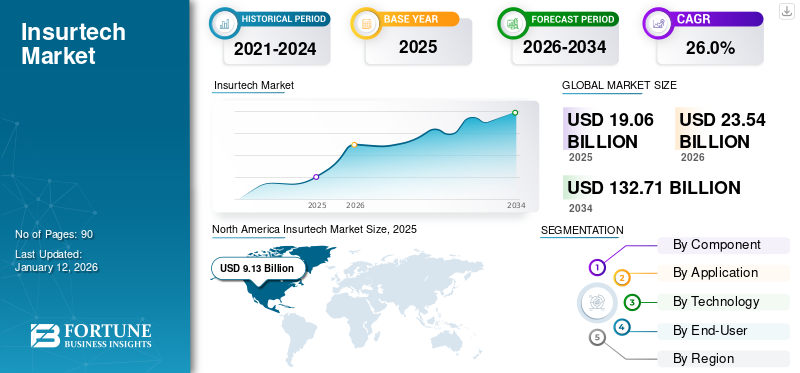

Insurtech Market Size, Share & Industry Analysis, By Component (Solution and Services), By Application (Claims Management, Policy Administration and Management, Fraud Detection and Prevention, Underwriting and Risk Assessment, Customer Experience Management, Regulatory Compliance, and Sales and Distribution), By Technology (AI & ML, Blockchain, Internet of Things, Big Data and Analytics, Cloud Computing, Robotic Process Automation, and Others), By End-User (Insurance Companies, Brokers and Agents, Third-Party Administrators, and Insureds), and Regional Forecast, 2026 – 2034

INSURTECH MARKET OVERVIEW AND FUTURE OUTLOOK

The global insurtech market size was valued at USD 19.06 billion in 2025 and is projected to grow from USD 23.54 billion in 2026 to USD 132.71 billion by 2034, exhibiting a CAGR of 24.1% during the forecast period. North America dominated the global market with a share of 47.9% in 2025.

Insurtech refers to the innovative application of technology within the insurance industry to improve efficiency, reduce costs, and enhance customer experience. The report focuses on companies that provide insurtech solutions such as digital platforms, Software as a Service (SaaS), and mobile apps. The market growth is driven by the growing demand for digital solutions, data analytics, and the use of artificial intelligence, coupled with a shift in consumer preferences toward seamless and easy-to-use insurance experiences. Insurtech companies use technology to automate processes such as underwriting, claims management, and customer service to improve operational efficiency and reduce costs for insurers. For instance,

- In March 2024, CNB Bank & Trust (CIBC) and Insuritas partnered to launch an integrated, full-service insurance offerings. Insuritas announced that CIBC has selected it to deploy its fully functional digital insurance agency solution. BUNDLE is Insuritas's full-featured insurance agency platform, integrated into the CIBC ecosystem and designed to provide a complete solution for CIBC’s retail and commercial clients.

Therefore, the combination of a product-driven growth model and a stronger focus on accessibility is expected to create lucrative opportunities for leading providers operating in this market.

We have considered some of the major players in the market study which includes DXC Technology, Insurance Technology Services, Majesco, Oscar Insurance, among others. These players are adopting various strategies to stay competitive in the market.

IMPACT OF GENERATIVE AI

Increasing Adoption of Generative-AI for the Personalization of Policies to Spur Market Growth

Generative AI can analyze large states of customer data to create more personalized insurance offerings. AI can help design tailored insurance plans that better match customer needs by understanding individual risk factors, preferences, and behavior. This could lead to more accruing pricing and potentially lower premiums for some individuals. As the technology continues to evolve, its influence on the insurance industry is likely to grow, reshaping everything from product development to customer satisfaction.

MARKET DYNAMICS

Market Drivers

Rising Digital Transformation in Insurance to Accelerate Market Growth

Insurtech is primarily driven by the adoption of digital technologies that enhance the customer experience, streamline operations, and reduce costs. Insurers are increasingly relying on AI, data analytics, cloud computing, and automation to deliver more personalized and efficient services.

