Interventional Oncology Market Size, Share & Industry Analysis, By Type (Radiation Therapy Devices, Ablation Devices {Microwave Ablation, Radiofrequency Ablation, Cryoablation, and Others}, and Embolization Devices {Microcatheters and Guidewires}, By Cancer Type (Lung Cancer, Liver Cancer, Kidney Cancer, and Others), By End-user (Hospital, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

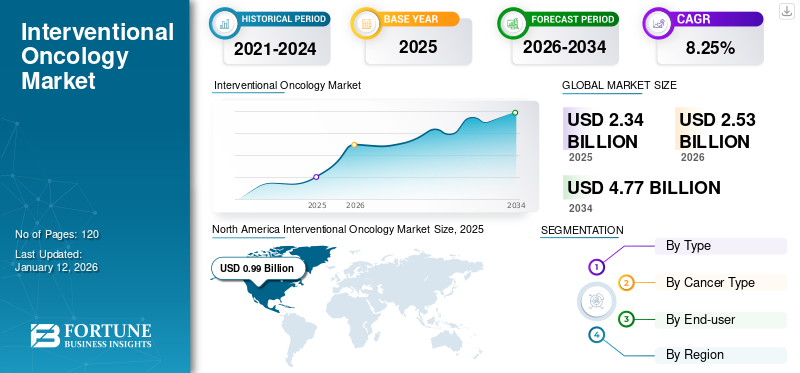

The global interventional oncology market size was valued at USD 2.34 billion in 2025 and is projected to grow from USD 2.53 billion in 2026 and reach USD 4.77 billion by 2034, exhibiting a CAGR of 8.25% during the forecast period. North America dominated the interventional oncology market with a market share of 42.20% in 2025.

Interventional oncology refers to the diagnosis, treatment, and palliation of cancer using minimally invasive procedures performed under image guidance. The increasing cancer incidence amongst the population and the rising healthcare burden caused by these conditions, is expected to boost the demand for novel interventional oncology procedures and approaches for the management of these diseases.

- For instance, in June 2023, according to the data published by the U.S. Centers for Disease Control and Prevention (CDC), there were 1,603,844 new cancer cases and 602,347 deaths due to cancer in the U.S. in 2020.

In addition to this, a surge in the number of cancer diagnoses and growing initiatives in terms of research activities among the market players to develop novel therapies for different cancer types is expected to spur the global interventional oncology market growth during the forecast period.

Furthermore, the global interventional oncology market witnessed a decline in its growth due to the COVID-19 pandemic. The decline in the market’s growth was due to the lockdown restrictions imposed by the government authorities, which resulted in the cancellation or postponement of oncology treatments, which reduced the number of patient visits to hospitals and clinics. Therefore, the demand for interventional oncology decreased among the patient population globally.

However, with the uplifting of lockdown restrictions, the number of hospital visits for cancer diagnostics and treatment significantly increased in 2021, which compensated for the missed appointments for various indications of 2020. The market is anticipated to witness steady growth during the forecast period of 2026-2034.

Global Interventional Oncology Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.34 billion

- 2026 Market Size: USD 2.53 billion

- 2034 Forecast Market Size: USD 4.77 billion

- CAGR: 8.25% from 2026–2034

Market Share:

- Region: North America dominated the market with a 42.20% share in 2025. This leadership is driven by the increasing adoption of embolization devices, a growing preference for minimally invasive cancer treatments, a large and rising patient population with cancer, and the strong presence of key market players.

- By Cancer Type: The liver cancer segment held the largest market share in 2024. This is due to the rising adoption of embolization devices specifically for liver tumors, a growing preference for minimally invasive procedures for this cancer type, and a strong focus from market players on developing advanced therapies for liver cancer.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific market, demand in Japan is spurred by a strong focus on improving healthcare infrastructure and the rising launch and adoption of advanced ablation and embolization devices for cancer treatment.

- United States: The market is fueled by a very high prevalence of cancer, with over 1.6 million new cases diagnosed in 2020. There is also a significant patient and provider shift toward minimally invasive procedures to reduce complications and improve recovery times.

