Intelligent Document Processing (IDP) Market Size, Share & Industry Analysis, By Function (Finance & Accounting, Human Resources, Supply Chain & Procurement, and Others), By Deployment Model (On-premises and Cloud), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Government, IT & Telecom, and Others), and Regional Forecast, 2026–2034

Intelligent Document Processing (IDP) Market Size

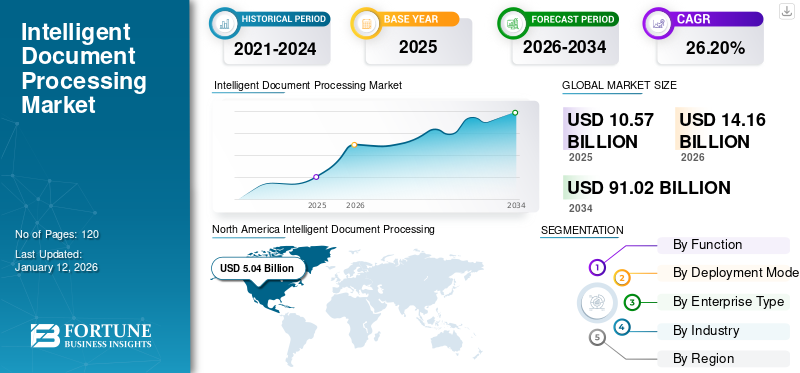

The global intelligent document processing (IDP) market size was valued at USD 10.57 billion in 2025. The market is projected to grow from USD 14.16 billion in 2026 to USD 91.02 billion by 2034, exhibiting a CAGR of 26.20% during the forecast period. North America dominated the global market with a share of 47.60% in 2025.

Intelligent document processing (IDP) refers to a workflow automation technology that mines, reads, scans, and categorizes data from documents to enhance business process automation. It combines OCR (optical character recognition) with AI (artificial intelligence) and ML (machine learning) algorithms to automate the handling of complex documents in different formats. The mechanism can process several categories of documents, including papers, Word docs, PDFs, spreadsheets, and other formats. The primary purpose of IDP is to mine valuable information from large sets of data deprived of human input. These factors are poised to play an important role in driving the market growth during the forecast period.

The sudden shift to remote work environments due to the COVID-19 pandemic necessitated automation tools to maintain business continuity. Intelligent document processing (IDP) solutions became critical in automating document-related tasks that were traditionally handled in the office. IDP solutions facilitated remote access to important documents and streamlined collaboration among remote teams by digitizing and automating document workflows.

In the scope of work, we have included solutions offered by companies such as ABBYY, UiPath, Rossum, IBM Corporation, Open Text Corporation, Tungsten Automation Corporation, AntWorks, and others.

Intelligent Document Processing (IDP) Market Trends

Implementation of IDP Solutions across the Healthcare Sector to Create New Market Opportunities

Intelligent document processing (IDP) is renovating healthcare by automating the management of huge amounts of data, which improves operational accuracy and efficiency. By restructuring administrative tasks, enhancing clinical documentation, and handling patient data more efficiently, IDP empowers healthcare professionals to place more emphasis on patient care.

Moreover, IDP fast-tracks research by rapidly analyzing and processing data from research documents and clinical trials. This comprehensive approach diminishes errors, saves time, and helps deliver better patient outcomes and compliance with governing standards. Hence, various work automation solutions, DTS (Digital Transformation Solutions) and IDP (Intelligent Document Processing), among others, are increasingly being implemented in healthcare enterprises. For instance,

- March 2023: HARMAN and Infor announced a strategic collaboration on healthcare delivery. With the partnership, HARMAN IHP (Intelligent Healthcare Platform) output is incorporated into existing provider systems (e.g., EHRs and others) to deliver benefits, including forecasting readmission or attrition risks, offering transparency into payer systems. It also helps estimate and identify claims fraud, thereby aiding with intelligent document processing.

These factors play an important role in increasing the adoption of intelligent document processing solutions in the healthcare sector, which is poised to fuel the market growth during the forecast period.

Download Free sample to learn more about this report.