- For instance, in August 2022, Lemonade, an AI-driven insurer, uses machine learning to streamline the claims process and offer personalized policies. Its AI bot, “Maya,” can handle claims with little to no human intervention, making it faster and affordable for customers to process their claims.

As a result of these factors, this market has experienced tremendous growth, with more end users exploring the possibilities of enhanced insurtech solutions due to the proliferation of digital solutions and insurance services.

Market Restraints

Concerns Related to Data Privacy to Hinder the Growth of the Market

The main barrier to Insurtech is privacy. Credit scores are tracked using distributed ledger technology, a database shared between many different companies and locations. It is constantly evolving, which poses challenges to data protection laws. Regulators with different approaches to managing distributed ledger technology face privacy concerns from international jurisdictions. Distributed ledger technology can be decentralized due to its collaborative nature, meaning no single organization is held accountable in the event of a dispute. Therefore, privacy concerns related to Insurtech are expected to hinder the growth of the market during the forecast period.

Market Opportunities

Adoption of Peer-to-Peer Insurance to Create Insurtech Market Opportunities

P2P (Peer-to-Peer) insurance models are gaining traction as they enable insurers to pool their resources together to insure each other. These models reduce administrative costs and offer greater transparency and community-driven insurance solutions. The P2P model is especially appealing to consumers seeking lower premiums and a greater sense of control over their insurance. This market also presents an opportunity for insurtech companies to create innovative, community-driven insurance models with the consumer desire for transparency and lower costs.

- For instance, in 2023, Friendsurance, a German-based insurtech platform, allowed users to pool their premiums together in small groups. In the event of a claim, the group shares the cost, and if no claims are made, the money is refunded to the member.

Thus, the adoption of a peer-to-peer model is expected to create lucrative opportunities for the key vendors operating in this market.

INSURTECH MARKET TRENDS

Rising Acceptance for Fully Automated and Embedded Insurance is a Latest Market Trend

The shift toward a digital-first insurance platform continues, with an emphasis on fully automated processes for everything from policy issuance to claim processing. This eliminates paperwork, reduces administrative costs, and speeds up service delivery.

- For instance, in 2024, Root Insurance used digital-first strategies, integrated with telematics and smartphone apps to monitor driving behavior and determine premiums, which are fully automated, leading to a seamless, and on-demand experience for customers.

Furthermore, embedded insurance is gaining traction, where insurance products are seamlessly integrated into the purchase of goods and services. This offers more convenience and accessibility for consumers.

Therefore, the increasing trend of fully automated and embedded insurance to enhance user experience is a key factor accelerating the Insurtech market growth.

SEGMENTATION ANALYSIS

By Component

Surge in Demand for Tailored Insurance Solutions Accelerated the Solution Segment Growth

Based on component, the market is divided into solution and services. The solution is further sub-divided into digital platforms, SaaS, and mobile applications.

The solution segment dominated the market share by 53.11% in 2026, as consumers increasingly demand for tailored insurance solutions that fit their specific needs and lifestyles. As the insurtech space grows, governments and regulatory bodies are increasingly adopting frameworks to support the innovation of digital insurance solutions while ensuring consumer protection.

- For instance, in 2024, The European Union’s Solvency directive and the U.S. Department of Insurance in various states are evolving to create a more flexible regulatory environment for insurtech. These frameworks are helping companies Such as Brolly and Lemonade scale their operations by providing clarity on regulatory compliance.

The service segment is projected to showcase the highest CAGR during the forecast period owing to the growing demand for digital transformation among insurance industries. Customers can track their policies, claims, and premiums in real time through digital platforms.

By Application

Growing Adoption of Modern Insurtech Platforms Propelled the Need for Policy Administration and Management Among Users

Based on application, the market is divided into claims management, policy administration and management, fraud detection and prevention, underwriting and risk assessment, customer experience management, regulatory compliance, and sales and distribution.

The policy administration and management segment dominated the market in 2024 due to the growing adoption of digitization and integration of data analytics. Modern platforms leverage vast amounts of data, such as customer behavior and claims history, to optimize policy management. This data is used to better underwrite decisions, assess risks, and make policy adjustments. The policy administration and management segment is expected to dominate the market share by 25.07% in 2026.

