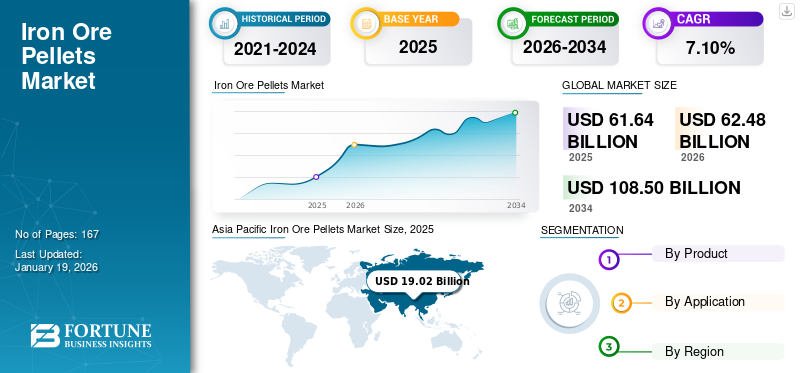

Iron Ore Pellets Market Size, Share & Industry Analysis, By Product (Blast Furnace and Direct Reduction), By Application (Steel Production, Iron Based Chemicals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global iron ore pellets market size was valued at USD 61.64 billion in 2025 and is projected to grow from USD 62.48 billion in 2026 to USD 108.5 billion by 2034, exhibiting a CAGR of 7.10% during the forecast period. Asia Pacific dominated the iron ore pellets market with a market share of 31% in 2025.

Iron ore pellets are small, spherical balls of iron ore that are used as the primary raw material in steelmaking. They are made by agglomerating finely ground iron ore concentrate (often magnetite or hematite) with binders (commonly bentonite clay, limestone, or organic binders), then firing them in a pelletizing furnace.

The market encompasses several major players with Samarco, Vale, Ferrexpo PLC, Bahrain Steel, Jindal Steel & Power Ltd. (JSPL), and ArcelorMittal at the forefront. Broad portfolio with innovative product launch, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Growing Global Steel Demand to Propel Market Growth

Global steel demand is the primary driver of the market, since nearly 90–95% of pellets are consumed in steelmaking. Each ton of steel requires around 1.4–1.6 tons of iron ore inputs, and pellets are increasingly preferred due to their higher Fe content (65–72%) and lower impurities compared to sinter and lump ore.

Pellets also provide a cost and environmental advantage. They improve blast furnace productivity by 10–15% and reduce coke consumption, translating into lower CO₂ emissions. With global climate targets pushing steelmakers toward greener operations, pellets are emerging as the preferred feedstock. Hence, the expansion of steel production, coupled with efficiency and sustainability requirements, makes steel demand the central pillar of iron ore pellets market growth.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

High Capital and Operating Costs Of Pelletizing Plants to Restrict Market Expansion

The high capital and operating costs of pelletizing plants are a major restraint to the market. Setting up a pellet plant requires heavy investment in beneficiation, balling drums, and induration furnaces. Pelletizing consumes large amounts of energy for drying and induration, with fuel costs accounting for 20–30% of production expenses. In regions with expensive energy, such as Europe, this reduces competitiveness.

- For instance, during the 2022 energy crisis in the EU, pellet producers such as LKAB (Sweden) reported higher production costs due to soaring electricity and natural gas

MARKET OPPORTUNITIES

Focus on Shift Toward Low-Carbon Steelmaking Creates Growth Opportunities

The global shift toward low-carbon steelmaking presents the biggest opportunity for the market. Traditional blast furnace–basic oxygen furnace (BF–BOF) routes are carbon-intensive, emitting around 1.9 tons of CO₂ per ton of steel. To meet climate targets, steelmakers are accelerating adoption of Direct Reduced Iron (DRI) and hydrogen-based reduction technologies, which require DR-grade pellets (>67% Fe, low silica, and alumina).

- For example, Sweden’s HYBRIT project and Germany’s Salzgitter SALCOS program are both planning to use high-grade pellets for hydrogen steelmaking.