Intelligent Document Processing (IDP) Market Growth Factors

Strategic Prominence of Automation with the Implementation of Low-code or Codeless Capabilities across Enterprises to Fuel the Market Progress

No-code or low-code platforms have transformed the way enterprises build applications and systems. These tools enable users to develop functional applications with nominal technical knowledge. These platforms deliver various benefits, including minimized development costs and simplified processes. Integration of IDP solutions with low-code or codeless applications develops complete automated work operations for processing unstructured and structured data, delivering vital solutions to address the continuously changing requirements of businesses. For instance,

- According to industry expert, it is projected that 75% of all new applications will be developed using low code by the year 2026, with 80% of operators being non-IT developers.

Incorporating intelligent document processing (IDP) software with no-code or low-code applications provides enhanced functionality and lifts automation rates in users' workflows. Hence, enterprises are advancing their solutions with no-code or low-code-based capabilities to strengthen their business progress. The growing importance of automation and rising applications of no-code or low-code capabilities aid in fueling intelligent document processing (IDP) market growth.

RESTRAINING FACTORS

Accuracy and Reliability Issues Can Impact the Usage of IDP Solutions Among Customers

Ensuring higher precision in data mining is one of the key challenges in IDP. Accuracy reduces when corporate documents diverge from templates, or user necessities exceed basic term extractions. It may happen with bad-quality scans. Such factors impact the reliability of this software for users.

Moreover, IDP systems face various difficulties due to the variety of document types they manage. Invoices, emails, contracts, and forms are some examples of semi-structured or structured data often used in cases. This variety makes creating a unified intelligent document processing solution harder. Thus, these factors are expected to hinder the market growth.

Intelligent Document Processing (IDP) Market Segmentation Analysis

By Function Analysis

Growing Need for Automation Tools for the Document Verification Process in the Banking Sector Fuels the Finance & Accounting Segment Growth

Based on function, the market is divided into finance & accounting, human resources, supply chain & procurement, and others (legal and marketing).

The finance & accounting segment captured the largest market share of 45.57% in 2026. Financial institutions are using IDP to automate Know Your Customer (KYC) and anti-money laundering (AML) processes by extracting data from documents such as IDs, utility bills, and bank statements. Thus, it boosts demand for intelligent document processing technology in the finance & accounts process, which drives the market growth globally.

The supply chain & procurement segment is expected to grow at the highest CAGR during the forecast period, as IDP is an important tool for businesses to enhance the efficiency of their supply chain. It is capable of quickly capturing valuable data from purchase orders and invoices, thus saving time and reducing costs. In addition, IDP ensures consistent and reliable extraction of data from various document formats, enhancing data integrity across the supply chain.

To know how our report can help streamline your business, Speak to Analyst

By Deployment Model Analysis

Access to the Latest Natural Language Processing Technologies Provided by Cloud-based Solutions to Spur Segment Growth

By deployment model, the market is categorized into on-premises and cloud.

The cloud segment captured a larger market share 65.18% in 2026 and it is projected to grow at the highest CAGR during the forecast period. Cloud-based solutions often provide access to the latest artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) technologies, ensuring that organizations benefit from cutting-edge capabilities. Implementation of these technologies in intelligent document processing (IDP) solutions helps businesses enhance their productivity by automating the process of large volumes of data in a structured format, which plays a vital role in boosting the market growth.

On the other hand, on-premise solutions help organizations to have complete control over their data, ensuring that sensitive information is protected according to their security protocols. By keeping data in-house, the risk of exposure through external breaches or third-party vulnerabilities is minimized.

By Enterprise Type Analysis

Increasing Demand for Automation Techniques among Large Enterprises Drives Segment Growth

In terms of enterprise type, the market is bifurcated into SMEs and large enterprises.

The large enterprises segment captured the maximum market share of 61.54% in 2026. Large enterprises handle vast volumes of documents daily. IDP automates repetitive tasks such as data entry, extraction, and validation, significantly reducing manual effort and freeing up employees for higher-value tasks. Moreover, the implementation of intelligent document processing (IDP) solution minimizes the need for manual data processing, which helps enterprises lower labor costs and reallocate resources to strategic initiatives. Automation methods reduce manual error, thereby minimizing the costs associated with data inaccuracies and rework. Thus, these factors play a vital role in boosting the market growth.

