserved areas, smaller wind turbines offer an effective means of electrification. They provide dependable power to farms, communities, and others without the need for considerable infrastructure investments, such as grid extensions, making them economical solutions for off-grid power.

By Deployment

To know how our report can help streamline your business, Speak to Analyst

Offshore Wind Farms Benefit from Higher Wind Speeds Compared to Onshore Areas

The market is divided by deployment into onshore and offshore.

The offshore segment is the fastest growing segment in the market. Offshore wind farms benefit from higher wind speeds compared to onshore areas. This benefit will lead to greater energy efficiency and improved marine facilities and sustainability. The ability to use these materials increases the need for larger and more specialized rotor blades designed for marine conditions. In September 2024, New Jersey hit the pause button on an onshore wind project struggling to find people to build turbine blades. The New Jersey Public Service Board told Leading Light Wind that it has put the project on hold until December 20 while developers look for a source for critical components. The Chicago-based Invenergy and New York-based EnergyRE project, is being built 40 miles (65 km) off Long Beach Island and will have 100 turbines, enough for 1 million houses.

The onshore segment is the dominating segment in the market as they require less investment for onshore wind power projects, making offshore projects more economically attractive. The low costs associated with ground installations contribute to the widespread use and continued demand for ground-breaking electric screens.

WIND TURBINE BLADE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Wind Turbine Blade Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific Market is Growing Due to Rising Energy Demand and Strong Governmental Support for Renewable Energy

Asia Pacific is the dominating region in the wind turbine blade market share. Asia Pacific is the dominant region in the wind turbine market. The Asia Pacific region is experiencing rapid industrial growth and urban expansion, leading to a heightened demand for energy.

The Asia Pacific region is industrializing and urbanizing, increasing the demand for energy. Countries such as China and India are emerging their energy infrastructure to support economic growth, making wind power an attractive option to meet growing energy demand while addressing concerns environment. China is the major producer and exporter of gas worldwide, affecting the Asia Pacific market. The Chinese government has executed policies and incentives to accelerate the use of wind energy, including large investments in onshore and offshore wind projects. This commitment has increased the installed capacity of the wind and increased the demand for turbine blades. In July 2024, Danish turbine OEM Vestas confirmed it will not renew its Taiwanese wind factory for its largest 15 MW, in a sign of the instability of the country's wind market.

China

China is One of Leader in Wind Turbine Installation and Manufacturing, Due to which it Dominates Market

According to the Global Wind Energy Council (GWEC), China leads in annual offshore wind development for the sixth consecutive year, with 6.3 GW commissioned in 2023. In addition, clean energy has become the major driver of China’s economic growth. Driven by the ‘30-60’ pledge, the Chinese government has set the goal that non-fossil energy sources will contribute to>80% of total energy use by 2060.

North America

North America Market is Growing Due to Favorable Government Policies and Investment in Renewable Energy

There is a strong focus on transitioning to renewable energy sources in North America due to anxieties about climate change and the need to reduce carbon emissions. This trend has led to significant investment in wind power projects, both onshore and offshore, which has increased the demand for wind power blades. The U.S. is leading this trend with a large share of new energy additions to the region. In May 2024, Researchers at the US Department of Energy's National Renewable Energy Laboratory (NREL) successfully used robotic assistance to build market, which could eliminate human labor and improve energy efficiency and product compatibility.

Although the wind power industry has used robots to grind and sharpen blades, they have not yet been widely used. Laboratory studies demonstrate the robot's ability to shave, grind, and sharpen blades. These operations are done after the two sides of the screen are made using a mold and then glued.

Europe

Europe Wind Turbine Blade Market is Growing Due to Ambitious Renewable Energy Goals and Strong Policy Support

Europe has committed to renewable energy with determined targets to reduce greenhouse gas emissions and increase the share of renewable energy in the energy mix. The EU's Green Deal aims to be carbon neutral by 2050, with a significant increase in wind energy. This commitment will increase the demand for market as an important part of new installations. Wind power installation capacity in Europe is growing faster than any other form of power generation. Countries such as Germany, Great Britain, and France are leading this growth with large investments in onshore and offshore power plants. As installation rates increase, so does the demand for turbine blades designed to meet the specific needs of these projects. According to industry representative Wind Europe, only 454 megawatts (MW) of old turbines will be removed by 2022, against an expected 1.5 gigawatts (GW). This is equivalent to more than 1,000 turbines having a longer life span in Europe.

Latin America

Latin America’s Shift toward Renewable Energy to Meet Sustainability and Ensure Energy Security is Driving Market Growth

There has been a significant increase in investment in wind power projects throughout Latin America, particularly in countries such as Argentina, Brazil, Chile, and Colombia. These investments are driven by private companies and government initiatives aimed at expanding the potential of renewable energy. For example, projects such as the 212 MW Assuruá 4 project in Brazil show the commitment to developing wind infrastructure, which directly increases the demand for market. In August 2024, Vestas' decision to expand its Brazilian output to the V163-4.5MW platform boosted local wind producer Aeris Energy.