MARKET CHALLENGES

Limited Availability of High-Grade Iron Ore to Hamper Market Growth

The market faces several challenges that could limit its growth despite rising demand. A key issue is the limited availability of high-grade iron ore required for pelletizing. Many regions, such as India, primarily have medium- to low-grade ore (55–62% Fe), which requires costly beneficiation before pellet production. This raises costs and reduces competitiveness compared to producers in Brazil or Sweden, who have access to naturally high-grade magnetite and hematite ores.

- A clear example of the limited availability of high-grade iron ore comes from India, the world’s second-largest steel producer. Most Indian ore reserves have an average Fe content of 55–62%, which is considered medium to low grade. To make pellets, this ore requires beneficiation—processes such as grinding, magnetic separation, and flotation—to upgrade Fe content above 65%. This adds significant costs.

IRON ORE PELLETS MARKET TRENDS

Shift toward Vertical Integration is a Significant Market Trend

One important trend in the market is vertical integration, where steelmakers invest directly in pellet production to secure raw material supply and reduce cost volatility. This approach helps companies control quality, ensure steady feedstock, and avoid dependence on third-party suppliers, especially during times of market disruption.

- A leading example is Cleveland-Cliffs in the U.S. The company not only operates several iron ore mines but also controls 28 MTPA of pellet capacity across Michigan and Minnesota. By supplying pellets directly to its downstream steel plants (including the former ArcelorMittal USA and AK Steel facilities it acquired), Cliffs ensures captive raw material security while reducing exposure to global price swings. This strategy has made it the largest pellet producer in North America.

Segmentation Analysis

By Product

Cost Effectiveness Contributes to Blast Furnace Segment’s Substantial Growth

On the basis of the segmentation of product, the market is classified into blast furnace and direct reduction.

The direct reduction segment accounting for 50.24% market share in 2026. The Direct reduction segment has witnessed steady growth in iron ore pellets consumption because pellets provide a cost-effective advantage over lump ore and sinter in the steelmaking process.

- In India, where reliance on imported coking coal drives up steelmaking costs, companies such as JSW Steel and Tata Steel use BF pellets extensively to optimize efficiency and reduce fuel consumption.

By Application

To know how our report can help streamline your business, Speak to Analyst

Growing Global Demand Fuels Growth of Steel Production Segment

In terms of application, the market is categorized into steel production, iron based chemicals, and others.

The steel production segment captured the largest share of the market in 2025. In 2026, the segment is anticipated to dominate with 88.51% share. The segment’s dominance is driven by the fact that more than 85% of all iron ore pellets are consumed in steelmaking. Pellets are the preferred feedstock in both Blast Furnace (BF) and Direct Reduction (DRI) routes due to their high Fe content (65–72%), consistent size, and low impurities. These properties improve furnace productivity, lower energy costs, and reduce emissions compared to sinter or lump ore.

- China, the world’s largest steelmaker, increasingly relies on imported pellets from Brazil, Sweden, and India to reduce pollution and improve furnace efficiency.

Iron based chemicals segment is expected to grow at a CAGR of 5.7% over the forecast period.

Iron Ore Pellets Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Iron Ore Pellets Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the dominant share in 2025 valuing at USD 19.02 billion and also took the leading share in 2026 with USD 19.39 billion. This dominance is driven by the region’s massive steel production base and growing industrial demand. According to the World Steel Association, APAC accounts for over 70% of global crude steel output, led by China, India, Japan, and South Korea. Since iron ore pellets are primarily used in steelmaking, the region’s steel growth directly drives pellet consumption. The Japan market is projected to reach USD 2.13 billion by 2026, the China market is projected to reach USD 7.88 billion by 2026, and the India market is projected to reach USD 4.98 billion by 2026.

- According to the Steel Ministry of India, India’s steel demand is expanding rapidly. It is expected to grow from 128 million tons in 2023 to over 170 million tons by 2030—boosting domestic pellet capacity from producers such as JSW Steel, NMDC, and KIOCL.

To know how our report can help streamline your business, Speak to Analyst

Latin America

Latin America and Europe are anticipated to witness a notable growth in the coming years. Latin America’s strength lies in its resource abundance and ability to supply high-grade pellets with Fe content above 67%, which are increasingly sought after in Europe and the Middle East for low-carbon steelmaking. The market in Latin America is estimated to reach USD 14.57 billion in 2025 and secure the position of second-largest region in the market. In the region, Brazil is estimated to reach USD 6.08 billion each in 2025.

