Document Management System Market Size, Share & Industry Analysis, By Component (Software and Services), By Deployment (Cloud and On-premise), By Enterprise Type (Small & Medium Enterprise and Large Enterprise), By Industry (BFSI, IT and Telecommunication, Government, Manufacturing, Real Estate, Retail, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

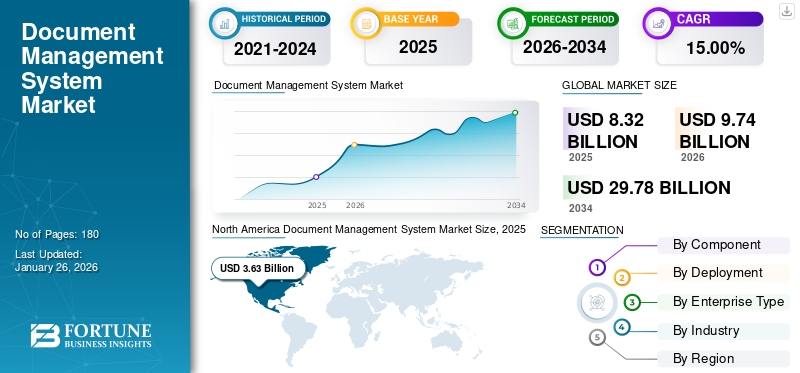

The global document management system market size was valued at USD 8.32 billion in 2025 and is projected to grow from USD 9.74 billion in 2026 to USD 29.78 billion by 2034, exhibiting a CAGR of 15.00% during the forecast period. North America dominated the global market with a share of 43.70% in 2025. Additionally, the U.S. document management system market is predicted to grow significantly, reaching an estimated value of USD 5,766.7 million by 2032.

The report includes software and services offered by players such as Adobe Inc., Oracle Corporation, Microsoft Corporation and others. The products and services offered by these companies include WebCenter Content by Oracle Corporation and OpenText Corporation’s OpenText documents management solution. These solutions offer secure and convenient storage for documents and provide document shredding services. In services, the scope includes documents offered by market players. The DMS software is witnessing potential demand from the government sector, owing to a surge in demand for paperless government and offices around the globe. Several organizations are implementing advanced software and services to digitize their business processes, reduce costs, and streamline workflows. The leading players in the market are developing advanced document management system open source solutions for small, medium, and large scale enterprises. For instance,

- In March 2022, Xerox Corporation launched an electronic document management system, which plays a vital role to improve productivity and smart workplace after the pandemic. The system is developed for customers across public and private establishments for an effective workplace.

- In April 2021, IBM Corporation launched an advanced IBM spectrum fusion storage solution designed for simplifying data availability & accessibility in the hybrid cloud environment. The advanced software-defined storage solutions were designed to help their users expand data availability and accessibility across complex hybrid clouds.

Such development activities by the major players in the market are expected to surge the demand for document management solutions and services over the forecast period.

The emergence of the COVID-19 pandemic has declined the demand for DMS software and services. As per the Gartner Report in 2020, the global IT spending in 2020 was USD 3.6 trillion, which declined by 3.2% in 2020 and reached USD 3.9 trillion in 2021. Also, key players operating in the market recorded a noteworthy decline in their revenues owing to the COVID-19 pandemic. In terms of revenue, the market witnessed a decline of around 0.9% in 2020.

During the pandemic, end-use organizations adopted digital technologies worldwide. Customers have adopted digital platforms such as social media, e-commerce, and knowledge platforms. The companies in the market are focused on developing advanced document management solutions for businesses to increase workplace efficiencies.

Document Management System Market Trends

Rising Adoption of Cloud-based Solutions by Businesses Aids the Market Growth

Document printing and archiving solutions based on the cloud allow end-users to securely organize, monitor, and retain business-critical documents. Key players in the market, such as Salesforce, SAP SE, Microsoft Corporation, and Oracle Corporation, are developing cloud-based solutions. Cloud-based document management systems are highly scalable, allowing businesses to adjust storage capacity and features according to their needs. As the volume of documents grows or business requirements change, cloud-based solutions can easily scale up or down without the need for significant upfront investment in hardware or infrastructure upgrades. Moreover, these systems offer cost savings compared to traditional on-premises solutions. Businesses can avoid upfront capital expenditures on servers, storage devices, and software licenses, as well as ongoing maintenance and IT support costs. Cloud-based solutions typically operate on subscription-based pricing models, allowing businesses to pay only for resources and features they use, reducing the total cost of ownership over time. For instance,

- In September 2021, Laserfiche launched Laserfiche, a cloud-based solution across the Middle East & Africa and Europe. The cloud-based solution is based on content management cloud offering and intelligent business process automation that delivers secure content and automates business processes.