The SMEs segment is expected to grow at the highest CAGR during the forecast period. Digitalization has a significant impact on SMEs and offers lucrative growth opportunities. Uptake of advanced technologies helps SMEs enhance efficiency and productivity and sustain the market competition. Thus, this factor is expected to fuel the market growth in the coming years.

By Industry Analysis

Growing Adoption of IDP Solutions for Fast Claim Settlement in Banks Drives BFSI Segment Expansion

By industry, the market is classified into BFSI, healthcare & life sciences, retail & e-commerce, manufacturing, government, IT & telecom, and others (construction, travel & transportation, and energy & power).

The banking, financial services, and insurance (BFSI) segment captured the largest intelligent document processing (IDP) market share in 2024. Banks are significantly implementing IDP solutions to streamline loan origination and approval processes by automating the extraction and validation of data from loan applications and supporting documents. In addition, automating the extraction of data from insurance claims documents improves accuracy and speeds up claims settlements. IDP streamlines the processing of policy applications, renewals, and changes, enhancing operational efficiency.

The healthcare & life sciences segment is expected to grow at the highest CAGR during the forecast period. Healthcare providers are adopting IDP solutions to digitize and manage patient records, improving data accuracy and accessibility. Furthermore, health insurance companies are using IDP solutions to automate the extraction and processing of data from claim documents, which reduces manual effort and processing times. Thus, these factors are expected to fuel the market growth in the coming years.

REGIONAL INSIGHTS

By region, the market has been analyzed across five key regions, namely North America, the Middle East & Africa, Europe, Asia Pacific, and South America.

North America Intelligent Document Processing (IDP) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the global market size in 2023. North American financial institutions face stringent regulatory requirements, driving the adoption of IDP solutions to ensure compliance. IDP solutions help institutions meet the requirements of regulations such as Dodd-Frank, Sarbanes-Oxley, and various anti-money laundering (AML) laws. Moreover, multiple North American banks have adopted IDP solutions to automate the processing of loan applications, compliance documents, and customer onboarding forms, resulting in faster processing times and improved customer satisfaction. These factors play an important role in boosting the market growth in the region. The U.S. market is projected to reach USD 5.07 billion by 2026. For instance,

- In March 2024, ABBYY partnered with Novelis to support intelligent automation efforts in the U.S. Through this partnership, Novelis aims to enhance its document efficiency and strategic process visibility for its customers by leveraging ABBYY’s intelligent automation solutions.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Government agencies are using IDP solutions to digitize and process large volumes of public records, applications, and permits, improving efficiency and service delivery. In addition, regulatory agencies have adopted IDP tools to automate the processing of compliance documents and audit trails, ensuring accuracy and compliance with regulatory standards. The Japan market is projected to reach USD 0.44 billion by 2026, the China market is projected to reach USD 0.75 billion by 2026. For instance,

- In December 2022, in Nakano-ku, Japan, the government reduced its work volume by 30% and outsourcing costs by 25% by using IDP solutions to transform its resident tax collection process.

India is anticipated to grow at the highest CAGR during the forecast period, owing to the high volume of documents in sectors such as banking, insurance, and government, which drives the need for efficient intelligent document processing (IDP) solutions. the India market is projected to reach USD 0.28 billion by 2026. Thus, the growing adoption of IDP solutions in various industries plays an important role, which is slated to bolster the market growth during the forecast period in the region.

Europe

Europe is anticipated to grow at a significant CAGR in the coming years. In Europe, hospitals have implemented IDP solutions to streamline the management of patient records, billing, and insurance claims, ensuring compliance with Health Insurance Portability and Accountability Act (HIPAA) regulations and improving patient care. Moreover, pharmaceutical companies use IDP to automate the processing of regulatory submissions and clinical trial documentation, ensuring accuracy and speeding up the time to market for drugs. IDP technology helps U.K. businesses optimize their processes and operate more efficiently by automating time-consuming tasks, such as purchase order handling, invoice processing, contract management, and customer database management. The UK market is projected to reach USD 0.57 billion by 2026, while the Germany market is projected to reach USD 0.56 billion by 2026.

- In September 2022, Carlberg Group implemented an intelligent process automation solution to automate its order and delivery processes. This move helped the company boost its digital transformation strategy, advance team productivity, and increase workflow efficiency.