- China: Growth is significantly influenced by favorable clinical outcomes, with studies in China demonstrating that patients undergoing Minimally Invasive Surgical (MIS) procedures have lower complication rates compared to open surgery, thus driving the adoption of interventional techniques.

- Europe: The market is propelled by a rising prevalence of key cancers, such as lung cancer, and an increasing demand for specialized cancer hospitals and clinics. The region's improving healthcare infrastructure also supports the adoption of advanced interventional oncology devices.

Interventional Oncology Market Trends

Growing Adoption of Radioembolization as a Treatment for Oncology to Drive Market Growth

In recent years, the market has seen significant adoption of radioembolization as a treatment for oncology, which is the prominent global interventional oncology market trend. Radioembolization is a minimally invasive procedure that involves the targeted delivery of radioactive microspheres directly into the blood vessels that feed tumors.

Previously, while this method was developed for liver cancer, radioembolization is currently being explored for the treatment of cancers, including colorectal cancer and neuroendocrine tumors.

- For instance, in June 2022, a study published by the Radiological Society of North America stated that a new research concluded that the patient’s survival after transarterial radioembolization (TARE) with yttrium 90 microspheres for metastatic colorectal cancer was 15 months.

This expansion of indications is expected to drive its adoption in a broader range of cancer, thereby driving market size. The market players are also increasing their focus on the advancements in imaging technology and the development of more precise microspheres for radioembolization to improve the procedure's safety and effectiveness. Such strategic initiatives by the market players increase the adoption of these devices for both patients and healthcare providers.

Download Free sample to learn more about this report.

Interventional Oncology Market Growth Factors

Growing Prevalence of Cancer Globally to Propel Market Growth

The growing prevalence of oncology patients suffering from different types of cancer, such as liver cancer, lung cancer, breast cancer, and others among the population, is one of the major factors contributing to the rising patient population globally. However, the prevalence of these oncological conditions is found to be higher in the male population as compared to the female. For instance, in February 2024, according to the data provided by the World Health Organization (WHO), there were an estimated 20 million new cancer cases and 9.7 million deaths in 2020.

Thus, these factors, coupled with the increasing focus of the market players to develop and introduce novel drugs and therapies to treat cancer, are expected to boost the demand and adoption of interventional oncology in the market during the forecast period.

Preferential Shift Towards Minimally Invasive Surgical Procedures to Augment Market Growth

There is a growing focus on minimally invasive surgical procedures amongst the patient population owing to their distinct advantages, such as lesser pain, reduced length of hospital stays, and other favorable factors. Moreover, faster recovery, lower risk of complications, and improved precision are some of the additional factors contributing to the rising adoption of these procedures among patients. Minimally invasive surgeries use techniques that limit the size and number of cuts during surgeries and decrease the number of soft-tissue injuries. According to a comparative study published by NCBI in January 2021, the study was on Minimally Invasive Surgical (MIS) procedures and open surgery in China, it was observed that patients who underwent MIS showed lower complications than patients who had undergone open surgery.

Additionally, increasing initiatives among governmental and non-governmental organizations to raise awareness about the benefits of minimally invasive surgical procedures are supporting the adoption of these procedures among healthcare providers. Therefore, rising benefits associated with minimally invasive procedures, coupled with rising focus on the development of new products by key players for cancer patients, are driving the global market size.

RESTRAINING FACTORS

High Cost and Lack of Specialized Professionals for Oncology Treatment May Limit Market Growth

The high costs associated with interventional oncology treatments have emerged as a significant hindrance that could limit the global market growth. In the treatment, the advanced technology and specialized equipment required for procedures include radiofrequency ablation, microwave ablation, and image-guided therapies. These instruments come with a substantial cost, which restricts hospitals or medical facilities from investing heavily in terms of installing them in their facility.