The underwriting and risk assessment segment is projected to showcase the highest CAGR of 33.30% during the forecast period. The key growth factors include the automation of underwriting via AI and machine learning, the use of big data and predictive analytics for more accurate risk assessments, and the utilization of behavioral and psychological data. These technologies significantly improve both customer satisfaction and risk management.

By Technology

AI and ML Segment Led the Market owing to its Ability to Predict Risk with Greater Precision

Based on technology, the market is divided into AI & ML, blockchain, Internet of Things, big data and analytics, cloud computing, robotic process automation, and others.

AI and ML dominated the market in 2024. AI and ML models help insurers assess risk more accurately by analyzing vast amounts of data from multiple sources. Machine learning algorithms can predict risk with greater precision by identifying patterns and correlations that might not be immediately obvious to human underwriters. For instance,

- Companies such as Lemonade use AI-driven underwriting systems that analyze customer data in real-time to offer personalized policies. This makes underwriting faster and more accurate and reduces costs.

The big data and analytics segment is expected to register the highest CAGR of 31.20% during the forecast period. This segment is likely to hold 24.22% of the market share in 2026. This technology enables insurers to reduce operational costs and improve operational efficiency. Additionally, they facilitate the integration of different insurance platforms and the development of new services, especially for individuals who previously had no access to insurance.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Technological Innovation Boosted the Insurance Companies Segment Growth

Based on end-user, the market is divided into insurance companies, brokers and agents, third-party administrators, and insureds.

Insurance companies dominated the market and are projected to showcase the highest CAGR of 27.90% during the forecast period owing to the growing digitization in the telecom sector. The insurance companies are expected to attain 47.16% of the market share in 2026. Technological innovation is one of the biggest drivers behind the insurtech revolution. Customers today expect insurance solutions that are more flexible, personalized, and digitally accessible.

- For instance, in 2024, Shift Technology offers an AI-driven solution that helps insurance companies with fraud detection. By automating fraud detection processes, Shift technology helps insurers detect and prevent fraudulent claims more accurately and efficiently, reducing claims cost and operation costs.

Brokers and agents holds the second largest share in the market owing to the enhancing efficiency, improved customer experience, and leveraging data for better risk assessment and product offerings.

INSURTECH MARKET REGIONAL OUTLOOK

North America

North America Insurtech Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market size in 2025 with USD 9.13 billion as consumers are increasingly spending more on insurance-related products. Insurtech solutions are becoming popular in the region due to their ability to offer customizable and adaptable property and health insurance options. The growing number of Insurtech startups is also driving the expansion of the region.

- For instance, according to industry analysis, in 2024, North American investors invested USD 61.9 billion in U.S. and Canadian startups.

Download Free sample to learn more about this report.

The U.S. dominated the market in 2025 and is estimated to grow with a considerable CAGR during the forecast period. Consumers are increasingly expecting personalized insurance products tailored to their specific needs. Insurtech startups in the U.S. are leveraging data analytics, machine learning, and AI to develop customized insurance products, including usage-based or on-demand coverage. The U.S. market is projected to hit USD 5.54 billion in 2026

Europe

Europe is projected to capture the third-largest market size of USD 3.74 billion in 2026. The region is expected to hold the second-largest insurtech market share owing to the development of several economies and financial centers in France, Germany, and the U.K. Insurance companies in the region are working to provide low-cost insurance options. The regional market is expected to grow as the demand for smartphones increases in Europe. The U.K. market size is expected to hit USD 0.95 billion in 2025, followed by Germany market size likely to be at USD 0.72 billion and France is expected to reach USD 0.60 billion in 2025.

Asia Pacific

Asia Pacific region is expected to hold the second-largest market size of USD 6.56 billion in 2026.

The regional market is expected to grow with the second-highest CAGR of 33.90% during the forecast period owing to rising smartphone usage in the region. Many insurtech companies are adopting a mobile-first approach, enabling customers to buy, manage, and claim insurance directly from their smartphones.