Middle East & Africa

The Middle East & Africa is estimated to have a notable growth during the forecast period. Many GCC countries have launched national programs to drive digital transformation and improve public sector efficiency. Moreover, private sector companies are investing in technology to stay competitive and meet the demands of the modern digital economy. For instance,

- In March 2024, SER, an enterprise content management (ECM) provider, engaged in a strategic partnership with BARQ Systems, an IT services provider based in Saudi Arabia. Through this partnership, SER will provide its AI-powered ECM platform Doxis, which is enabled with Intelligent Document Processing capabilities, to meet the unique needs of companies in the UAE, Saudi Arabia, and Egypt.

South America

Moreover, in South America, hospitals have implemented IDP solutions to streamline the management of patient records, billing, and insurance claims, ensuring compliance with local healthcare regulations and improving patient care. Further, pharmaceutical companies use IDP to automate the processing of regulatory submissions and clinical trial documentation, ensuring accuracy and speeding up the time to market for new drugs. Owing to these factors, companies in the region are starting to embrace intelligent automation solutions such as IDP, which is expected to fuel the market growth in coming years.

KEY INDUSTRY PLAYERS

Key Market Players Are Focusing on Acquisition Strategies to Retain Their Dominance

Leading market players are expanding themselves geographically by offering industry-specific services. These players are emphasizing on mergers and acquisitions with domestic market players in order to maintain their dominance throughout various regions. Top participants are launching their new services and solutions in order to expand their customer base. With an increase in the R&D investments to bring innovations in their products, leading players are enhancing the market expansion. Hence, they are rapidly implementing these strategic tactics to maintain their competitiveness in the market.

List of Top Intelligent Document Processing (IDP) Companies:

- ABBYY (U.S.)

- Rossum (Czech Republic)

- AntWorks (Singapore)

- Hyperscience (U.S.)

- UiPath (U.S.)

- IBM Corporation (U.S.)

- Open Text Corporation (Canada)

- Automation Anywhere, Inc. (U.S.)

- Hyland Software, Inc. (U.S.)

- Tungsten Automation Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: ABBYY announced the launch of a redesigned marketplace for artificial intelligence (AI) document skills while responding to the rising demand for enhanced-quality data required for the operative application of LLM (large language models). The ABBYY Marketplace has a wide-ranging online library. It features various in-built AI assets intended to improve ABBYY Vantage, the firm’s low-code IDP (intelligent document processing) platform.

- February 2024: Rossum announced the launch of the newest IDP platform with its exclusive LLM (Large Language Model) Aurora with its proprietary LLM. It is a modernized AI engine for transactional documents such as packing lists, bills of lading, invoices, and purchase orders. With this, Rossum Aurora intends to transform document understanding and simplify automation end-ways.

- February 2024: OpenText announced the release of new updates across its IDP solution, Intelligent Capture. It comprises artificial intelligence (AI) and machine learning (ML) technologies. It offers omnichannel capture of digitized documents and built-in digital documents to mine and route information and content securely and efficiently to the potential users and solutions in the organization.

- February 2023: Rossum introduced an education and training program to aid users in gaining all the benefits of document processing mechanisms empowered by artificial intelligence (AI). The Rossum Academy offers simplified access to video tutorials, webinars, technical documentation, and other training materials required for customers to completely make use of the firm's Intelligent Document Processing (IDP) solution.

- February 2022: AntWorks announced the availability of CMR+ on the Pega Marketplace. The Pega Marketplace enables Pega clients to access more than 200 solutions, components, and packaged services, enabling clients to improve their existing Pega solutions.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 26.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Function

By Deployment Model

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 91.02 billion by 2034.

In 2025, the market was valued at USD 10.57 billion.

The market is projected to grow at a CAGR of 26.20% during the forecast period.

By function, the finance & accounting segment led in 2024.

The strategic prominence of automation with the implementation of low-code or codeless capabilities across enterprises is slated to fuel the market progress.

ABBYY, UiPath, Rossum, IBM Corporation, Open Text Corporation, Tungsten Automation Corporation, and AntWorks are the top players in the market.

North America dominated the global market with a share of 47.60% in 2025.

By industry, the healthcare & life sciences segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us