Zein Protein Market Size, Share & Industry Analysis, By Grade (Food Grade, Pharma Grade, and Industrial Grade), By Form (Liquid, Granular, and Powder), By Function (Emulsifier, Coating Agent, Binding agent, Controlled-Release Agent, and Others), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Agriculture, and Industrial), By Distribution Channel (Offline and Online), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

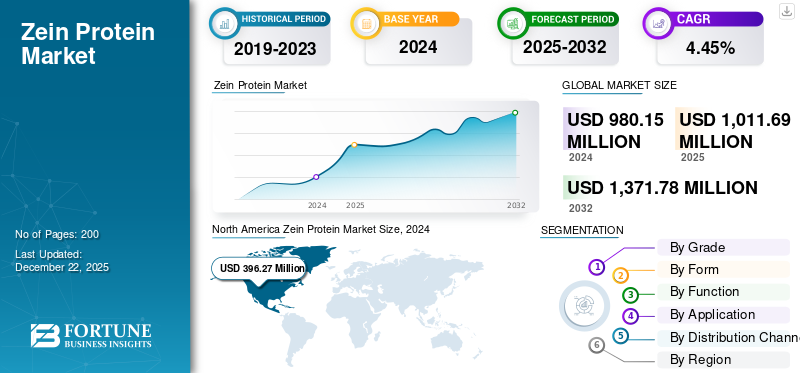

The global zein protein market size was valued at USD 1011.69 million in 2025 and is projected to grow from USD 1047.36 million in 2026 to USD 1108.21 million by 2034, exhibiting a CAGR of 4.88% during the forecast period. North America dominated the zein protein market with a market share of 40.26% in 2025.

Zein is a protein found in corn (Zea mays) kernels, specifically in the endosperm. The growing concern about health and the rising interest of consumers in plant-based proteins are driving the expansion of the market. Plant proteins offer several potential health advantages, including enhanced metabolism and digestion, promoting weight loss, lowering calorie intake, and supplying essential vitamins and minerals, among other benefits. The increasing consumer demand for all-natural food products made with plant-based components has resulted in the extensive use of corn protein in the production of food ingredients, particularly for food coating agents. Major players in the market include Roquette Frères, Sigma-Aldrich, Global Protein Products Inc., Tokyo Chemical Industry Co., Ltd., and Flo Enterprises LLC.

Zein Protein Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1011.69 million

- 2026 Market Size: USD 1047.36 million

- 2034 Forecast Market Size: USD 1108.21 million

- CAGR: 4.88% from 2026–2034

Market Share:

- North America dominated the zein protein market with a 40.26% share in 2025, driven by vast corn production, an efficient processing industry, and strong R&D investment.

- By application, the food & beverages segment is expected to hold the major market share in 2025, supported by the rising demand for plant-based, clean-label ingredients and its use as a functional coating.

Key Country Highlights:

- United States: Leads the market due to high corn production, advanced extraction technologies, and significant R&D in new applications.

- Germany: Demand is driven by strong consumer preference for vegan, clean-label, and organic ingredients in food and pharmaceutical products.

- China: Rapid market growth fueled by an expanding food processing industry, rising disposable incomes, and increasing adoption of zein in food and animal feed.

- Brazil: Growth is supported by its position as a major producer of corn, including non-GMO varieties, creating a strong raw material base for zein extraction.

MARKET DYNAMICS

Market Drivers

Growing Demand for Biodegradable and Sustainable Packaging Solutions to Drive Market Growth

The rising demand for sustainable and eco-friendly packaging solutions is indeed a significant driver for the global market, as zein possesses excellent film-forming, hydrophobic, and biodegradable properties. These attributes enable zein to be used effectively in food preservation and packaging applications, where biodegradable films can replace conventional plastics. According to the National Institutes of Health (NIH), chemically modified zein, blended with other biodegradable polymers such as poly(butylene adipate-co-terephthalate) (PBAT), can produce films with strong mechanical properties, good oxygen barrier performance, and reduced water vapor permeability. However, such properties make it ideal for food packaging and agricultural use, further fueling its demand in the market.

Expansion in Pharmaceutical and Biomedical Applications to Drive Market Growth

The expansion of corn protein's pharmaceutical and biomedical applications is a significant driver of its market growth. Zein protein’s biocompatibility, natural origin, film-forming, and encapsulation properties make it ideal for several pharmaceutical uses. Such uses include oral drug coatings that create smooth tablet surfaces to enhance swallowability, helping reduce side effects compared to synthetic coatings. This natural feature boosts acceptance by manufacturers, consumers, and regulatory bodies globally.