Furthermore, the lack of specialized professionals to perform minimally invasive oncology procedures is another limiting factor, especially in emerging countries. The developing countries might lack in providing training, as these medical professionals need to undergo extensive training and education, which requires cost and time. Moreover, patients in developing regions with a shortage of specialized professionals may face delays in receiving minimally invasive oncology treatments, thereby negatively impacting the adoption of devices. This hindrance is expected to limit the growth of the market during the forecast period.

Interventional Oncology Market Segmentation Analysis

By Type Analysis

Radiation Therapy Devices Segment to Grow Due to the Rising Number of Hospitalizations

Based on product type, the market is divided into radiation therapy devices, ablation devices, and embolization devices. The ablation devices segment is further sub-segmented into microwave ablation, radiofrequency ablation, cryoablation, and others. Furthermore, the embolization devices segment is further segmented into microcatheters and guidewires.

The radiation therapy devices segment held the highest market share with 49.48% in 2026 and is anticipated to record a substantial CAGR during the forecast period. The segment’s growth is attributed to the rising number of hospitalizations coupled with the increasing prevalence of cancer, such as lung, liver, and kidney cancer.

The embolization devices segment is anticipated to grow at the highest CAGR during the forecast period. The increasing adoption of embolization devices drives the segment growth during the projected period. Moreover, the benefits associated with embolization devices in minimally invasive oncology treatment, such as providing precise and targeted tumor control while minimizing damage to surrounding healthy tissues, drive its demand in the future.

To know how our report can help streamline your business, Speak to Analyst

By Cancer Type Analysis

Liver Cancer Segment to Dominate Owing to the Rising Adoption of Embolization Devices

Based on cancer type, the market is segmented into lung cancer, liver cancer, kidney cancer, and others. The liver cancer segment held the largest interventional oncology market share with 59.70% in 2026 and is anticipated to expand at a significant CAGR during the analysis period. The rising adoption of embolization devices, coupled with the growing preference for minimally invasive procedures in healthcare facilities, is anticipated to contribute to the segment growth during the forecast period. Furthermore, the growing focus of market players to develop advanced liver cancer therapies using interventional devices drives the segment.

The kidney cancer segment is anticipated to grow at the highest CAGR during the projected period, 2025-2032. The segment’s growth is attributed to the rising adoption of radiofrequency ablation devices, such as microwave ablation, radiofrequency ablation, and cryoablation. Furthermore, the increasing prevalence of kidney cancers globally is anticipated to contribute to the segment growth during the projected period.

The lung cancer segment is anticipated to grow at a moderate CAGR during the forecast timeframe. The growth is attributed to the rising cases of lung cancer globally coupled with the growing focus of market players to introduce novel devices for the treatment of lung cancer.

By End-user Analysis

Hospitals Segment to Continue its Dominance Due to Increasing Patient Admissions

By end-user, the market is segmented into hospitals, specialty clinics, and others. The hospitals segment held the largest market share with 67.34% in 2026 and is anticipated to expand at a substantial CAGR during the forecast period. The growth is attributed to the rising number of hospital admissions requiring minimally invasive oncology treatment. Moreover, the increasing number of hospitals and increasing footfall of patients in hospitals for cancer treatment is estimated to boost the demand for Interventional Oncology devices in the projected years.

The specialty clinics segment is expected to record the highest CAGR during 2025-2032. The segment’s growth is due to awareness of minimally invasive oncology treatment and rising equipment launches by the market players.

REGIONAL INSIGHTS

By geography, the market is analyzed across North America, Europe, Asia Pacific, and the rest of the world.

North America Interventional Oncology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market value in North America stood at USD 0.99 billion in 2025 and is expected to dominate the market during the forecast period. The increasing adoption of embolization devices and the growing usage of minimally invasive treatment of oncology is projected to augment market growth in the region. Moreover, the rising patient population suffering from cancer, an increase in hospital admissions, and a strong presence of key market players are the other factors estimated to boost market growth across North America. The U.S. market is projected to reach USD 1 billion by 2026.

- For instance, in January 2024, the data published by the American Cancer Society stated that every year, more than 800,000 people are diagnosed with liver cancer across the world.