- For instance, Turtlemint in India provides a mobile app where users can compare various insurance policies, purchase them, and make claims directly through their phones.

Middle East & Africa

The Middle East & Africa is expected to be the fourth-largest market with a value of USD 1.06 billion in 2026. The market in the region is in the emerging phase. Mobile-first solutions are becoming central in this region, especially in countries where traditional insurance penetration is low. Insurtechs are providing mobile apps and digital platforms that make it easier for consumers to access insurance products. The UAE market is likely to hit USD 0.44 billion in 2025.

South America

The South American market is in an evolving phase as companies operating in the market are leveraging AI and ML to improve customer service. AI-driven chatbots and claims processing are becoming standard in South American countries and will contribute to regional growth in the upcoming year.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Companies Focus on Partnerships to Extend Global Reach

Leading companies are making strategies during partnerships and acquisitions to gain market share. These strategies are anticipated to help them in designing a robust product portfolio, to increase global reach. Participants operating on a global level are also forming collaborating and alliances with newly entered companies to significantly expand their operations.

- For instance, in September 2023, McKinsey and Salesforce entered into a partnership to develop generative AI for commerce, marketing, sales, and service. This partnership involves a team of solution architects, UX designers, data scientists, cloud engineers, and organization culture specialists.

List of Key Insurtech Companies Studied:

- NTT Data Corporation (Japan)

- Hexaview Technologies, Inc. (U.S.)

- InsureMO Corporation (Singapore)

- Damco Group (U.S.)

- DXC Technology (U.S.)

- Insurance Technology Services (U.S.)

- Majesco (U.S.)

- Oscar Insurance (U.S.)

- Quantemplate (U.S.)

- Shift Technology (France)

- Wipro Limited (India)

- ZhongAn Insurance (China)

- Acko General Insurance (India)

- Metromile (U.S.)

- Alan (France)

- Luko (France)

- Benevolent (U.K.)

- Evari (Australia)

- Brolly (U.K.)

- Vouch Insurance (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS:

- December 2024: Sure partnered with CU Financial Group, LLC to unveil SimpleQuote, the latest digital insurance solution that will help credit unions provide their members seamless access to insurance.

- November 2024: Fedo.ai partnered with Canara HSBC Life Insurance to launch non-invasive health assessments using AI. This strategic partnership is aimed at enhancing the customer experience in health assessments.

- March 2024: Zego, a U.K.-based insurtech company, expanded its fleet insurance offering to Southeast Asia, highlighting the growing globalization of insurtech companies.

- January 2024: Lemonade acquired an AI-powered claims automation startup to improve its claims processing efficiency. The company aims to use this technology to speed up its claims review process and reduce operational costs.

- March 2022: Nividous partnered with Damco Solutions to deliver optimal business value through industries by restructuring core and non-core processes with intelligent automation technology.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Insurtech encompass a broad range of activities aimed at improving the usability, accessibility, and overall experience of digital products and services. The market is expected to grow as companies increasingly investing to provide a seamless and engaging experience to users. Rising investment in SaaS, mobile applications and digital platforms by users will create great opportunity for key market players in coming years.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Application, Technology, End-User, and Region |

|

Segmentation |

By Component

By Application

By Technology

By End-User

By Region

|

|

Companies Profiled in the Report |

NTT Data Corporation (Japan), Hexaview Technologies, Inc. (U.S.), InsureMO Corporation (Singapore), Damco Group (U.S.), DXC Technology (U.S.), Insurance Technology Services (U.S.), Majesco (U.S.), Oscar Insurance (U.S.), Quantemplate (U.S.), and Shift Technology (France) |

Frequently Asked Questions

The market is projected to reach USD 132.71 billion by 2034.

In 2025, the market was valued at USD 19.06 billion.

The market is projected to grow at a CAGR of 24.1% during the forecast period.

By technology, AI & ML led the market in 2025.

Rising digital transformation in insurance is a key factor accelerating market growth.

NTT Data Corporation, Hexaview Technologies, Inc., InsureMO Corporation, Damco Group, and DXC Technology are the top players in the market.

North America leads the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us