Market Restraints

High Processing Cost and Competition from Other Plant-based Proteins to Impede Market Growth

The high processing cost of corn protein extraction stems from the need for specialized and often intensive techniques such as ultrasonic homogenizer-assisted extraction using ethanol solutions. This process involves multiple steps, including grinding and sieving corn seeds, defatting the flour, and sonication to maximize protein yield, all requiring precise equipment and time optimization to achieve high purity and concentration. Moreover, corn protein faces competition from other plant-based proteins available at lower costs or with better functional properties, affecting its market share.

Market Opportunities

Rising Technological Advancements to Unlock New Growth Opportunities

R&D efforts focus on the development of new corn varieties, optimizing extraction, processing, and formulation techniques for zein protein, which improve its purity, functional performance, and reduce production costs. This enables greater industrial scale-up and cost competitiveness. For instance, in March 2025, Chinese agricultural scientists from China’s Huazhong Agricultural University developed new strains of protein-rich corn that can serve as a substitute for soybeans in animal feed. This new high-protein corn is mainly targeted to supplement animal feed to boost livestock growth, immunity, and product quality, contributing to higher feed efficiency and profitability for farmers.

Zein Protein Market Trends

Growing Demand for Plant-based Proteins and Clean-label Ingredients to Shape Industry

The rising demand for plant-based proteins and clean-label ingredients is indeed a major trend driving the zein protein market growth. Such protein, derived from corn, is considered a natural, clean-label ingredient that is free from allergens and GMOs, making it attractive to consumers seeking transparent and wholesome food choices. The clean-label trend emphasizes natural, less processed, and ethically sourced ingredients. Organic and plant-based proteins benefit from consumer preferences for transparency, healthiness, and sustainability, further shaping the industry's growth.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic affected the global demand for zein protein in a mixed but ultimately positive manner. Initially, the pandemic caused disruptions in supply chains and manufacturing activities, impacting production and distribution. However, growing consumer focus on health, wellness, and plant-based diets during and after the pandemic significantly boosted demand for alternative proteins. According to the Food and Health Survey, 2020, around 28% of consumers had increased their consumption of plant-based proteins as compared to a year ago. Additionally, fear related to meat consumption during the pandemic, including concerns about virus transmission and disruptions in meat supply chains, shifted preference away from animal proteins toward plant-based alternatives.

SEGMENTATION ANALYSIS

By Grade

Food Safety and Coating Properties Led to Food Grade Segment’s Highest Market Proportion

On the basis of grade, the market is segmented into food grade, pharma grade, and industrial grade.

The food grade segment held the largest share of the global market in 2024. This dominance is primarily caused due to zein protein’s wide use in food and beverage applications, especially as coating agents. Zein is recognized as safe for food application, and ongoing innovation enhances its functionality and production efficiency, supporting broader adoption in food uses. According to the U.S. FDA, zein is generally recognized as safe for food applications and has been affirmed as a Generally Recognized as Safe (GRAS) substance.

The pharma grade segment is expected to grow significantly in the forecast period. This is driven primarily by the increasing demand for natural, biocompatible, and biodegradable ingredients in pharmaceutical formulations.

By Form

Longer Shelf Life and Versatility to Lead Powder Segment’s High Market Proportion

On the basis of form, the market is segmented into liquid, granular, and powder.

The powder segment holds the largest global market share in the market. This dominance is attributed to the powder form’s ease of use, longer shelf life, and versatility in applications such as food coatings and additives.

The granular segment is expected to grow significantly in the forecast period. Granular offers better handling, dispersibility, and storage stability compared to other forms such as powder or liquid. Granular form is easier to process at an industrial scale. Its flowability and lower dust generation are favorable in automated manufacturing settings.

By Function

Tough Film Forming and Hydrophilic Properties to Lead Coating Agent Segment’s Growth

On the basis of function, the market is segmented into emulsifier, coating agent, binding agent, controlled-release agent, and others.

The coating agent segment held the largest global market share in 2024. Zein protein, derived from corn, is widely used as a coating agent in food products such as confectionery, nuts, and dried fruits, due to its hydrophobic, grease-proof, and tough film-forming capabilities. These features enhance the aroma, appearance, and texture of food, making zein highly desirable in the food and beverage industry.

The binding agent segment is expected to grow significantly. Its ability to form smooth and consumable coatings on tablets facilitates easier swallowing and controlled release of drugs, boosting its use as a binding agent in pharmaceuticals.

By Application

Growing Application as Food Coatings and Rise in Plant-based Ingredients to Drive Food & Beverage Segment's Dominance

On the basis of application, the market is segmented into food & beverages, personal care & cosmetics, pharmaceuticals, agriculture, and industrial.

The food & beverages segment is expected to hold a major share of the global market. This segment is expected to lead the market as more manufacturers adopt corn protein as a coating for chocolates, nuts, jelly bars, dried fruits, and various other food items, utilizing its ability to enhance flavor and improve texture. Additionally, the growing preference for plant-based ingredients and clean-label natural proteins in food products plays a significant role in this expansion.