Europe

Europe held the second-largest market share in 2024 and is expected to register a moderate CAGR during the forecast period. The growth is attributed to the rising prevalence of lung cancer and the rising demand for cancer hospitals across Europe. Furthermore, the rising improvement in healthcare infrastructure and the increasing number of hospitals in the region, is propelling the device’s demand used in the minimally invasive treatment of cancer. The UK market is projected to reach USD 0.1 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. The growth is attributed to the strong focus on healthcare infrastructure improvement and the rising launch of ablation devices in the region. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.16 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

The market in the rest of the world is estimated to grow at a comparatively lower CAGR during the projected period. The increasing improvement in healthcare infrastructure, rising healthcare expenditures, and growing awareness regarding the treatment of oncology are estimated to drive market growth.

Key Industry Players

Diversified Product Portfolio of Boston Scientific Corporation to Lead to its Market Dominance

The market is consolidated due to the presence of prominent players with significant market share. Key players, such as Siemens Healthineers, Boston Scientific Corporation, and Terumo Corporation, were the leading market players in 2024.

Boston Scientific Corporation dominated the market for interventional oncology in 2024. The company's diversified product portfolio is one of the key factors contributing to its dominance in the market. Moreover, factors such as better capabilities in research & development, manufacturing, and marketing also strengthen its market share.

Other companies, such as Merit Medical Systems and BD, held substantial market share due to their strong presence in the U.S. and Europe. Furthermore, strategic initiatives, such as product portfolio expansion and new product launches, are expected to increase their market shares in the long run.

List of Top Interventional Oncology Companies:

- Delcath Systems, Inc.

- Boston Scientific Corporation (U.S.)

- Merit Medical Systems (U.S.)

- Terumo Corporation (Japan)

- Siemens Healthcare GmbH (Germany)

- BD (U.S.)

- AngioDynamics (U.S.)

- Hologic, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - Delcath Systems, Inc. announced the first commercial use of HEPZATO KIT for the treatment of metastatic uveal melanoma (mUM). HEPZATO KIT is a combination drug/device product which administers HEPZATO (melphalan) directly to the liver, which offers higher drug exposure in target tissues, while limiting systemic toxicity.

- May 2023 - IceCure Medical announced the installation of the ProSense System at Kovai Medical Center and Hospital in Coimbatore, India. The ProSense System is a minimally invasive cryoablation technology that destroys tumors by freezing as an alternative to surgical tumor removal.

- September 2022 - Fluidx Medical completed enrollment in a trial for its GPX embolic device. GPX was used to treat a variety of renal adenoma tumors, primary and metastatic tumors, and arterial and venous applications in the multicenter trial.

- March 2022 - Merit Medical Systems received approval from the U.S. FDA for Embosphere Microspheres for the Genicular Artery Embolization (GAE) indication.

- November 2021 - Siemens Healthcare GmbH has announced the U.S. FDA clearance of two new workflow optimization and mammography reading solutions in order to expand the company’s offerings for breast health.

REPORT COVERAGE

The global market research report includes the segments of type, cancer type, end-user, and geography. It focuses on industry overviews and market dynamics, such as the drivers, restraints, opportunities, and market trends. Moreover, the report provides information related to key industry developments such as mergers and acquisitions and technological advancements in the market. Furthermore, the report focuses on the incidence of cancer in key countries. In addition, the impact of COVID-19 and the industry overview during the pandemic are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 8.25% from 2026-2034 |

|

Segmentation |

By Type

|

|

By Cancer Type

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 2.53 billion in 2026 and reach USD 4.77 billion by 2034.

In 2025, the North American market value stood at USD 0.99 billion.

The market is expected to exhibit a CAGR of 8.25% during the forecast period of 2026-2034.

The liver cancer segment is projected to lead the market by cancer type.

Key factors, such as rising cases of liver cancer globally, growing initiatives in research activities, growing awareness of cancer care, and growing product launches, such as embolic agents, are expected to drive market growth.

Siemens Healthineers, Boston Scientific Corporation, and Terumo Corporation are the top players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us