Download Free sample to learn more about this report.

Document Management System Market Growth Factors

Rising Demand for Workplace Efficiency with Advanced DMS System Drives Market Growth

The rising integration of technologies, such as cloud computing, AI, real-time tracking systems, and others, is driving the document management system market growth. For instance, in August 2021, eGrove Systems Corporation launched an integrated advanced time-tracking project management and agile document service. Document management solutions allow employees to access documents and files from anywhere with an internet connection, using any device, such as laptops, smartphones, or tablets. This has increased workplace efficiency with the use of advanced software solutions.

Further, the DMS solution is extensively adopted for paperless digital transformation of businesses across industries, including healthcare, BFSI, government, and others. For instance,

- In September 2020, Indian Bank launched an advanced IB-eNote documents management system for a paperless environment.

Rising demand for paperless offices for increasing workforce productivity and developing environment-friendly offices drives market growth. As per Xerox Corporation, approximately 46% of professional employees waste their time owing to paper-related workflows. This can be reduced by using advanced document management solutions to improve business efficiencies and reduce the overall processing time.

RESTRAINING FACTORS

Rising Data Privacy Concerns and Regulatory Compliance to Limit Market Growth

The increasing utilization of digital platforms has increased data privacy and security concerns. With modern technology-based document management services and systems, several information privacy concerns and other vulnerabilities are rising. Vulnerabilities such as security & data breaches, data privacy, cyber-attacks, identity theft, and others are a few hindering factors for market growth. According to the Cybersecurity Ventures Report in 2019, the damage cost of cyber-attacks reached 6 trillion in the year. Such an increase in cyber-attacks in various sectors such as retail, BFSI, government, and others may hinder market growth.

Document Management System Market Segmentation Analysis

By Component Analysis

Implementation of Advanced DMS Solutions in Organizations to Propel Market Growth

By component, the market is bifurcated into software and services. The software segment is expected to hold the largest market share during the forecast period, driven by the rising development and adoption of advanced DMS software for business digitalization across BFSI, retail, and government sectors, with the cloud-based component accounting for a 52.39% market share in 2026. For instance,

- In September 2021, the Bank of India (BOI) partnered with MAS Financial Services Ltd (MAS), an India-based non-banking finance company, to enter the MSME loan segment. Also, the company aims to provide its customers with an advanced document management system with enhanced backup, security, and disaster recovery features.

The services segment is expected to grow with the highest CAGR over the forecast period. Organizations are launching services across various regions for better customer experience.

By Deployment Analysis

Rising Adoption of Cloud Computing Solutions to Fuel the Market Growth

Based on deployment, the market is divided into cloud and on-premise. Among these, the cloud segment held the larger market share in 2024 and is expected to maintain its dominance by registering the highest CAGR during the forecast period, supported by increasing adoption of DMS solutions among small and medium-sized organizations and rising investments in cloud infrastructure, with the software segment accounting for a 68.18% market share in 2026. For instance,

- In October 2021, Oracle Corporation launched and expanded its cloud services worldwide. The company planned to open more than 14 cloud regions across Asia Pacific, Europe, the Middle East & Africa, and South America.

By Enterprise Type Analysis

Adoption of DMS Solution across Large Enterprises Boosts the Market Growth

Based on enterprise type, the market is categorized into large enterprises and small & medium enterprises (SMEs). The large enterprises segment is expected to hold the largest market share over the forecast period, as organizations invest heavily in data security, privacy, workflow automation, and document storage solutions, accounting for a 69.67% market share in 2026.

Further, the SME segment is expected to grow with the highest CAGR during the forecast period, owing to rising demand for DMS systems across startups. For instance,

- In August 2021, Exela Technologies, Inc. expanded its Digital Mailroom Platform (DMP) service offerings to small and medium-sized businesses in Germany and France. The DMR platform provides additional services, including inbuilt features such as electronic signature, data redaction, and storage parcel delivery.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Adoption of Advanced Management Solutions across BFSI and Healthcare Sectors to Foster Market Growth

Based on industry, the market is divided into BFSI, IT and telecommunication, government, manufacturing, real estate, retail, healthcare, and others (education). BFSI is expected to hold the largest share in the global market, as the use of DMS solutions helps banks save money by reducing their paper consumption and associated costs. Also, it helps banks to provide efficient customer service and easily review multiple documents during audits.

IT and telecommunication, government, manufacturing, and retail are growing moderately due to advancements across digital technologies. Leading players in these sectors adopt document management solutions to digitalize their business processes.