The pharmaceuticals segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is primarily driven owing to zein's unique functional benefits for drug delivery systems, including its biocompatibility, ability to form smooth tablet coatings, and capacity to enable controlled or timed drug release.

The industrial segment is also expected to grow significantly, owing to zein protein’s hydrophobic, film-forming, biodegradable, and non-toxic properties. Such properties make it increasingly attractive for industrial applications, especially in packaging, textiles, and others.

By Distribution Channel

Offline Segment accounts for the Highest Market Share Due to the Concentration of Production and Supply Chain Dynamics

Based on distribution channel, the market is segmented into offline and online.

The offline segment dominates the global market. The zein protein industry is heavily influenced and controlled by wholesalers and suppliers. Zein, a corn-derived protein, is produced by a small number of specialized manufacturers. This creates supply concentration, where wholesalers act as intermediaries between producers and end-users across industries, including food and beverage, pharmaceutical, cosmetics, and others. Wholesalers and suppliers manage bulk procurement, storage, and global distribution, often maintaining exclusive regional rights. Their ability to offer competitive pricing, especially for large-volume purchases, makes them dominant players.

The online segment is expected to grow significantly in the forecast period. The segment is witnessing growing adoption for distribution in the global market, with prominent players expanding their presence through online channels to reach a wider customer base and developing regions.

To know how our report can help streamline your business, Speak to Analyst

Zein Protein Market Regional Outlook

Regionally, the report covers the global market analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Zein Protein Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global zein protein market share in 2025. North America dominated the market with a valuation of USD 0.41 billion in 2025 and USD 0.42 billion in 2026. The region, especially the U.S., enjoys vast corn cultivation and a mature processing industry capable of efficiently extracting such protein from corn gluten. This foundation supports high production and cost efficiencies in zein manufacturing. According to the United States Department of Agriculture (USDA), in 2024/2025, the U.S. accounted for 31% of global corn production, reaching a total production of 377.63 million metric tons. Moreover, North America’s strong commitment to innovation, backed by robust infrastructure and significant R&D investment, has enabled advances in zein extraction and purification technologies. These advances result in high-quality, functional, and cost-effective zein products.

Asia Pacific

Asia‑Pacific is expected to witness the fastest growth in the global market. Asia Pacific's rapidly growing food processing and animal feed industries increasingly use corn protein for its film-forming, emulsifying, and nutritional properties. The region is a major market for food processing equipment and technology, with China and India leading in terms of growth and market size. Economic expansion, increasing disposable incomes, and urban lifestyles in countries such as China and India drive higher consumption of processed and convenience foods that use this protein in coatings and additives. This economic dynamism allows for investment in innovative food products where such protein is a valued component.

Europe

Europe's market for zein protein is expected to continue its growth trajectory, majorly supported by consumer demand and industrial application expansion within food, pharmaceuticals, and other sectors. European consumers increasingly prefer vegan, gluten-free, clean-label, and organic ingredients, which align well with corn protein's natural, plant-based, and gluten-free characteristics. According to the Good Food Institute report 2024, around 46% of European consumers report trusting plant-based food significantly or somewhat more than three years ago, while only 13% trust it less. This aligns with broader data trends reflecting increasing confidence and acceptance of plant-based foods in Europe. The region’s growing pharmaceutical and cosmetics sectors are boosting demand for zein as both a functional and sustainable ingredient.

South America

South America is expected to witness moderate market growth during the forecast period. The region is experiencing strong momentum in plant-based proteins, driven by factors such as health awareness, environmental concerns, affordability, and ethical diets. Although most demand currently centers on soy, pea, and rice proteins, zein protein could leverage this broadening interest. South America, particularly Brazil and Argentina, is a major corn producer. Importantly, these countries also generate a higher share of non-GMO corn, a preferred raw material for zein extraction, reducing the reliance on costly imports and supporting regional processing, fueling the growth of the market.

Middle East & Africa

In the Middle East & Africa region, corn protein usage appears lower compared to mature markets such as North America and Europe. This is mainly due to low adoption rates in some developing areas and high processing costs. However, consumers in countries such as the UAE and South Africa are shifting towards plant-based diets to improve heart health, reduce cholesterol, and manage obesity, creating strong demand for plant proteins, including zein derived from corn. According to the Agriculture and Agri-Food Canada report, in 2021, the Gulf Cooperation Council imported USD 1.8 billion of plant-based protein ingredients from the world. In addition, the growing fitness culture generates demand for protein supplements, driving interest in plant proteins as substitutes for animal sources.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Strategic Partnership and Collaborations to Support Market Growth

The competitive landscape of the global zein protein market is characterized by a mix of established key players and emerging companies focusing heavily on research and development to innovate and expand applications. Prominent players in the market include Roquette Frères, Sigma-Aldrich, Global Protein Products Inc., Tokyo Chemical Industry Co., Ltd., and Flo Enterprises LLC. These players have been competing by investing in R&D to improve zein extraction, processing efficiency, and product applications, such as durable food coatings, biodegradable packaging films, and pharmaceutical coatings. Strategic partnerships and collaborations between producers and downstream users are common to ensure innovation and consistent supply.

