Workforce Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By End-user (Healthcare, IT & Telecommunication, BFSI, Manufacturing, Retail, Food & Beverages, Government, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

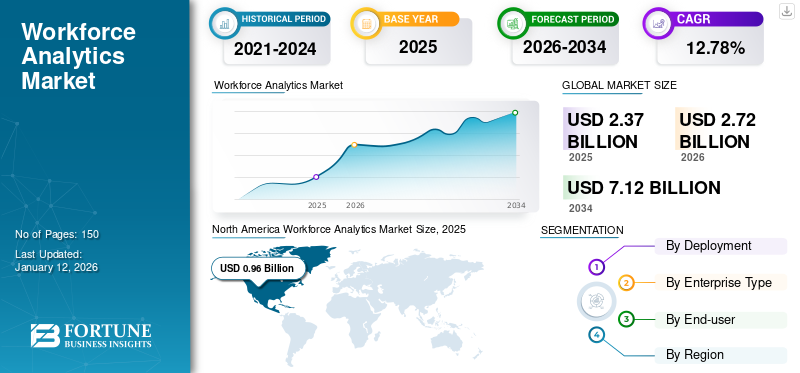

The global workforce analytics market was valued at USD 2.37 billion in 2025. The market is projected to be worth USD 2.72 billion in 2026 and reach USD 7.12 billion by 2034, exhibiting a CAGR of 12.78% during the forecast period. North America dominated the global market with a share of 40.48% in 2025.

Workforce analytics is an enhanced suite of data analytics solutions for workforce performance improvement and evaluation. It evaluates staffing, employment, employees, development and training, and compensation & benefits. The market comprises applications such as workforce planning, compensation management, performance and talent management, recruitment, and employee collaboration & engagement, among others.

Trends in the workforce analytics market include the increased use of data for strategic workforce planning, the need to alleviate long-term labor issues, and the use of performance data to identify talent gaps and improve competitive advantage. These also include the increasing need to gain an edge and ensure employee satisfaction and engagement. Further, AI-based workforce analytics solutions, the availability of vast amounts of (HR) data, the number of data sources, and the use of machine learning and blockchain technologies in workforce analytics are expected to grow in the coming years. However, the integration of all data available from various sources, lack of analytical capabilities, and privacy and compliance concerns are expected to hinder the growth of the market.

The COVID-19 pandemic had a positive impact on the development of the market owing to the increasing implementation of work from a work-from-home model by various organizations, which is anticipated to surge the requirement of workforce analytics for efficient and productive management of the workforce.

Workforce Analytics Market Trends

Rising Demand for Monitoring Performance to Boost Software Demand

The major factors driving the market growth are trends such as increasing use of data for strategic workforce planning, achieving a competitive advantage, the need to reduce long-term labour issues, and ensuring employee engagement & satisfaction.

Tracking this data helps analyze the effectiveness of managers engaging their employees in planning improvement, clarifying doubts, setting expectations, and reporting performance anxieties. Thus, evaluating their employee's performance clarifies the parts of their performance that require improvement and sections that are meeting or exceeding expectations. For instance,

- Infosys and Tata Consultancy Services shifted toward a performance system by which they believe they can track employee performance at regular intervals and predict their performance.

The factors mentioned above will bolster the market during the projected period.

Download Free sample to learn more about this report.

Workforce Analytics Market Growth Factors

Integration of Artificial Intelligence (AI) and Machine Learning (ML) with Workforce Analytics to Fuel Market

Workforce analytics is a data-driven method for managing individuals at work. It relies on statistical and data methods to aid companies in improving and understanding employee performance, engagement, and retention. Recently, the market has been elevated by the rising availability of data and the implementation of new technologies such as ML and AI.

- As per a survey by the World Economic Forum, 85% of respondents specified they are likely to accept entity and user Big Data analytics by 2022. The surge in the execution of AI and Big Data analytics contributed to the growth of the market.

In addition, enterprises are using ML and AI to automate the procedure of evaluating workforce data, which can be utilized to classify patterns and trends that would be otherwise challenging to detect. These unique insights can then be used to make better decisions about improving performance, managing employees, and sustaining talent in the company.

As a result, the incorporation of AI and ML in workforce analytics is expected to boost market growth during the forecast period.

RESTRAINING FACTORS

High Installation Costs of Software to Hamper Market Expansion

The key areas of improvement are in the execution process of this product into companies. The lack of product information causes these analytics tools not to be personalized suitably for the organization, which hinders an effective and productive implementation strategy. In addition, uniting available data from various sources, concerns related to data privacy and compliance, and lack of analytical skills are expected to hinder the market growth during the forecast period. Moreover, the high implementation cost is likely to slow down the market growth.

Workforce Analytics Market Segmentation Analysis

By Deployment Analysis

Cloud to Lead Owing to Swift Digital Transformation

By deployment, the market is bifurcated into cloud and on-premise. The cloud segment accounts for the maximum market share of 77.64% in 2026. It is also anticipated to grow at the highest CAGR during the projected period as cloud-driven deployment provides flexibility, efficiency, and cost-effectiveness. Also, it provides a better platform for the users that can be accessed from various points.

The on-premise segment has high software installation costs and upgrading charges, making users choose cloud-driven software owing to its benefits. This quick shift from using on-premise to a cloud-based platform hindered the segment's growth.