Further, virtual learning demands have gained popularity in the education sector amidst the COVID-19 pandemic. Document management solution is used to manage and deliver complete online learning and training solutions for students and teachers to control and validate the documents.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Asia Pacific, Europe, South America, and the Middle East & Africa. They are further categorized into countries.

North America

North America Document Management System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to dominate the document management system market during the forecast period, driven by the presence of prominent players such as Oracle Corporation and Microsoft Corporation, which continuously invest in developing advanced DMS solutions to address growing data demands, with the regional market valued at USD 3.63 billion in 2025. The U.S. market is projected to reach USD 3.23 Billion by 2026.For instance,

- In October 2021, EFileCabinet launched an advanced document management system with a Point of Presence (PoP) across Canada. EFileCabinet’s expansion in Canada and worldwide locations met growing customer demand for document management and workflow automation platforms.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is estimated to exhibit a noteworthy growth rate during the forecast period. The market is growing with a significant CAGR during the forecast period, owing to the adoption of DMS solutions by the manufacturing, government, and other sectors. The Japan market is projected to reach USD 0.33 Billion by 2026, the China market is projected to reach USD 0.55 Billion by 2026, and the India market is projected to reach USD 0.29 Billion by 2026.

Europe

Furthermore, Europe is growing moderately owing to rising investments in digital platforms and rapid digitalization. In addition, leading players adopt strategies, such as partnerships, mergers, collaborations, and acquisitions, to expand the document management solutions offerings in European countries.The UK market is projected to reach USD 0.56 Billion by 2026, while the Germany market is projected to reach USD 0.55 Billion by 2026.

- In November 2021, France-based Digital Affairs Secretary invested USD 2.00 billion for the country’s digital and cloud-computing technology.

Middle East & Africa

The market in the Middle East & Africa is projected to exhibit growth with a significant CAGR over the forecast period. GCC, South Africa, the UAE, and others are gaining popularity to adopt advanced document management systems. Government authorities are investing in adopting paperless offerings to eliminate paper waste. For instance,

- In December 2021, the UAE’s Crown Prince launched 100% paperless government that aimed to save more than USD 350.0 million. The digitization of the government provided digital services to the customers & reduced paper consumption by over 336 million papers.

Key Industry Players

Key Players Focus on Reinforcing their Market Position with Continuous Advancements

The key players in the market are investing in developing advanced technology-based document management systems and solutions. The prominent companies’ offerings include ClickUp, pCloud, HubSpot, Alfresco, LogicalDOC, Feng Office, and Nuxeo. Also, the prominent players are adopting various business strategies, such as mergers, acquisitions, partnerships, and collaborations, to expand their market presence.

List of Top Document Management System Companies:

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Open Text Corporation (Canada)

- Hyland Software (U.S.)

- IBM Corporation (U.S.)

- Xerox Corporation (U.S.)

- Adobe Inc. (U.S.)

- Kyocera Document Solutions Inc. (Japan)

- Konica Minolta, Inc. (Japan)

- Exela Technologies Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: iCONECT, a provider of document management solutions, launched a new update in its document management tool. This new update is faster than the previous version, and it can be accessed over iCONECT SaaS and on-premises.

- March 2023: Newgen Software entered into a partnership with BRAC Bank, based in Bangladesh. Through this partnership, BRAC Bank aims to implement Newgen’s Document Management System (DMS) to help the bank streamline end-to-end customers’ journeys and provide better experiences.

- November 2022: Inspectorio, a provider of cloud-based SaaS solutions for logistics enterprises, unveiled Inspectorio DocuFlow, a document management solution. This solution helps supply chain partners to streamline and automate workflows of document management and collaborate with users within and outside of organization to ensure proper document control.

- August 2022: India-based industrial automation company, Cybernetik Technologies Pvt. Ltd, partnered with CloudFronts for deployment of its document management system. This partnership would help the company to track and manage its documents with CloudFronts.

- March 2022: ShipNet launched Documents SE, a DMS tool to help enterprises manage policies and procedures. This tool can be accessed anywhere, on any platform (Mac OS, Windows OS), and provides flexibility to remote work culture.

REPORT COVERAGE

The report highlights leading regions worldwide to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry, market research, competitive landscape, and market growth trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth driving factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 29.78 billion by 2034.

In 2025, the market was valued at USD 8.32 billion.

The market is projected to grow at a CAGR of 15.00 during the forecast period.

The software segment held the largest market share in 2026.

North America dominated the global market with a share of 43.70% in 2025.

Asia Pacific is expected to grow with a remarkable CAGR.

North America is expected to hold a significant market share. The market in this region was valued at USD 3.63 billion in 2025.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us