Key Players in the Zein Protein Market

|

Rank |

Company Name |

|

1 |

Roquette Frères |

|

2 |

Sigma-Aldrich |

|

3 |

Global Protein Products Inc. |

|

4 |

Tokyo Chemical Industry Co., Ltd. |

|

5 |

Flo Enterprises LLC |

List of Key Zein Protein Companies Profiled:

- Roquette Frères (France)

- Cargill, Incorporated (U.S.)

- Global Protein Products Inc. (U.S.)

- Sigma-Aldrich (U.S.)

- Flo Enterprises LLC (U.S.)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- BIOZEIN TECHNOLOGY CORP., LTD. (China)

- Nordmann Rassmann GmbH (Germany)

- Haihang Industry Co., Ltd (China)

- ZeinPharma (Germany)

KEY INDUSTRY DEVELOPMENTS:

- June 2025: The U.S. Grains Council (USGC) announced the inaugural shipment of corn fermented protein (CFP) certified under its corn sustainability assurance protocol (CSAP) in the United Arab Emirates. This groundbreaking delivery signifies an important advancement in fostering sustainable agricultural practices and broadening markets for U.S. corn co-products.

- March 2025: The American Chemical Society (ACS) developed an eco-friendly detergent made from wood fiber (cellulose nanofibers) and corn protein (zein), which cleans clothes and dishes as effectively as commercial detergents without harming the environment.

- February 2023: Prairie AquaTech, a global leader in fermented plant-based ingredients, announced a new operating name, Synergy Biotech, to support its vision of delivering innovative and sustainable protein solutions, including corn protein.

- February 2022: Scientists from Singapore’s Nanyang Technological University (NTU) and Harvard T.H. Chan School of Public Health have developed a new "smart" food packaging material that is biodegradable, sustainable, and antimicrobial. The packaging is made from natural biopolymers, including corn protein (zein) and starch, infused with natural antimicrobial compounds such as thyme oil and citric acid.

- February 2022: No Apology, a flagship brand of NIAM International Private Limited, launched a range of hair care products featuring ‘coconut milk’ as the main ingredient for the first time in India. The products are made with ingredients such as soy protein, wheat protein, corn protein, coconut milk, and others.

REPORT COVERAGE

The global zein protein industry research report analyzes the market in depth and highlights crucial aspects such as market trends, market dynamics, prominent companies, and end-use. Besides this, the market statistics report also provides insights into the market analysis and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.88% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentations |

By Grade, Form, Function, Application, Distribution Channel, and Region |

|

Segmentation |

By Grade · Food Grade · Pharma Grade

|

|

By Form · Liquid · Granular · Powder |

|

|

By Function · Emulsifier · Coating Agent · Binding agent · Controlled-Release Agent

|

|

|

By Application · Food & Beverages · Personal Care & Cosmetics · Pharmaceuticals · Agriculture · Industrial |

|

|

By Distribution Channel · Offline · Online |

|

|

By Region · North America (By Grade, Form, Function, Application, Distribution Channel, and Country) • U.S. (By Form) • Canada (By Form) • Mexico (By Form) · Europe (By Grade, Form, Function, Application, Distribution Channel, and Country) • Germany (By Form) • Spain (By Form) • Italy (By Form) • France (By Form) • U.K. (By Form) • Rest of Europe (By Form) · Asia Pacific (By Grade, Form, Function, Application, Distribution Channel, and Country) • China (By Form) • Japan (By Form) • India (By Form) • Australia (By Form) • Rest of Asia Pacific (By Form) · South America (By Grade, Form, Function, Application, Distribution Channel, and Country) • Brazil (By Form) • Argentina (By Form) • Rest of South America (By Form) · Middle East & Africa (By Grade, Form, Function, Application, Distribution Channel, and Country) • South Africa (By Form) • UAE (By Form) • Rest of the MEA (By Form) |

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 1011.69 million in 2025 and is anticipated to reach USD 1108.21cmillion by 2034.

At a CAGR of 4.88%, the global market will exhibit steady growth over the forecast period.

By distribution channel, the offline segment leads the market.

North America held the largest market share in 2025.

Expansion in pharmaceutical and biomedical applications drives the market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us