Europe

During the forecast period, Europe is projected to record the growth rate of 5.6%, which is the third highest amongst all the regions and touch the valuation of USD 14.50 billion in 2025. This is primarily due to the growing push toward green steelmaking. The EU’s decarbonization agenda under the European Green Deal is pushing steelmakers to adopt hydrogen-based Direct Reduced Iron (DRI). Backed by these factors, Germany is estimated to record USD 4.42 billion in 2026, Italy to record USD 1.77 billion, and France USD 1.25 billion in 2025. After Europe.

North America

Over the forecast period, North America and the Middle East & Africa regions would witness a moderate growth in this market. The North American market in 2025 is set to record USD 8.74 billion valuation. The region’s market is driven primarily by the U.S. and Canada, both of which possess significant pelletizing capacity and strong domestic steel industries. The U.S. market is projected to reach USD 8.17 billion by 2026. In the Middle East & Africa, Saudi Arabia is set to attain the value of USD 1.07 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Wide Range of Product Offerings coupled with Strong Distribution Network of Key Companies Support their Leading Position

The iron ore pellets market is moderately consolidated, with a few major mining and steel companies dominating global production and trade. These players are actively involved in product innovation, strategic partnerships, and geographic expansion.

Samarco, Vale, Ferrexpo PLC, Bahrain Steel, Jindal Steel & Power Ltd. (JSPL), and ArcelorMittal are some of the dominating players in the market. A comprehensive range of products, global presence through a strong distribution network, and collaborations with end use industries are few characteristics of these players which support their dominance.

Other prominent players in the market include Ansteel, Baowu, and Severstal among others. These companies are undertaking various strategic initiatives such as investments in R&D and partnerships with other companies to enhance their market presence.

LIST OF KEY IRON ORE PELLETS COMPANIES PROFILED

- Samarco (Brazil)

- Vale S.A. (Brazil)

- Ferrexpo PLC (Switzerland)

- Bahrain Steel (GIIC) (Bahrain)

- Jindal Steel & Power Ltd. (JSPL) (India)

- KIOCL Ltd. (India)

- ArcelorMittal (Luxembourg)

- Ansteel Group (China)

- China Baowu Steel Group (China)

- Severstal (Russia)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Samarco revealed plans to double its installed production capacity, aiming to expand output of iron ore pellets and fines in 2025.

- October 2024: Vale, in collaboration with Jinnan Steel & Iron Group, declared an investment in establishing an iron ore concentration plant in Oman.

- February 2024: KIOCL, the Indian state-owned pellet manufacturer, announced plans to commence mining operations at its Devadari iron ore mines in FY 2025, with a target of reaching full production capacity within four years.

- June 2023: Samarco achieved a significant milestone by producing 20 million tons of iron ore pellets since resuming operations in December 2020.

- August 2023: Bahrain Steel entered into a partnership with the Essar Group to supply iron ore pellets for the Green Steel Arabia (GSA) project.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Product · Blast Furnace · Direct Reduction |

|

By Application · Steel Production · Iron Based Chemicals · Others |

|

|

By Geography · North America (By Product, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Product, Application, and Country/Sub-region) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Product, Application, and Country/Sub-region) o China (By Application) o Japan (By Application) o India (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Product, Application, and Country/Sub-region) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Product, Application, and Country/Sub-region) o Saudi Arabia (By Application) o South Africa (By Application) · Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 62.48 billion in 2026 and is projected to reach USD 108.5 billion by 2034.

In 2025, the market value stood at USD 19.02 billion.

The market is expected to exhibit a CAGR of 7.10% during the forecast period of 2026-2034.

The Blast Furnace (BF) segment led the market by product.

The key factors driving the market are the increasing demand for steel, and shift towards high grade feed.

Samarco, Vale, Ferrexpo PLC, Bahrain Steel, Jindal Steel & Power Ltd. (JSPL), and ArcelorMittal, are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Growing demand for high-grade iron ore coupled with shift toward low-carbon steelmaking are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us