By Enterprise Type Analysis

Rising Product Demand will Assist Large Enterprise Segment to Dominate

As per our study, the software is used by large enterprises and small & medium enterprises. Large enterprises will dominate the market share of 66.62% in 2026, due to early adoption of the software. Moreover, a report by Enlyft, a software company, mentioned that of all the customers using SAP SuccessFactors Workforce Analytics, approximately 72% are large enterprises and 38% are small & medium enterprises.

Small & medium enterprises segment is anticipated to witness a rapid growth rate during the forecast period owing to the increasing number of SMEs in developing regions such as the Middle East & Africa, South America, and Asia Pacific.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Data Generation of Employees to Boost the IT & Telecommunication Segment

According to our research, the IT & telecommunication segment holds the highest share of 21.94% in 2026, due to rapid development in the sector owing to the rising need for better IT & telecommunication services. Various companies are investing highly in this software for data security and managing the data efficiently.

The challenges encountered by BFSI, including security threats, expansion, and low-profit margins have encouraged the industry to set up better infrastructure and technology to survive. Therefore, BFSI is anticipated to invest in these solutions to achieve these needs, boosting the market during the forecast period.

REGIONAL INSIGHTS

As per our report, the market is studied across North America, South America, Europe, Asia Pacific and the Middle East & Africa. These regions are further categorized into leading countries.

North America Workforce Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.96 billion in 2025 and USD 1.09 billion in 2026. The region is technologically advanced that accepts new technologies sooner. In addition, several organizations providing analytics solutions in the region are also responsible for North America's dominance in the global market. The U.S. market is projected to reach USD 0.72 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is projected to witness a quick rise in revenue growth during the forecast period and offers huge potential for market growth. The growing adoption and deployment of advanced technologies, such as cloud-based solutions, fuels the demand for this software. Moreover, increasing partnerships and collaborations among regional enterprises to deliver better solutions are propelling the Asia Pacific workforce analytics market share. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.15 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

Europe

Europe holds the second highest share in the global market owing to increasing concern of dealing with enormous data, reducing labor costs, improving operational competences, and developing digital technologies such as cloud, Big Data, 5G, mobile platforms, and advanced analytics platforms. The UK market is projected to reach USD 0.17 billion by 2026, and the Germany market is projected to reach USD 0.17 billion by 2026.

Middle East, Africa, and South America

The increasing productivity in the manufacturing sector in the Middle East, Africa, and South America is anticipated to elevate the opportunity for these software providers. The manufacturing industries are becoming a vital economic indicator of the Middle East & African countries over the past few years. According to the World Bank’s World Development Indicators database, the Middle East & African manufacturing sectors have grown steadily, at 12.37% in 2020. Hence, the need for software to manage the workers and recognize their proper potential fuels regional growth.

Key Industry Players

Market Leaders Launch New Products to Strengthen Market Position

Significant key players in the industry are working toward enhancing new and advanced workforce analytics solutions for customers. They also aim to enhance their existing product portfolio to provide flexible and easy-to-use solutions with exclusive features. In addition, the companies focus on partnerships, collaboration, and acquisitions to improve their product offerings.

List of Top Workforce Analytics Companies

- ADP, Inc. (U.S.)

- Cornerstone OnDemand, Inc. (U.S.)

- IBM Corporation (U.S.)

- Kronos Incorporated (U.S.)

- SAP SE (Germany)

- Workday, Inc. (U.S.)

- WorkForce Software, LLC (U.S.)

- Visier, Inc. (Canada)

- Oracle Corporation (U.S.)

- TriNet Group, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2023: Sapience Analytics, a workforce analytics and insights provider and QuantumWork Advisory (QWA), partnered to revolutionize companies to manage external labor spending through data analytics and strategic workforce design.

- April 2023: Workday, Inc. and Alight, Inc., providers of enterprise cloud applications for finance and human resources, entered into a strategic partnership to provide a simplified, unified payroll experience for human resources and payroll professionals across the globe.

- October 2022: Cornerstone OnDemand, Inc., a supplier of talent experience solutions, launched a Talent Experience Platform (TXP) to aid talent leaders in revealing the true potential of its workforce.

- September 2022: Intellicus launched Workforce Management Solution Flow, allowing Business Process Management (BPM) organizations to maximize productivity and elevate their workforce.

- November 2021: Oracle develops Fusion Cloud HCM Analytics to advance Workforce Insights. Oracle Fusion HCM Analytics offers HR organizations insights into managing compensation ratios, optimizing recruiting efforts, understanding workforce diversity, mitigating team member attrition, predicting retention trends, and evaluating data supporting other crucial events.

REPORT COVERAGE

The research report comprises prominent areas worldwide to get a better knowledge of the market. In addition, the study provides insights into the most recent market trends and an analysis of technologies being adopted globally. It also highlights some of the growth-stimulating restrictions and elements, enabling the reader to gain a detailed understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.78% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 7.12 billion by 2034.

In 2025, the market size stood at USD 2.37 billion.

The market is projected to grow at a CAGR of 12.78% over the forecast period (2026-2034).

By deployment, the cloud segment is likely to lead the market.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) with workforce analytics to drive market growth.

ADP, Inc., Cornerstone OnDemand, Inc., IBM Corporation, Kronos Incorporated, SAP SE, Workday, Inc., WorkForce Software, LLC, Visier, Inc., Oracle Corporation, and TriNet Group, Inc. are the top players in the market.

North America dominated the global market with a share of 40.48% in 2025.

By end-user, the healthcare segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us