Middle East & Africa

Middle East & Africa has Growth Potential Due to Rising Investments in Renewable Energy and Vast Wind Resources

The Middle East & Africa is experiencing a rise in energy demand driven by population expansion, urban development, and industrial growth. As nations in the region aim to diversify their energy portfolios and enhance energy security, the demand for renewable energy options, particularly wind energy, is on the rise. This surge in energy demand serves as the primary catalyst for the wind turbine market. In February 2024, Rabat Chinese wind turbine manufacturer Aeolon hopes to contribute to Morocco's transition to renewable energy by establishing its first production facility for offshore wind turbine blades in Nador.

The strategic investment in the aerospace manufacturing base is a sign of Morocco's growing influence in sustainable practices, strong economic growth, and job creation.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players are Dominating the Market By Holding Expertise in Manufacturing and Design

The global market is mostly fragmented, with key players operating in the industry. The market for wind turbine blades has seen considerable growth due to increasing demand for renewable energy sources and government encouragement.

The competitive landscape of the wind turbine blade market is highly vibrant, with key players competing based on modernization, production capability, and cost competence.

LM Wind Power is one of the major companies in the market. It is involved in designing, manufacturing, and service of wind turbine blades. In addition, Vestas Wind Systems A/S- is also one of the prominent companies in the market that produces its blades to guarantee high performance and compatibility with its turbines.

List of Key Companies Profiled in the Report

- LM Wind Power (Denmark)

- Siemens Gamesa Renewable Energy (Spain)

- TPI Composites Inc. (U.S.)

- Mingyang Smart Energy Group Co., Ltd (China)

- Nordex SE (Germany)

- Suzlon Energy Limited (India)

- Sinoma Wind Power Blade Co., Ltd. (China)

- Enercon GmbH (Germany)

- Zhongfu Lianzhong Composites Group Co., Ltd (China)

- Aeris Energy (Brazil)

- Wuxi Turbine Blade Co., Ltd. (WTB) (China)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Experts from Shell, Suzlon, and artificial intelligence are working together to improve the reliability of wind turbines. Surface quality is a concern in the gas sector amid the industry's "arms race" to produce bigger machines. A new project has been launched to increase the reliability of turbine blades using digital traps and artificial intelligence to prevent "catastrophic" failures in wind farms. Oil and gas giant Shell, Indian automaker Suzlon, and several Dutch players are on board.

- December 2023: The ZEBRA (Zero waste Blade ReseArch) Consortium presented the successful completion of the certification tests of the first recyclable blade and the creation of a second blade with repeated insulation to increase the reliability of the industry gas and achieve a circular economy.

- November 2022: Vestas signed a multi-year framework agreement with long-standing partner TPI Composite Inc. (TPI), a foremost supplier of wind turbine blades and services. TPI is set to strengthen its global assembly network for current and future wind turbine blades.

- November 2021: NREL will explore new design approaches for next-generation wind turbine blades.3 D Printing of thermal blades enables wind power and improves recycling.

- December 2020: GE Renewable Energy signed an agreement with Veolia to recycle its wind turbine blades on land in the U.S. The recycling contract, the first in the U.S. electric power industry, turns the blades into raw materials for cement production. The result: a 27% reduction in CO2 emissions. This solution, which can be used on a large scale, increases the environmental benefits of the gas industry.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In May 2024, a world-class wind power test facility is being built in Blyth, Northumberland, as part of an ~£86m (~USD 114.49 Billion) investment in RandD wind power plants that will reduce CO2 emissions and boost the economy, the Minister says for Science, Research and Innovation Andrew Griffiths.

The new facility, located at the National Renewable Energy Center, will test, certify, and validate Offshore Renewable Energy (ORE) Catapult turbines and is expected to prevent 2.5 million tons of CO2 emissions, twice as much as was emitted. The thousand Newcastle in a year over eight and a half months will bring some of the biggest and best wind turbines to market faster. This means more energy is needed to keep the lights on and heat homes from a natural source.

REPORT COVERAGE

The report on the global wind turbine blade market provides comprehensive information about the market. It emphasizes important elements such as major companies and their roles in the manufacturing and production. Additionally, it presents insights into market trends and technologies while underscoring significant developments in the industry. Alongside these factors, it includes various elements and challenges that have influenced the market's growth and decline in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 27.07% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Blade Length

|

|

By Capacity

|

|

|

By Deployment

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 27.55 billion in 2023.

The market is likely to grow at a CAGR of 27.07% during the forecast period.

By capacity, the above 10 MW segment leads the market.

The market size of Asia Pacific stood at USD 15.37 billion in 2023.

The growing demand for renewable energy is expected to drive the market growth.

Some of the top players in the market are LM Wind Power, Siemens Gamesa Renewable Energy, and TPI Composites Inc.

The global market size is expected to record a valuation of USD 205.14 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us